Regulation

Data shows the Bitcoin mining bear market has a ways to go

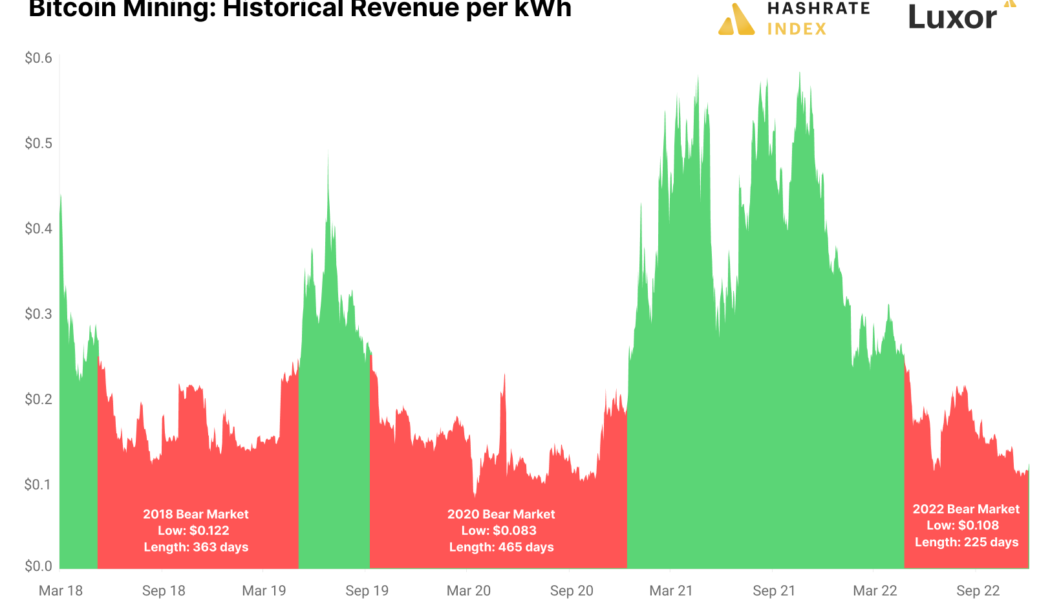

Bitcoin (BTC) mining is the backbone of the BTC ecosystem and miners’ returns also provide insight into BTC’s price movements and the health of the wider crypto sector. It is well-documented that Bitcoin miners are struggling in the current bear market. Blockstream, a leading Bitcoin miner recently raised funds at a 70% discount. Current mining activity shares similarities to historic BTC bear markets with a few caveats. Let’s explore what this means for the current Bitcoin cycle. Analysis shows that based on previous cycles the bear market may continue Bitcoin mining profitability can be measured by taking the miner’s revenue per kilowatt hour (kWh). According to Jaran Mellerud, a Bitcoin analyst for Hashrate Index, a BTC mining bear market has a sustained period of revenue per kWh of les...

US lawmakers question federal regulators on banks’ ties to crypto firms

Two members of the United States Senate have called on the heads of federal financial regulators to address “ties between the banking industry and cryptocurrency firms” in the wake of FTX’s collapse. In letters dated Dec. 7 to Federal Reserve chair Jerome Powell, acting Comptroller of the Currency Michael Hsu, and Federal Deposit Insurance Corporation acting chair Martin Gruenberg, Senators Elizabeth Warren and Tina Smith — both on the Senate Banking Committee — acknowledged that the crypto industry was not so “deeply integrated” with traditional financial institutions to severely impact markets after FTX’s bankruptcy filing. However, the two lawmakers pointed to reports suggesting ties between FTX and the Washington-based Moonstone Bank as well as stablecoin issuer Tether and the Bahamas-...

Sam Bankman-Fried hires defense attorney as US authorities probe FTX: Report

Former FTX chief executive officer Sam Bankman-Fried has reportedly hired Mark Cohen, a former federal prosecutor, to act as his defense attorney. According to a Dec. 6 report from Reuters, Bankman-Fried’s spokesperson Mark Botnick said the former FTX CEO has retained Cohen amid a flurry of civil litigation from investors in the crypto exchange and investigations by lawmakers and regulators in the United States. Cohen, a co-founder of law firm Cohen & Gresser, was a former assistant U.S. attorney for the Eastern District of New York who also on the defense team for the high-profile case involving Ghislaine Maxwell — sentenced to 20 years in prison for child sex trafficking and related charges. Lawmakers with the U.S. Senate and House of Representatives have announced separate hea...

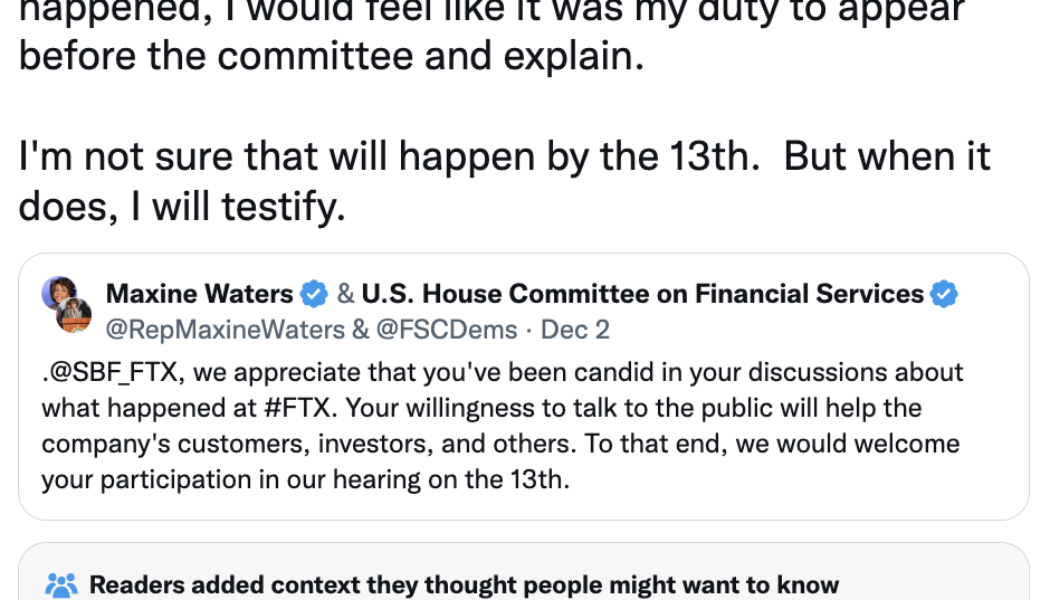

US House committee chair pushes back against SBF’s excuse to potentially delay testimony

Maxine Waters, chair of the United States House Financial Services Committee, has called out former FTX CEO Sam Bankman-Fried for announcing on social media he intended to testify after “learning and reviewing what happened” at the exchange. In a Dec. 5 Twitter thread, Waters cited Bankman-Fried’s numerous media interviews in the wake of FTX’s bankruptcy as evidence that his information was “sufficient for testimony” before the committee. Waters will preside over a hearing investigating the collapse of FTX on Dec. 13, in which committee leadership said they expected Bankman-Fried and other individuals associated with the events around the exchange’s downfall to appear. “The collapse of FTX has harmed over one million people,” said Waters, in a statement directed to Bankman-Fried. “Your tes...

How can UK-based businesses accept Bitcoin?

Accepting Bitcoin payments is advantageous due to lower fees than credit and debit cards, expansion of customer base and real-time bank balances. However, risks like volatility and cybercrime may undermine these benefits. Cryptocurrency payments help save excessive credit and debit card processing fees as they are decentralized and do not need intermediaries to verify the transaction. Moreover, merchants do not incur overseas currency exchange changes if payments are made in BTC or other cryptocurrencies. High transaction speed is another benefit of accepting Bitcoin payments, allowing businesses to receive payments in real-time. Moreover, with the increasing customer demand to pay in crypto, offering Bitcoin as a payment method will help acquire more shoppers. However, accepting cryptocur...

Dems and Reps join forces to pressure SBF to testify before Congress

The leadership with the United States House Financial Services Committee have separately called on former FTX CEO Sam Bankman-Fried to appear in an investigative hearing scheduled for Dec. 13. In Dec. 2 posts on Twitter, House Financial Services Committee chair Maxine Waters, a Democrat, and ranking member Patrick McHenry, a Republican, requested SBF speak at a hearing aimed at investigating the events around the collapse of FTX. It’s unclear if the U.S. lawmakers intended the former FTX CEO to appear in person or remotely from the Bahamas. “[Sam Bankman-Fried], we appreciate that you’ve been candid in your discussions about what happened at FTX,” said Waters. “Your willingness to talk to the public will help the company’s customers, investors, and others.” “As you said, [Sam B...

South Korean judge dismisses arrest warrants for Terra co-founder Do Kwon’s former associates

A judge with the Seoul Southern District Court has reportedly set aside arrest warrants for Terra co-founder Shin Hyun-seong along with those of 3 Terra investors and 4 developers. According to an Dec. 3 report from South Korea’s Yonhap News Agency, Judge Hong Jin-Pyo said there was little risk of Shin or the Terra associates destroying evidence related to the case against the crypto firm, and dismissed warrants that the Seoul Southern District Prosecutors Office issued on Nov. 29. The report added that Terra co-founder Do Kwon, also facing legal action in South Korea for his role in the firm’s collapse, was unlikely to return to the country. “The Seoul Southern District Court’s ruling on Dec. 3rd to reject South Korean prosecutors’ detention warrant requests for former Terraform Labs empl...

Shiba Inu developer says WEF wants to work with project to ‘help shape’ metaverse global policy

The volunteer project lead and developer for Shiba Inu known only as ‘Shytoshi Kusama’ has reported on social media that the World Economic Forum, or WEF, wants to work with the meme-based cryptocurrency on global policy. In a poll posted to Twitter on Nov. 22, Kusama said the WEF had “kindly invited” the Shiba Inu (SHIB) project to collaborate on “MV global policy.” The Shiba Inu developer seemed to be referring to policy on the metaverse. Crypto and blockchain have sometimes been under discussion at WEF events, but partnering with a popular meme token would seemingly be a first for the organization. “Yes I am serious,” said Kusama. “We would be at the table with policy makers and would help shape global policy for the MV alongside other giants like FB (bye Zuck), Sand, Decentraland etc.”...

Approving a spot crypto ETF is ‘all about political power’ — Perianne Boring

Perianne Boring, founder and CEO of blockchain advocacy group Chamber of Digital Commerce, placed the lack of approval of a Bitcoin exchange-traded fund in the United States squarely on Securities and Exchange Commission chair Gary Gensler, suggesting politics played more of a role than economics. Speaking to Cointelegraph at the Texas Blockchain Summit in Austin on Nov. 18, Boring said the events surrounding FTX’s collapse may have “emboldened the regulation by enforcement approach” from the U.S. Securities and Exchange Commission and Treasury, with Republican lawmakers likely to focus on oversight using their House majority in the next Congress. According to the Chamber of Digital Commerce CEO, passing any kind of legislation — including bills on crypto, blockchain, and stablecoins — wil...