proof-of-stake

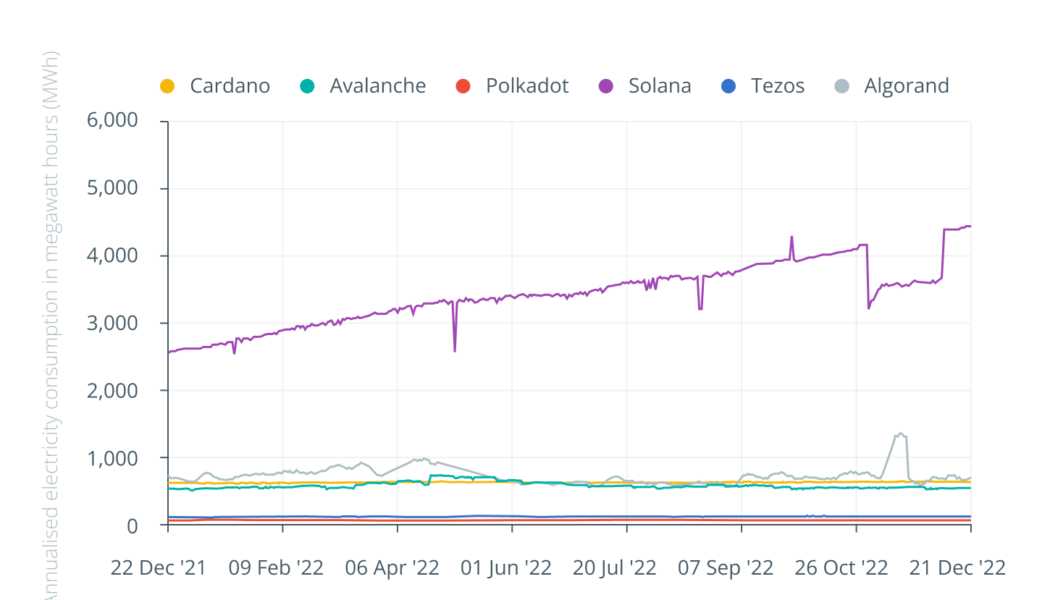

The most eco-friendly blockchain networks in 2022

2022 saw the continued advancement of green crypto projects as more industry companies focused on sustainability to reduce carbon emissions. A series of elemental forces drove the paradigm shift, including user demands for faster and more energy-efficient blockchains, growing climate change awareness among investors, and rising government concerns about energy consumption in the crypto sector. Among the most notable eco-friendly crypto developments in 2022 was the transition of the Ethereum blockchain from a proof-of-work (PoW) to proof-of-stake (PoS) consensus layer. The Merge, completed in September, joined the original execution layer of Ethereum with its new PoS consensus layer, the Beacon Chain. It eliminated the need for energy-intensive mining by enabling the network to be secu...

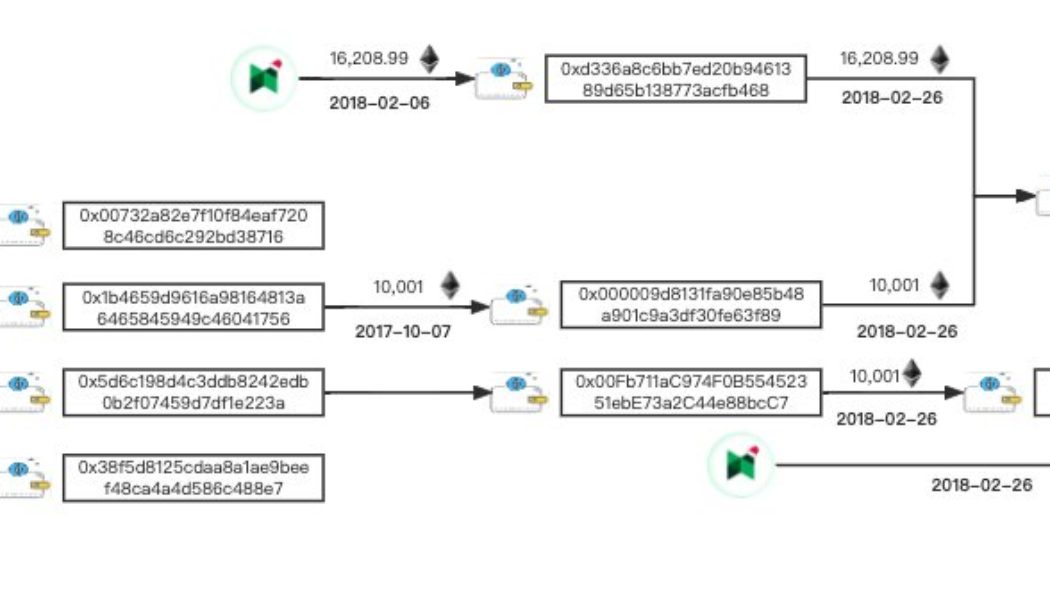

Ethereum bulls wake up after four years to transfer 22,982 ETH

At a time of bear market-induced uncertainty, crypto investors often tend to stick with Bitcoin (BTC) and Ethereum (ETH) to evade impermanent losses. As a result, the significant movement of such assets intrigues the community as they try and decipher the intent behind the move. Two addresses that have remained dormant for over four years recently came back to life to transfer 22,982 ETH to new addresses — leaving investors scratching their heads. The ETH tokens in question originated from trading platforms Genesis and Poloniex and were found transferring 13,103.99 ETH and 9,878 ETH, respectively. #PeckShieldAlert 2 Dormant addresses transferred 22,982 $ETH (~27.2M) to 2 fresh addresses, their last movement was October 2018 (1,535 days ago). These $ETH originated from Genesis and Poloniex ...

Casper Association launches $25M grant to support developers on its blockchain

Scalable blockchain network Casper announced the launch of its new Casper Accelerate Grant Program on Nov. 23, created to support developers and innovators who are building apps to support infrastructure, end-user applications, and research innovation on its blockchain. JUST IN from @nextblockexpo: We’re glad to announce the launch of a $25M Casper Accelerate Grant Program. This fund will support learning, development, and innovations in Infrastructure, #dApps, #DeFi, #Gaming & NFTs. Learn more https://t.co/jClYyYxRVW pic.twitter.com/V8KszHEjM3 — Casper (@Casper_Network) November 23, 2022 The Casper Network is a Proof-of-Stake (PoS) enterprise-focused blockchain designed to help businesses to build private or permissioned apps, aimed at accelerating businesses and the adopti...

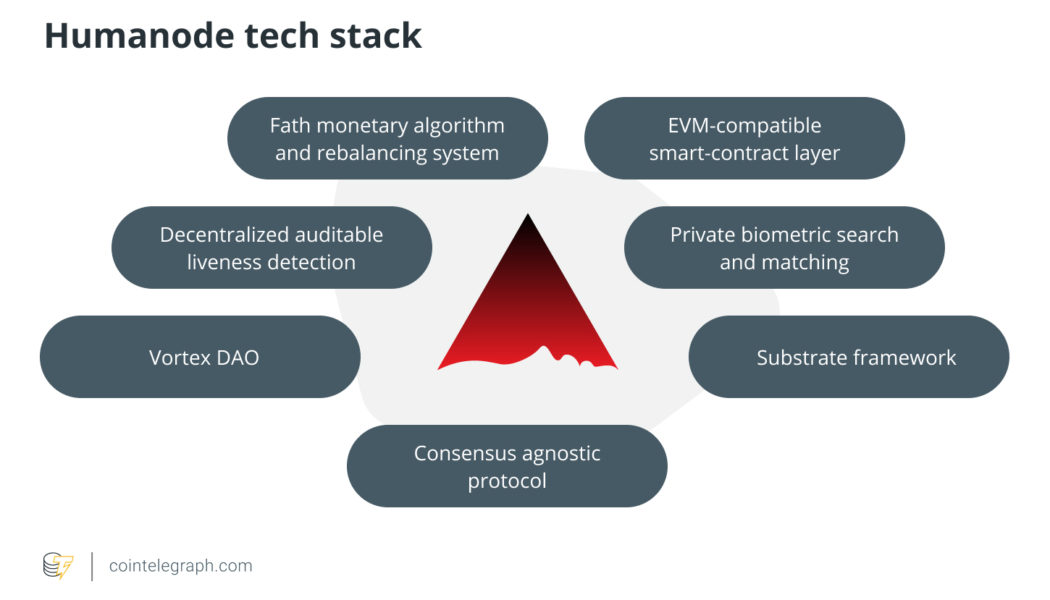

What is Humanode human-powered blockchain?

Humanode is a project that gracefully combines different technological stacks including blockchain and biometrics. Humanode tech encompasses a bunch of layers such as a blockchain layer represented by a Substrate module: a biometric authorization module based on cryptographically secure neural networks for the private classification of three-dimensional (3D) templates of users’ faces, a private liveness detection mechanism for identifying real human beings, a Vortex decentralized autonomous organization (DAO) and a monetary algorithm named Fath, where monetary supply reacts to real value growth and emission is proportional. Let’s look at them in more detail. Substrate framework Humanode is a layer-1 blockchain whose architecture lies on the Substrate open-sour...

Polygon Studios’ Ryan Watt talks Web3’s core principles and fairer internet

The year 2022 in crypto was eventful in many ways. However, the negative impacts of a bear market dampened the excitement around the blockchain upgrades that significantly brought crypto ecosystems closer to the future of finance. For Bitcoin, it was the Taproot soft fork upgrade, which was aimed at improving the scripting capabilities and privacy of the Bitcoin network. Ethereum underwent the Merge upgrade to transition from a proof-of-work to a proof-of-stake (PoS) consensus mechanism. Leading decentralized Ethereum scaling platform Polygon kicked off the year with mainnet upgrades based on Ethereum Improvement Proposal (EIP)-1559, otherwise known as the London hard fork. The upgrade was accompanied by Polygon (MATIC) token burning and better fee visibility. On Jan. 25, Ryan Wyatt joined...

Ethereum flashes a classic bullish pattern in its Bitcoin pair, hinting at 50% upside

Ethereum’s native token, Ether (ETH), looks poised to log a major price rally versus its top rival, Bitcoin (BTC), in the days leading toward early 2023. Ether has a 61% chance of breaking out versus Bitcoin The bullish cues emerge primarily from a classic technical setup dubbed a “cup-and-handle” pattern. It forms when the price undergoes a U-shaped recovery (cup) followed by a slight downward shift (handle) — all while maintaining a common resistance level (neckline). Traditional analysts perceive the cup and handle as a bullish setup, with veteran Tom Bulkowski noting that the pattern meets its profit target 61% of all time. Theoretically, a cup-and-handle pattern’s profit target is measured by adding the distance between its neckline and lowest point to the neckline level. The Ether-to...

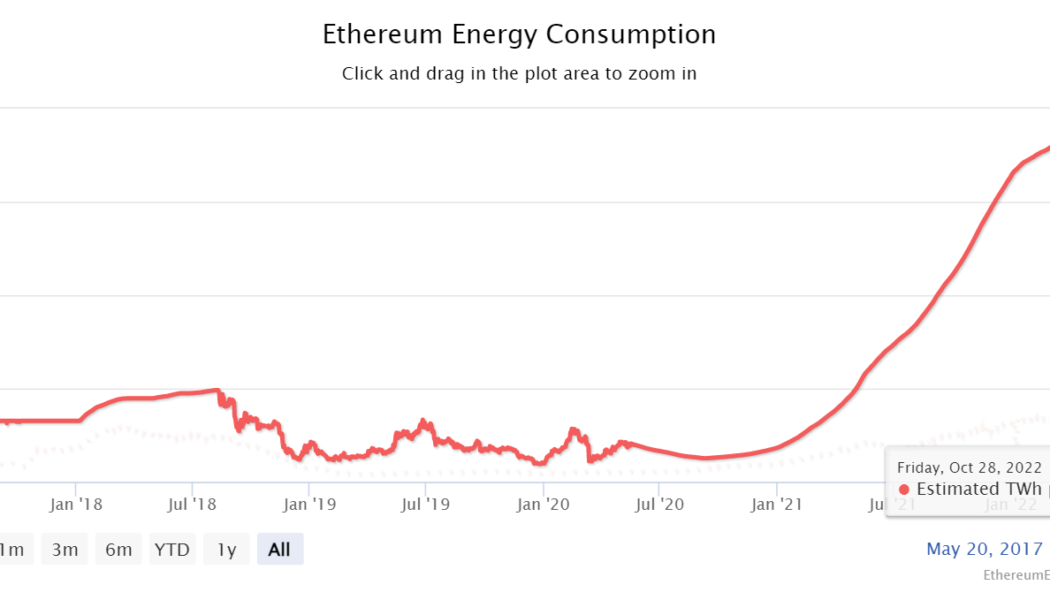

The Merge brings down Ethereum’s network power consumption by over 99.9%

The Merge, which is considered one of the most significant blockchain upgrades on Ethereum (ETH) to date, brought down the network’s energy consumption by 99.9% immediately. On Sept. 15, the Ethereum blockchain migrated from proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism in an effort to transition into a green blockchain. What followed was an immediate and steep drop in total energy consumption of the Ethereum network. The Ethereum Energy Consumption Index. Source: digiconomist.net Before the Merge upgrade, in 2022, the energy consumption of Ethereum ranged between 46.31 terawatt hour (TWh) per year to 93.98 TWh per year. The lowest energy consumption for Ethereum was recorded on Dec. 26, 2019, at 4.75 TWh per year. The estimated annual energy consumption in TWh/yr ...

51% of Ethereum blocks are now compliant with OFAC standards, raising censorship concerns

One month after the Merge, 51% of Ethereum blocks were compliant with OFAC standards, according to blockchain development Labrys’ data, as MEV-boost relays take over market share. On Twitter, users highlighted how the figures represent a milestone towards censorship, as more blocks are under surveillance: We reached another sad milestone in censorship: 51%This means if the censoring validators would now stop attesting to non-censoring blocks they would eventually form the canonical, 100% censoring chain. pic.twitter.com/JrYUjowLpt — Martin Köppelmann (@koeppelmann) October 14, 2022 OFAC stands for the Office of Foreign Assets Control, the entity in charge of enforcing United States economic sanctions, while mev-boost relays are centralized entities that act as trusted medi...

Ethereum Merge spikes block creation with a faster average block time

The Merge upgrade for Ethereum (ETH), which primarily sought to transition the blockchain into a proof-of-stake (PoS) consensus mechanism, has been revealed to have a positive impact on the creation of new Ethereum blocks. The Merge was considered one of the most significant upgrades for Ethereum. As a result of the hype, numerous misconceptions around cheaper gas fees and faster transactions plagued the crypto ecosystem, which was debunked by Cointelegraph. However, some of the evident improvements experienced by the blockchain post-Merge include a steep increase in daily block creation and a substantial decrease in average block time. Ethereum blocks per day. Source: YCharts On Sept. 15, Ethereum completed The Merge upgrade after successfully transitioning the network to PoS. On the same...

Is post-Merge Ethereum PoS a threat to Bitcoin’s dominance?

While Ethereum (ETH) fans are enthusiastic about the successful Merge, Swan Bitcoin CEO Cory Klippsten believes the upgrade will lead Ethereum into a “slow slide to irrelevance and eventual death.” [embedded content] According to Klippsten, the Ethereum community picked the wrong moment for detaching the protocol from its reliance on energy. As many parts of the world are experiencing severe energy shortages, he believed the environmental narrative is taking the back seat. In an exclusive interview with Cointelegraph, Klippsten said “I think the world is just waking up to reality and Ethereum just went way off into Fantasyland at the exact wrong time.” “It is just really bad timing to roll out that narrative. It just looks stupid.” According to some predictions, institutional capital...

Ethereum risks another 10% drop versus Bitcoin as $15.4M exits ETH investment funds

Ethereum’s Merge on Sep. 15 turned out to be a sell-the-news event, which looks set to continue. Notably, Ether (ETH) dropped considerably against the U.S. dollar and Bitcoin (BTC) after the Merge. As of Sep. 22, ETH/USD and ETH/BTC trading pairs were down by more than 20% and 17%, respectively, since Ethereum’s switch to Proof-of-Stake (PoS. ETH/USD and ETH/BTC daily price chart. Source: TradingView What’s eating Ether bulls? Multiple catalysts contributed to Ether’s declines in the said period. First, ETH’s price fall against the dollar appeared in sync with similar declines elsewhere in the crypto market, driven by Federal Reserve’s 75 basis points (bps) rate hike. Second, Ethereum faced a lot of flak for becoming too centralized ...

Ethereum miners dump 30K ETH, stonewalling ‘ultra sound money’ deflation narrative

Ethereum’s switch to proof-of-stake (PoS) on Sept. 15 failed to extend Ether’s (ETH) upside momentum as ETH miners added sell pressure to the market. On the daily chart, ETH price declined from around $1,650 on Sept. 15 to around $1,350 on Sept. 20, an almost 16% drop. The ETH/USD pair dropped in sync with other top cryptocurrencies, including Bitcoin (BTC), amid worries about higher Federal Reserve rate hikes. ETH/USD daily price chart. Source: TradingView Ethereum remains inflationary The Ether price drop on Sept. 15 also coincided with an increase in ETH supply, albeit not immediately post-Merge. $ETH is now Ultra Sound Money pic.twitter.com/fKz6VmoWdR — DavidHoffman.eth (@TrustlessState) September 15, 2022 Roughly 24 hours later, the supply change flipped positi...