Regulation

NEXO risks 50% drop due to regulatory pressure and investor concerns

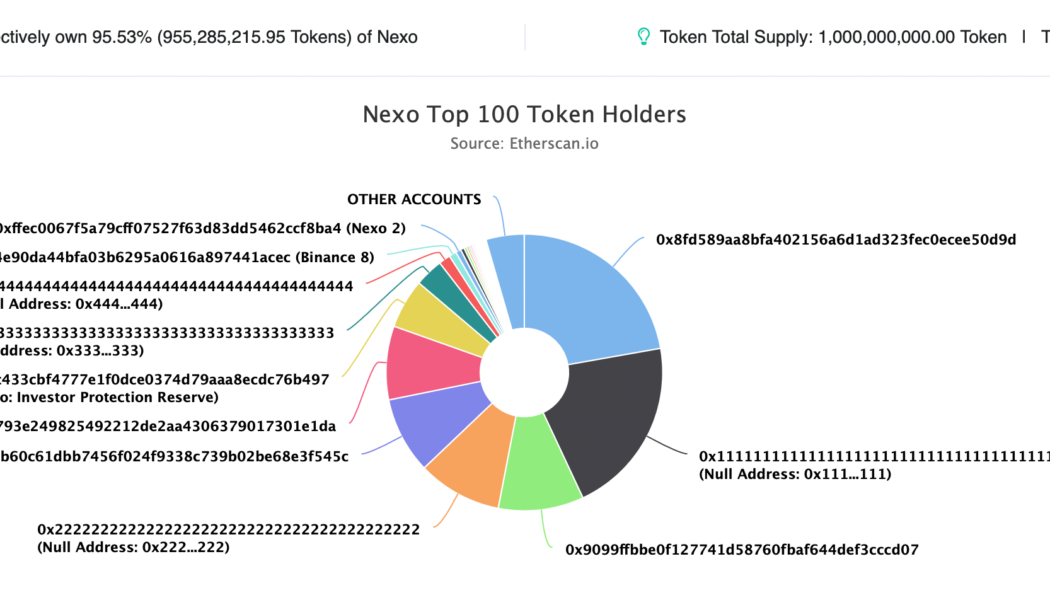

Crypto lending firm Nexo is at risk of losing half of the valuation of its native token by the end of 2022 as doubts about its potential insolvency grow in the market. Is Nexo too centralized? For the unversed: Eight U.S. states filed a cease-and-desist order against Nexo on Sep. 26, alleging that the firm offers unregistered securities to investors without alerting them about the risks of the financial products. In particular, regulators in Kentucky accused Nexo of being insolvent, noting that without its namesake native token, NEXO, the firm’s “liabilities would exceed its assets.” As of July 31, Nexo had 959,089,286 NEXO in its reserves — 95.9% of all tokens in existence. “This is a big, big, big problem because a very basic market analysis demonstrates that Nexo would be...

Crypto and decentralization could influence voters in 2022 US midterm elections: Report

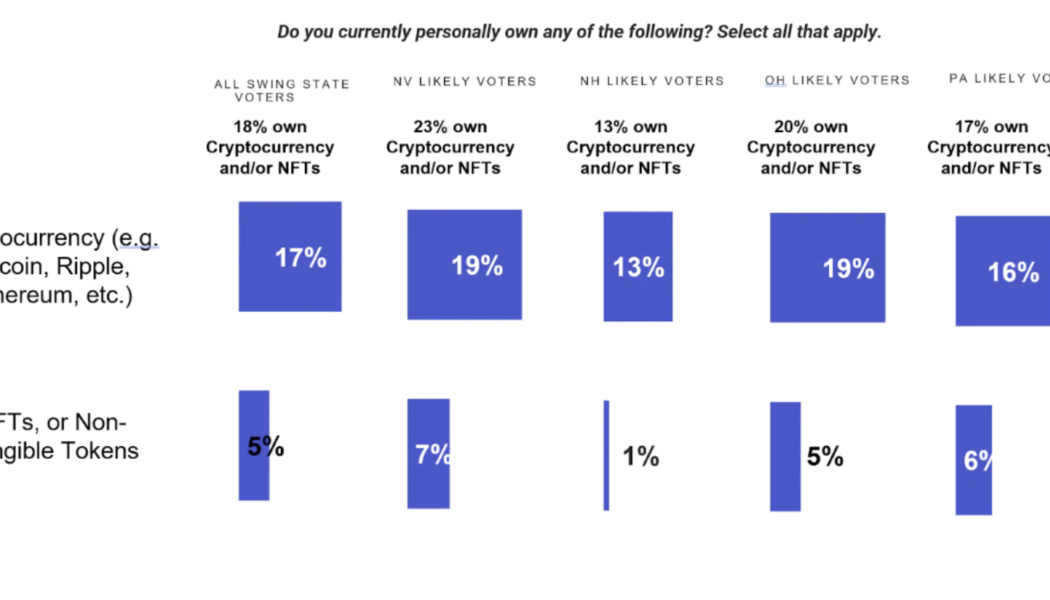

A poll of 800 likely midterm voters in four U.S. swing states suggested that the overwhelming majority favored ideas around decentralization, and many were HODLers. According to a Sept. 29 report from venture capital firm Haun Ventures on a survey conducted by business intelligence company Morning Consult, roughly one in five voters polled in New Hampshire, Nevada, Ohio and Pennsylvania said they owned cryptocurrency or nonfungible tokens. In addition, 91% of respondents supported a “community owned, community governed” internet that “gives people greater control over their information.” Poll of 800 swing state voters who own digital assets. Source: Haun Ventures “Significantly, and reflective of how the values that voters associate with Web3 will drive electoral behavior, voters are less ...

California fraud cases highlight the need for a regulatory crackdown on crypto

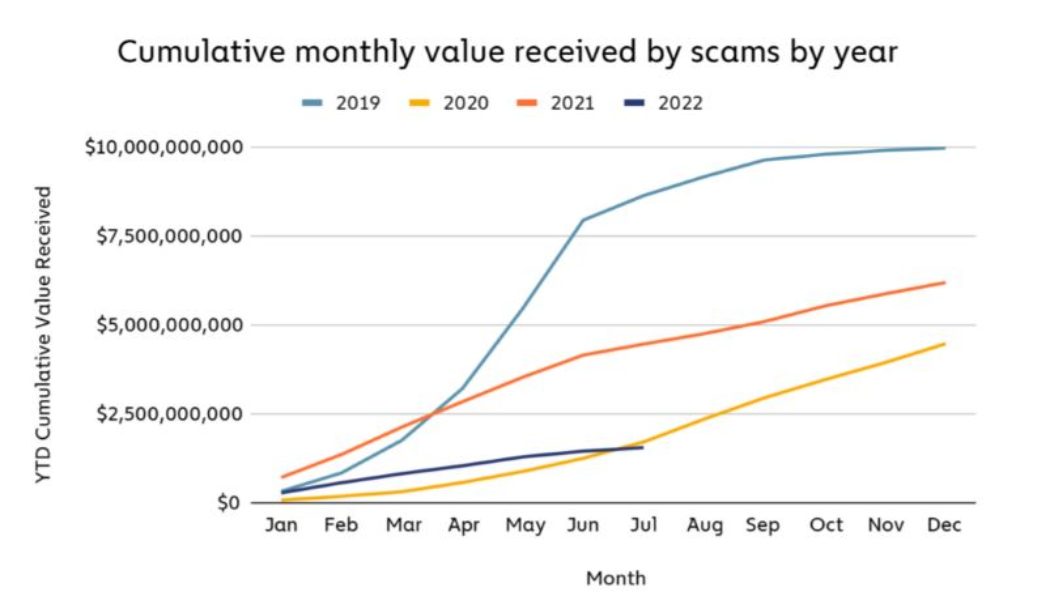

The California Department of Financial Protection and Innovation (DFPI) announced last month that it had issued desist and refrain orders to 11 entities for violating California securities laws. Some of the highlights included allegations that they offered unqualified securities as well as material misrepresentations and omissions to investors. These violations should remind us that while crypto is a unique and exciting industry for the public at large, it is still an area that is rife with the potential for bad players and fraud. To date, government crypto regulation has been minimal at best, with a distinct lack of action. Whether you are a full-time professional investor or just a casual fan who wants to be involved, you need to be absolutely sure of what you are getting into before get...

CFTC takes legal action against Digitex futures exchange and CEO

The United States Commodity Futures Trading Commission, or CFTC, filed a complaint against Digitex LLC and its founder and CEO Adam Todd for failing to register the cryptocurrency futures exchange and manipulating the price of its DGTX token. According to a Sept. 30 court filing in the Southern District of Florida, Todd allegedly pumped up the price of DGTX tokens in an effort to inflate Digitex’s holdings. The U.S. regulator claimed the Digitex CEO used different corporate entities as part of a scheme to launch and operate an illegal digital asset derivatives trading platform, in violation of the Commodity Exchange Act. CFTC rules require performing rKnow Your Customer checks and implementing a customer information program. Todd said in 2020 that he planned to remove all KYC procedures&nb...

US lawmaker hints at calling for Republican votes in 2022 midterms over crypto policies

North Carolina Representative Patrick McHenry may have used his virtual appearance at a cryptocurrency conference as a soapbox to call for votes in the 2022 United States midterm elections. In a prerecorded message for the attendees of the Converge22 conference in San Francisco on Sept. 29, McHenry suggested that the goal of a “clear regulatory framework” for digital assets could drive U.S. lawmakers to develop legislation. The Republican lawmaker used terms including “bipartisan consensus” and support from both major political parties over certain regulatory frameworks related to digital assets and stablecoins before seemingly encouraging crypto users to vote red in the next election. “To ensure that these technologies flourish here in the United States, we need to provide regulatory clar...

US lawmakers propose amending cybersecurity bill to include crypto firms reporting potential threats

United States Senators Marsha Blackburn and Cynthia Lummis have introduced proposed changes to a 2015 bill that would allow “voluntary information sharing of cyber threat indicators among cryptocurrency companies.” According to a draft bill on amending the Cybersecurity Information Sharing Act of 2015, Blackburn and Lummis suggested U.S. lawmakers allow companies involved with distributed ledger technology or digital assets to report network damage, data breaches, ransomware attacks, and related cybersecurity threats to government officials for possible assistance. Should the bill be signed into law, agencies including the Financial Crimes Enforcement Network and the Cybersecurity and Infrastructure Security Agency would issue policies and procedures for crypto firms facing potential cyber...

FCA green lights Revolut, making no UK crypto firms operating under temporary status

The United Kingdom’s Financial Conduct Authority, or FCA, has added cryptocurrency-friendly payments app Revolut to its list of companies authorized to offer crypto products and services in the country. In a Monday update to its list of registered crypto asset firms in the U.K., the FCA showed Revolut was in compliance with amended regulations from 2017 on “Money Laundering, Terrorist Financing and Transfer of Funds.” The fintech firm joined 37 other companies with the green light to offer crypto services in the country after being granted an extension to operate as a crypto asset firm with temporary registration in March. Firms offering crypto-related products and services in the U.K. are permitted to operate following registration with the FCA, a rule in force since 2020. How...

The European Union is stifling stablecoin adoption

The digital asset landscape in the European Union is evolving ahead of the passage of the Markets in Crypto-Assets (MiCA) regulation framework that aims to instill regulatory clarity around crypto assets. While well-intentioned, the current structure of MiCA may throttle innovation. But if a revised version of this policy passes, it could see the European Union become one of the leaders in the digital payment space. If not, then there is a genuine possibility of the continent falling behind. MiCA aims to set a regulatory framework for the crypto asset industry within the EU. At this point, much still needs to be codified and clarified, but the broad strokes are now known. Simultaneously, financial technology firm Circle launched a stablecoin called Euro Coin (EUROC). Euro Coin impleme...

Lawyers for Celsius investors file motion to have interests represented in court

An international law firm representing groups of Celsius investors has filed a motion to appoint a committee to represent their interests in the crypto lending firm’s bankruptcy case. In a Thursday filing with the U.S. Bankruptcy Court in the Southern District of New York, lawyers with the law firm Milbank requested the appointment of an “Official Preferred Equity Committee” to represent certain Celsius shareholders. According to the filing, the equity holders “urgently require their own fiduciary” for representation in court alongside Celsius debtors and an Unsecured Creditors Committee, or UCC. “The need for a fiduciary to pursue the Equity Holders’ interests is particularly critical when one considers the practical realities of these cases: There are only two groups of real ...

Framework to ban members of Congress and SCOTUS from trading stocks includes crypto provision

Members of the United States House of Representatives and Senate as well as Supreme Court justices currently trading cryptocurrencies may have to stop HODLing while in office should a bill get enough votes. According to a framework released on Thursday, chair Zoe Lofgren of the Committee on House Administration — responsible for the day-to-day operations of the House — said she had a “meaningful and effective plan to combat financial conflicts of interest” in the U.S. Congress by restricting the financial activities of lawmakers and SCOTUS justices, as well as those of their spouses and children. The bill, if passed according to the framework, would suggest a change in policy following the 2012 passage of the Stop Trading on Congressional Knowledge Act, or STOCK Act, allowing members of Co...

CFTC commissioner visits Ripple offices as decision in SEC case looms

Caroline Pham, one of five commissioners at the United States Commodity Futures Trading Commission, or CFTC, met with Ripple CEO Brad Garlinghouse ahead of a court decision which could affect how regulators handle XRP tokens. In a Monday tweet, Pham said she visited Ripple Labs’ offices as part of a “learning tour” involving crypto and blockchain. Garlinghouse later tweeted that the commissioner’s visit was related to “public-private engagement” — likely referring to a privately funded company like Ripple engaging with U.S. regulators. The next stop on my learning tour was visiting @Ripple Labs. Thanks @bgarlinghouse! #XRP #crypto #blockchain pic.twitter.com/ICr8H2ZE3q — Caroline D. Pham (@CarolineDPham) September 19, 2022 The timing of Pham’s visit had many on social media reacting to the...

South Korean authorities ask Interpol to issue ‘Red Notice’ for Do Kwon: Report

South Korean prosecutors have reportedly requested Interpol intervene in their case against Terra co-founder Do Kwon by issuing a “Red Notice” — suggesting global law enforcement agencies may attempt to find and detain him. According to a Monday report from the Financial Times, the Seoul Southern District prosecutors’ office said it had “begun the procedure” to place Kwon on Interpol’s Red Notice list following steps to revoke the Terra co-founder’s passport while he was in Singapore. Interpol’s website states that a Red Notice is requested by authorities “locate and provisionally arrest a person pending extradition, surrender, or similar legal action,” but the agency cannot compel local law enforcement to arrest the subject of such notice. “We are doing our best to locate and ...