Regulation

SEC pushes deadline to decide on ARK 21Shares spot Bitcoin ETF to January 2023

The United States Securities and Exchange Commission, or SEC, has extended its window to decide on whether shares of ARK 21Shares’ Bitcoin exchange-traded fund could be listed on the Chicago Board Options Exchange BZX Exchange. In a Nov. 15 announcement, the SEC issued a notice for a longer designation period for the application of ARK 21Shares’ Bitcoin (BTC) ETF, originally filed with federal regulator on May 13. The SEC twice extended its window to approve or disapprove of the crypto investment vehicle in July with an extension and in August with a comment period. “The Commission finds that it is appropriate to designate a longer period within which to issue an order approving or disapproving the proposed rule change so that it has sufficient time to consider the proposed rule change and...

FDIC acting chair says no crypto firms or tokens are backed by agency

Federal Deposit Insurance Corporation acting chair Martin Gruenberg said the agency does not back any crypto firms in the United States, nor does its insurance cover losses from tokens. In a Nov. 15 hearing of the Senate Banking Committee on the oversight of financial regulators, New Jersey Senator Bob Menendez said lawmakers needed to “take a serious look at crypto exchanges and lending platforms” over risky behavior. Gruenberg responded to Menendez’s questions confirming there were “no cryptocurrency firms backed by the FDIC” and “FDIC insurance does not cover cryptocurrency of any kind.” FDIC acting chair Martin Gruenberg addressing the Senate Banking Committee on Nov. 15 FDIC insurance normally protects deposits at financial institutions in the United States in the event of bank failur...

OCC makes its staff available for fintech-related discussions

The United States Office of the Comptroller of the Currency, or OCC, has announced its representatives will be available on a one-to-one basis to discuss financial technology. In a Nov. 3 announcement, the OCC said entities considering fintech products and services, partnerships with banks, or concerns “related to responsible innovation in financial services” have the opportunity for one-hour meetings with its staff between Dec. 14-15. The government office said it will screen requests and proposed topics of discussions and announce virtual meeting times. The OCC announcement followed the department saying it planned to establish an Office of Financial Technology starting in 2023 in an effort to gain a “deep understanding of financial technology and the financial technology landscape.” The...

UK lawmakers open inquiry into NFT regulation — ‘there are fears that the bubble may burst’

Members of the United Kingdom’s Digital, Culture, Media and Sport Committee have opened an inquiry to hear from the public on the potential benefits and risks of nonfungible tokens, or NFTs, and blockchain on the country’s economy. In a Nov. 4 announcement, the DCMS committee said its inquiry was related to the sudden growth of the NFT market, responding to fears the assets may be overvalued and at risk of the bubble bursting. According to the committee, NFT regulation in the U.K. is “largely non-existent,” with the DCMS planning to assess the assets ahead of a review by the treasury department. What are the risks, and benefits of NFTs and the wider blockchain? We want to consider whether NFT investors, especially vulnerable speculators, are put at risk by the market and whether there is a...

Japan’s Digital Agency launches DAO to explore DAOs and Web3

The Digital Agency of Japan, aimed at harmonizing nationwide initiatives related to digital transformation, has launched a research decentralized autonomous organization, or DAO, targeting Web3. In a Nov. 2 meeting, the Digital Agency said it had established a DAO in an effort to explore the “functions and roles” of DAOs. The group added it would consider the benefits and challenges of granting the DAO legal status in Japan, citing the U.S. state of Wyoming approving similar legislation in July 2021. According to the Digital Agency, it planned to investigate aspects of digital assets and DAOs which could potentially be used for “cross-border crimes that exploit blockchain technology” and threaten user protection. The announcement suggested the agency could conduct a blockchain analysis of ...

38% of US voters will consider candidates’ position on crypto in midterms: Survey

Roughly a third of eligible voters in the United States will be “considering crypto policy positions” when choosing candidates in the 2022 midterm elections, according to a new survey. In the results of a 2,029-person survey conducted by The Harris Poll between Oct. 6 and 11, 57% of likely midterm voters say they would be more likely to vote for a political candidate interested in staying informed about cryptocurrencies, while 38% said they would consider positions on crypto policy when voting in the midterms. The survey, initiated by Grayscale Investments, also suggests that crypto regulation is a bipartisan issue, with 87% of Democratic and 76% of Republican respondents saying they want clarity from the U.S. government. “Voters and lawmakers alike have been hearing about crypto, and...

Crypto regulation is 1 of 8 planned priorities under India’s G20 presidency, says finance minister

India’s Finance Minister Nirmala Sitharaman said she would love to show that the country is “moving speedily forward” with digital financial technology as it prepares to assume the presidency of the G20. Speaking at the Indian Council for Research on International Economic Relations on Nov. 1, Sitharaman said the people of India have taken to digital technology “as fish to water.” The finance minister added that crypto asset regulation would likely be one of India’s priorities in its leadership of the G20, but needed the support of other members. According to Sitharaman, India needed to work with organizations including the International Monetary Fund, Financial Stability Board, and Organization for Economic Co-operation and Development to ensure crypto “can be regulated with all countries...

Pro-crypto city of Lugano and El Salvador sign economic agreement based on adoption

Switzerland’s southern city of Lugano and El Salvador have signed an economic cooperation agreement based on crypto and blockchain. According to an Oct. 28 announcement from Lugano, the two pro-crypto jurisdictions signed a memorandum of understanding on economic cooperation at the city’s Plan B event. Lugano Mayor Michele Foletti cited El Salvador adopting Bitcoin (BTC) as legal tender as part of the city’s interest in the agreement, which will allow the pro-crypto country to establish a physical government presence in an effort to “foster cooperation with educational and research institutions.” “The use of Bitcoin and Blockchain technology creates new opportunities for growth and investment that benefit our communities; it is a new alternative financial and exchange tool that fosters tra...

Terra co-founder Do Kwon faces $57-million lawsuit in Singapore

Do Kwon, the co-founder of Terraform Labs who may be facing legal actions in South Korea and the United States, is the target of a lawsuit in Singapore along with the Luna Foundation Guard (LFG) and Terra founding member Nicholas Platias. In a lawsuit filed in Singapore’s high court on Sept. 23, 359 individuals allege Kwon, Platias, the LFG and Terra made fraudulent claims, including that Terra’s stablecoin, TerraUSD (UST) — now TerraUSD Classic (USTC) — was not “stable by design” and unable to maintain its U.S. dollar peg. The claimants are seeking compensation for roughly $57 million worth of “loss and damage” combined based on the value of UST tokens they purchased and held or sold amid the market downturn in May. They also request an order to pay for “aggravated damages.” According to ...

United Kingdom banks hate crypto, and that’s bad news for everyone

In 2018, the United Kingdom’s Financial Conduct Authority (FCA) wrote to the heads of the country’s biggest high street banks to emphasize the importance of due diligence when dealing with crypto businesses. That seems to have led to widespread high-risk ratings and bans on crypto-related banking, impacting both crypto businesses hoping to operate in the U.K. and investors alike. Banks are, understandably and responsibly, concerned with scams, but the current situation creates uncertainty. Crypto investors need to be able to move their money around as they like, and crypto businesses need access to payment rails for a variety of other reasons, such as paying staff and suppliers. A catch-22 that harms market competition By barring crypto businesses from accessing “mainstream” banking, organ...

UK police council reports there are officers in every unit trained for crypto enforcement

The detective chief superintendent for the United Kingdom’s National Police Chiefs’ Council has said all police forces in the country have officers trained for investigations involving the enforcement and seizure of cryptocurrencies. In an Oct. 25 parliamentary debate on the U.K. Economic Crime and Corporate Transparency Bill, Andy Gould of the NPCC said that the country’s police force had the capability to address economic crimes involving crypto, but not the capacity. He reported that the authorities had used £100 million — roughly $116 million at the time of publication — over the last four years to create “cryptocurrency tactical advisers across the whole of policing.” “There are now officers in every force and every regional organised crime unit who are trained and equipped to [invest...

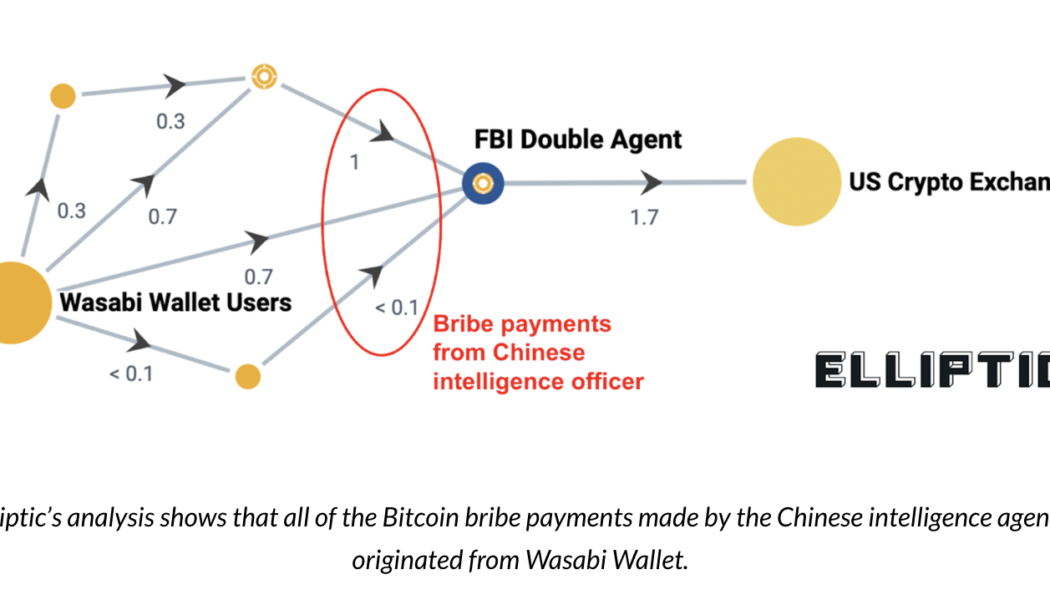

Chinese agents used Bitcoin transactions through Wasabi to allegedly bribe US government employee

The United States Department of Justice has announced charges against two Chinese intelligence officers who allegedly bribed a double agent with Bitcoin. In an Oct. 24 announcement, the Justice Department said Guochun He and Zheng Wang attempted to obstruct the prosecution of an unnamed global telecommunications company based in China, which allegedly involved paying a U.S. government employee roughly $61,000 in bribes using Bitcoin (BTC). However, the individual was a double agent working on behalf of the Federal Bureau of Investigation and did not move against authorities in the Eastern District of New York in the case against the China-based company. According to an analysis by cryptocurrency risk management firm Elliptic, He and Wang used Wasabi Wallet to conceal the BTC transactions a...