rate hike

Bitcoin price hits $20.8K as volatility ensues over Fed 75-point rate hike

Bitcoin (BTC) saw instant volatility on Nov. 2 as the United States Federal Reserve enacted a fourth consecutive 0.75% interest rate hike. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Fed hints more hikes to com Data from Cointelegraph Markets Pro and TradingView showed BTC/USD initially dropping to $20,200 before momentarily rebounding to $20,800. The Fed confirmed the 0.75% hike, which marks its most intensive hiking schedule in forty years, in a statement. “The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 3-3/4 to 4 percent,” it stated. “The Committee anticipates that ongoing increases in the target range wil...

Bitcoin trader predicts $18K return within days as stocks wilt post-CPI

Bitcoin (BTC) cooled near $19,200 after the Oct. 14 Wall Street open as stocks struggled to preserve their “bear trap.” BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Analyst: “Abandon all hope” for asset price rebound Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it came off one-week highs on the day to circle $19,300. The pair had seen intense volatility on the back of United States economic data the day prior, this sparking hundreds of millions of dollars in liquidations from both long and short positions. Now, after turning the tables and adding almost $2,000 in 24 hours, Bitcoin was again losing momentum as U.S. equities turned red on the day. At the time of writing, the S&P 500 was down 1.9%, while the Nasdaq Composite Index trad...

Will the Fed prevent BTC price from reaching $28K? — 5 things to know in Bitcoin this week

Bitcoin (BTC) enters a new week with a question mark over the fate of the market ahead of another key United States monetary policy decision. After sealing a successful weekly close — its highest since mid-June — BTC/USD is much more cautious as the Federal Reserve prepares to hike benchmark interest rates to fight inflation. While many hoped that the pair could exit its recent trading range and continue higher, the weight of the Fed is clearly visible as the week gets underway, adding pressure to an already fragile risk asset scene. That fragility is also showing in Bitcoin’s network fundamentals as miner strain becomes real and the true cost of mining through the bear market shows. At the same time, there are encouraging signs from some on-chain metrics, with long-term investors still re...

Bitcoin bounces 8% from lows amid warning BTC price bottom ‘shouldn’t be like that’

Bitcoin (BTC) spared hodlers the pain of losing $20,000 on June 15 after BTC/USD came dangerously close to last cycle’s high. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin “bottom” fools nobody Data from Cointelegraph Markets Pro and TradingView showed BTC/USD surging higher after reaching $20,079 on Bitstamp. In a pause from its sell-off, the pair followed United States equities higher on the Wall Street open, hitting $21,700. The S&P 500 gained 1.4% after the opening bell, while the Nasdaq Composite Index managed 1.6%. The renewed market strength, commentators said, was thanks to the majority already pricing in outsized key rate hikes by the Federal Reserve, due to be confirmed on the day. Nonetheless, it was crypto taking the worst hit in...

Bitcoin nervously awaits Fed as Paul Tudor Jones says ‘clearly don’t own’ stocks, bonds

Bitcoin (BTC) kept investors guessing on May 3 as markets awaited May 4’s Federal Reserve comments. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Tudor Jones says “no thanks” to stocks, bonds Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hovering just above $38,000 at May 3’s Wall Street open. The pair had stayed practically static over 24 hours to the time of writing as volatility in stocks dictated the mood. Amid multiple calls for a “capitulation” style event to hit both crypto and TradFi markets, there was an eerie sense of calm leading up to the Federal Open Markets Committee (FOMC) meeting, with news on U.S. rate hikes to follow. Everyone is waiting for Jerome Powell to come up tomorrow to have a speech...

Fed ‘will determine the fate of the market’ — 5 things to know in Bitcoin this week

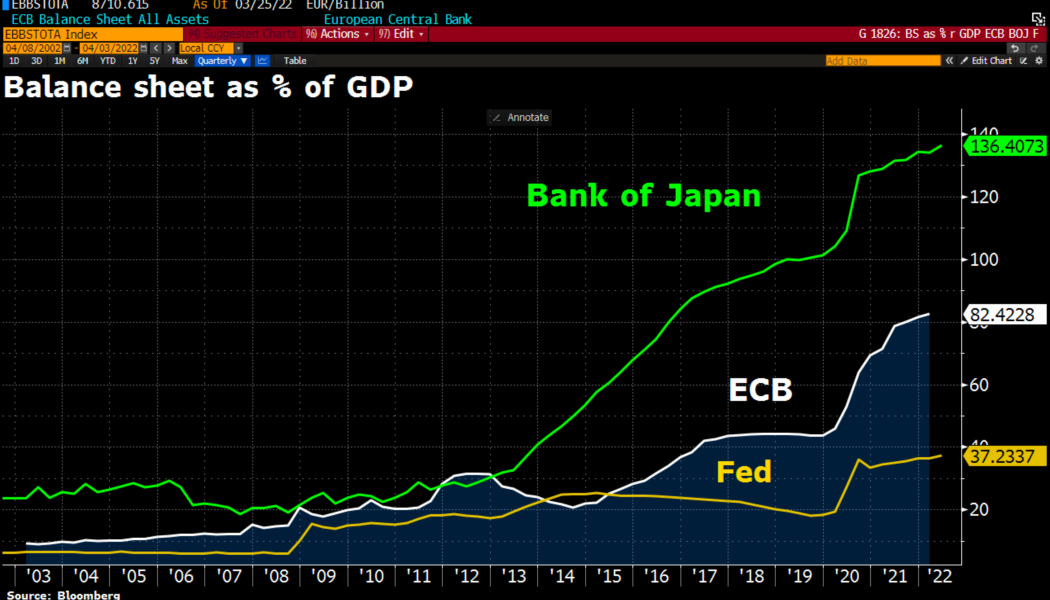

Bitcoin (BTC) starts a new week with much to make up for after its worst April performance ever. The monthly close placed BTC/USD firmly within its established 2022 trading range, and fears are already that $30,000 or even lower is next. That said, sentiment has improved as May begins, and while crypto broadly remains tied to macro factors, on-chain data is pleasing rather than panicking analysts. With a decision on United States economic policy due on May 4, however, the coming days may be a matter of knee-jerk reactions as markets attempt to align themselves with central bank policy. Cointelegraph takes a look at the these and other factors set to shape Bitcoin price activity this week. Fed back in the spotlight Macro markets are — as is now the standard — on edge this week as another U....

Bitcoin sentiment falls into ‘fear’ as BTC price action hits $42.9K breakdown target

Bitcoin (BTC) kept disappointing hodlers on April 7 as the Bitcoin 2022 conference got underway to a limp BTC price performance. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Fed prepares $95 billion monthly balance sheet shrink Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it dropped below multiple support levels to reach its lowest since March 23. Reversing at $42,741 on Bitstamp on April 7, the largest cryptocurrency was decidedly less bullish than the week prior, with analysts quick to point out contributing factors. Central bank monetary tightening, namely from the U.S. Federal Reserve, remained the favorite, this having a potential long-lasting impact across risk assets going forward. “The biggest headwind to Bitcoin and macroeconomi...

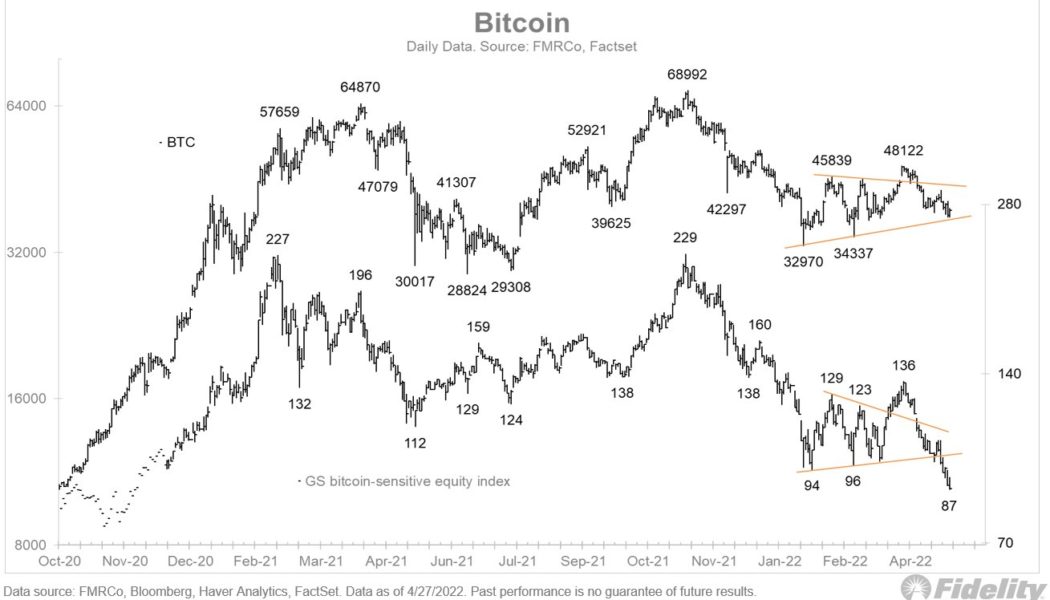

BTC starts 2022 all over again — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week and a new quarter as if it were starting the new year — at just over $46,000. In what will seem like some serious deja-vu for hodlers, BTC/USD is at practically the same level it was on Jan. 1, 2022. Price action has been quiet — too quiet, perhaps — in recent days, but behind the declining volatility, there are signs that the market is busy deciding future direction. From macro to on-chain, there are in fact plenty of cues to keep an eye on in April, amid a backdrop of Bitcoin — at least so far — retaining its yearly open price as support. Cointelegraph takes a look at five of these factors as they pertain to BTC price performance over the coming week. Inflation meets fresh money printing There has been much talk of the end of the post-COVID “easy money” pe...

Bitcoin calls traders‘ bluff with fresh $40K fakeout as Fed decision day arrives

Bitcoin (BTC) tested traders‘ neves yet again on March 16 as a fresh spike over $40,000 ended in minutes. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Shorts feel the burn after abrupt trip to $41,700 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD suddenly surging to highs of $41,700 on Bitstamp before instantly reversing. Two hourly candles were all it took for the entire market to rise by $2,000, break significant resistance levels and come all the way back down again. The move, while recently commonplace, was not without its casualties, as evidenced by liquidations across exchanges. According to data from on-chain monitoring resource Coinglass, Bitcoin accounted for $98 million of these over the 24 hours at the time of writing. Total crypto liquid...

Bitcoin drifts into weekly close while Fed rate hike looms as next major BTC price trigger

Bitcoin (BTC) upped the volatility into the weekly close on March 13 as markets braced for geopolitical and macro economic cues. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Long-awaited Fed action set to come this week Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it again came close to testing $38,000 support during Sunday. The pair had seen a quiet end to the week on Wall Street, the weekend proving similarly calm as the status quo both within and outside crypto continued without surprises. Now, attention was already focusing beyond Sunday’s close, specifically on the upcoming decision on interest rates from the United States Federal Reserve. Due March 16, the extent of the presumed rate hike could provide temporary volatility and even...

Bitcoin casts off dip, climbs past $45K as Fed signals rate hike coming in March

Bitcoin (BTC) hit daily lows then bounced strongly on March 2 as fresh comments by the United States Federal Reserve added to macro volatility. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Powell: March rate hike expected “appropriate” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping to $43,350 on Bitstamp before the Wall Street open Wednesday. A recovery ensued as trading began, however, with the pair already back above $45,000 at the time of writing. The volatility followed the release of a new statement from Fed Chair Jerome Powell, who for the first time gave concrete notice of a key rate hike coming this month. “Our monetary policy has been adapting to the evolving economic environment, and it will continue to do so,̶...