proof-of-stake

Flashbots build over 82% relay blocks, adding to Ethereum centralization

Following the completion of The Merge upgrade, Ethereum (ETH) transitioned into a proof-of-stake (PoS) consensus mechanism, helping the blockchain become energy efficient and secure. However, mining data reveals Ethereum’s heavy reliance on Flashbots — a single server — for building blocks, raising concerns over a single point of failure for the ecosystem. Flashbots is a centralized entity dedicated to transparent and efficient Maximal Extractable Value (MEV) extraction, which acts as a relay for delivering Ethereum blocks. Data from mevboost.org show that there are six active relays currently delivering at least one block in Ethereum, namely Flashbots, BloXroute Max Profit, BloXroute Ethical, BloXroute Regulated, Blocknative and Eden. Relays sorted by number of delivered blocks. Source:&n...

Ethereum Merge: Community reacts with memes, GIFs and tributes

It’s been less than a day since Ethereum’s historic transition to proof-of-stake, with most of the crypto community still abuzz with excitement following the successful Merge. On Sept. 15 at 06:42:42 UTC, the last Ethereum block using the old proof-of-work consensus mechanism was mined. Replacing it is an energy-efficient proof-of-stake consensus mechanism. Many crypto enthusiasts and climate advocates worldwide have been thrilled by the positive impact it will have on the environment and thus, crypto’s reputation. Others have just been in awe of the technological feat of upgrading an entire blockchain network without any stoppages. Ethereum Ethereum30 minutes ago Now pic.twitter.com/cyQb3pAdtt — WolfOfEthereum.eth ️ (@Crypto_Wolf_Of) September 15, 2022 Uniswap Labs founder and CEO ...

Only 10 hours to the Ethereum Merge: Here’s what you need to know

Ethereum’s long-awaited transition from proof-of-work (PoW) to proof-of-stake (PoS) is upon us as the Merge looms in less than 10 hours. There’s plenty to consider for the wider cryptocurrency space — and here’s what you need to know. What is the Merge? The Ethereum blockchain will transition away from its energy-intensive consensus mechanism PoW as its execution layer merges with the new PoS consensus layer known as the Beacon Chain. The Beacon Chain went live in December 2020, allowing ecosystem participants to deposit or “stake” ETH to become the new validators of the network, in doing so replacing PoW miners that had previously put in the work to process transactions, produce blocks and secure the network. In its simplest form, the Merge will make the Ethe...

Downsides of Proof-of-Work and Proof-of-Stake, explained

Proof-of-Work and Proof-of-Stake are arguably the best-known consensus mechanisms — but new ones are continually emerging. PoW blockchains have long dominated the cryptocurrency landscape, with both Bitcoin and Ethereum using this model. This means miners are responsible for securing the network and validating transactions — and they get rewarded with new coins as a result. However, a common criticism surrounding Proof-of-Work relates to how much energy it uses, and the impact such blockchains have on the environment. Miners need to use vast amounts of computing power to solve arbitrary mathematical equations. More advanced hardware has been required as the industry matured, with electricity usage surging too. This has led Proof-of-Stake to be regarded as a mo...

Ethereum’s potential fork ETHPOW has crashed 80% since debut — More pain ahead?

The listing of ETHPOW (ETHW) across multiple crypto exchanges has been followed by a huge drop in price despite some initial success. ETHPOW drops 80% On the daily chart, ETHW’s price dropped by more than 80% to $25 on Sept. 10, over a month after its market debut. ETHW/USD daily price chart. Source: TradingView For starters, ETHPOW only exists as a futures ticker, for now, conceived in anticipation that an upcoming network update on Ethereum could result in a chain split. Ethereum will undergo a major protocol change called the Merge by mid-September, switching its existing consensus mechanism from proof-of-work (PoW) to proof-of-stake (PoS). Therefore, Ethereum will obsolete its army of miners, replacing them with “validators,” which are nodes that woul...

Everyone’s talking about the Ethereum Merge: New report reveals the most interested countries

A new report released from CoinGecko uncovered the places around the world most interested in the upcoming Ethereum Merge. The data found Singapore as the country most interested and by a large margin at that. Singapore scored 377, which is nearly 100 points higher than the second place nations, Switzerland and Canada, both tied at 286 points. Germany, the United States and the Netherlands filled out the remaining top five spots. Scores were determined through an analysis of the frequency of ten search terms and then combined for the overall ranking. These terms included “Ethereum Merge,” “ETH Merge” and “Ethereum PoW,” among others. Certain terms had particular potency in Singapore such as “Ethereum Merge,” “ETH Classic” an...

Hive Blockchain explores new mineable coins ahead of Ethereum merge

Cryptocurrency miner Hive Blockchain has been working to replace the mining of Ether (ETH) with other coins in the event of Ethereum’s upcoming transition to proof-of-stake, or PoS. The Canadian crypto mining firm has been analyzing options for mining with its GPU stash ahead of the Ethereum Merge, Hive said in its latest production update on Tuesday. According to the update, Hive started implementing beta-testing of various GPU-mineable coins this week as the Ethereum Merge PoS is expected to occur in mid-September. Hive’s technical division is specifically implementing a strategy to optimize its Ethereum mining capacity, which amounts to 6.5 terahashes per second. “The company acknowledges the potential Ethereum Merge to Proof of Stake,” Hive said in the update. It noted that it sees a c...

Vitalik reminds node operators to update client before the Bellatrix upgrade

Ethereum co-founder Vitalik Buterin is reminding node operators to upgrade their clients before the Bellatrix “hard fork,” slated for Sept. 6. Buterin said that the scheduled upgrade will be the final update that prepares the Beacon chain (proof-of-stake chain) for the Merge. The merge is still expected to happen around Sep 13-15. What’s happening today is the Bellatrix hard fork, which *prepares* the chain for the merge. Still important though – make sure to update your clients! — vitalik.eth (@VitalikButerin) September 6, 2022 An Ethereum client is the software that allows Ethereum nodes to read blocks on the blockchain and smart contracts. A “node” is the running piece of the client software. In order to run a node, one has to first download an Ethereum client applicati...

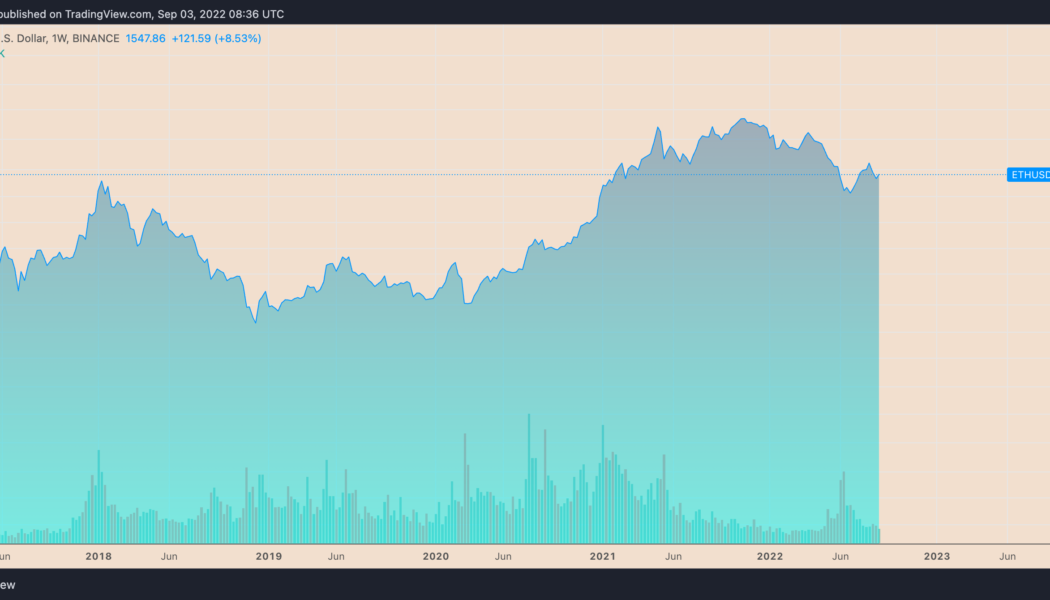

Surge or purge? Why the Merge may not save Ethereum price from ‘Septembear’

Ethereum’s native token, Ether (ETH), is not immune to downside risk in September after rallying approximately 90% from its bottom of around $880 in June. Much of the token’s upside move is attributed to the Merge, a technical upgrade that would make Ethereum a proof-of-stake (PoS) protocol, slated for Sep. 15. But despite logging impressive gains between June and September, Ether still trades almost 70% below its record high of around $4,950 from November 2021. Therefore, its possibility of heading lower remains on the cards. ETH/USD weekly price chart. Source: TradingView Here are three Ethereum bearish market indicators that show why more downside is likely. Sell the Ethereum Merge news Ethereum options traders anticipate Ether’s price to reach $2,200 f...

Buterin and Armstrong reflect on proof-of-stake shift as Ethereum Merge nears

Ethereum co-founder Vitalik Buterin and Coinbase CEO Brian Armstrong believe that a gradual mind shift and important community contributions led to their backing of Ethereum’s upcoming move from a proof-of-work (PoW) to aproof-of-stake (PoS) consensus. The two industry titans joined Coinbase protocol specialist Viktor Bunin on the Around the Block podcast for an enlightening discussion centered on The Merge, which is set to take place in mid-September 2022. Buterin reflected on his history of considering proof-of-stake as a potential consensus mechanism for the Ethereum blockchain, which was initially met with skepticism due to a number of unsolved problems that made it seemingly unviable. According to the Ethereum co-founder, one of the project’s first blog posts in 2014 proposed an...

Largest Ether mining pool Ethermine opens new ETH staking service

Ahead of the rapidly approaching Ethereum (ETH) Merge on Sept. 15, Ethermine, the world’s largest Ethereum mining pool has unveiled a new staking pool for users. Notably however, it is not available to U.S. miners The new service offers Ethermine members a chance to collectively stake their ETH and earn interest on top of their deposits. As little as 0.1 ETH ($159) required to enter. However the smaller the holding, the greater the fee. The platform is currently offering stakers an annual ETH interest rate of 4.43%. At the time of writing, 393 Ether worth roughly $626,000 at current prices has been invested into Ethermine’s new pool. Staking pools such as these hold significance as they offer competitive interest rates and a lower barriers of entry than solo staking as node operators...

Millions of dollars in ETH lie unclaimed in presale wallets — but there’s a way to get them back

Out in the cryptosphere, there’s a vast amount of wealth that’s seemingly out of reach. A long-running statistic suggests four million Bitcoin — almost 20% of the total supply — has been lost forever. Much of it was mined when the network was just beginning, with early adopters tearing their hair out after losing their private keys. One Welshman has endured a nine-year battle as he attempts to receive a hard drive containing 7,500 BTC from landfill. But this isn’t the only treasure trove that’s worth exploring. For example, did you know that over 500 Ethereum presale wallets are yet to be recovered… and collectively, they have a value of several billion dollars? The presale for ETH — which is now the world’s second-largest cryptocurrency — took place bac...