Regulation

Singapore’s financial watchdog considers further restrictions on crypto

The Monetary Authority of Singapore, or MAS, has been “carefully considering” adding restrictions that could affect how retail investors handle crypto, according to one of the government’s senior ministers. According to parliamentary records published on Monday, Singapore senior minister and MAS chair Tharman Shanmugaratnam said the financial watchdog may consider “placing limits on retail participation” for crypto investors as well as introducing rules on the use of leverage for crypto transactions. Shanmugaratnam also called for regulatory clarity among financial regulators around the world, “given the borderless nature of cryptocurrency markets.” In January, the MAS barred crypto service providers from advertising or marketing in public spaces, and was behind regulations to shut down cr...

ECB officials prepare for ‘harmonization’ of crypto regulations: Report

The European Central Bank, or ECB, will reportedly be preparing to implement a new law by warning European Union member states about the necessity of harmonizing regulations for crypto. According to a Sunday report from the Financial Times, the ECB was concerned about possible regulatory overlap between respective central banks in the EU and crypto companies as officials prepare to implement the Markets in Crypto-Assets, or MiCA, framework. The European Parliament, European Commission, and European Council reached an agreement on June 30 to bring crypto issuers and service providers within their jurisdictional control under a single regulatory framework. Regulators from 19 EU member states will reportedly attend a supervisory board meeting in July to discuss MiCA and its possible implement...

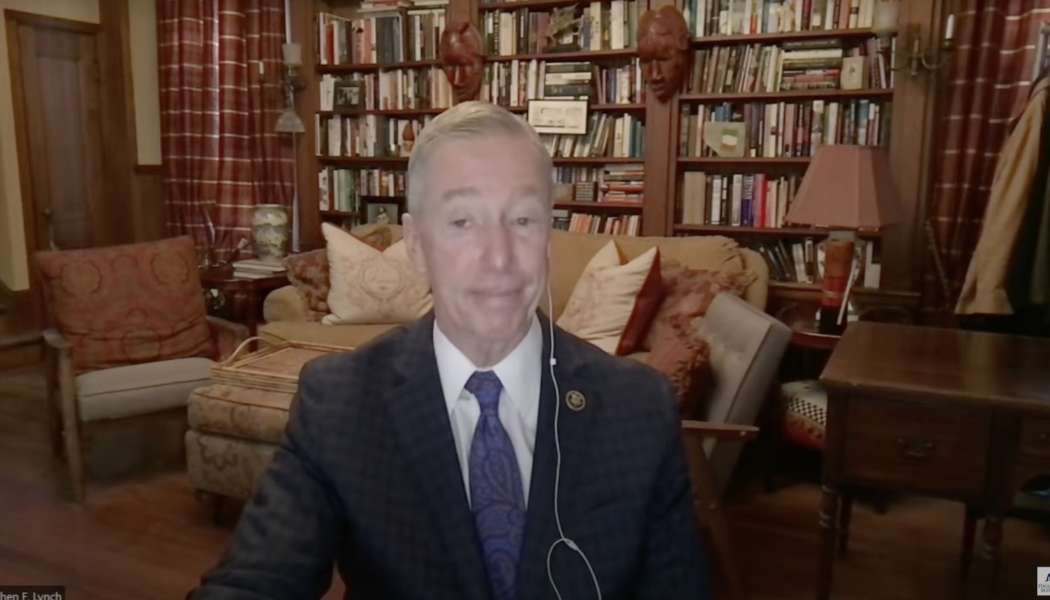

US lawmakers say crypto industry has a ‘tech bro’ problem hurting innovation

According to some United States lawmakers in the House Financial Services Committee, the lack of diversity in the financial technology space could be hurting many companies’ bottom lines. In a Thursday virtual hearing on “Combatting Tech Bro Culture,” U.S. lawmakers and witnesses discussed how women and people of color were underrepresented in leadership positions in the financial technology industry, including crypto firms. Massachusetts Representative Stephen Lynch cited data that only 2% of venture capital funding went to firms in which the founders were women, while only 1% went to those with black founders, and 1.8% for Latinx. According to Lynch and some on the committee, this trend suggested an “old boys club” culture in companies including those involved with cryptocurrencies, in w...

Former Monero maintainer Riccardo ‘Fluffypony’ Spagni to surrender for South Africa extradition

Riccardo Spagni, the former maintainer of the privacy coin Monero also known as Fluffypony, faces extradition to South Africa months after his arrest by U.S. authorities. In a Thursday court filing for the Middle District of Tennessee, Magistrate Judge Alistair Newbern ordered Spagni to surrender to U.S. Marshals on July 5 for extradition to South Africa. He will reportedly face 378 charges related to allegations of fraud and forgery between 2009 and 2011 at a company called Cape Cookies. U.S. authorities arrested Spagni in Nashville in July 2021 at the request of the South African government, holding him in custody until September. The court filings hint at allowing Spagni to be in the United States for the Independence Day holiday weekend before being taken to Africa early on Tuesday. No...

US govt delays enforcement of crypto broker reporting requirements: Report

The provision in the U.S. infrastructure bill signed into law in November, which will require financial institutions and crypto brokers to report additional information, could reportedly be delayed. According to a Wednesday report from Bloomberg, the United States Department of the Treasury and Internal Revenue Service may not be willing to enforce crypto brokers collecting information on certain transactions starting in January 2023, citing people familiar with the matter. The potential delay could reportedly affect billions of dollars related to capital gains taxes — the Biden administration’s budget for the government for the 2023 fiscal year previously estimated modifying the crypto tax rules could reduce the deficit by roughly $11 billion. Under the current infrastructure bill, Sectio...

EU officials reach agreement on AML authority for supervising crypto firms

The European Council has reached an agreement to form an anti-money laundering body that will have the authority to supervise certain crypto asset service providers, or CASPs. In a Wednesday announcement, the council said it had agreed on a partial position of a proposal to launch a dedicated Anti-Money Laundering Authority, or AMLA. According to the regulatory body, the AML body will have the authority to supervise “high-risk and cross-border financial entities” including crypto firms — “if they are considered risky.” European Parliament member Ondřej Kovařík said EU officials had also reached a “provisional political agreement” on the government body’s Transfer of Funds Regulation. Not all the details of the revision are clear at the time of publication, but Cointelegraph reported that a...

That’s ‘Sir’ Crypto Dad: French order knights former CFTC chair Chris Giancarlo

The French government has given former United States Commodity Futures Trading Commission chair Chris Giancarlo, also known as “Crypto Dad,” the equivalent of a knighthood. In a Tuesday tweet from Giancarlo, the former CFTC head said France’s National Order of Merit awarded him a Chevalier — the equivalent of a knighthood — in a ceremony at the French ambassador’s residence in Washington D.C. Those attending included current and former CFTC commissioners Rostin Behnam, Brian Quintenz, Christy Goldsmith Romero, Kristin Johnson, Caroline Pham, as well as Hester Peirce of the Securities and Exchange Commission. Merci for honor of l’Ordre National du Mérite at the Résidence de France before mes amis @CFTCbehnam @BrianQuintenz @HesterPeirce Dawn Stump Dan Berkovitz @CFTCcgr @C...

Chainalysis tips Australia will crack down on misleading crypto ads

Chainalysis’ head of international policy Caroline Malcolm expects Australia’s new rules governing crypto advertising, promotion and consumer safeguards to follow a similar path to the United Kingdom when they come into place within the next year. “I think we’re more likely to see something along the lines of the UK model which is really focusing on a crackdown on misleading advertising or advertising which doesn’t present the risks alongside the opportunities.” During the Chainalysis Links event in Sydney on June 21, Malcolm told Cointelegraph that this meant treating crypto products and services in a similar way to financial products and services when it comes to advertising and promotion. In March, U.K.’s Advertising Standards Authority (ASA) released new guidanc...

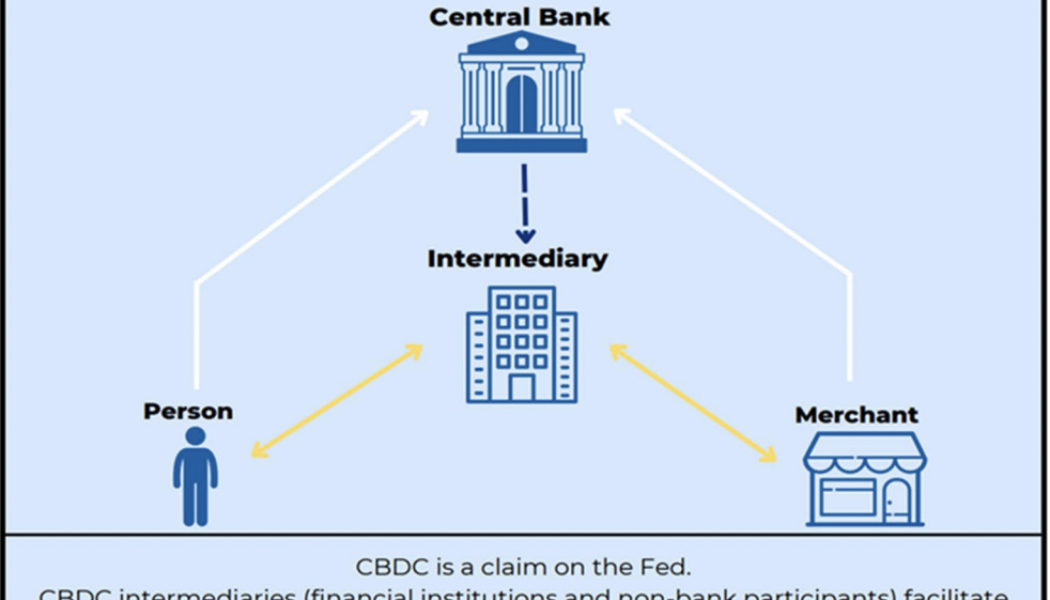

US lawmaker lays out case for a digital dollar

Connecticut House of Representatives member Jim Himes has released a proposal aiming to start a dialogue on the United States potentially launching a central bank digital currency, or CBDC. In a white paper released on Wednesday, Himes urged Congress to begin exploring the rollout of a digital dollar issued by the Federal Reserve to prevent the government from falling behind in innovations in financial technology. According to the U.S. lawmaker, a CBDC “should not be thought of as replacing legacy payment systems and currencies but as an additional alternative for consumers and businesses.” The white paper laid out a proposal in which a CBDC could present concerns over transparency, security and privacy when compared with fiat currency. Himes added that any regulatory framework on CBDCs en...

Colombia’s new president seems to be a fan of Bitcoin

Gustavo Petro, who recently won the 2022 Colombian presidential election, has previously made statements in favor of cryptocurrencies. Petro will replace Iván Duque Márquez as the president of Colombia on August 7 for four years after winning the second round of a run-off election on Sunday. The president-elect took to social media in December 2017 shortly after a major bull run to speak on the “strength” of Bitcoin (BTC). Petro hinted at the time that cryptocurrencies like BTC could remove power from government and traditional banks and give it back to the people. El bitcoin quita poder de emision a los estados y el señoreaje de la moneda a los bancos. Es una moneda comunitaria que se basa en la confianza de quienes realizan transacciones con ella, al tener como base el blockchain, la con...