proof-of-stake

ATOM price is reaching for the Cosmos, but why?

As a market crash takes place, assets become oversold and typically there’s an “oversold bounce,” “return to mean,” “mean reversion,” or some price snapback to the bottom of the pre-crash range. Afterward, the asset under study either consolidates, continues the downtrend, or returns to the bullish uptrend if the downside catalyst was not significant enough to break the market structure. That’s all basic trading 101. This week Cosmos (ATOM) price appears to be following this path, and the altcoin is showing a bit of strength with a 35% gain since Aug. 22. But why? Depending on how you look at it, and technical analysis is by all means a subjective process, ATOM price is either in an ascending channel, or one could say a rounding bottom pattern is present with price close to breaking ...

Bug bounty quadruples for Ethereum network — Up to $1M payouts ahead of Merge

The Ethereum Foundation has announced it will be increasing the network’s bug bounty payouts fourfold ahead of the blockchain’s transition to proof-of-stake. In a Wednesday blog post, the Ethereum Foundation said between Aug. 24 and Sept. 8, all “Merge-related bounties for vulnerabilities” will be quadrupled for white hats testing the network. According to the foundation, identifying “critical bugs” — those that have a high impact or likelihood of a high impact on the blockchain — will be worth up to $1 million. The bounty program also allows submissions for low, medium and high-risk bugs. • Merge Bug Bounty Bonus: There is a 4X MULTIPLIER between now and 08 September on all bounties and vulnerabilities, with critical bugs worth up to $1mm USD • See full post for updated Execution Layer (E...

Coinbase would rather shut down staking than enable on-chain censorship — Brian Armstrong

In light of the recent ban on crypto mixing tool Tornado Cash and the subsequent arrest of the Tornado Cash developer, there has been a growing debate over whether crypto services providers would choose decentralization or censorship as form of compliance. The question has become more prominent as Ethereum is moving from its current proof-of-work (PoW) blockchain to a proof-of-stake (PoS) mining consensus. With the transition less than a month away, a user pointed out that more than 66% of validators on the Beacon Chain (Ethereum PoS chain) will adhere to the United States Department of the Treasury’s Office of Foreign Assets Control (OFAC) regulations. Start with the big, current one. Currently it looks like over 66% of the beacon chain validators will adhere to OFAC regulatio...

Ethereum Foundation clarifies that the upcoming Merge upgrade will not reduce gas fees

According to a new clarification by the Ethereum Foundation on Wednesday, the network’s upcoming proof-of-stake transitory upgrade — dubbed the “Merge,” — will not reduce gas fees. Regarding this, the Ethereum Foundation wrote: “Gas fees are a product of network demand relative to the network’s capacity. The Merge deprecates the use of proof-of-work, transitioning to proof-of-stake for consensus, but does not significantly change any parameters that directly influence network capacity or throughput.” The Merge, which seeks to join the existing execution layer of the Ethereum mainnet with its new proof-of-stake consensus layer, the Beacon Chain, will eliminate the need for energy-intensive mining. It is expected to land within the third or final qua...

Coinbase will ‘briefly pause’ ETH and ERC-20 token deposits and withdrawals during Ethereum Merge

United States-based cryptocurrency exchange Coinbase has announced it will be temporarily suspending certain token deposits and withdrawals when Ethereum’s core developers transition the blockchain to proof-of-stake, or PoS. In a Tuesday blog post, Coinbase product manager Armin Rezaiean-Asel said that during the Merge event, the crypto exchange will “briefly pause” deposits and withdrawals of Ether (ETH) and ERC-20 tokens “as a precautionary measure” to handle the migration. The exchange also warned users against scammers offering ETH2 tokens, saying crypto users did not need to take additional action to receive staked ETH prior to the Merge. “Although the Merge is expected to be seamless from a user perspective, this downtime allows us to ensure that the transition has been successf...

Coinbase will ‘briefly pause’ ETH and ERC-20 token deposits and withdrawals during Ethereum Merge

United States-based cryptocurrency exchange Coinbase has announced it will be temporarily suspending certain token deposits and withdrawals when Ethereum’s core developers transition the blockchain to proof-of-stake, or PoS. In a Tuesday blog post, Coinbase product manager Armin Rezaiean-Asel said that during the Merge event, the crypto exchange will “briefly pause” deposits and withdrawals of Ether (ETH) and ERC-20 tokens “as a precautionary measure” to handle the migration. The exchange also warned users against scammers offering ETH2 tokens, saying crypto users did not need to take additional action to receive staked ETH prior to the Merge. “Although the Merge is expected to be seamless from a user perspective, this downtime allows us to ensure that the transition has been successf...

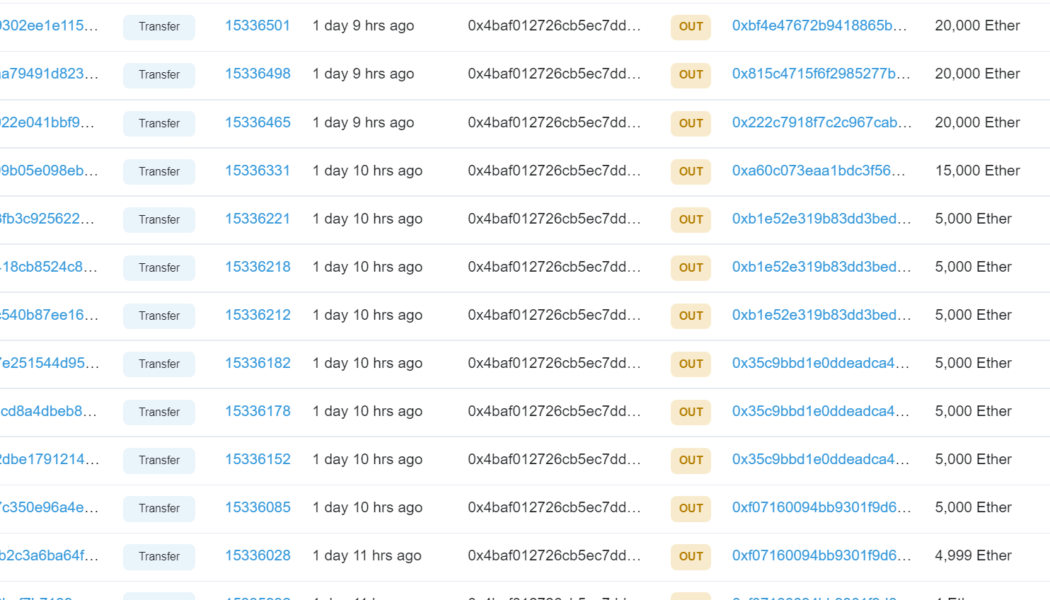

Ethereum ICO-era whale address transfer 145,000 ETH weeks before the Merge

An Ethereum (ETH) whale wallet that participated in the Genesis Initial Coin Offering (ICO) and obtained about 150,000 ETH in 2014 was activated again on Aug. 14 after three years of dormancy. The whale address transferred 145,000 ETH to multiple wallets as Ether price surged to a new 3-month high of over $2,000. The transfers were made in a batch of 5,000 ETH per transaction and a few transfers of over 10,000 ETH. The total value of the transferred ETH is over $280 million, and the wallet address currently has a balance of 0.107 ETH. Ethereum ICO era wallet transactions Source: Etherscan The 145,000 ETH transfer was only the second instance after the ICO when the whale wallet was activated, the first coming in July 2019 when the wallet sent out 5,000 ETH to Bitfinex3 exchange ...

Celestia: Launching a blockchain to be as easy as deploying a smart contract

Developers and communities will be able to deploy their own sovereign, custom-made blockchains at the “click of a button” says Celestia co-founder Ismail Khoffi. Speaking with Cointelegraph at Korean Blockchain Week 2022 last week, Khoffi said that the project’s vision is to decouple the consensus and application execution layers to unlock new possibilities for decentralized app builders. Celesita is basically a stripped back minimalist layer one blockchain that offers users the infrastructure that makes it easy to deploy their own blockchain, or layer two rollup. in the future, we’ll all be able to have our own blockchains. and it represents one of the biggest social revolutions of our lifetimes. here’s 10 ways it could change technology, finance, work, and entire political systems ...

The Merge: Top 5 misconceptions about the anticipated Ethereum upgrade

The excitement around Ethereum’s (ETH) upcoming upgrade, The Merge, which involves the merger of two blockchains — Mainnet Ethereum and Beacon Chain — has unknowingly spurred rumors across the community. Termed the most significant upgrade in the history of Ethereum, The Merge does indeed mark the end of proof-of-work (PoW) for the Ethereum blockchain. However, here are five misconceptions that stand out among the rest. Misconception 1: Ethereum gas fees will reduce after The Merge Ethereum’s impending upgrade will reduce Ethereum’s infamous gas fees (transaction fees) is one of the biggest misconceptions circulating among investors. While reduced gas fees tops every investor’s wishlist, The Merge is a change of consensus mechanism that will transition the Ethereum blockchain from PoW to p...

Ethereum whale transactions peak at 2-month high amid Goerli testnet merger

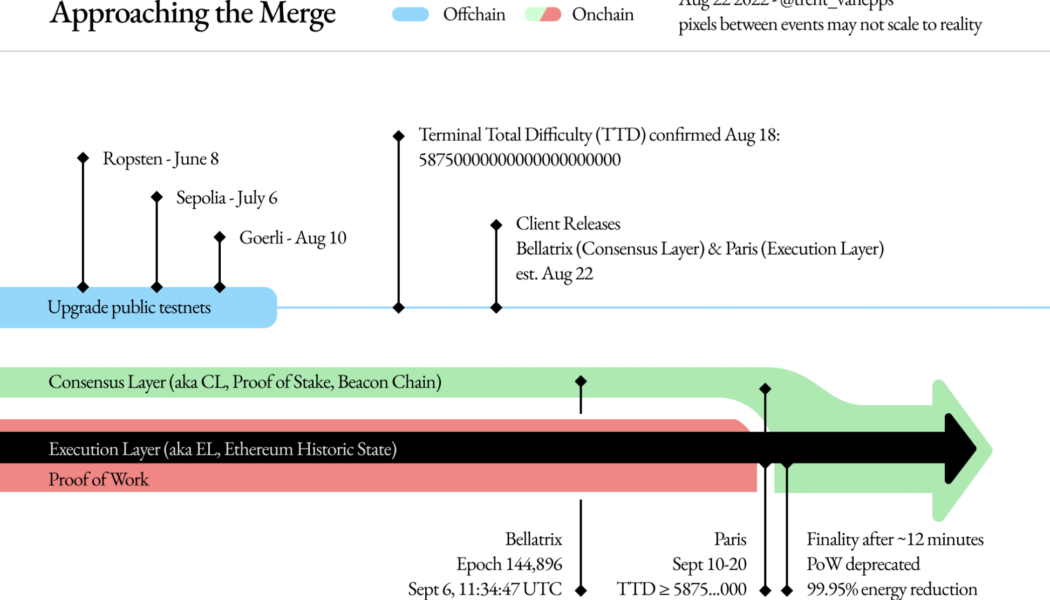

The Goerli testnet was successfully merged to the proof-of-stake (PoS) network, marking the final step before Ethereum’s mainnet transition. The triumphant final testnet merger means the mainnet transition slated for Sept. 19 could go as scheduled. Goerli is the third and final testnet after Ropsten and Sepolia that makes Ethereum’s final rehearsal before its official transition to the PoS network. BREAKING: The Goerli Testnet has activated Proof of Stake Mainnet™ — bankless.eth (@BanklessHQ) August 11, 2022 The PoS Merge is considered to be one of the most significant updates for the Ethereum blockchain since its inception, and the bullish sentiment behind the event has started to reflect on the altcoin’s price. The native token Ether (ETH) has more than doubled its price sin...

Decentralized apps on Polygon hit 37,000, rocketing 400% this year

The number of decentralized applications (DApps) on Ethereum-scaling-platform Polygon has topped 37,000, marking a 400% increase since the start of 2022. The Polygon team shared the figures via an Aug. 10 blog post, which was sourced from partnered Web3 development platform Alchemy, noting that the figure represents the cumulative number of applications ever launched on both the testnet and mainnet. It also noted that the number of monthly active teams — a measure of developer activity on a blockchain — reached 11,800 at the end of July, up a whopping 47.5% from March. The project team also highlighted a breakdown of dApp projects which notably showed that “74% of teams integrated exclusively on Polygon, while 26% deployed on both Polygon and Ethereum.” Polygon’s EVM compatible ...

Ethereum price rises by 50% against Bitcoin in one month — but there’s a catch

Ether (ETH), Ethereum’s native toke, has been continuing its uptrend against Bitcoin (BTC) as euphoria around its upcoming network upgrade, “the Merge,” grows. ETH at multi-month highs against BTC On the daily chart, ETH/BTC surged to an intraday high of 0.075 on Aug. 6, following a 1.5% upside move. Meanwhile, the pair’s gains came as a part of a broader rebound trend that started a month ago at 0.049, amounting to approximately 50% gains. ETH/BTC daily price chart. Source: TradingView The ETH/BTC recovery in part has surfaced due to the Merge, which will have Ethereum switch from proof-of-work (PoW) mining to proof-of-stake (PoS). Ethereum’s “rising wedge” suggests sell-off From a technical perspective, Ether stares at potential interim loss...