Regulation

HM Treasury changes course on collecting data around unhosted crypto wallets

The government of the United Kingdom said it intends to modify a proposal that would have required crypto firms to collect personal data from individuals holding unhosted wallets that were the recipients of digital asset transfers. In its Amendments to the Money Laundering, Terrorist Financing and Transfer of Funds updated on Wene, HM Treasury said it will be scaling back its requirements for gathering data from both the senders and recipients of crypto sent to unhosted wallets, unless the transaction poses “an elevated risk of illicit finance.” The U.K. government added that unhosted wallets could be used for a variety of legitimate purposes, including asan additional layer of protection as is sometimes the case for cold wallets. “There is not good evidence that unhosted wallets present a...

US lawmakers urge EPA to consider the potential benefits of crypto mining

A group of 14 United States senators and House representatives have signed a letter to the Environmental Protection Agency extolling what they believe are the benefits of crypto mining. In a Thursday letter, many U.S. lawmakers including pro-Bitcoin Senator Cynthia Lummis and Representative Tom Emmer addressed EPA administrator Michael Regan, requesting the government agency analyze the potential impact of crypto mining in an effort to balance innovation with environmental concerns. The group of 14 senators and representatives claimed mining could have a “substantial stabilizing effect on energy grids” and cited examples of mining operations using flared gas and renewable energy sources. “Digital assets, and their related mining activities, are essential to the economic future of the Unite...

Stablecoins highlight ‘structural fragilities’ of crypto — Federal Reserve

The Federal Reserve’s board of governors pointed to stablecoins as a potential risk to financial stability amid a volatile crypto market. In its Monetary Policy Report released on Friday, the board of governors of the Federal Reserve System said “the collapse in the value of certain stablecoins” — likely referring to TerraUSD (UST) becoming unpegged from the United States dollar in May — in addition to “recent strains” in the digital asset market suggested “structural fragilities.” The government department pointed to the President’s Working Group on Financial Markets report from November 2021, in which officials said legislation was “urgently needed” to address financial risks. “Stablecoins that are not backed by safe and sufficiently liquid assets and are not subject to appro...

EU commissioner reiterates need for ‘regulating all crypto-assets’

Mairead McGuinness, the Commissioner for Financial Services, Financial Stability and Capital Markets Union at the European Commission, is moving forward with a discussion on regulating cryptocurrencies amid three major events in the space. In written remarks for a speech in Brussels on Tuesday, McGuinness said the Celsius Network’s recent suspension of withdrawals, as well as the crash of Terra (originally LUNA, now LUNA Classic, or LUNC), show the need for crypto-asset regulation in the European Union. She added that ongoing concerns about crypto potentially being used to circumvent sanctions on Russia were also a factor. “Regulating all crypto-assets — whether they’re unbacked crypto-assets or so-called “stablecoins — and crypto-asset service providers is necessary...

BNB price risks 40% drop as SEC launches probe against Binance

Binance Coin (BNB) price dropped by nearly 7.3% on June 7 to below $275, its lowest level in three weeks. What’s more, BNB price could drop by another 25%–40% in 2022 as its parent firm, Binance, faces allegations of breaking securities rules and laundering billions of dollars in illicit funds for criminals. Bad news twice in a row BNB was issued as a part of an initial coin offering (ICO) in 2017 that amassed $15 million for Binance. The token mainly behaves as a utility asset within the Binance ecosystem, primarily enabling traders to earn discounts on their trading activities. Simultaneously, BNB also functions as a speculative financial asset, which has made it the fifth-largest cryptocurrency by market capitalization. BNB market capitalization was $45.42 billion as of June ...

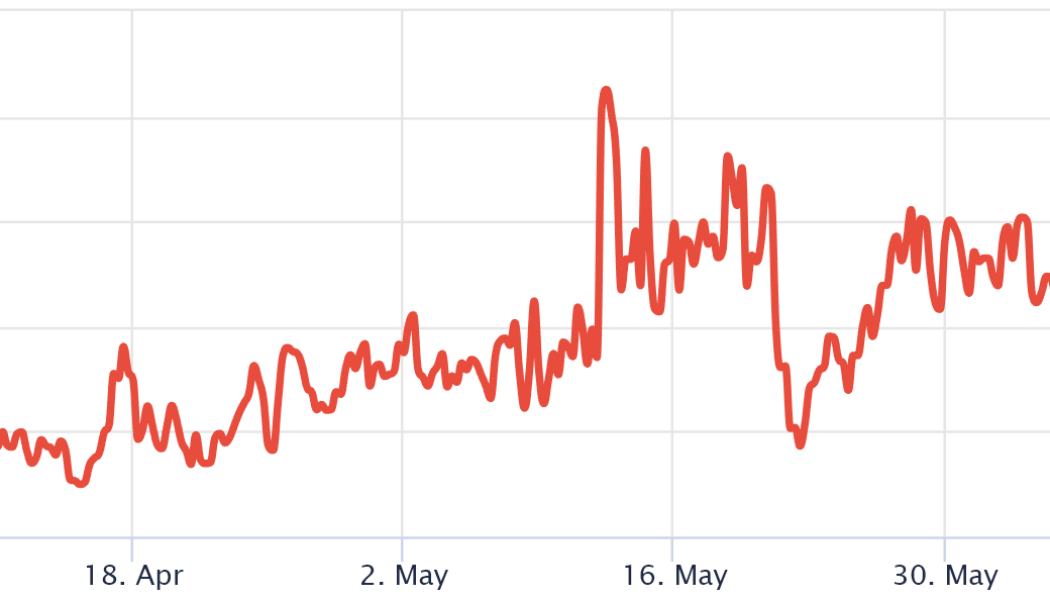

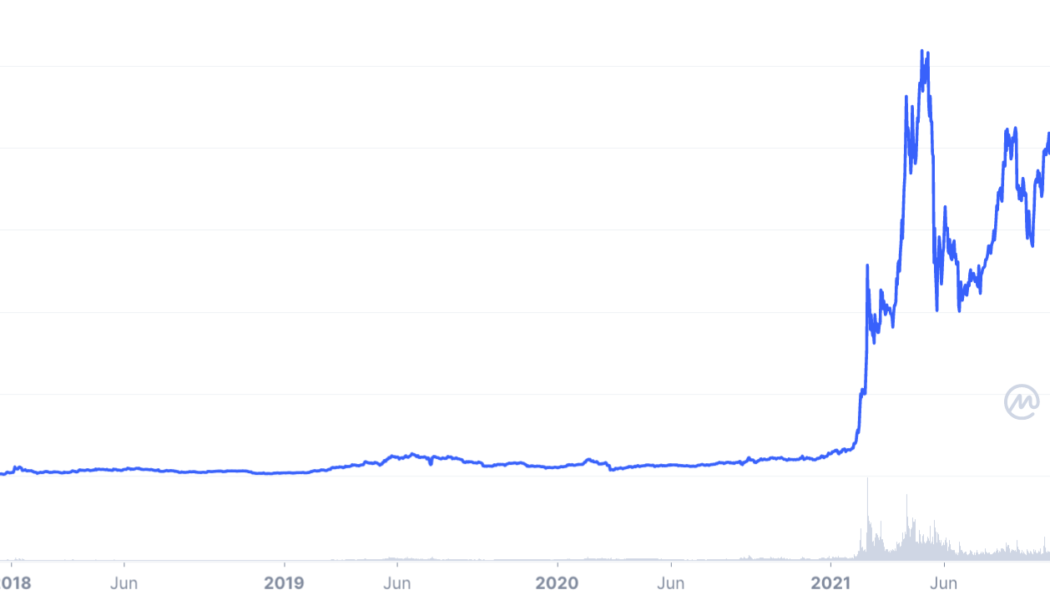

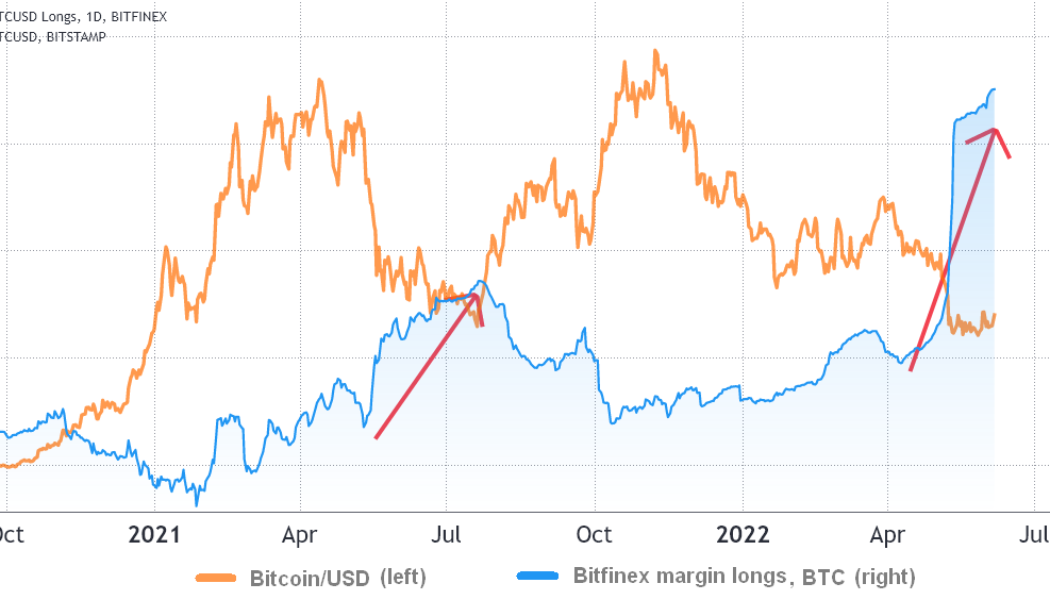

Bitfinex Bitcoin longs hit a record-high, but does that mean BTC has bottomed?

Bitcoin (BTC) has been unable to close above $32,000 for the past 28 days, frustrating bulls and pushing the Fear and Greed index to bearish levels below 10. Even with June 6’s small boost, the tech-heavy Nasdaq stock market index is down 24% year-to-date. Investors who keep a close eye on regulatory development were possibly scared after New York state made clear its intention to regulate the crypto industry, including Bitcoin mining. On June 2, New York Attorney General Attorney Letitia James issued an investor alert against “risky cryptocurrency investments,” citing the assets’ volatility. According to Cointelegraph, the attorney general is convinced that crypto investments create “more pain than gain” for investors. The New York State Senate approved a pro...

FCA will ‘absolutely’ consider recent stablecoin depegging when drafting crypto rules: Report

Sarah Pritchard, the executive director of markets at the United Kingdom’s Financial Conduct Authority, or FCA, reportedly said the regulator will look at the recent volatility in the crypto markets when creating rules for the space in 2022. According to a Friday Bloomberg report, Pritchard said the financial regulator will “absolutely” take into account stablecoins like TerraUSD (UST) and Tether (USDT) depegging from the U.S. dollar in drafting regulatory guidelines with Her Majesty’s Treasury for release later this year. While the USDT price only briefly dropped to $0.97 on May 12, UST’s has fallen more than 93% since May 9 to reach roughly $0.06 at the time of publication. “It really shows at front of mind the really significant issues that exist here, both in terms of a well-func...

Panama’s president says he won’t sign crypto bill into law ’at this moment’

Laurentino Cortizo, the president of Panama, has said he won’t sign off on a crypto bill recently approved by the country’s National Assembly without additional Anti-Money Laundering rules. Speaking at the Bloomberg New Economy Gateway Latin America conference on Wednesday, Cortizo said the bill recently passed by Panama’s legislature must go through legal checks before reaching his desk, but added he needed more information before potentially signing it into law. Describing the legislation as an “innovative law” and a “good law,” the president said he approved of certain aspects of the bill but hinted at possible illicit uses of cryptocurrencies that needed to be addressed. “I will not sign that law at this moment,” said Cortizo. “If the law has clauses related to money laundering activit...

Biden’s pick for Fed vice chair for supervision calls for congressional action on stablecoins

Michael Barr, a law professor and former advisory board member of Ripple Labs who is United States President Joe Biden’s pick for vice chair for supervision at the Federal Reserve, called for U.S. lawmakers to regulate stablecoins in an effort to address “financial stability risks.” In a confirmation hearing before the Senate Banking Committee on Thursday, Barr said innovative technologies including cryptocurrencies had “some potential for upside in terms of economic benefit” but also “some significant risks,” citing the need for a regulatory framework on stablecoins to prevent the risk of runs. Barr added that the Fed potentially releasing a central bank digital currency was an issue that required “a lot more thought and study,” echoing Fed chair Jerome Powell’s views concerning due dilig...

California regulator will revisit long-running ban on crypto donations on May 19

A California state regulator may be looking at overturning a ban on cryptocurrency donations to political campaigns which has been in effect since 2018. According to its May 2022 agenda, California’s Fair Political Practices Commission, or FPPC, has scheduled a “pre-notice discussion” on Thursday on the use of cryptocurrencies f campaign contributions in the state. The commission said it will be considering drafting amendments to its regulations requiring that “no contribution may be made or received in cryptocurrency.” In September 2018, the FPPC voted to ban both sending and receiving crypto contributions for political campaigns in the state of California, due to concerns the donations “might be utilized to circumvent contribution limits and prohibitions, or by foreign entities to ...

US federal judge approves of Justice Dept criminal complaint on using crypto to evade sanctions

The United States Department of Justice may move forward on a criminal prosecution case against a U.S. citizen who allegedly violated sanctions through cryptocurrency. According to a Friday opinion filing in U.S. District Court for the District of Columbia, the unnamed individual who is the subject of a criminal investigation by the Justice Department allegedly sent more than $10 million in Bitcoin (BTC) from a U.S.-based crypto exchange to an exchange in a country for which the U.S. currently imposes sanctions — suggesting Russia, Cuba, North Korea, Syria, or Iran. The filing alleged the individual “conspired to violate the International Emergency Economic Powers Act” and conspired to defraud the United States. The individual allegedly “proudly stated the Payments Platform could circumven...