Research

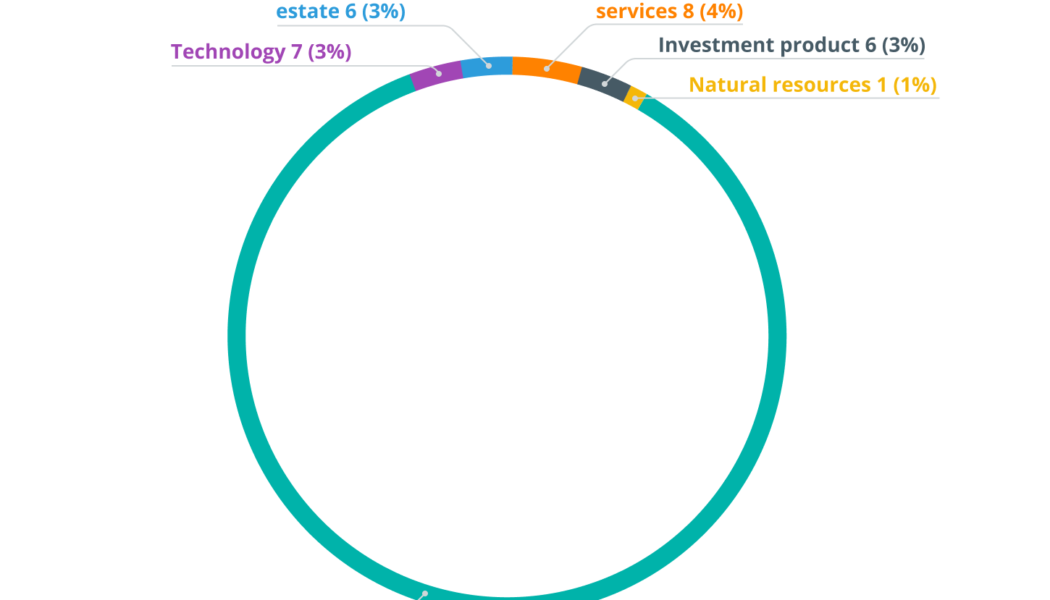

Blockchain VC funding surpasses 2021 total despite declining since May

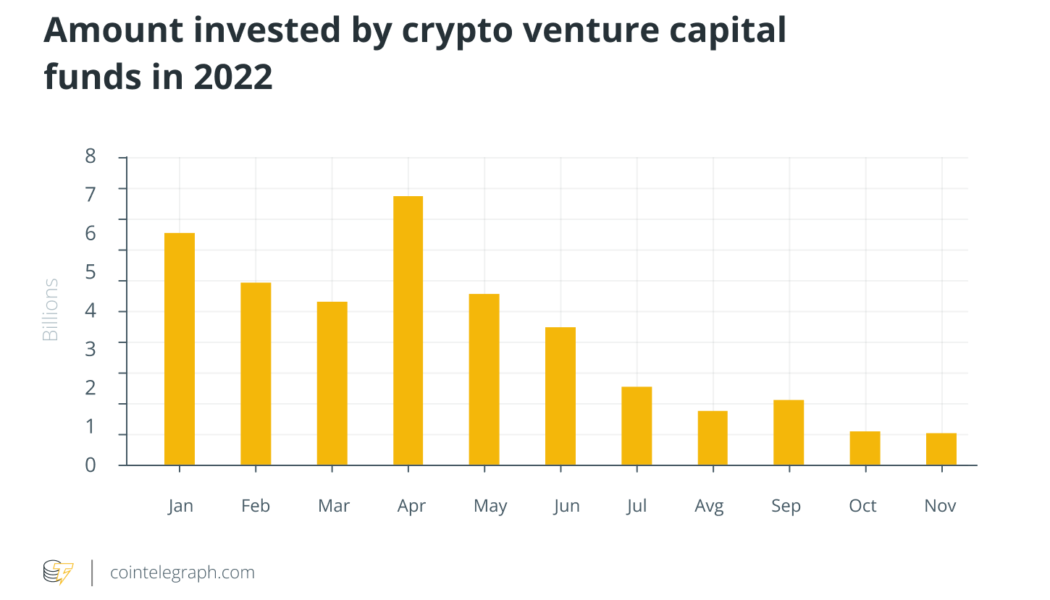

It’s been a tough year for crypto, and venture capital activity confirms it. The collapse of FTX in November was the latest and most shocking in a series of closures of key market players this year — including Celsius, Voyager and BlockFi — that have shaken investor sentiment and wiped out $1.5 trillion in market capitalization from cryptocurrency space. Blockchain venture capital funding has been on a downward slope since May 2022, and November was no different, with inflows declining even further. However, the total capital inflows for 2022 have surpassed 2021 by almost $6 billion. According to Cointelegraph Research, VC funding declined 4.8% in November, totaling $840.4 million — down from $843 million in October. The Cointelegraph Research Terminal’s Venture Capital Database — which co...

13% of Americans have now held crypto: JPMorgan research

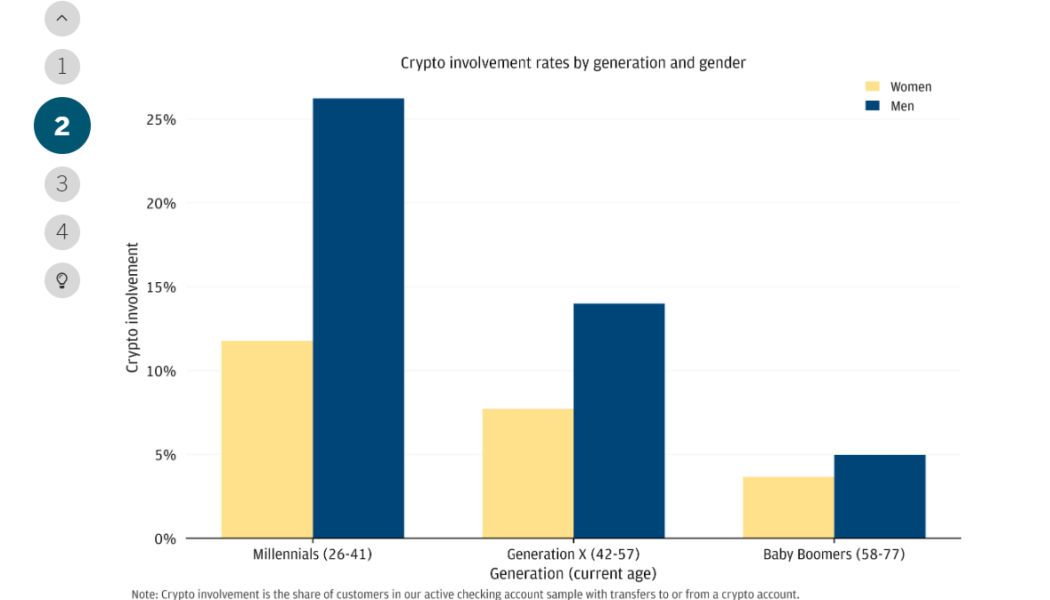

Around 13% of the American population — or 43 million people — have held cryptocurrency at some point in their lives, new research from JPMorgan Chase has revealed. According to a Dec. 13 report titled “The Dynamics and Demographics of U.S. Household Crypto-Asset Use,” this number has risen dramatically since before 2020, when the figure was only around 3%. The latest data from JPMorgan comes from analyzing checking account transfers from a sample of over 5 million customers. It found that 600,000 customers in this sample group transferred cash to crypto accounts at some point during period from 2020 to 2022. The study also noted that cryptocurrency holders typically made their first crypto purchases during spikes in crypto prices. During this time, the amount of cash being sent into...

Non-whale Bitcoin investors break new BTC accumulation record

Some non-whale Bitcoin (BTC) investors seem to have had zero issues with the cryptocurrency bear market as well as fear, uncertainty and doubt (FUD) around the fall of FTX, on-chain data suggests. Smaller retail investors have turned increasingly bullish on Bitcoin and started accumulating more BTC despite the ongoing market crisis, according to a report released by the blockchain intelligence platform Glassnode on Nov. 27. According to the data, there are at least two types of retail Bitcoin investors that have been accumulating the record amount of BTC following the collapse of FTX. The first type of investors — classified as shrimps — defines entities or investors that hold less than 1 Bitcoin, $16,500 at the time of writing, while the second type — crabs — are a category of addresses h...

Separating Web3 facts from fiction: Report

The term Web3 is often used as shorthand to discuss the new phase of the internet. It describes leaving the era of centralized social media and massive e-commerce platforms and arriving at a utopia of user-controlled data. Web3, in a colloquial sense, is simply an umbrella marketing term that means anything crypto-adjacent. To offer clarity on this topic, the Cointelegraph Research team has released a new report detailing the nature of the real Web3. These key insights are invaluable for investors to understand to separate facts from fundamental misconceptions. The blockchain web and the decentralized web Cointelegraph Research’s “Web3: Marketing Buzz or Tech Revolution?” makes a clear distinction between the “blockchain web,” which is the integration of blockchain technology into th...

Surprising Research Finds Rats Can Dance to Music Too

It seems a love of dancing is one commonality humans have with rats. A new study published in Science Advances found that not only can rats perceive the beat of music and bop their heads to the rhythm, but they also share a similar strength with humans particularly in synchronizing with beats between 120 and 140 BPM. The dancing rats studied at the University of Tokyo were no modest mice. The experimental research saw the furry rodents reacting to the sounds of Lady Gaga, Maroon Five, Queen and Mozart, among others. The movements of the rats were studied using an accelerometer attached to their heads. The desire to head-bob to music was previously only thought to have existed in humans alone, but in a squeaky clean conclusion, they found otherwise. Scroll to Continue Recommended Articles &...

Surprising Research Finds Rats Can Dance to Music Too

It seems a love of dancing is one commonality humans have with rats. A new study published in Science Advances found that not only can rats perceive the beat of music and bop their heads to the rhythm, but they also share a similar strength with humans particularly in synchronizing with beats between 120 and 140 BPM. The dancing rats studied at the University of Tokyo were no modest mice. The experimental research saw the furry rodents reacting to the sounds of Lady Gaga, Maroon Five, Queen and Mozart, among others. The movements of the rats were studied using an accelerometer attached to their heads. The desire to head-bob to music was previously only thought to have existed in humans alone, but in a squeaky clean conclusion, they found otherwise. Scroll to Continue Recommended Articles &...

Web3 sees 15 new scam smart contracts an hour: Solidus Labs

The Web3 and cryptocurrency space is seeing a significant amount of smart contract scams proliferating, with blockchain risk monitoring firm Solidus Labs saying it has detected on average 15 newly deployed scams every hour. Solidus Labs said on Oct. 27 that it had been monitoring 12 blockchains including Ethereum, Polygon and BNB Chain since Oct. 10, and in that time, had detected 188,525 smart contract scams. Former United States Consumer Financial Protection Bureau (CFPB) director, Kathy Kraninger, who is now Solidus’ vice president of regulatory affairs, said in the statement that “while some of the big rug pulls and scams make the news […] the full picture stemming from our data shows the vast majority of these scams go unnoticed.” The firm also shed some light on the number...

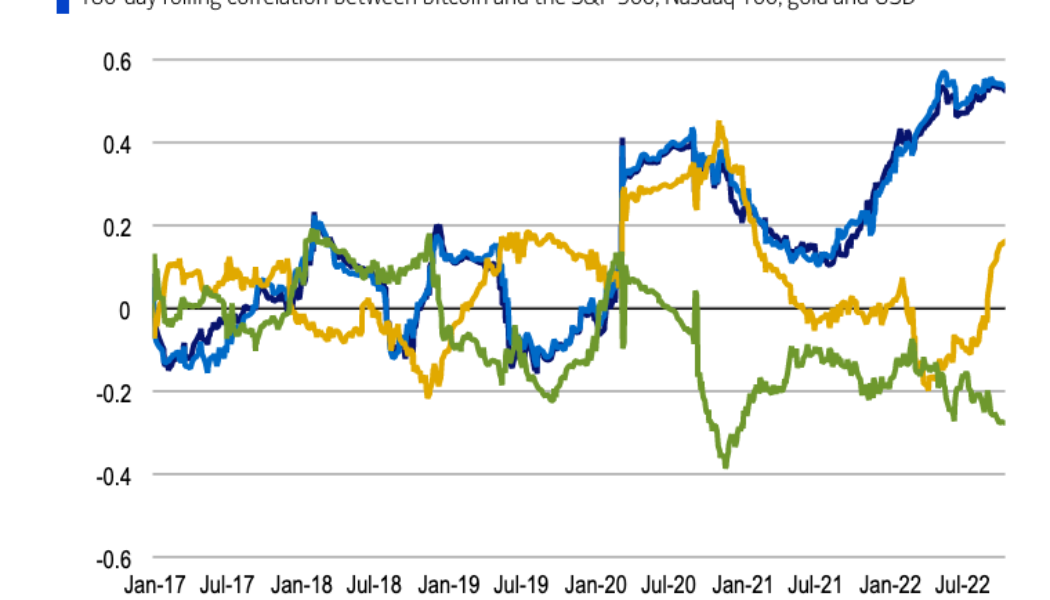

Gold vs BTC correlation signals Bitcoin becoming safe haven: BofA

Despite the ongoing cryptocurrency bear market, investors have been increasingly looking at Bitcoin (BTC) as a safe haven, a new study suggests. The rise in the correlation between Bitcoin and gold (XAU) is one of the major indicators demonstrating investors’ confidence in BTC amid the ongoing economic downturn, according to digital strategists at the Bank of America. Bitcoin’s correlation with gold — which is commonly viewed as an inflation hedge — has been on the rise this year, hitting its highest yearly levels in early October. The growing correlation trend started on Sept. 5 after remaining close to zero from June 2021 and turning negative in March 2022, BofA strategists Alkesh Shah and Andrew Moss said in the report. “Bitcoin is a fixed-supply asset that may eventually become an infl...

Top 10 most Googled questions about cryptocurrency and its implication

What people end up searching on Google provides raw insights into the real mindset, often revealing their interest, fear, and range of other emotions about a particular topic. To identify investor sentiment amid a bear market that is yet to find its bottom, Cointelegraph dug deep into the web to find out the most Googled questions about cryptocurrencies. The top 10 Google searches related to cryptocurrencies uncover an increase in curiosity among general investors — represented by two ‘Whys,’ three ‘What’s’ and five ‘How’s.’ Let’s go through the most crypto-related Google searches, from highest to lowest. What is cryptocurrency Even after thirteen years of disruption to traditional finance, the most popular question that general investors ask Google is, “What is cryptocurrency.” With...

Blockchain investments are disrupting the real estate industry: Report

The Cointelegraph Research Terminal, the leading provider of premium databases and institutional-grade research on blockchain and digital assets, has added a new report to its expanding library from the industry leader in tokenization. The report, from Security Token Market and sister company Security Token Advisors, covers the rapidly emerging asset-backed real estate tokenization industry. It has information on the developing shifts in the industry and is a must for any firm or business with a portfolio that encompasses real estate. The tokenized real estate industry is growing rapidly amid the current market frenzy. With investors looking for a more secure investment that utilizes emerging technology, the demand for blockchain-based investment opportunities backed by real-world as...

Crypto industry seeks to educate, influence US lawmakers as it faces increasing regulation

Interaction between the cryptocurrency industry and Capitol Hill is becoming ever more intensive as efforts to regulate crypto grow in tandem with its popularity. The surge in crypto industry lobbying last year was given some concrete parameters in February by crypto analytics startup Crypto Head. It released a report showing that the crypto companies that spent the most money on lobbying in 2021 were Robinhood, Ripple Labs, Coinbase and the Blockchain Association. These organizations were the lobbying leaders during the past five years as well, although with different rankings. Here is what the United States crypto-lobbying landscape looks like today. Metrics of influence Robinhood spent $1.35 million on lobbying in 2021 and was the only crypto-related organization to spend more than $1 m...