Price analysis

Price analysis 3/18: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

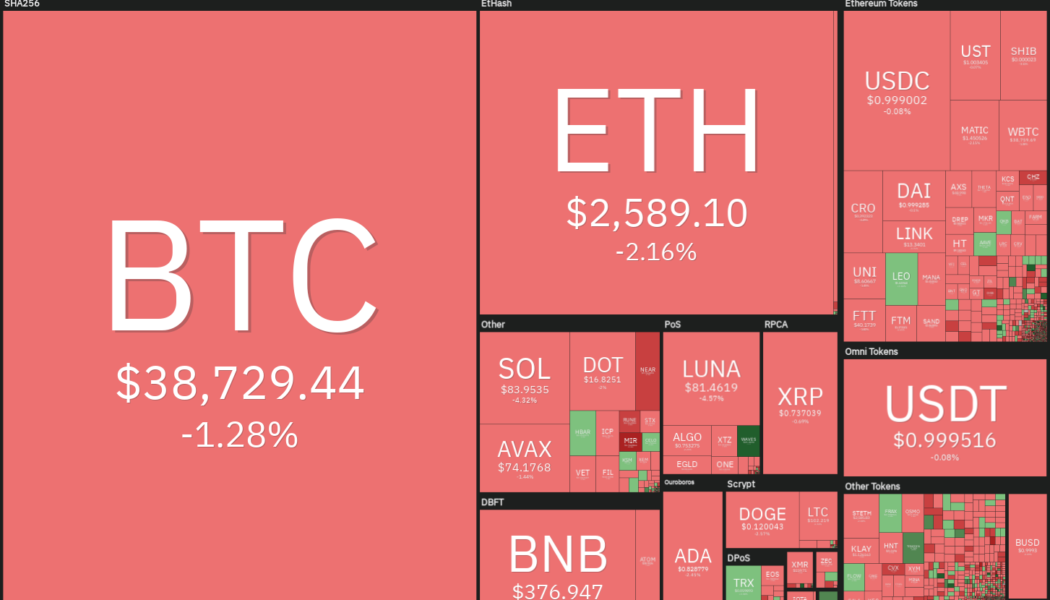

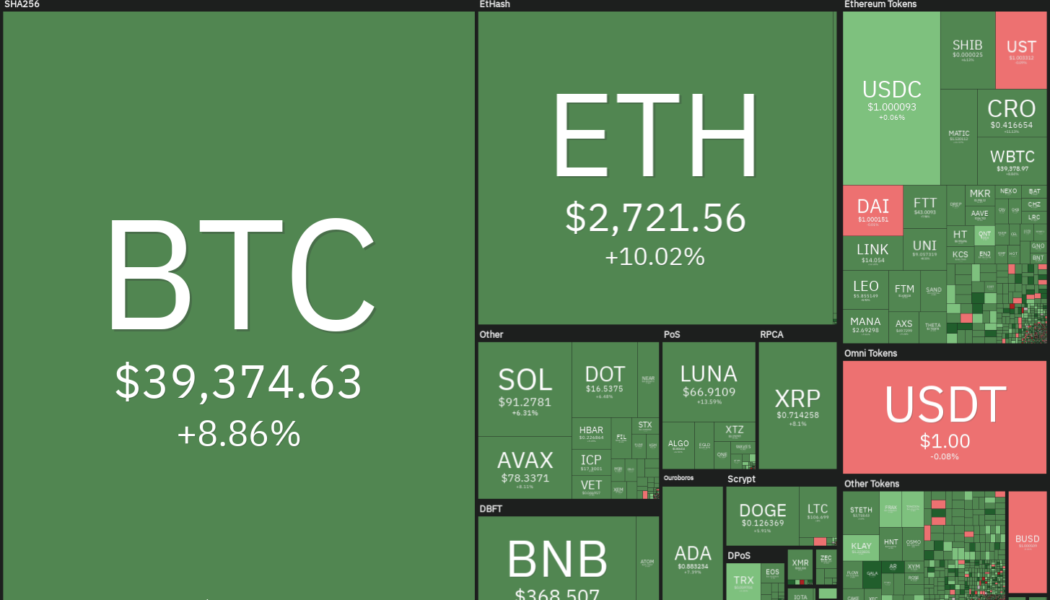

Bitcoin (BTC) is facing a challenging environment in 2022 due to the surging inflation and geopolitical turmoil. Although gold has outperformed Bitcoin year-to-date, Bloomberg Intelligence senior commodity strategist Mike McGlone believes that Bitcoin could make a strong comeback. McGlone expects the current circumstances to “mark another milestone in Bitcoin’s maturation.” Another bullish sign for the long term is that the Bitcoin miners have been increasing their Bitcoin holdings since 2021. Compass Mining founder and CEO Whit Gibbs said to Cointelegraph that Bitcoin mining companies are “taking more of a bullish approach to Bitcoin.” Daily cryptocurrency market performance. Source: Coin360 Terraform Labs founder Do Kwon said that its stablecoin TerraUSD (UST) will be backed by mor...

Price analysis 3/16: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

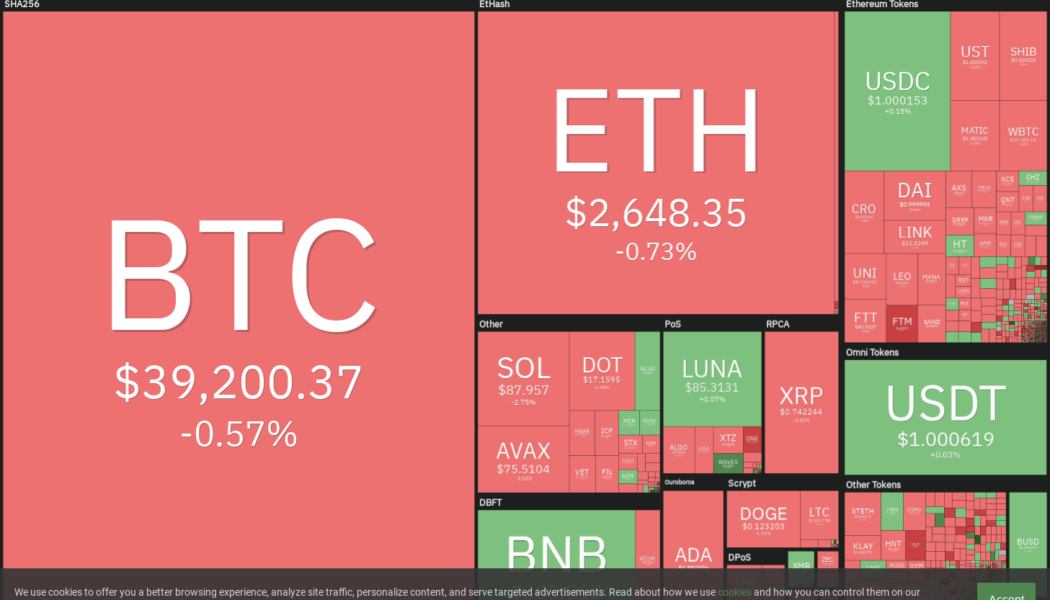

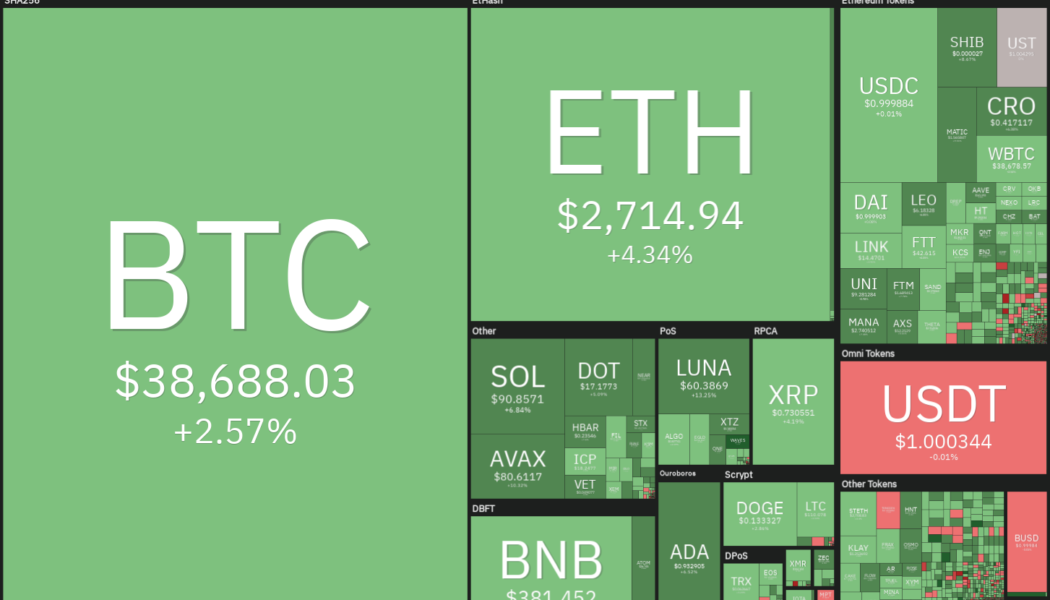

Bitcoin (BTC) is witnessing a see-saw battle near $40,000 with both the bulls and the bears trying to gain the upper hand. The volatility could remain high as the markets await the United States Federal Reserve’s policy decision due on March 16. Analyst Willy Woo suggests that Bitcoin could witness a capitulation event based on a cost basis, a metric that indicates the transfer of Bitcoin from inexperienced to experienced traders. Such sharp declines usually suggest the formation of market bottoms. Daily cryptocurrency market performance. Source: Coin360 However, Glassnode believes that a capitulation has been avoided because the sell-offs have been absorbed by a relatively strong market. Although 82% of the short-term holders’ coins are in loss, Glassnode considers this to be a late...

Price analysis 3/11: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

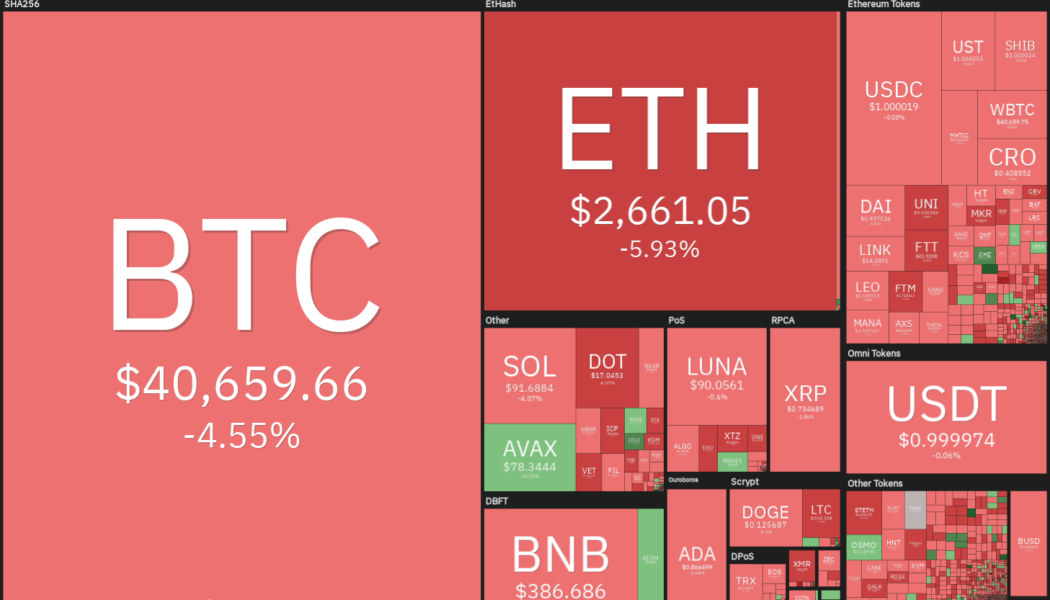

Bitcoin (BTC) has been volatile in the past few days but the long-term investors seem to be using the current weakness to buy. According to Whale Alert and CryptoQuant, about 30,000 BTC left Coinbase and was deposited in an unknown wallet. It is speculated to be a genuine purchase and not an in-house transaction. Although investors may be bullish for the long term, the short-term picture remains questionable. Stack Funds said in their recent weekly research report that they “expect sideways trading and possibly a potential dip” in the short term due to the increase in inflation and the lack of clarity regarding the conflict in Ukraine. Daily cryptocurrency market performance. Source: Coin360 While Bitcoin has been volatile, gold-backed crypto assets have made a strong showing in 2022...

Which Terra-based coins have the most explosive potential? | Find out now on The Market Report live

“The Market Report” with Cointelegraph is live right now. On this week’s show, Cointelegraph’s resident experts discuss which Terra-based coins you should be looking out for in 2022. But first, market expert Marcel Pechman carefully examines the Bitcoin (BTC) and Ether (ETH) markets. Are the current market conditions bullish or bearish? What is the outlook for the next few months? Pechman is here to break it down. Next up, the main event. Join Cointelegraph analysts Benton Yaun, Jordan Finneseth and Sam Bourgi as they debate which Terra-based coin has the most explosive potential. Will it be Bourgi’s pick of StarTerra, which capitalizes on blockchains’ biggest trends — play-to-earn, nonfungible tokens (NFTs) and staking — basically combining multiple multibillion-dollar industri...

Price analysis 3/7: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

The geopolitical tension between Russia and Ukraine has resulted in investors seeking safe-haven assets. Contrary to expectations by crypto investors, Bitcoin (BTC) has failed to rise along with gold and it remains closely correlated with the U.S. stock markets. Lloyd Blankfein, the former CEO of Goldman Sachs, said that the actions of governments freezing accounts, blocking payments and inflating the U.S. dollar should all be positive for crypto but the price action suggests a lack of large inflows. Daily cryptocurrency market performance. Source: Coin360 On-chain data suggests that investors may be accumulating Bitcoin for the long term. Data from Santiment shows that 21 out of the past 26 weeks have seen Bitcoin move off the exchanges. Could Bitcoin climb back above $40,000 and pull alt...

Top 5 cryptocurrencies to watch this week: BTC, XRP, NEAR, XMR, WAVES

Bitcoin (BTC) plunged below $40,000 on March 4 and has been trading below the level throughout the weekend. Although the crypto price action has been volatile in the past few days, Glassnode data shows that institutional investors have been gradually accumulating Bitcoin through the Grayscale Bitcoin Trust (GBTC) shares since December 2021. Another positive sign has been that fund managers have not panicked and dumped their holdings in GBTC. This suggests that managers possibly are bullish in the long term, hence they are riding out the short term pain. Crypto market data daily view. Source: Coin360 Bloomberg Intelligence said in their crypto market outlook report on March 4 that Bitcoin may remain under pressure if the U.S. stock markets keep falling, but eventually, they expect crypto to...

Price analysis 3/4: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

The equity markets in Europe and the United States are seeing a sea of red as traders continue to sell risky assets due to the geopolitical situation. Bitcoin (BTC) and several major cryptocurrencies are also witnessing profit-booking after the recent rise. Another reason that could be keeping investors on the edge is the upcoming Federal Open Market Committee (FOMC) meeting on March 16. A statement from Fed hair Jerome Powell on March 2 highlighted that the central bank is likely to hike rates this month. Fitch Ratings chief economist Brian Coulton expects core inflation to remain high in 2022 and the Fed to boost the “Fed fund rate to 3% by the end of 2022.” Daily cryptocurrency market performance. Source: Coin360 ExoAlpha managing partner and chief investment officer David Lifchit...

Price analysis 2/28: BTC, ETH, BNB, XRP, ADA, SOL, AVAX, LUNA, DOGE, DOT

Bitcoin (BTC) soared above $40,000 on Feb. 28 even though the S&P 500 remained soft. This suggests that the correlation between Bitcoin and the U.S. equity markets may be showing the first signs of decoupling. If bulls sustain the price above $38,500 till the end of the day, Bitcoin would avoid four successive months of decline. The volatility of the past few days does not seem to have shaken the resolve of the long-term investors planning to stick with their positions. Data from on-chain analytics firm Glassnode showed that the amount of Bitcoin supply that last moved between three to five years ago soared to more than 2.8 million Bitcoin, which is a four year high. Daily cryptocurrency market performance. Source: Coin360 Interestingly, an experiment by Portuguese software developer T...

Price analysis 2/25: BTC, ETH, BNB, XRP, ADA, SOL, AVAX, LUNA, DOGE, DOT

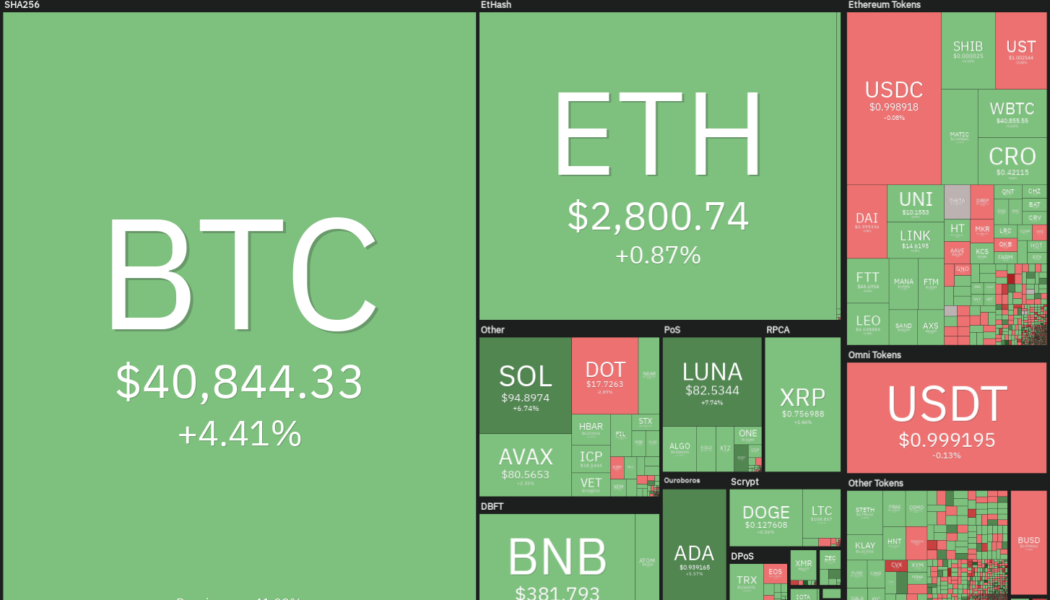

The U.S. equity markets and Bitcoin (BTC) have rebounded sharply from their Feb. 24 lows while gold has made a retreat from its recent highs. This indicates that investors may be buying risky assets and reducing exposure to assets perceived as a safe haven. Recent reports also suggest that Russian President Vladimir Putin may send a delegation to negotiate with Ukraine and this raises hope that the conflict could end sooner than analysts expect. Some analysts believe that the U.S. Federal Reserve may not raise rates aggressively in March due to the geopolitical situation. Allianz chief economic advisor Mohamed El-Erian believes that the March 50 basis point rate hike is “completely off the table.” Daily cryptocurrency market performance. Source: Coin360 Dr. Raullen Chai, the co-f...

Top 5 cryptocurrencies to watch this week: BTC, LUNA, AVAX, ATOM, FTM

The geopolitical news flow is likely to result in volatile moves in Bitcoin (BTC) and altcoins in the next few days. News of Russian President Vladimir Putin ordering the nuclear deterrence forces on high alert may be viewed as a negative, but reports of talks between the warring nations could be positive as it raises hopes of an end to the conflict. The crypto community came into focus as the Ukrainian government called for help and sought crypto donations. Some individuals on social media said their Ukrainian credit cards had stopped working and they were not able to withdraw money from their banks. They highlighted how crypto was the only money left with them. Crypto market data daily view. Source: Coin360 While some analysts are projecting that Bitcoin may have bottomed out, Cointelegr...

Price analysis 2/23: BTC, ETH, BNB, XRP, ADA, SOL, AVAX, LUNA, DOGE, DOT

Bitcoin (BTC) and several altcoins have bounced off their immediate support levels after buyers attempted to arrest the current decline. Bloomberg Senior Commodity Strategist Mike McGlone highlighted in a recent Tweet that Bitcoin was trading roughly 20% below its 50-week moving average and such discounted levels have “often resulted in good price support.” The bearish price action of the past few days does not seem to have deterred the institutional traders from accumulating at lower levels. According to CoinShares’ Feb. 22 “Digital Asset Fund Flows Weekly” report, institutional investors pumped about $89 million into Bitcoin funds between Feb. 14 and Feb. 18, taking the total inflows in the current month to $178.3 million. Daily cryptocurrency market performance. Source: Coin360 Crypto t...

Solana’s weekend bounce risks turning into a bull trap — Can SOL price fall to $60 next?

A rebound move witnessed in the Solana (SOL) market this weekend exhausted midway as its price dropped below the $90 level from a high of $96 on Feb. 21. In doing so, SOL price technicals are now risking a classic bearish reversal setup. Solana price risks dropping to $60 Dubbed head-and-shoulders (H&S), the technical pattern emerges when the price forms three peaks in a row atop a common support level (called a neckline). As it typically turns out, the pattern’s middle peak, called a “head,” comes longer than the other two peaks, called theleft and right shoulders, which come to be of similar heights. The H&S pattern tends to send the prices lower—at length equal to the maximum distance between the head and the neckline—once they decisively break below its ...