Regulation

US lawmakers question regulators over ‘revolving door’ with crypto industry

Several Democratic members of the United States Senate and House of Representatives have requested information from top regulators and agencies in the country regarding crypto firms hiring government officials upon their departure. In letters dated Oct. 24 addressed to the heads of the Securities and Exchange Commission, Commodity Futures Trading Commission, Treasury Department, Federal Reserve, Federal Deposit Insurance Corporation, Office of the Comptroller of the Currency, and Consumer Financial Protection Bureau, five U.S. lawmakers asked for a response in regard to the steps the government departments and agencies were taking “to stop the revolving door” between themselves and the crypto industry. Senators Elizabeth Warren and Sheldon Whitehouse and Representatives Alexandria Ocasio-C...

Japan is losing its place as the world’s gaming capital because of crypto hostility

A marked hostility toward new and emerging Web3 technologies like cryptocurrencies runs the risk of costing Japan its place as the world’s gaming capital. We’re getting dangerously close to the point of no return, and here’s why. Nobody can be sure where the country’s antagonism to crypto originated or why it still persists even after the nonfungible token (NFT) and crypto “boom” of 2021, which took off in a major global way and prompted officials in the United States and Europe to backtrack on their initial antipathy for the space, finally opening up to regulations. The White House just released its first crypto regulatory framework in September 2022, and the European Parliament Committee followed up in October 2022 by approving the Markets in Crypto-Assets framework, also known as ...

US regulator touts to ‘aggressively police’ crypto in new report

The U.S. commodities regulator certainly doesn’t want to look like it’s going easy on crypto, revealing it was behind 18 separate enforcement actions targeting digital assets in the 2022 fiscal year. In an Oct. 20 report from the Commodity Futures Trading Commission (CFTC), a total of 82 enforcement actions were filed in 2022’s fiscal year, imposing $2.5 billion in “restitution, disgorgement and civil monetary penalties either through settlement or litigation.” The CFTC said that 20% of the enforcements were aimed at digital asset businesses, with chairman Rostin Behnam stating: “This FY 2022 enforcement report shows the CFTC continues to aggressively police new digital commodity asset markets with all of its available tools.” One of the more recent CFTC enforcement actions tha...

CFTC action shows why crypto developers should get ready to leave the US

Considerable anxiety exists in the world of Web3 related to regulation and the legal status of cryptocurrency projects. It’s particularly apparent in the United States, where the Commodity Futures Trading Commission (CFTC) fueled concerns in September with an announcement that it was imposing a $250,000 fine on a decentralized autonomous organization (DAO), Ooki DAO, and its investors. The fine was particularly ominous, considering DAOs are intended to be “regulation proof.” The CFTC said in its statement on the issue that Ooki DAO’s bZeroX protocol offered illegal off-exchange trading of digital assets. The agency took issue with the fact that the founders, Tom Bean and Kyle Kistner, tried to use the existing bZeroX protocol within the DAO to put it beyond the reach of regulators. “By tra...

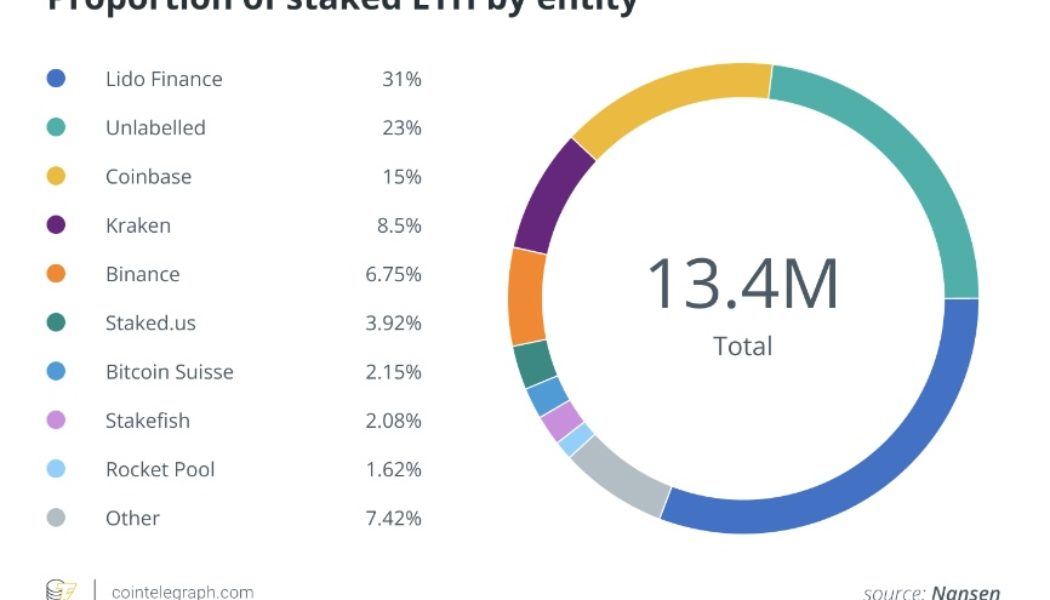

KYC to stake your ETH? It’s probably coming to the US

Over the last few years, the cryptocurrency industry has been a primary target for regulators in the United States. The legal battle between Ripple and the United States Securities and Exchange Commission (SEC), Nexo’s lawsuit with the securities regulators of eight states, and the scrutiny targeting Coinbase’s Lend program last year are only a few high-profile examples. This year, even Kim Kardashian had first-hand experience with regulatory scrutiny after agreeing to pay a $1.26 million fine for promoting the dubious crypto project EthereumMax. While Ethereum developers intended to pave the way for key network upgrades in the future, it seems like the recent Merge has further complicated matters between crypto projects and U.S. regulators. Ethereum: Too substantial for the cry...

It’s time for the feds to define digital commodities

This month, the European Union (EU) agreed on the text for a unified licensing regime for cryptocurrency exchanges to operate across the EU bloc as part of its Markets in Crypto Assets Regulation (MiCA). The United States — despite being a traditional global leader in legal frameworks for technological innovation — has not provided that same regulatory clarity. National cryptocurrency exchanges in the U.S. are regulated at the state level through a patchwork of money transmission laws that overburden companies while under-protecting consumers. In our view, many digital tokens are properly characterized as digital commodities rather than securities. Yet, a unified federal regime for cryptocurrency exchanges listing digital commodities does not exist. To create one, Congress must pass ...

US lawmaker says crypto regulation from SEC is ‘needed now’

John Hickenlooper, a United States Senator representing Colorado, has penned a letter to Gary Gensler urging the Securities and Exchange Commission chair to establish “clear rules” for the crypto market. In an Oct. 13 letter, Hickenlooper called on the SEC to take action on regulatory issues including identifying the cryptocurrencies that will be considered sasecurities, establishing registration guidelines for trading platforms, and “determining what disclosures are necessary for investors to be properly informed.” According to the senator, the lack of a coordinated regulatory framework from the government has led to uneven enforcement, while the SEC is the agency “well positioned to offer regulatory guidance.” “Given the complexity of these issues, and recognizing that some digital asset...

US lawmakers request Justice Dept share CBDC assessment

Republican members of the U.S. House Financial Services Committee have requested the Department of Justice provide its assessment and legislative proposals regarding a digital dollar within ten days. In an Oct. 5 letter addressed to U.S. Attorney General Merrick Garland, 11 Republican lawmakers asked the Justice Department for a copy of its “assessment of whether legislative changes would be necessary to issue a CBDC,” as required by President Joe Biden’s executive order on digital assets issued in March. The House members claimed the “appropriate place for the discussion” on legislation concerning a central bank digital currency would be in the U.S. legislative branch rather than the federal executive department. “The House Committee on Financial Services […] has spent considerable ...

EU Council approves MiCA text, proposal moves to Parliament for a vote

Representatives from a committee with the European Council have moved forward with regulating digital assets in the European Union through the Markets in Crypto-Assets, or MiCA, framework, sending the finalized text to parliament for a vote. According to an information note on Oct. 5, the European Council’s Permanent Representatives Committee approved the MiCA text and sent it to the chair of the European Parliament Committee on Economic and Monetary Affairs. Edita Hrdá, chair of the Permanent Representatives Committee, confirmed that the crypto framework proposal would be enacted “should the European Parliament adopt its position at first reading” in the same wording. The MiCA proposal, first introduced to the European Commission in September 2020, aims to create a consistent regulatory f...

European Parliament members vote in favor of crypto and blockchain tax policies

Members of the Parliament of the European Union voted in favor of a non-binding resolution aimed at using blockchain to fight tax evasion and coordinate tax policy on cryptocurrencies. In an Oct. 4 notice, the European Parliament said 566 out of 705 members voted in favor of the resolution originally drafted by member Lídia Pereira. According to the legislative body, the resolution recommended authorities in its 27 member states consider a “simplified tax treatment” for crypto users involved in occasional or small transactions and have national tax administrations use blockchain technology “to facilitate efficient tax collection.” For cryptocurrencies, the resolution called on the European Commission to assess whether converting crypto to fiat would constitute a taxable event, depending on...

CFTC can issue summons through Ooki DAO’s help chat box, says judge

The United States Commodities Futures Trading Commission can serve members of the Ooki decentralized autonomous organization, or DAO, with summons through online communications, according to a federal judge. In an Oct. 3 order granting a CFTC motion, U.S. District Judge William Orrick said the commission could provide a copy of its summons and complaint through Ooki DAO’s help chat box as well as a notice on its online forum. The judge said the court’s decision was based on the CFTC effectively serving the Ooki DAO by providing the necessary documents. The CFTC filed a lawsuit against the Ooki DAO on Sept. 22, alleging the organization offered “illegal, off-exchange digital asset trading,” violated registration guidelines and broke provisions of the Bank Secrecy Act. The legal action came ...

US Treasury recommends lawmakers decide which regulators will oversee crypto spot market

Officials with the United States Financial Stability Oversight Council, or FSOC, have recommended U.S. lawmakers pass legislation to determine which “rulemaking authority” will be responsible for regulating parts of the crypto spot market. In an Oct. 3 meeting of the FSOC, Jonathan Rose, a senior economist at the Federal Reserve Bank of Chicago, said the FSOC had released a report in accordance with President Joe Biden’s executive order on crypto, detailing potential financial stability risks of digital assets and regulatory gaps. The report identified regulatory gaps including the spot market for cryptoassets that were not securities subject to “limited direct federal regulatory” — hinting at lawmakers stepping in to prevent possible market manipulation and conflicts of interest. “While s...