Price predictions

JPMorgan picks out crypto as the preferred alternative asset

JPMorgan analysts chose Bitcoin over real estate, adding that the former’s fair value is 30% above current prices They also observed that VC funding should turn the current bear market and prevent a crypto winter akin to 2018/2019 JPMorgan analysts led by Nikolaos Panigirtzoglou have opined on the current crypto market, finding that the fair price of the world’s leading digital asset, Bitcoin, is 30% higher than current prices. The bank’s analysts said that there’s significant potential that Bitcoin could rise to $38,000 and carry other crypto tokens along with it, despite recent market capitulation. “The past month’s crypto market correction looks more like capitulation relative to last January/February, and going forward, we see upside for Bitcoin and crypto markets more generally,...

Market strategist claims the crypto crash might be ‘good’ for the sector in the long term

The unprecedented fall of Terra (LUNA) and the algorithmic stable coin UST sent shockwaves across the whole crypto market The crash has given more voice to calls for regulation and investor protection The past few weeks have been turbulent for investors in the crypto space, with market movements creating margins never seen before. Investors have had to cut losses, not to mention being caught in fixes, unable to predict how the cryptocurrencies they track might perform upon trading. The heavy downturn has opened up discussions on the utility and market performance among industry experts. Bitcoin may hit a bottom of $12,000 during this current cycle In an interview with Stanberry Research, Gareth Soloway, the President of InTheMoneyStocks.com, dismissed the popular belief that Bitcoin f...

Cathie Wood says the bear crypto market could be nearing a close

ARK Invest’s Cathie Wood believes a bearish run for crypto markets could soon be over, as markets all over are now capitulating She predicted that the market cap of truly ‘disruptive innovation’ will exponentially grow to $210 trillion by 2030 CEO of asset management firm ARK Invest Cathie Wood remains unfazed over the long-term behaviour of cryptocurrencies despite the most recent downturn in the price levels of this asset class. Speaking during an appearance in a recent update of the Into the Know series, the ARK Invest chief explained that the increased co-movement between crypto-assets and the stock market, which has caused the current unimpressive run, is a sign that the bear market could be coming to an end. She said that a bear environment for crypto assets could soon tou...

“There is more damage to be done,” insists Galaxy Digital’s Novogratz

Yesterday, Galaxy Digital reported a $111.7 million loss in Q1 due to unrealised losses on crypto holdings Mike Novogratz expects volatile and testing crypto markets to continue over the next few quarters Fintech and asset management firm Galaxy Digital on Monday reported that it recorded a loss in the first quarter of the year. The financial services firm explained that the downturn was largely due to the price volatility of crypto markets. Specifically, Galaxy Digital said it saw a net loss of $111.7 million for the quarterly period ended March 31, which overturned the $858.2 million net comprehensive income gain recorded in Q1 last year. It was not all bad, or rather, it would have been worse were it not for its investment banking and mining operations. Galaxy Digital revealed that it l...

Everything you need to know about Ethereum 2.0 & The Merge!

Quick facts about The Merge… Ethereum 2.0 is the transition from the proof of work (PoW) consensus mechanism to the proof of stake (PoS) model. PoW is used by a handful of blockchains, the most notable of which is the father of cryptocurrencies—Bitcoin (BTC). Ethereum also started out using the PoW method, but as its popularity grew, PoW was found to be too labour intensive for Web 3.0, too slow, and too environmentally unfriendly. PoS on the other hand completes transactions more efficiently, uses less power, and benefits from much lower transaction fees. Network stakeholders validate transactions and are rewarded for their efforts with the native currency of the platform—in this case, ETH. Why do people call The Merge Ethereum 2.0? Ethereum 2.0, Eth2 or The Merge are all the same thing u...

Top crypto analyst predicts LUNA could shed up to 50%

Cred says LUNA’s market structure is showing a post fakeout reclaim He predicts that the price of the native token for Terra could slide as low as $40 A largely-followed crypto analyst has predicted that a downfall could be coming for LUNA, with a forecast that the price of the Terra-native asset could fall more than 50%. Cred, a top crypto analyst, said in a recent YouTube session that the current LUNA structure is a cause of concern and should it emulate previous patterns (a post-fakeout reclaim shown by Solana), then the recent optimistic prices shaped up into a massive a bull trap. “I’m just drawing a structure from the highest close, the December high, and then [the] weekly [candle] closed way above it. Made a new all-time high and the next weekly just bearish engulfed it… That’...

Ethereum targets $3,500 as Bitcoin touches a three-month high

Bitcoin raced past $48k during Monday’s trading session setting a new year-to-date high above $48,086 Ethereum’s native token Ether has today shot up to a multi-week high of $3,428.85 on the back of the broader market rally Bitcoin yesterday set a new yearly high north of $48,000 as its price reacted to bullish news of Terra acquiring more Bitcoin that will act as reserve for its TerraUSD stable coin. The price ascent means Bitcoin has erased the losses it has recorded thus far. Though it has since retreated to $47,540 at the time of writing, market data shows Bitcoin has made marginally over 11% in the last seven days. These gains have helped the Satoshi coin come off a two-month cycle of range-trading between $35,000 and $45,000. At its current price, Bitcoin has moved up by over 43% fro...

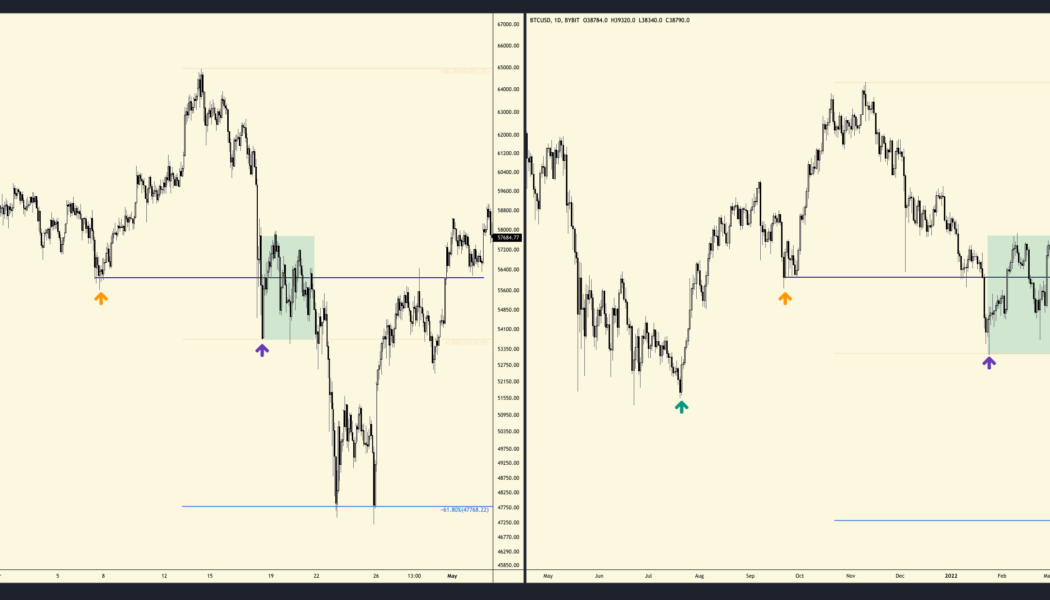

Bitcoin’s current price trend is reflective of its pattern before last year’s huge downturn, analyst observes

Crypto Capo believes an extended third wave of the current correction could push BTC to achieve bearish targets as low as $21k FTM and LUNA are both showing signs of a further downward correction Well-known crypto markets analyst, Crypto Capo, has said that Bitcoin’s recent recovery in the markets during the February mini-surge could soon be defied by a strong descent move. He notes that the BTC market is showing a similar pattern as it did during the massive correction of May 2021. Capo adds that February’s relief rally and the successive price action is evocative of the period before when the market nosedived, starting May last year and eventually pitting bottom below $30k in July. BTC/USD trading chart A more recent update from the crypto analyst indicates that Bi...

Bitcoin’s recent correction below $40k conforms to a previously bullish triangle pattern, crypto analyst notes

A top crypto analyst has set forth that Bitcoin’s rejection at $45k indicates the asset is now in a triangle trading pattern Credible Crypto also explained that it is unlikely Bitcoin will plunge below $30k as it recently grew above $44,700 Popular crypto markets analyst Credible Crypto has predicted that Bitcoin’s recent rejection at $45k and correction downwards below $40k indicates that the asset is preparing for a surge towards $50k in the coming weeks. In a post shared to his 313k-large Twitter following, the pseudonymous crypto strategist said that following its recent rejection at $45,069, the asset is now fitting into a triangle structure, similar to the one it showed when the price was at $10k. He explained that should the daily demand hold at $38k, then Bitcoin could comple...

Here is why deVere Group CEO expects Bitcoin to clock $50k this month

Nigel Green believes the Ukraine crisis and institutional investor interest could spur a price surge He explained that the recent developments have paraded Bitcoin’s key traits Since hitting an all-time peak, Bitcoin has been the epitome of fluctuating currencies, but CEO of Financial services firm deVere Group Nigel Green believes that the asset is likely to rise (in the coming months) from its 14th place among the most valuable currencies in the world today. Pointing to its current momentum, the CEO has predicted that Bitcoin could hit $50k before the end of March. Green backed his projection citing the ongoing crisis in Ukraine and a growing appetite for institutional investment as the impetus that will sustain the push to the predicted price. The financial services mogul held tha...

Ethereum’s rejection off its bull market support band could mean an extended bear market

Benjamin Cowen, a popular crypto analyst, has expressed bearish sentiment on Ethereum The crypto strategist has predicted an extended period of market correction for the native token of the top smart contract platform Speaking in a video published on his YouTube channel on Monday, Cowen reviewed Ethereum’s recent behaviour around the bull market support band. He observed that Ethereum faced rejection at the support band, arguing that its price is becoming a cause for concern. The bull market support band is a moving average indicator that integrates the 20-week simple moving average (SMA) and the 21-week exponential moving average (EMA). Ethereum did not even actually reach the 21-week exponential moving average before it resumed the slump, which the crypto strategist labelled a show...

Glassnode theorises an extended BTC bear market, points to on-chain metrics

Analytics firm Glassnode says sizeable investor losses and recency bias are likely to sustain a prolonged bear market Despite the currently unimposing number of daily active users, Glassnode notes that long term hodlers are increasing linearly in the long term In its February 21 newsletter, blockchain data and intelligence provider Glassnode has suggested that Bitcoin investors are seeing a significantly growing number of motivations to sell their holdings. As volatility pushed Bitcoin to either side of the $40k psychological support last week, it peaked close to $45k but eventually closed nearer $38k. The blockchain analytics firm observed that external factors, including anticipation of the Fed’s March meeting and geopolitical issues globally, are cause for the dwindling price leve...