Russia

Russia Will Be Allowed to Compete in Eurovision 2022 Despite Ukraine Invasion

Organizers of the 2022 Eurovision Song Contest say that Russia will still be allowed to compete in the international competition despite the country’s unprovoked invasion of the neighboring nation of Ukraine. Via The Huffington Post, the European Broadcast Union (EBU), which produces the competition, defended Eurovision as a “non-political cultural event.” At the time of this writing, several Ukrainian cities are under attack, and Russian special forces and airborne troops have breached Ukraine’s capitol city of Kyiv. American officials have suggested that President Vladimir Putin may seek to replace the democratically-elected government of Ukraine with a shadow government, or perhaps even annex Ukraine into Russia. Two days ago, Putin said, “Ukraine has never had its own authentic st...

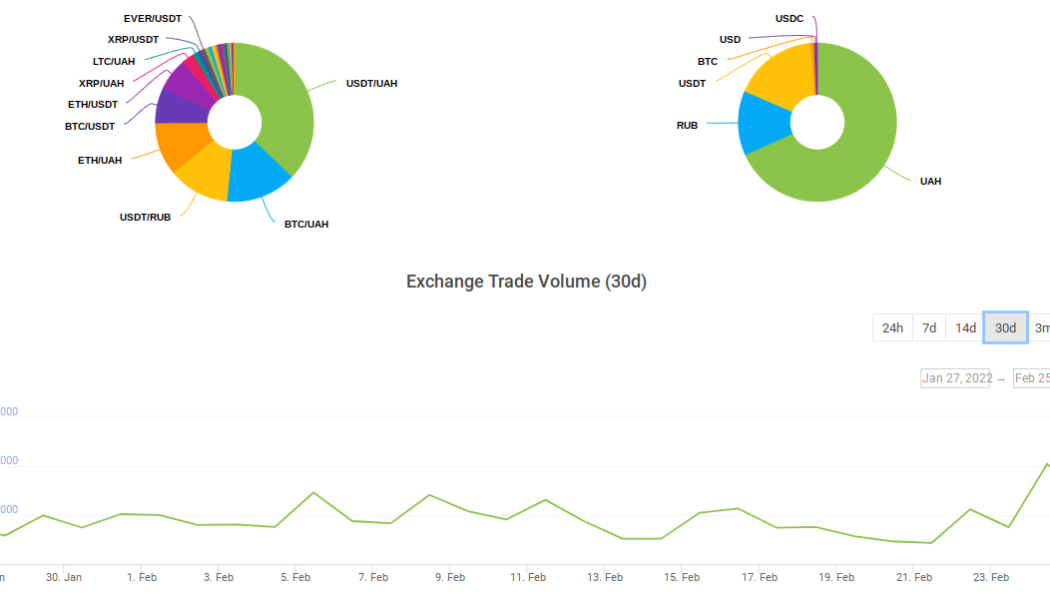

Ukraine Bitcoin exchange volume spikes 200% as Russia war sparks currency concerns

Bitcoin (BTC) and altcoin trading volumes have surged at a major Ukraine cryptocurrency exchange in the aftermath of Russia’s invasion, data shows. According to monitoring resource CoinGecko, on Feb. 24, volume at Kuna almost trippled to over $4 million. Crypto on the radar of Ukrainians As the armed conflict with Russia began, the impact on the fiat currencies of both countries was immediately apparent. While the Russian ruble suffered noticeably more, the Ukrainian hryvnia also fell, targeting 30 per dollar in what would be a new all-time low. Ukraine, which just this month finally ratified a law legalizing cryptocurrency after much to-and-fro between lawmakers, unsurprisingly saw interest in alternatives snap higher. The effect was obvious at seven-year-old Kuna, volumes at which ...

Bitcoin price spike to $39K leads traders to say ‘the panic is over for a few days’

Global financial markets and crypto markets were pummeled over the past 24-hours as the invasion of Ukraine by Russian forces sent investors scrambling and sell-offs took place across most asset classes. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) hit a low of $34,333 in the early trading hours on Feb. 24, shortly after the Ukraine incursion began, and has since climbed its way back to $38,500 after an unexpected short-squeeze may have rapped bearish investors on the knuckles. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts are saying about BTC price and how the ongoing conflict could impact crypto markets in the short-term. BTC in a “great buy area” Bitcoin’s collapse on the night of Feb. 23 was not unexp...

Crypto could bypass President Biden’s ‘devastating’ sanctions on Russian banks and elites: Report

The sanctions announced by United States President Joe Biden in response to Russia’s attack on Ukraine did not include cutting the country off from payments on the SWIFT system or cryptocurrency transfers. In a Thursday announcement from the White House, Biden said the U.S. and its allies and partners would be enforcing sanctions aimed at imposing “devastating costs” on Russia due to “Putin’s war of choice against Ukraine.” The U.S. president announced that the country would sever its financial system from Russia’s largest bank, Sberbank, as well as impose “full blocking sanctions” on VTB Bank, Bank Otkritie, Sovcombank OJSC, Novikombank, and their subsidiaries. Biden also named several elite nationals who have “enriched themselves at the expense of the Russian state” as part of the ...

Sean Penn Is in Ukraine Filming a Documentary on the Russian Invasion

Sean Penn is in Ukraine filming a documentary about the Russian invasion, according to a press release from the Office of the President of Ukraine (via Newsweek). The American filmmaker first landed in Ukraine in November 2021 to make a movie about Russian aggression. After briefly retuning to the US, he was back in Ukraine’s capitol city of Kyviv on Thursday to attend a press conference. For the project, he has reportedly interviewed local journalists, military leaders, and Deputy Prime Minister Iryna Vereshchuk. According to a statement from the Office of the President, “The director specially came to Kyiv to record all the events that are currently happening in Ukraine and to tell the world the truth about Russia’s invasion of our country. Sean Penn is among those who support ...

FTX CEO speaks on market crisis amid the Russian invasion of Ukraine

Sam Bankman-Fried said Eastern European countries could consider Bitcoin an alternative to their destabilised currencies He also explored the contrasting positions between fundamental and algorithmic investors Early Thursday, reports of invasion into Ukraine by Russia’s military led Bitcoin and other crypto markets tumbling. Stock markets also fell along with cryptocurrencies as Russia started what President Putin called a demilitarisation operation in Ukraine. In a recent Twitter thread, FTX CEO Sam Bankman-Fried has shared his view on the massive correction that crypto markets saw. According to data provided by CoinMarketCap, Bitcoin fell as low as $34,459. Markets have recovered to some extent and the ticker is currently trading at $35,482. Conflicting sentiments on Bitcoin&#...

Bitcoin slumps following Putin’s announcement of a military operation in Ukraine

Russian President Vladimir Putin has announced military action in Ukraine Bitcoin, alongside the majority of the crypto assets, have plunged as the market reacts to the news Tensions have been high across the month, with reports warning that Russia has been consolidating troops in areas bordering Ukraine. Russia has insistently maintained that it had no plans to invade Ukraine. However, the situation has changed dramatically in recent hours. Russia’s President Vladimir Putin announced early Thursday that the country’s military is advancing into Ukraine for what he referred to as a “special military operation” to conclude the “demilitarisation” of Ukraine. With reports of explosions in Ukraine’s Kyiv capital, worry is growing that this could turn in...

Russia to seize retail deposits if sanctions go too far, official warns

In the event of harsh Western sanctions as Russian forces invade Ukraine, retail customers could risk losing their savings. Russians’ savings could be confiscated in response to sanctions against the country, according to Nikolai Arefiev, a member of the country’s Communist Party and vice-chairman of the Duma’s committee on economic policy. The Russian government can potentially seize about 60 trillion rubles ($750 billion) worth of people’s deposits should Western nations decide to block all of Russia’s foreign funds, Arefiev said in an interview with the local news agency News.ru on Monday. “If all the foreign funds are blocked, the government will have no other choice but to seize all the deposits of the population, or 60 trillion rubles in order to solve the situation,” the official st...

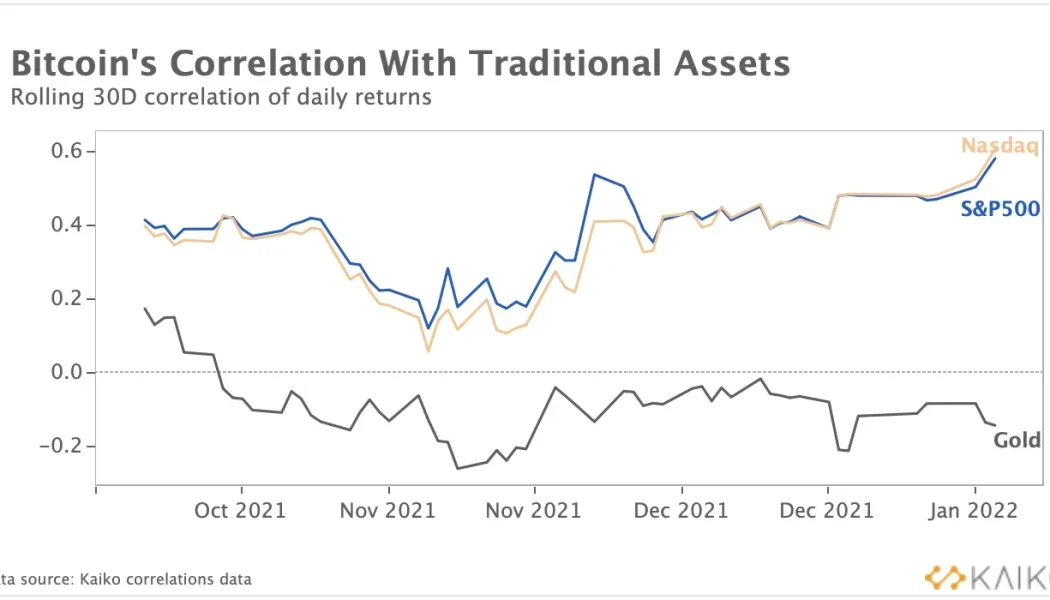

FTX CEO weighs in on Bitcoin market outlook amid Ukraine crisis

The world woke up to a “sea of red” that was not necessarily limited to the financial markets, as Russia declared war on Ukraine early Thursday. The traditional financial markets along with the crypto markets have been sliding bearishly for the past week and saw a rapid decline early on Thursday. Apart from crude oil prices, which jumped to an eight-year high above $100, the majority of stocks has lost over 5%. The Russian invasion on Thursday triggered the bears leading to a $500-billion crypto market sell-off, where the majority of the cryptocurrencies lost critical support to trade at a three-month low. The crypto market capitalization saw a 10% decline during early morning Asian trading hours, falling below the $1.5-trillion mark. Bitcoin (BTC) is considered an inflation hedge, and man...

Last Bitcoin support levels above $20K come into play as BTC price faces ‘time of uncertainty’

Bitcoin (BTC) may yet reenter the $20,000 zone, but the coming weeks could provide a solid buying opportunity, a new report forecasts. In its latest market update on Feb. 24, trading platform Decentrader laid out the final areas of support between the current Bitcoin spot price and $20,000. Analyst eyes BTC’s 20-week and 200-week MA for cues Military action by Russia in Ukraine has markets in a spin Thursday, with stocks and crypto following a firm downtrend as uncertainty grips Asia, Europe and the United States alike. Bitcoin has already lost 12% in under 24 hours, and expectations are that the worst is not yet over —reactions to the Russian offensive continue to flow in, along with potential financial sanctions. As such, Decentrader, like many other analysts, is notably cautious o...

![Cardi B Comments On Ukraine Crisis, Thinks Invasion Is Very Mid [Video]](https://www.wazupnaija.com/wp-content/uploads/2022/02/cardi-b-comments-on-ukraine-crisis-thinks-invasion-is-very-mid-video-1050x600.jpg)

![Cardi B Comments On Ukraine Crisis, Thinks Invasion Is Very Mid [Video]](https://www.wazupnaija.com/wp-content/uploads/2022/02/cardi-b-comments-on-ukraine-crisis-thinks-invasion-is-very-mid-video-80x80.jpg)