Quantitative Tightening

Bitcoin is a ‘wild card’ set to outperform —Bloomberg analyst

Bloomberg analyst Mike McGlone has labeled Bitcoin (BTC) a “wild card” which is “ripe” to outperform once traditional stocks finally bottom out. In a Sept.7 post on Linkedin and Twitter, McGlone explained that while the United States (U.S.) Federal Reserve tightening will likely determine the direction of the stock market, Bitcoin remains a “wildcard” that could buck the trend, stating: “Bitcoin is a wild card that’s more ripe to outperform when stocks bottom, but transitioning to be more like gold and bonds.” The commodities strategist shared more details in a Sept. 7 report, which noted that Bitcoin was primed to rebound strongly from the bear market despite a “strong headwind” toward high-risk assets: “It’s typically a matter of time for the fed funds gauge to flip toward cu...

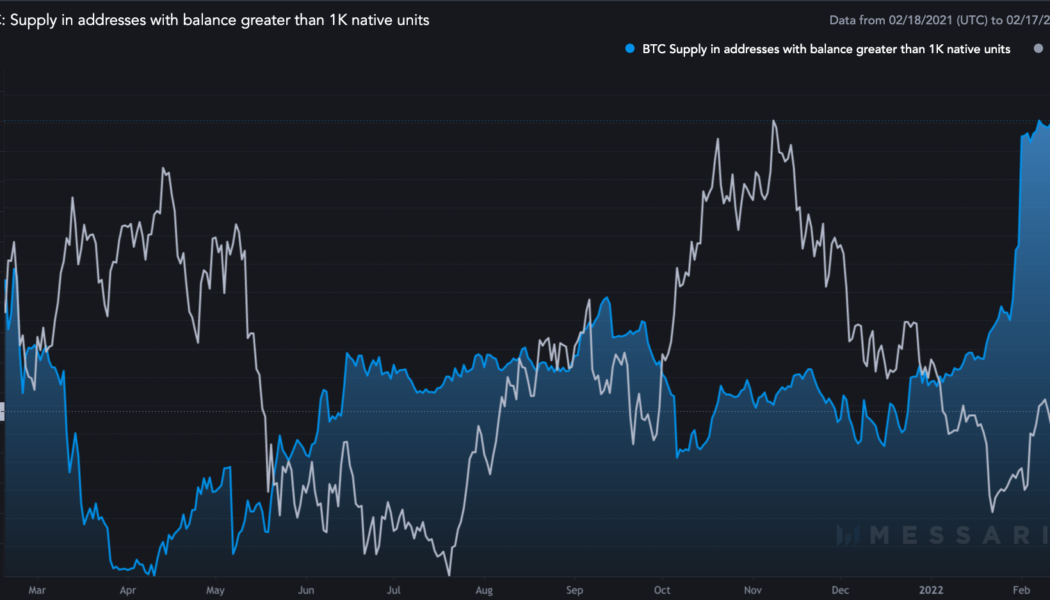

Bitcoin ‘whales’ and ‘fishes’ pause accumulation as markets weigh March 50bps hike odds

An uptick in Bitcoin (BTC) supply to whales’ addresses witnessed across January appears to be stalling midway as the price continues its intraday correction toward $42,000, the latest data from CoinMetrics shows. Whales, fishes take a break from Bitcoin The sum of Bitcoin being held in addresses whose balance was at least 1,000 BTC came to be 8.10 million BTC as of Feb. 16, almost 0.12% higher month-to-date. In comparison, the balance was 7.91 million BTC at the beginning of this year, up 2.4% year-to-date. Bitcoin supply in addresses with balance greater than 1,000 BTC. Source: CoinMetrics, Messari Notably, the accumulation behavior among Bitcoin’s richest wallets started slowing down after BTC closed above $40,000 in early February. Their supply fluctuated with...