RenVM

REN price at risk of 50% drop after a bearish trading pattern shows up

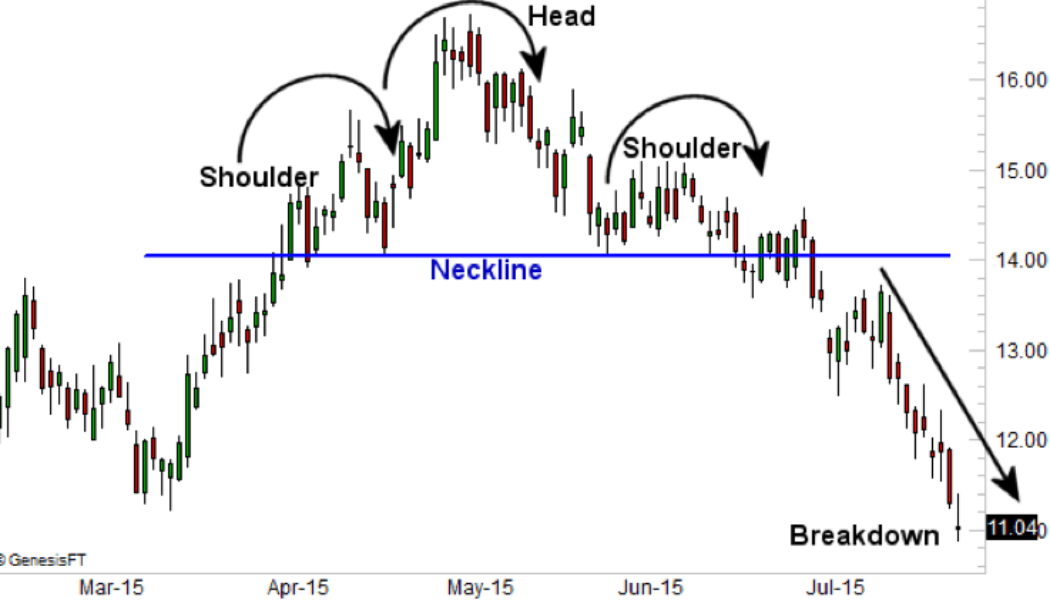

The prospects of Ren (REN) continuing its ongoing rebound to fresh highs appear slim as a classic bearish reversal pattern begins to emerge. Dubbed head and shoulders, the setup appears when the price forms three peaks, with the middle peak (called the head) longer than the other two peaks described as the left and right shoulders. The bottoms of these peaks are supported by a neckline. An illustration of the head and shoulders pattern. Source: Corporate Finance Institute The pattern comes into play primarily when the price breaks below the neckline in a correction that follows the formation of the right shoulder. That prompts traders to open short entries below the neckline, with their ideal target at a length equal to the distance between the head’s high point and the neckline. Wha...