Regulation

Crypto ‘cannot be partisan,’ says US lawmaker who scored negative on bipartisanship index: Report

United States House of Representatives member Tom Emmer has reportedly suggested that regulating and encouraging innovation in the crypto space should not be a political win for either Democrats or Republicans. According to an interview released Tuesday by Axios reporter Brady Dale, Emmer said many of his colleagues in Congress were treating cryptocurrencies as a risk that merited warnings, rather than an investment opportunity for the United States. The U.S. lawmaker added that encouraging figures like FTX CEO Sam Bankman-Fried to stay in the country will open more doors for residents rather than driving them away with regulatory uncertainty. Emmer, who has often pushed back against the “regulation by enforcement” approach some government agencies — including the Securities and Exchange C...

President of Paraguay vetoes crypto regulation law

Paraguay’s president, Mario Abdo Benítez, vetoed a bill that sought to recognize cryptocurrency mining as an industrial activity on Monday. He reasoned that mining’s high electricity consumption could hinder the expansion of a sustainable national industry. The decree stated that crypto mining uses intensive capital with low manpower usage, and therefore would not generate added value on par with other industrial activities. Around the world, cryptocurrency is one of the largest job creators. The LinkedIn’s Economic Graph shows that crypto and blockchain jobs listing rose 615% in 2021 compared to 2020 in the United States. In accordance with the bill’s sponsor, Senator Fernando Silva Facetti, the law aimed to promote crypto mining through the use of surplus el...

Binance froze $1M corporate account due to law enforcement request

Major crypto exchange Binance has confirmed it restricted account access to $1 million in crypto for a Tezos tool contributor after being called out on social media. In a Thursday Twitter thread, Binance said it had restricted the account of Tezos staking rewards auditor Baking Bad “as the result of a law enforcement request.” The Tezos contributor alleged that the crypto exchange had blocked access to its corporate account containing Bitcoin (BTC), Ether (ETH), Polgyon (MATIC), Tether (USDT) and other tokens since July 1 “without any explanations” — a claim Binance denied. “BakingBad is well aware of [Binance’s actions], as he was already advised of this multiple times and provided the LE contact form through our support chat system on 7/6, 7/12, and 7/22,” said Binance. “Attempting to mi...

GameFi developers could be facing big fines and hard time

Are cryptocurrency games innocent fun? Or are they Ponzi schemes facing an imminent crackdown by regulators in the United States? Tokens related to cryptocurrency games — known colloquially as “GameFi” — were worth a cumulative total of nearly $10 billion as of mid-August, give or take a few billion. (The number may vary depending on whether you want to include partially finished projects, how you count the number of tokens that projects technically have in circulation, and so on.) In that sense, whether the games are legal is a $10 billion question that few investors have considered. And that’s an oversight they may soon regret. That’s because a bipartisan consensus appears to be forming among legislators in the U.S. that the industry needs to be shut down. They haven’t addressed the issu...

Celsius calls out Prime Trust in court, alleging firm didn’t turn over $17M in crypto

Crypto lending platform Celsius Network has filed a lawsuit claiming that custodian Prime Trust failed to turn over roughly $17 million worth of cryptocurrency. In a Tuesday filing with the U.S. Bankruptcy Court in the Southern District of New York, Celsius’ legal team brought a complaint against Prime Trust, alleging the company did not return $17 million worth of crypto assets in June 2021 when it terminated its relationship with the lending firm. According to Celsius, Prime Trust acted as crypto custodian for New York- and Washington-based users from 2020 through mid-2021, returning $119 million in crypto following the end of the business arrangement but holding back some funds: 398 Bitcoin (BTC), 3,740 Ether (ETH), 2,261,448 USD Coin (USDC) and 196,268 Celsius (CEL). “Upon the commence...

United Texas Bank CEO wants to ‘limit the issuance of US dollar-backed stablecoins to banks’

Scott Beck, chief executive officer of United Texas Bank, called on members of the state’s blockchain working group to recommend policy for leaving stablecoins to banks rather than crypto firms. Speaking before the Texas Work Group on Blockchain Matters in Austin on Friday, Beck suggested limiting the issuance of U.S. dollar-backed stablecoins to licensed banks rather than issuers like Circle. The United Texas Bank CEO cited a November report from the President’s Working Group on Financial Markets, in which the group said stablecoin issuers should be held to the same standards as insured depository institutions including state and federally chartered banks. “If such stablecoins are defined to be ‘money’, banks are the proper economic actor to issue and manage stablecoins,” said Beck. “Bank...

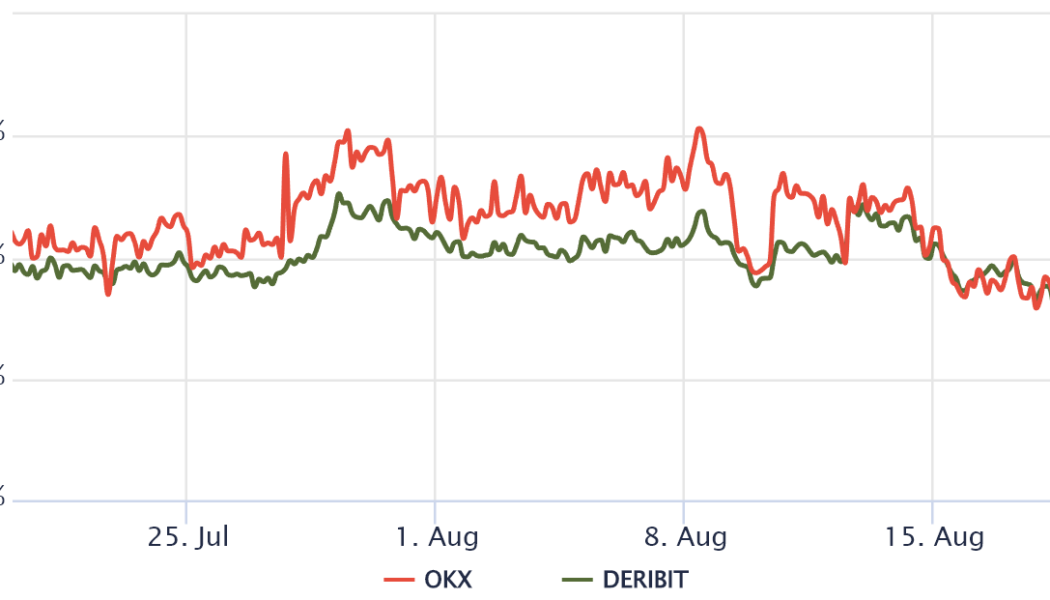

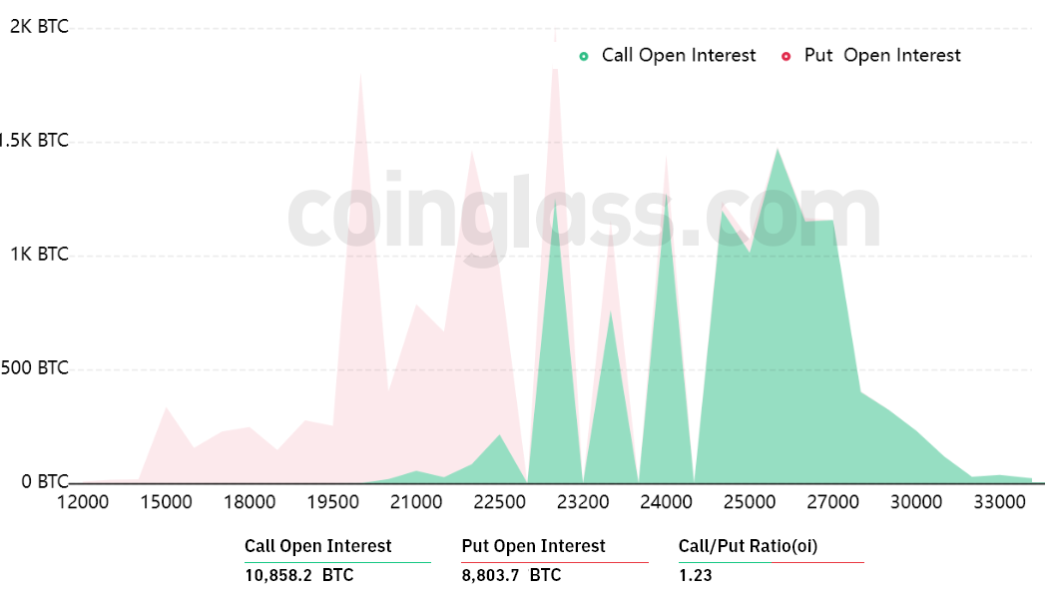

3 reasons why Bitcoin’s drop to $21K and the market-wide sell-off could be worse than you think

On Friday, August 19, the total crypto market capitalization dropped by 9.1%, but more importantly, the all-important $1 trillion psychological support was tapped. The market’s latest venture below this just three weeks ago, meaning investors were pretty confident that the $780 billion total market-cap low on June 18 was a mere distant memory. Regulatory uncertainty increased on Aug. 17 after the United States House Committee on Energy and Commerce announced that they were “deeply concerned” that proof-of-work mining could increase demand for fossil fuels. As a result, U.S. lawmakers requested the crypto mining companies to provide information on energy consumption and average costs. Typically, sell-offs have a greater impact on cryptocurrencies outside of the top 5 asset...

US lawmakers appeal directly to 4 mining firms, requesting info on energy consumption

Four members of the United States House of Representatives from the Energy and Commerce Committee have demanded answers from four major crypto mining firms in regards to the potential effects of their energy consumption on the environment. In letters dated Wednesday to Core Scientific, Marathon Digital Holdings, Riot Blockchain, and Stronghold Digital Mining, U.S. lawmakers Frank Pallone, Bobby Rush, Diana DeGette, and Paul Tonko requested the companies provide information from 2021 including the energy consumption of their mining facilities, the source of that energy, what percentage came from renewable energy sources, and how often the firms curtailed operations. The four members of the House committee also inquired as to the average cost per megawatt hour the companies spent mining...

European Central Bank addresses guidance on licensing of digital assets

The European Central Bank, or ECB, laid the foundation for the criteria it would be considering when harmonizing the licensing requirements for crypto in Europe. In a Wednesday statement, the ECB’s banking supervision division said it would be taking steps to regulate digital assets as “national frameworks governing crypto-assets diverge quite extensively” and given the seemingly differing approaches to harmonization following the passage of the Markets in Crypto-Assets (MiCA) regulation and the Basel Committee on Banking Supervision issuing guidelines for banks’ exposure to crypto. The ECB said it would apply criteria from the Capital Requirements Directive — in effect since 2013 — to assess licensing requests for crypto-related activities and services. Specifically, the central bank will...

Binance obtains in-principle approval to operate in Kazakhstan

The Astana Financial Services Authority, or AFSA, an independent financial regulator in Kazakhstan, has taken a step towards licensing major cryptocurrency exchange Binance to operate in the country. In a Monday announcement, AFSA said it had granted in-principle approval toward Binance operating as a digital asset trading facility and providing custody services in the Astana International Financial Centre, a financial hub in the capital city of Nur-Sultan. In a Monday blog post, Binance said it was required to complete the application process for approval, which the crypto exchange expected to do “in due course.” According to AFSA CEO Nurkhat Kushimov, the move toward granting Binance a license to operate in Kazakhstan could lead to the development of a “vibrant ecosystem of digital asset...

SBI Group reports investee getting CFTC approval for OTC derivatives trading in US

The United States subsidiary of electronic trading platform developer Clear Markets has reportedly received approval from the Commodity Futures Trading Commission, or CFTC, to offer over-the-counter crypto derivatives products with physical settlement. In a Tuesday notice, SBI Holdings — a stakeholder of Clear Markets — said the CFTC had approved the U.S. subsidiary operating a Swap Execution Facility, in which it plans to offer derivatives trading for U.S. dollar and Bitcoin (BTC) pairs. The Japan-based financial services company said its market maker planned to expand its trading partners in the United States following pilot transactions on Clear Markets. SBI Holdings announced it had acquired a 12% stake in Clear Markets in August 2018, which it planned to increase in the future. At the...