Regulation

US Justice Department seized $500K in fiat and crypto from hackers connected to DPRK government

The United States Department of Justice has seized and returned roughly $500,000 in fiat and crypto from a hacking group tied to the North Korean government, which included two crypto payments made by U.S. health care providers. In a Tuesday announcement, the Justice Department said in conjunction with the FBI it had investigated a $100,000 ransomware payment in Bitcoin (BTC) from a Kansas hospital to a North Korean hacking group in order to regain access to its systems, as well as a $120,000 BTC payment from a medical provider in Colorado to one of the wallets connected to the aforementioned attack. In May, the FBI filed a seizure warrant for funds from the two ransom attacks and others laundered through China, which the Justice Department reported as worth roughly $500,000 total. “These ...

US lawmaker criticizes SEC enforcement director for not going after ‘big fish’ crypto exchanges

Brad Sherman, the congressperson who previously called for banning cryptocurrencies in the United States, criticized the Securities and Exchange Commission’s (SEC) approach to enforcement among major crypto exchanges. In a Tuesday hearing before the House Committee on Financial Services, Sherman said SEC enforcement director Gurbir Grewal needed to show “fortitude and courage” when pursuing securities cases against cryptocurrency exchanges in the United States. The lawmaker added that the SEC enforcement division had “gone after” XRP as a security, but not the crypto exchanges that processed “tens of thousands” transactions of the token. “If XRP is a security — and you think it is, and I think it is, why are these crypto exchanges not in violation of law and is it enough that the crypto ex...

Circle CSO lays out policy principles for stablecoins in US

Dante Disparte, Circle’s chief strategy officer and head of global policy who has previously testified at congressional hearings, has called on United States lawmakers to balance the risks with developing a regulatory path for stablecoins. In a Monday blog post, Disparte named 18 principles Circle had established as part of its effort to shape stablecoin policy in the United States. Circle, the company behind USD Coin (USDC) with a reported $54 billion in circulation, highlighted privacy concerns, “a level playing field” between banks and non-banks over a U.S. dollar-pegged digital currency, how stablecoins can coexist alongside a central bank digital currency, and the need for regulatory clarity. “Harmonizing national regulatory and policy frameworks for dollar digital currencies advances...

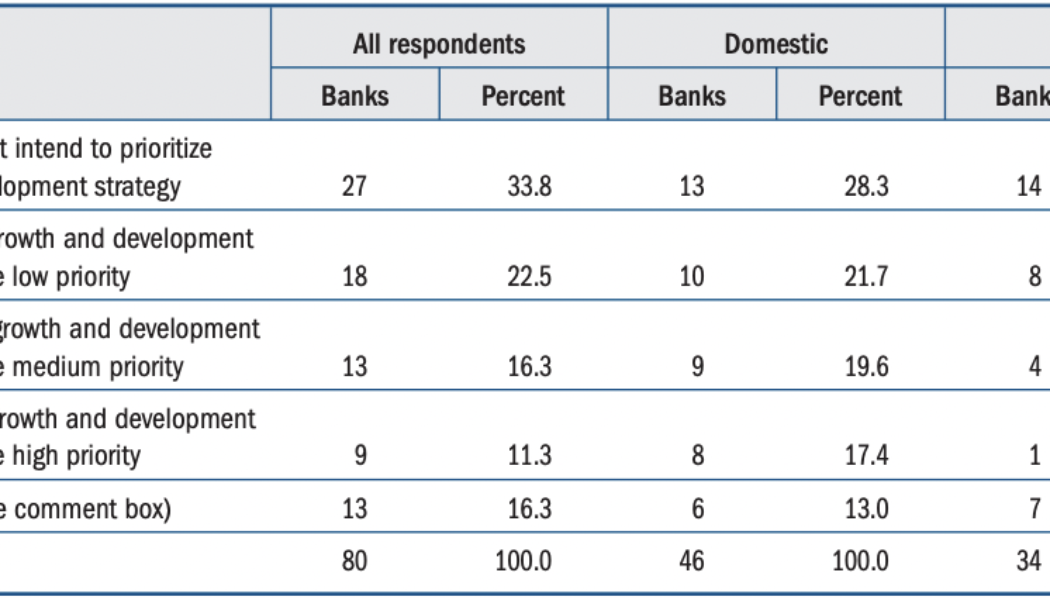

56% of banks say DLT and crypto are ‘not a priority’ in near future — Fed survey

A survey conducted by the Federal Reserve Board of the United States suggested that the majority of officials at major banks did not consider crypto-related products and services a priority in the near future. According to the results of a Fed survey released on Friday, more than 56% of senior financial officers from 80 banks said distributed ledger technology and crypto products and services were “not a priority” or were “a low priority” for their growth and development strategy for the next two years, while roughly 27% said they were a medium or high priority. However, roughly 40% of respondents in the survey said the technology was a medium or high priority for their banks for the next two to five years. Results of Fed survey from May 2022. Source: Federal Reserve Answers from surveyed ...

SEC commissioner Allison Lee departs, readying financial regulator for Jaime Lizárraga

Allison Herren Lee, one of five members of the United States Securities and Exchange Commission’s board, has officially left the regulatory body after more than three years as a commissioner. In a Friday announcement, chair Gary Gensler and commissioners Hester Peirce, Mark Uyeda, and Caroline Crenshaw said Lee had left the SEC, where in 2005 she started as a staff attorney at the agency’s enforcement division at a regional office in Denver. She moved on to be appointed a commissioner in 2019 under the former presidential administration, and later served as acting chair to the regulatory body for three months, until Gensler’s confirmation in April 2021. “Commissioner Lee has been a stalwart advocate for strong and stable markets, including by emphasizing the need for market participants to...

South African exchanges welcome the new ‘crypto is financial asset’ ruling

South Africa’s Reserve Bank is set to begin regulating cryptocurrencies as financial assets in the next 18 months, with exchanges expecting the move to drive adoption in the country. The move to classify cryptocurrencies as financial assets and not currency, has been talked about for some time by the South African Reserve Bank (SARB). Deputy governor Kuben Chetty confirmed that the new regulations would take effect over the next year, speaking in an online dialogue on July 11. The cryptocurrency space has been left to develop organically in South Africa, with no clear-cut regulations issued by the SARB until recently. The country has become a leader in cryptocurrency adoption, with more than 6 million South Africans estimated to own some cryptocurrency. Now that the SARB has finally t...

US Senate confirms Michael Barr as Fed vice chair for supervision

The United States Senate has confirmed the nomination of law professor Michael Barr to become the next vice chair for supervision for the Federal Reserve. In a 66-28 vote on the Senate floor on Wednesday, U.S. lawmakers confirmed Barr as vice chair for supervision of the Federal Reserve System for four years, filling the last seat on the seven-member board of governors. Barr, who was on the advisory board of Ripple Labs from 2015 to 2017, also served as the Treasury Department’s assistant secretary for financial institutions under former President Barack Obama, and taught courses on financial regulation at the University of Michigan. As vice chair for supervision, Barr will be responsible for developing policy recommendations for the Fed as well as overseeing the supervision and regulation...

UK Treasury Committee opens inquiry into crypto industry

The Treasury Committee of the United Kingdom’s House of Commons has called on the public to submit evidence related to the role of crypto’s risks and opportunities. In a Tuesday notice, the committee said it had opened an inquiry allowing people to write in about the role of crypto assets in the United Kingdom. The Treasury Committee said it would be exploring how the U.K. government, the Financial Conduct Authority, or FCA, and the Bank of England could balance regulation “to provide adequate protection for consumers and businesses without stifling innovation” as well how cryptocurrencies and distributed ledger technology could impact individuals, businesses and financial institutions. The British public has until Sept. 12 to submit evidence, which the committee may use in its report to P...

How Bitcoin’s strong correlation to stocks could trigger a drop to $8,000

The Bitcoin (BTC) price chart from the past couple of months reflects nothing more than a bearish outlook and it’s no secret that the cryptocurrency has consistently made lower lows since breaching $48,000 in late March. Bitcoin price in USD. Source: TradingView Curiously, the difference in support levels has been getting wider as the correction continues to drain investor confidence and risk appetite. For example, the latest $19,000 baseline is almost $10,000 away from the previous support. So if the same movement is bound to happen, the next logical price level would be $8,000. Traders are afraid of regulation and contagion On July 11, the Financial Stability Board (FSB), a global financial regulator including all G20 countries, announced that a framework of recommendations for the crypt...

Bitcoin not a currency? South Africa to regulate crypto as financial asset

The South African Reserve Bank is set to introduce regulations next year that will see cryptocurrencies classed and treated as financial assets to balance investor protection and innovation. Cryptocurrency use in South Africa is in a healthy space, with around 13% of the population estimated to own some form of cryptocurrency, according to research from global exchange Luno. With more than six million people in the country having cryptocurrency exposure, regulation of the space has long been a talking point. Companies or individuals looking to provide advice or intermediary services involving cryptocurrencies are currently required to be recognized as financial services providers. This involves meeting a number of checkboxes to comply with global guidelines set out by the Financial Action ...

SEC extends window to decide on ARK 21Shares spot Bitcoin ETF to August

The United States Securities and Exchange Commission has pushed the deadline to approve or disapprove ARK 21Shares’ Bitcoin exchange-traded fund to August 30. According to a Tuesday filing from the SEC, the regulatory body extended the deadline for approving or disapproving the ARK 21Shares spot Bitcoin (BTC) ETF from July 16 for an additional 45 days, to August 30. The application, originally filed with the SEC in May and published for comment in the Federal Register on June 1, included a proposed rule change from the Chicago Board Options Exchange BZX Exchange. Ark Invest partnered with Europe-based ETF issuer 21Shares to file for a spot Bitcoin ETF listed on CBOE BZX Exchange in 2021, but the SEC rejected its application in April. Under current rules, the regulatory body is able to dela...

US Treasury calls for public comment on digital asset policy, following Biden’s executive order

The United State Department of the Treasury has requested comments from the public on the potential opportunities and risks of digital assets in compliance with President Joe Biden’s executive order from March. In a Tuesday announcement, the U.S. Treasury said it was asking for input from the public that will “inform its work” in reporting to the president the possible implications of digital assets on the financial markets and payment infrastructures. Biden’s executive order directed the Treasury Department to take the lead among other government agencies in developing policy recommendations aimed at mitigating both systemic and consumer risks around cryptocurrencies. “For consumers, digital assets may present potential benefits, such as faster payments, as well as potential risks, includ...