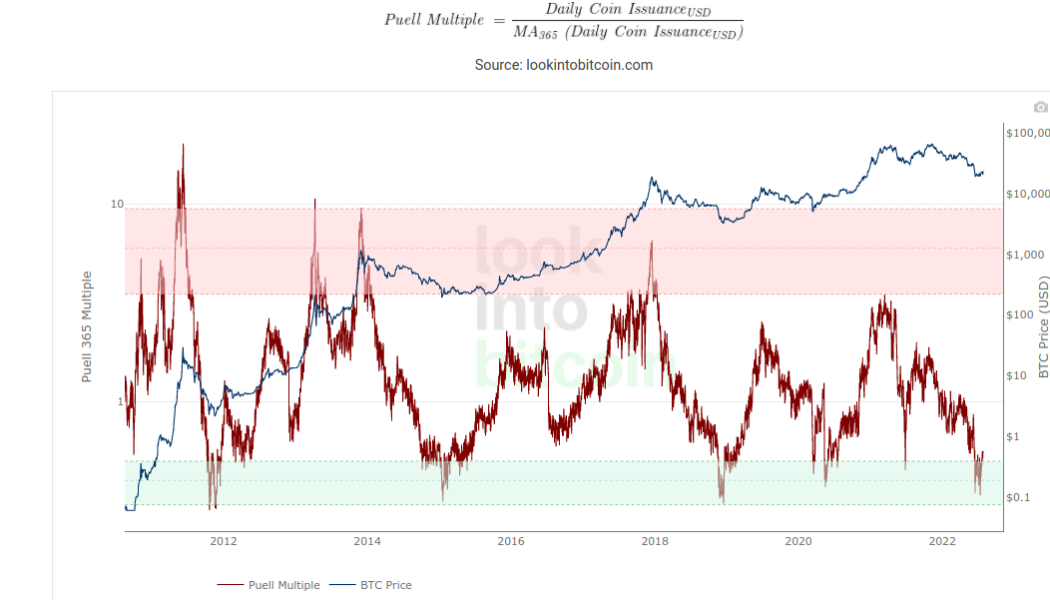

Puell Multiple

Historically accurate Bitcoin metric exits buy zone in ‘unprecedented’ 2022 bear market

Bitcoin (BTC) is enjoying what some are calling a “bear market rally” and has gained 20% in July, but price action is still confusing analysts. As the July monthly close approaches, the Puell Multiple has left its bottom zone, leading to hopes that the worst of the losses may be in the past. Puell Multiple attempts to cement breakout The Puell Multiple one of the best-known on-chain Bitcoin metrics. It measures the value of mined bitcoins on a given day compared to the value of those mined in the past 365 days. The resulting multiple is used to determine whether a day’s mined coins is particularly high or low relative to the year’s average. From that, miner profitability can be inferred, along with more general conclusions about how overbought or oversold the market...

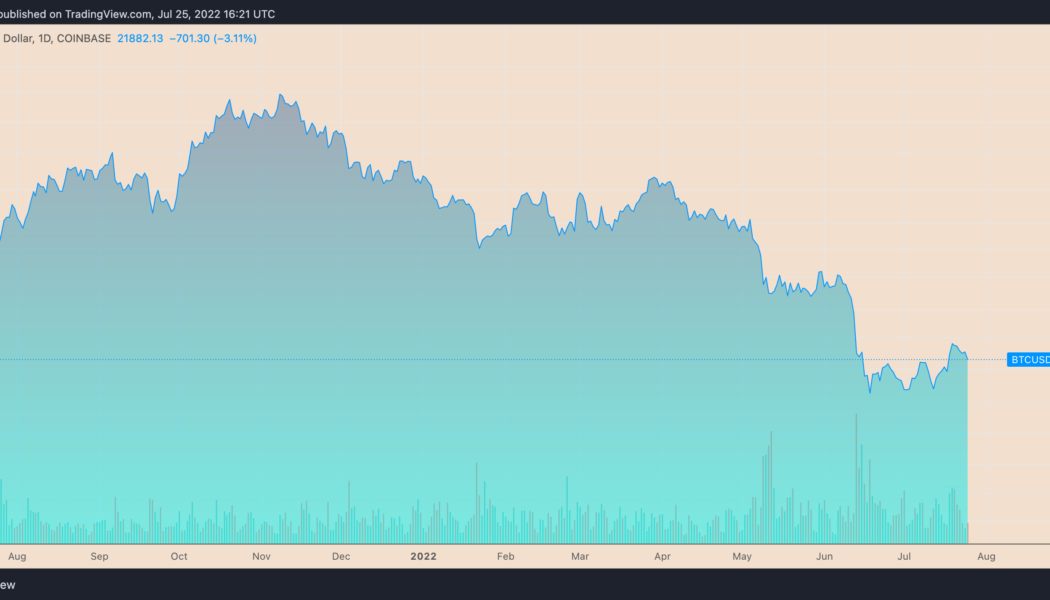

3 signs Bitcoin price is forming a potential ‘macro bottom’

Bitcoin (BTC) could be in the process of bottoming after gaining 25%, based on several market signals. BTC’s price has rallied roughly 25% after dropping to around $17,500 on June 18. The upside retrace came after a 75% correction when measured from its November 2021 high of $69,000. BTC/USD daily price chart. Source: TradingView The recovery seems modest, however, and carries bearish continuation risks due to prevailing macroeconomic headwinds (rate hike, inflation, etc.) and the collapse of many high-profile crypto firms such as Three Arrows Capital, Terra and others. But some widely tracked indicators paint a different scenario, suggesting that Bitcoin’s downside prospects from current price levels are minimal. That big “oversold” bounce The...