Quantitative Easing

Is Bitcoin really a hedge against inflation?

While Bitcoin (BTC) has failed in countering this year’s rampant global inflation, it should still be considered as an inflation hedge, says Steven Lubka, the managing director of private consumers at Swan Bitcoin. According to Lubka, Bitcoin works well as a hedge against rising prices when inflation is caused by monetary expansion. It is less effective when inflation is caused by the disruption of the food supply and energy, which he sees as the leading cause of this year’s rampant inflation. [embedded content] “In a world where the price of goods is going up because there’s been a radical loss of abundance, Bitcoin isn’t going to protect investors from that,” Lubka said. He also points out that Bitcoin is a better hedge against inflat...

Is Bitcoin really a hedge against inflation?

While Bitcoin (BTC) has failed in countering this year’s rampant global inflation, it should still be considered as an inflation hedge, says Steven Lubka, the managing director of private consumers at Swan Bitcoin. According to Lubka, Bitcoin works well as a hedge against rising prices when inflation is caused by monetary expansion. It is less effective when inflation is caused by the disruption of the food supply and energy, which he sees as the leading cause of this year’s rampant inflation. [embedded content] “In a world where the price of goods is going up because there’s been a radical loss of abundance, Bitcoin isn’t going to protect investors from that,” Lubka said. He also points out that Bitcoin is a better hedge against inflat...

Ethereum price ‘bullish triangle’ puts 4-year highs vs. Bitcoin within reach

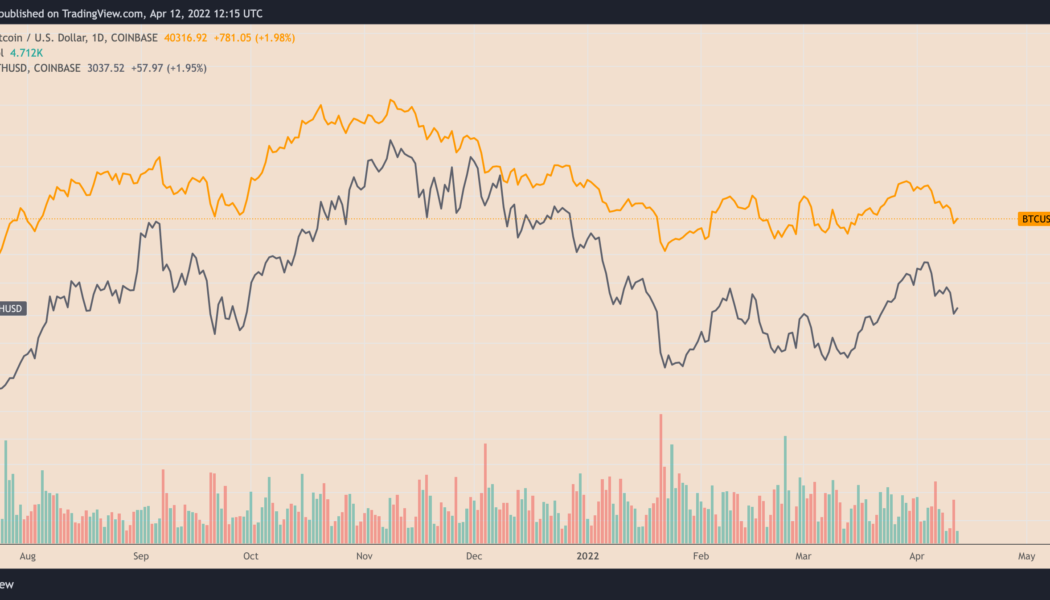

Ethereum’s native token Ether (ETH) has dropped about 17% against the U.S. dollar in the last two weeks. But its performance against Bitcoin (BTC) has been less painful with the ETH/BTC pair down 4.5% over the same period. The pair’s down-move appears as both ETH/USD and BTC/USD drop nearly in lockstep while reacting to the Federal Reserve’s potential to hike rates by 50 basis points and slash its balance sheet by $95 billion per month. The latest numbers released on April 12 show that consumer prices rose 8.5% in March, the most since 1981. BTC/USD vs. ETH/USD daily price chart. Source: TradingView ETH/BTC triangle breakout Several technicals remain bullish despite ETH/BTC dropping in the last two weeks. Based on a classic continuation pattern, the pair still l...

Why the rise of a Bitcoin standard could deter war-making

Alex Gladstein, the CSO at the Human Rights Foundation, says that if Bitcoin was adopted as a global reserve currency, nation-states would be less incentivized to start wars. According to Gladstein, the U.S. was able to sustain its “forever wars” in Iraq and Afghanistan mainly by borrowing capital. That was possible largely because of the Federal Reserve’s monetary policy, which has been keeping interest rates relatively low through quantitative easing. “We literally print money, we sell bonds to the open market for a promise to pay in the future and we use the income from the bond sales to pay for these wars.”, explained Gladstein in a latest interview with Cointelegraph. Unlike fiat currency, Bitcoin’s total supply is immutable. That ...

Bitcoin ‘whales’ and ‘fishes’ pause accumulation as markets weigh March 50bps hike odds

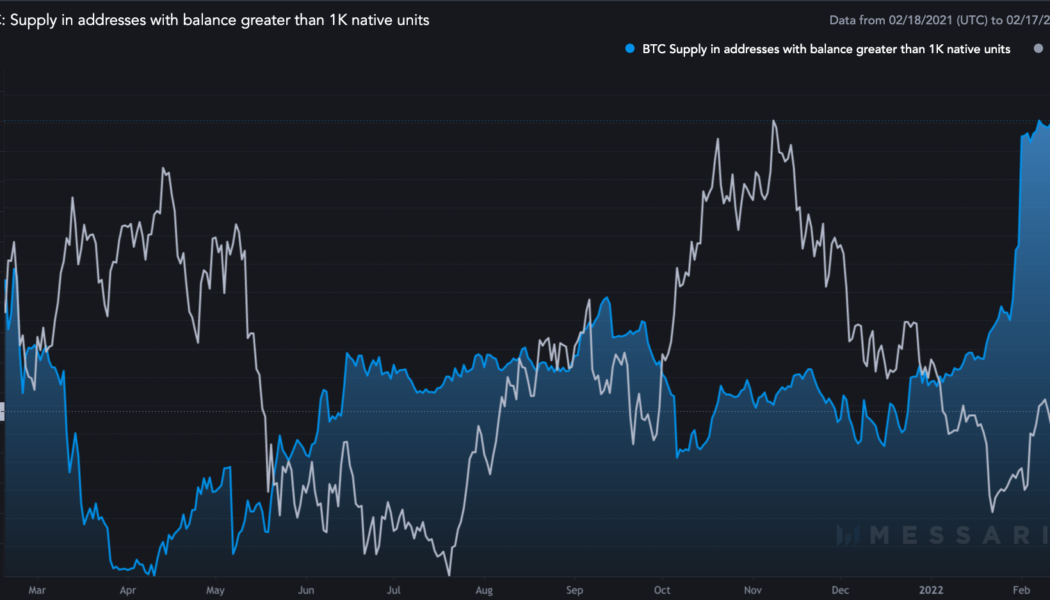

An uptick in Bitcoin (BTC) supply to whales’ addresses witnessed across January appears to be stalling midway as the price continues its intraday correction toward $42,000, the latest data from CoinMetrics shows. Whales, fishes take a break from Bitcoin The sum of Bitcoin being held in addresses whose balance was at least 1,000 BTC came to be 8.10 million BTC as of Feb. 16, almost 0.12% higher month-to-date. In comparison, the balance was 7.91 million BTC at the beginning of this year, up 2.4% year-to-date. Bitcoin supply in addresses with balance greater than 1,000 BTC. Source: CoinMetrics, Messari Notably, the accumulation behavior among Bitcoin’s richest wallets started slowing down after BTC closed above $40,000 in early February. Their supply fluctuated with...

Can Ethereum price reach $4K after a triple-support bounce?

Ethereum’s native token Ether (ETH) looks ready to continue its ongoing rebound move toward $4,000, according to a technical setup shared by independent market analyst Wolf. Classic bullish reversal pattern in the works? The pseudonymous chart analyst discussed the role of at least three support levels in pushing the ETH price up by nearly 30% from its local bottom of $2,160. These price floors included a 21-month exponential moving average, the 0.786 Fib level of a Fibonacci retracement graph drawn from $1,716-swing low to $4,772-swing high, and the lower boundary of an ascending triangle pattern. ETH/USD daily price chart featuring the three-supports. Source: TradingView Wolf noted that the triple-support scenario could push Ether price to $3,330. In doing so, ...

Terra (LUNA) at risk of 50% drop if bearish head-and-shoulders pattern plays out

Terra (LUNA) may fall to nearly $25 per token in the coming weeks as a head-and-shoulders (H&S) setup develops, indicating a 50% price drop, according to technical analysis shared by CRYPTOPIKK. H&S patterns appear when the price forms three peaks in a row, with the middle peak (called the “head”) higher than the other two (left and right shoulders). All three peaks come to a top at a common price floor called the “neckline.” Traders typically look to open a short position when the price breaks below the H&S neckline. However, some employ a “two-day” rule where they wait for the second breakout confirmation when the price retests the neckline from the downside as resistance, before entering a short position. Meanwhile, the ideal short ta...