Quant

5 altcoins that could be ripe for a short-term rally if Bitcoin price holds $19K

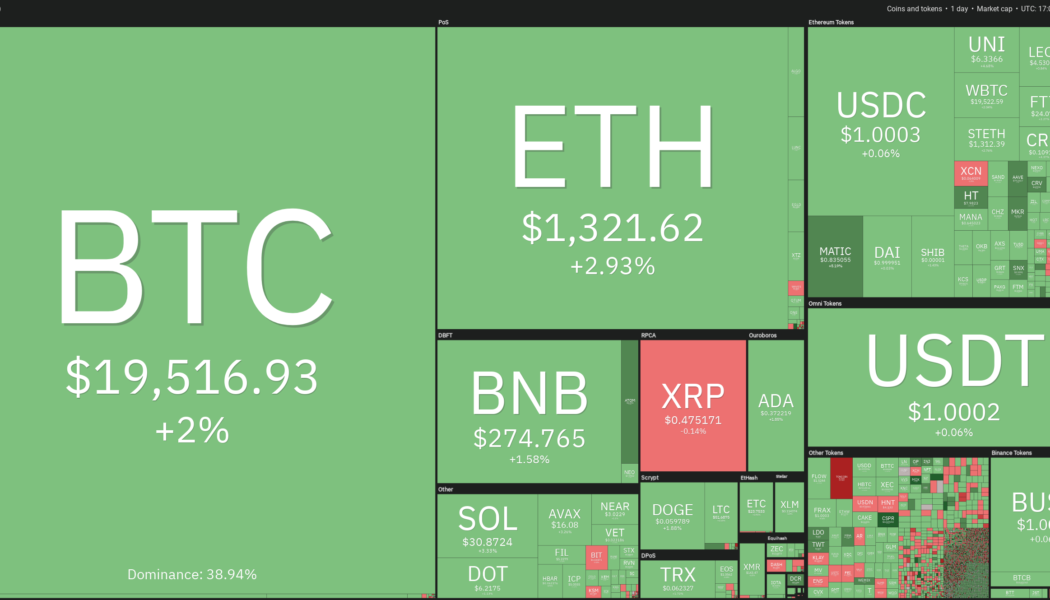

The S&P 500 and the Nasdaq Composite fell to a new year-to-date low last week and closed the week with a loss of 1.55% and 3.11%, respectively. The scenario changed drastically on Oct. 17 after the earnings, season ramped up and a sharp policy reversal from U.K. Finance Minister Jeremy Hunt added detail to the government’s plan to fix his predecessor’s (Kwasi Kwarteng’s) fiscal package, which had triggered a record fall in the value of the GBP and a near liquidation of pension plans in the United Kingdom. At the time of writing, the Dow is up 1.78%, while the S&P 500 and Nasdaq present 2.57% and 3.26% respective gains. Meanwhile, Bitcoin (BTC) has managed to stay well above its year-to-date low showing short-term outperformance. Some analysts expect that Bit...

Crypto traders eye ATOM, APE, CHZ and QNT as Bitcoin flashes bottom signs

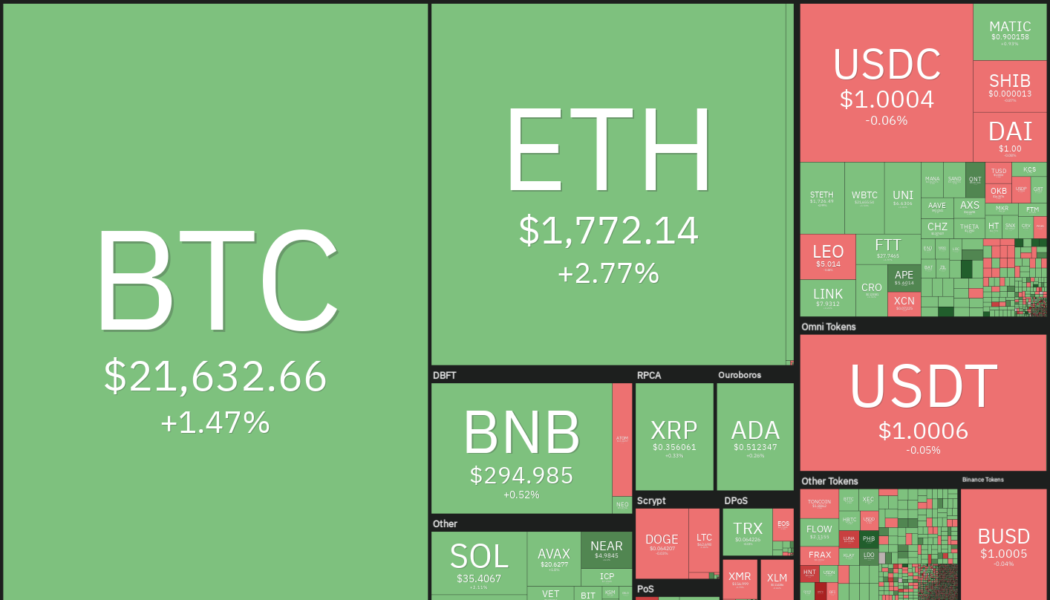

The United States equities markets rallied sharply last week, ending a three-week losing streak. The S&P 500 rose 3.65% last week while the Nasdaq Composite soared 4.14%. Continuing its close correlation with the U.S. equities markets, Bitcoin (BTC) also made a strong comeback and is trying to end the week with gains of more than 7%. The sharp rally in the stock markets and cryptocurrency markets are showing signs of a bottoming formation but it may be too early to predict the start of a new bull move. The equities markets may remain on the edge before the release of the U.S. inflation data on Sept. 13 and the Federal Reserve meeting on Sept. 20-21. Crypto market data daily view. Source: Coin360 Along with taking cues from the equities markets, the cryptocurrency space has its own impo...

Here’s 5 cryptocurrencies with bullish setups that are on the verge of a breakout

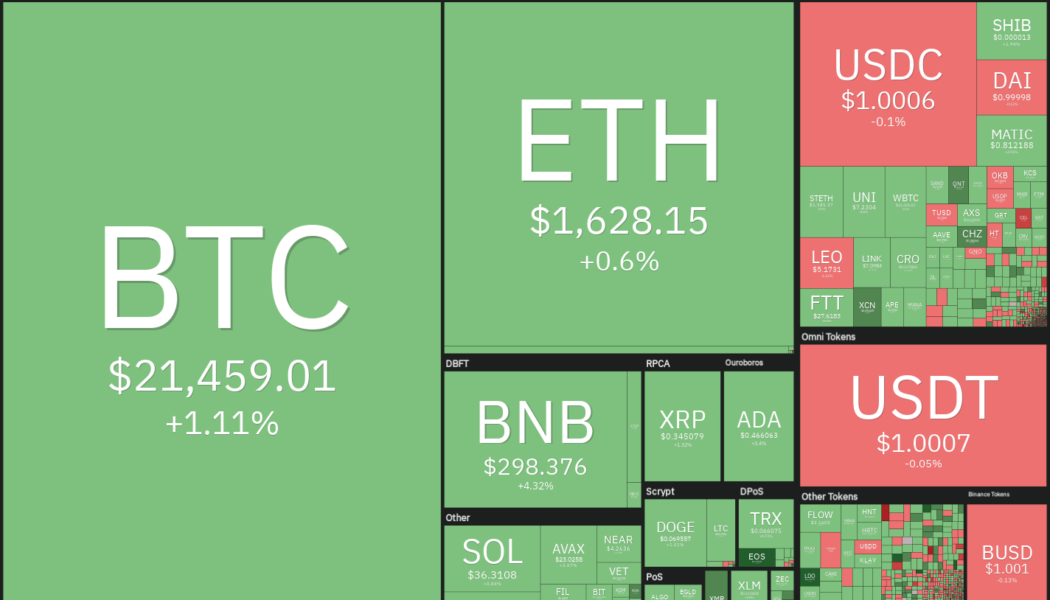

The S&P 500 ended its four-week-long recovery last week after minutes from the Federal Reserve’s July meeting hinted that the central bank’s rate hikes will continue until inflation is under control. Members of the Fed said there was no evidence that inflation pressures appear be easing. Another dampener was the statement by St. Louis Fed president James Bullard who said that he would support a 75 basis point rate hike in September’s Fed policy meeting. This reduced hopes that the era of aggressive rate hikes may be over. Crypto market data daily view. Source: Coin360 Weakening sentiment pulled the S&P 500 lower by 1.29% for the week. Continuing its close correlation with the S&P 500, Bitcoin (BTC) also witnessed a sharp decline on Aug. 19 and is likely to end the week with ste...

Top 5 cryptocurrencies to watch this week: BTC, FLOW, THETA, QNT, MKR

The United States jobs data on Aug. 5 was above market expectations, indicating that inflation has not cooled down. The strong numbers reduce the possibility that the U.S. Federal Reserve will slow down its aggressive pace of rate hikes. After the release, the likelihood of a 75 basis points hike in September has risen to 68%, according to CME Group data. However, analysts at Fundstrat Global Advisors have a different view. They highlighted that three out of six times, the S&P 500 bottomed out six months before the Fed’s last rate hike. Therefore, the firm anticipates the S&P 500 to witness a strong rally to 4,800 in the second half of the year. Crypto market data daily view. Source: Coin360 If the tight correlation between the equities markets and the cryptocurrency markets mainta...