Report

Why DeFi should expect more hacks this year: Blockchain security execs

Decentralized finance (DeFi) investors should buckle themselves up for another big year of exploits and attacks as new projects enter the market and hackers become more sophisticated. Executives from blockchain security and auditing firms HashEx, Beosin and Apostro were interviewed for Drofa’s An Overview of DeFi Security In 2022 report shared exclusively with Cointelegraph. The executives were asked about the reason behind a significant increase in DeFi hacks last year, and were asked whether this will continue through 2023. Tommy Deng, managing director of blockchain security firm Beosin, said while DeFi protocols will continue to strengthen and improve security, he also admitted that “there is no absolute security,” stating: “As long as there is interest in the crypto market, the number...

Be ‘very wary’ of crypto proof-of-reserve audits: SEC official

A senior official from the United States Securities and Exchange Commission has warned investors to be “very wary” about relying on a crypto company’s “proof-of-reserves.” “We’re warning investors to be very wary of some of the claims that are being made by crypto companies,” said SEC’s acting chief accountant Paul Munter in a Dec. 22 interview with The Wall Street Journal. A number of crypto firms have commissioned “proof-of-reserves” audits since the collapse of crypto exchange FTX, aiming to quell concerns over their own exchange’s financial soundness. However, Munter said the results of these audits isn’t necessarily an indicator that the company is in a good financial position. “Investors should not place too much confidence in the mere fact a company says it’s got a proof-of-reserves...

Separating Web3 facts from fiction: Report

The term Web3 is often used as shorthand to discuss the new phase of the internet. It describes leaving the era of centralized social media and massive e-commerce platforms and arriving at a utopia of user-controlled data. Web3, in a colloquial sense, is simply an umbrella marketing term that means anything crypto-adjacent. To offer clarity on this topic, the Cointelegraph Research team has released a new report detailing the nature of the real Web3. These key insights are invaluable for investors to understand to separate facts from fundamental misconceptions. The blockchain web and the decentralized web Cointelegraph Research’s “Web3: Marketing Buzz or Tech Revolution?” makes a clear distinction between the “blockchain web,” which is the integration of blockchain technology into th...

Genesis denies ‘imminent’ plans to file for bankruptcy

Cryptocurrency lending company Genesis has refuted speculation that it is planning an “imminent” bankruptcy filing should it fail to cover a $1 billion shortfall caused by the fall of crypto exchange FTX. The firm has reportedly faced difficulties raising money for its lending unit and told investors it would have to file for bankruptcy, according to a Nov. 21 Bloomberg report citing people familiar with the matter. A spokesperson for Genesis told Cointelegraph that there were no plans to file for bankruptcy “imminently” and that it continued to have “constructive” discussions with creditors. “We have no plans to file bankruptcy imminently. Our goal is to resolve the current situation consensually without the need for any bankruptcy filing. G...

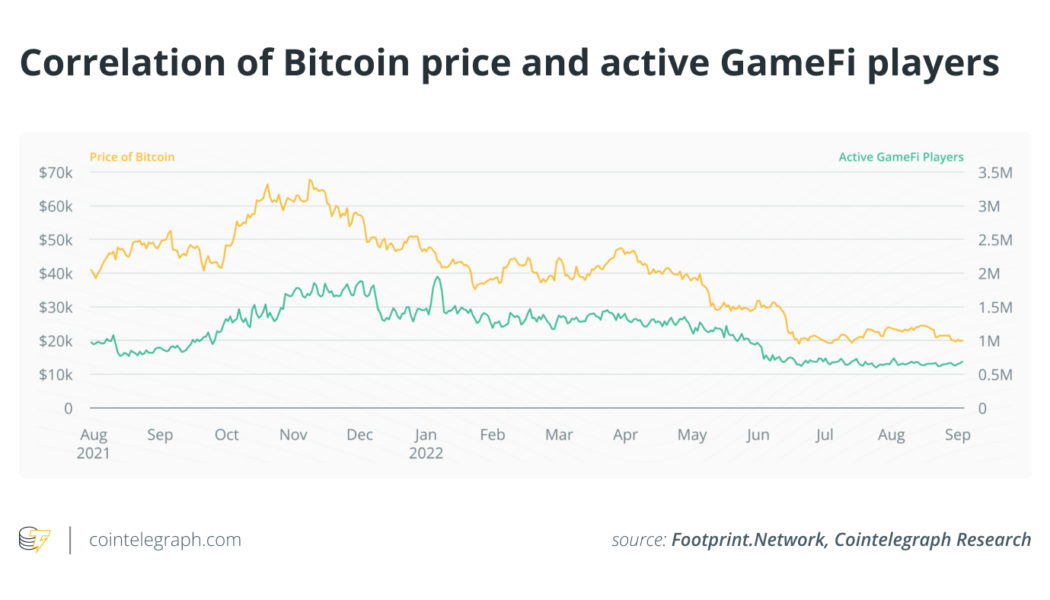

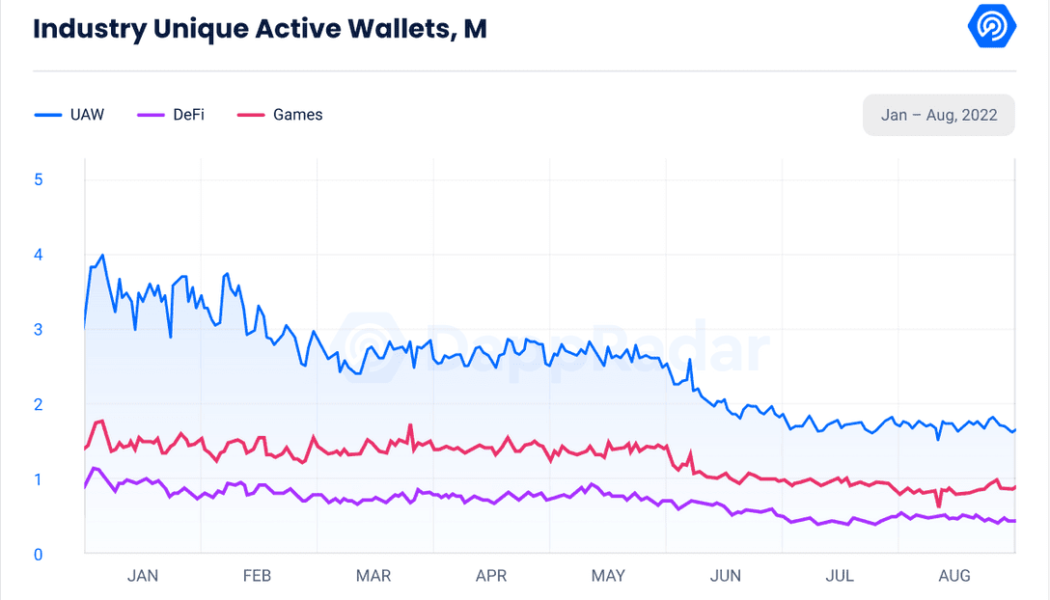

DeFi DApps activity rises 3.7% in August for first time since May — Report

DeFi dapps showed a slight recovery for the first time since May, with the daily average of unique active wallets (UAWs) increasing 3.7% on a month-over-month basis, according to a report from DappRadar. The rise was partially driven by the Flow protocol, which rose 577% UAW due to Instagram’s support of its NFTs and the game Solitaire Blitz. On the other hand, Solana UAW shrank by 53% in August from the previous month, while transactions dropped by 68%, the findings showed. There were 1.67 million unique wallets connected to blockchain DApps in August, down 3.52% from last month, and down 14.73% compared to August 2021. Source: DappRadar Among industries, gaming accounted for over 50% of the activity usage, with 847,230 daily UAW, although it is down 11% and the numb...

Independent Tether attestation reveals 58% decrease in commercial paper holdings

An announcement from USDT issuer Tether Holdings Limited revealed information from an independent attestation about the company’s previous quarter’s performance. The reviewer, top accounting firm BDO Italia, assessed Tether’s assets as of June 30, 2022. Tether had previously announced a commitment to decreasing its commercial paper holdings by the end of August 2022. Data from the report revealed a 58% decrease in commercial paper exposure since the previous quarter from $20 billion to $8.5 billion. The chief technology officer of Tether, Paolo Ardoino, tweeted that Tether has plans to continue to decrease its commercial paper holdings to $200 million by the end of August and zero them out by the following October. As of June 30th, more than 58% decrease in Tether’s commer...

Three-quarters of institutions to use crypto in the three years: Ripple

A whopping 76% of surveyed financial institutions plan on using crypto within the next three years, according to the report. Ripple’s new report highlights trends in the adoption and utilization of emerging technologies like crypto and blockchain in enterprise and financial institutions. Both financial institutions and enterprises are understanding the benefits of internal crypto usage. The most common reason is that crypto gives more people access to more financial services, says 42% of financial institutions and 41% of enterprises. According to the survey, portfolio management and payments come forward as the most valuable additions to the enterprise world. Portfolio management is detailed as hedging against inflation, hedging against other asset types and asset appreciat...

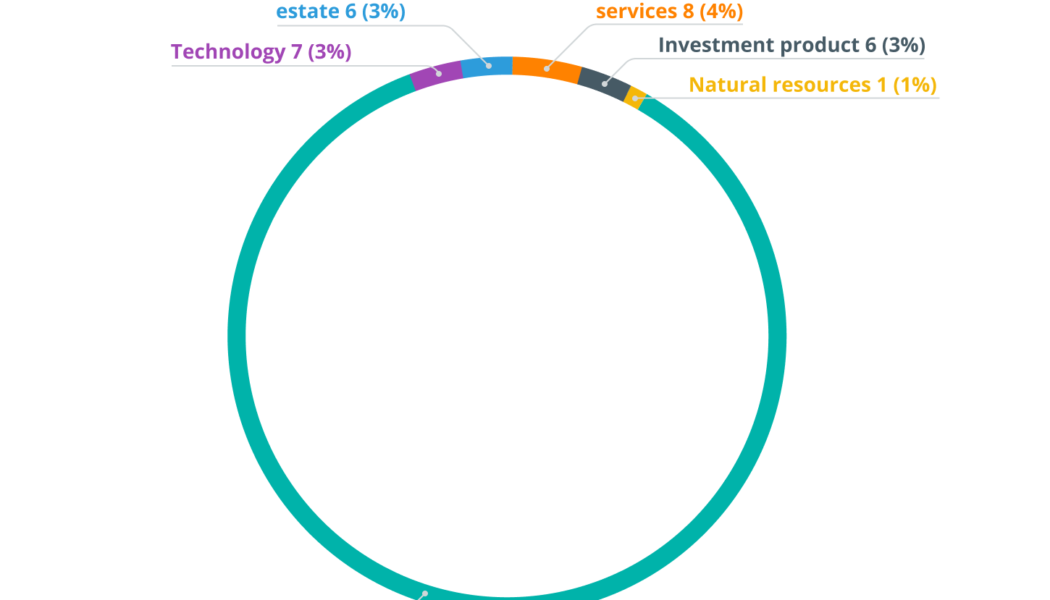

Blockchain investments are disrupting the real estate industry: Report

The Cointelegraph Research Terminal, the leading provider of premium databases and institutional-grade research on blockchain and digital assets, has added a new report to its expanding library from the industry leader in tokenization. The report, from Security Token Market and sister company Security Token Advisors, covers the rapidly emerging asset-backed real estate tokenization industry. It has information on the developing shifts in the industry and is a must for any firm or business with a portfolio that encompasses real estate. The tokenized real estate industry is growing rapidly amid the current market frenzy. With investors looking for a more secure investment that utilizes emerging technology, the demand for blockchain-based investment opportunities backed by real-world as...

11% of US insurers invest — or are interested in investing — in crypto

United States-based insurers are the most interested in cryptocurrency investment according to a Goldman Sachs global survey of 328 chief financial and chief investment officers regarding their firm’s asset allocations and portfolios. The investment banking giant recently released its annual global insurance investment survey, which included responses regarding cryptocurrencies for the first time, finding that 11% of U.S. insurance firms indicated either an interest in investing or a current investment in crypto. Speaking on the company’s Exchanges at Goldman Sachs podcast on Tuesday, Goldman Sachs global head of insurance asset management Mike Siegel said he was surprised to get any result: “We surveyed for the first time on crypto, which I thought would get no respondents, but I was surp...

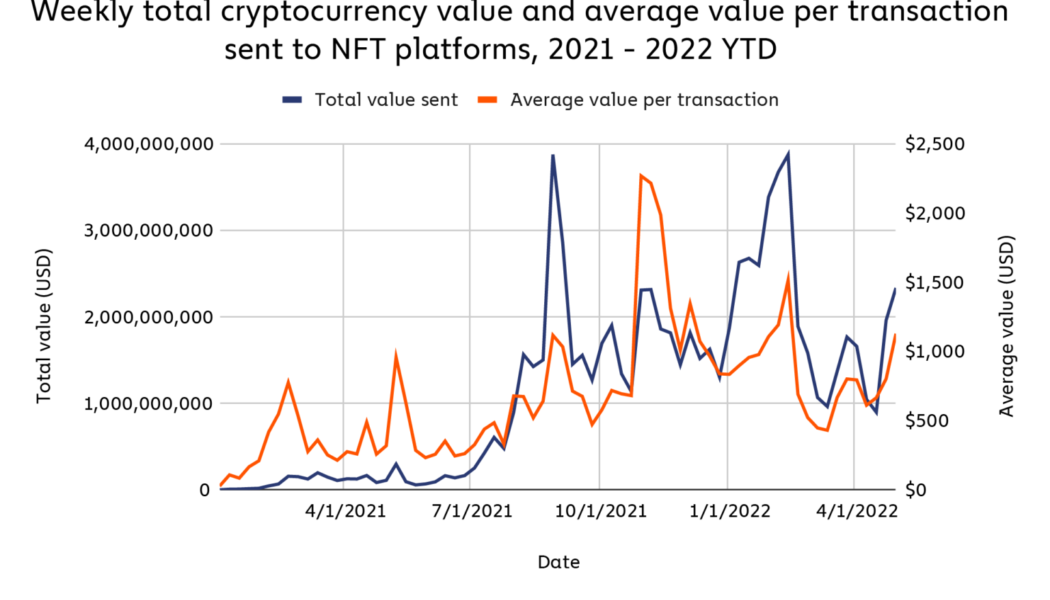

NFT collectors sent $37B to marketplaces in 2022, nearly equaling 2021 already

Collectors of nonfungible tokens (NFTs) have already sent more than $37 billion in value to NFT marketplaces this year as of Sunday, a figure that nearly exceeds the total amount in all of 2021. According to a report from Chainalysis, investors sent $40 billion worth of cryptocurrency to smart contracts associated with NFT collections and marketplaces throughout 2021. Source: Chainalysis Since the beginning of last year, NFT transaction volume has grown considerably, but the overall growth of the industry has been inconsistent. The report outlines that NFT transaction volume occurs sporadically and has been in a downturn since mid-February. The NFT market has since made a brief recovery as of mid-April — most likely due to the recent hype around Moonbirds and the Bored Ape Yacht Club...