Price analysis

Price analysis 5/30: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

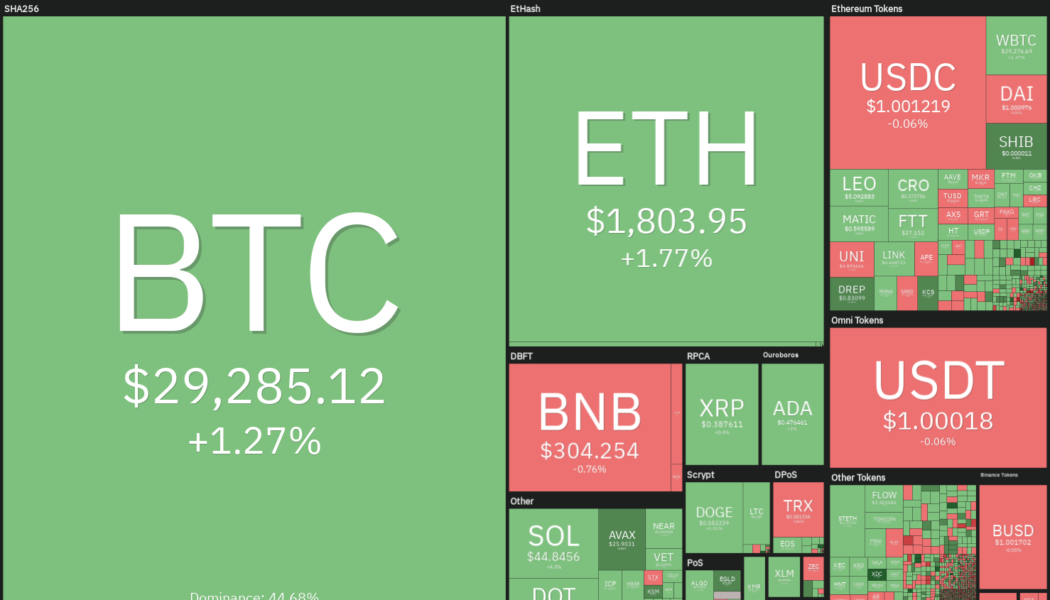

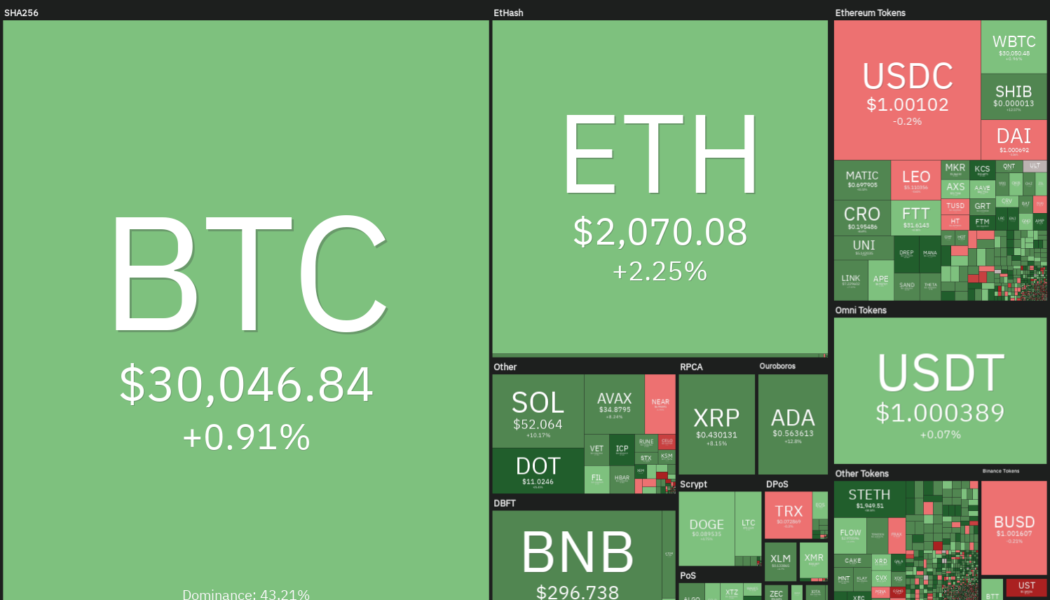

After creating the dubious record of nine successive red weekly closes, Bitcoin (BTC) is attempting to make amends by starting a price recovery to end the losing streak. Analysts have repeatedly said that investors should not fear a bear market because it is one of the best times to invest in fundamentally strong projects in preparation for the next bull phase. CryptoQuant CEO Ki Young Ju highlighted that unspent transaction outputs (UTXOs) that are older than six months reflect 62% of the realized cap, which is similar to the level seen during the March 2020 crash. Hence, Ki said that Bitcoin may be close to forming a cyclic bottom. Daily cryptocurrency market performance. Source: Coin360 In the current bearish environment, it is difficult to fathom a Bitcoin rally to $250,000 ...

Top 5 cryptocurrencies to watch this week: BTC, ETH, XTZ, KCS, AAVE

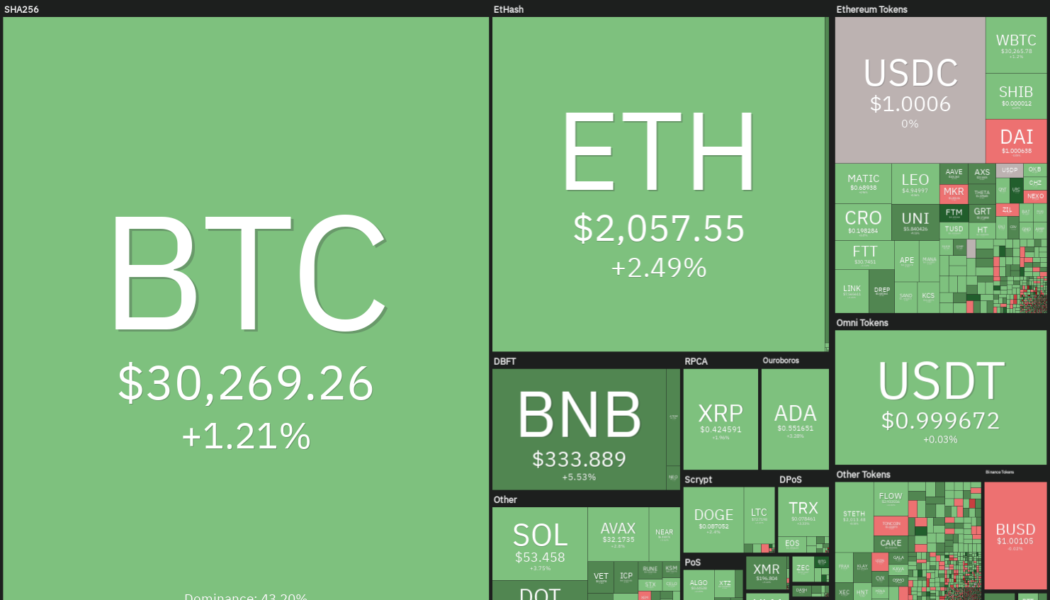

After declining for eight successive weeks, the Dow Jones Industrial Average rebounded sharply last week to finish higher by 6.2%. However, Bitcoin (BTC) has not been able to replicate the performance of the United States equities markets and is threatening to paint a red candle for the ninth week in a row. A positive sign is that Bitcoin whales have been buying the market correction. Glassnode data shows that the number of Bitcoin whale wallets with a balance of 10,000 Bitcoin or more has risen to its highest level since February 2021. The accumulation in the whale wallets suggests that their long-term view for Bitcoin remains bullish. Crypto market data daily view. Source: Coin360 Blockware Solutions highlighted that the Mayer Multiple metric which compares the 200-day simple moving aver...

Price analysis 5/23: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

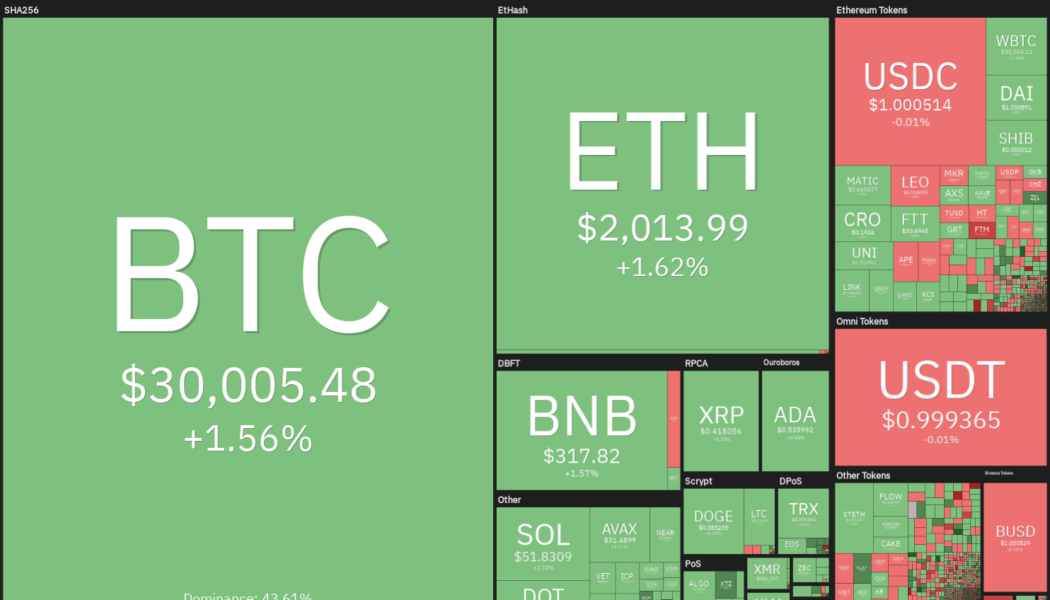

The United States equity markets are attempting a recovery after weeks of relentless selling. Along similar lines, on-chain monitoring resource Material Indicators expects the crypto market to recover, but they anticipate Bitcoin (BTC) to spend some time in a range before “a real breakout.” The seven-day moving average of the on-chain transaction volume tracked by Glassnode hit a nine-month low on May 23. This suggests that Bitcoin’s lackluster price action in 2022 has led to reduced participation from traders. Daily cryptocurrency market performance. Source: Coin360 While signs of a short-term recovery are visible, a sustained recovery could be difficult because the macro conditions remain challenging. International Monetary Fund managing director Kristalina Georgieva wrote in a blog post...

Top 5 cryptocurrencies to watch this week: BTC, BNB, XMR, ETC, MANA

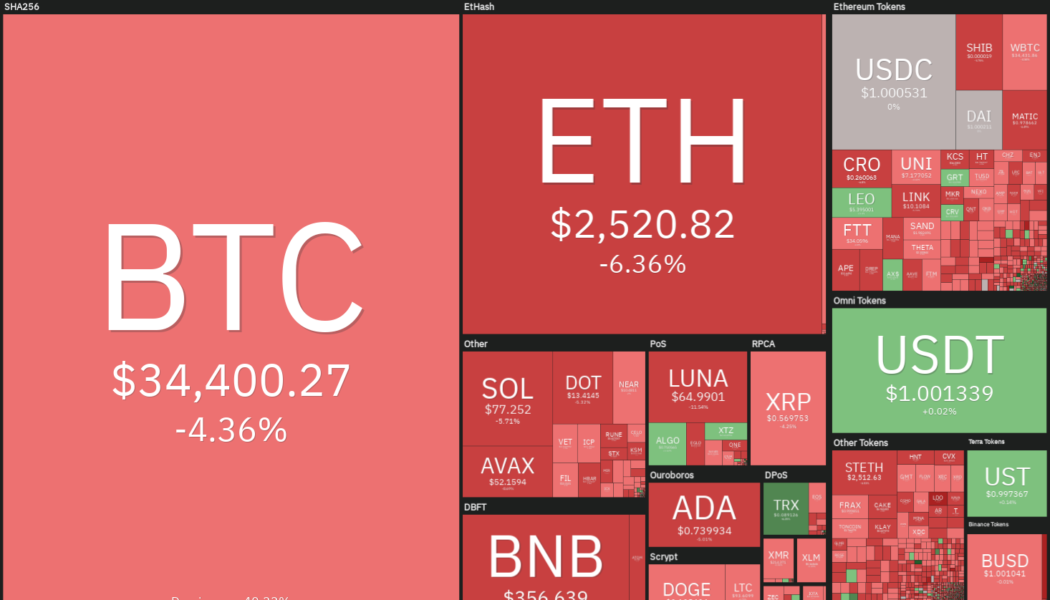

The Dow Jones Industrial Average has declined for eight consecutive weeks, the first such losing streak since 1923. On May 20, the S&P 500 briefly fell into bear market territory, indicating that traders continue to sell risky assets in fear of a recession. Due to its tight correlation with US equities markets, Bitcoin (BTC) has remained under pressure for many weeks. The bulls are attempting to push Bitcoin higher during the weekend and avert an even longer losing streak. Crypto market data daily view. Source: Coin360 Bitcoin’s performance in the first five months has been the worst since 2018, indicating that sellers are in control. However, after several weeks of weakness, the crypto markets may be on the cusp of a bear market rally. What are the critical levels that may signa...

Top 5 cryptocurrencies to watch this week: BTC, BNB, XMR, ETC, MANA

The Dow Jones Industrial Average has declined for eight consecutive weeks, the first such losing streak since 1923. On May 20, the S&P 500 briefly fell into bear market territory, indicating that traders continue to sell risky assets in fear of a recession. Due to its tight correlation with US equities markets, Bitcoin (BTC) has remained under pressure for many weeks. The bulls are attempting to push Bitcoin higher during the weekend and avert an even longer losing streak. Crypto market data daily view. Source: Coin360 Bitcoin’s performance in the first five months has been the worst since 2018, indicating that sellers are in control. However, after several weeks of weakness, the crypto markets may be on the cusp of a bear market rally. What are the critical levels that may signa...

Price analysis 5/18: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

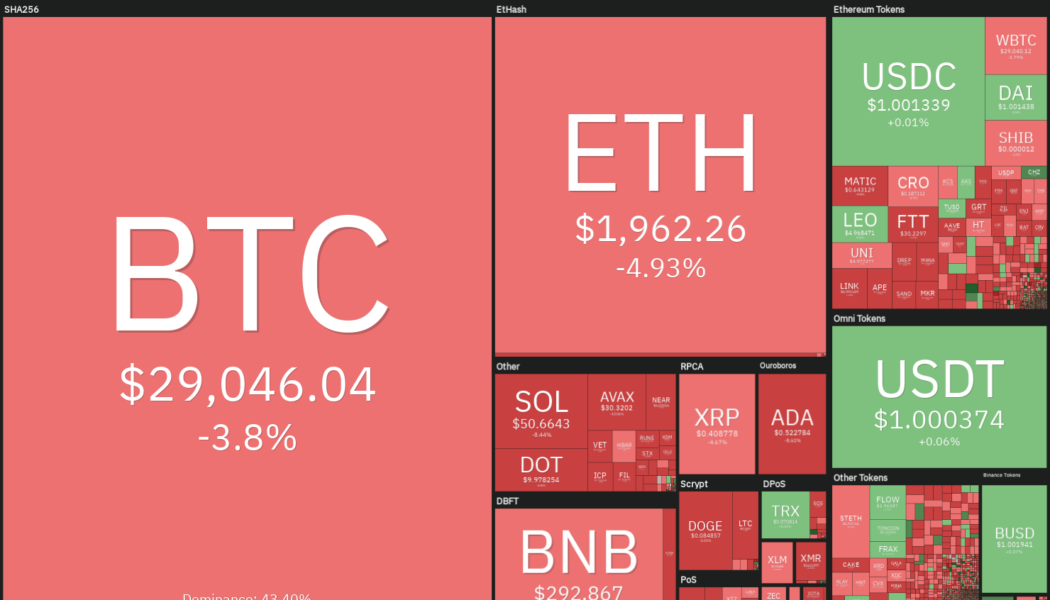

On May 17, United States Federal Reserve Chairman Jerome Powell told the Wall Street Journal that the 50-basis-point rate hikes would continue until inflation is under control. Powell’s emphasis on a hawkish policy suggests that monetary conditions are likely to remain tight in 2022, which could limit the upside in risky assets. On-chain market intelligence firm Glassnode said that historically, Bitcoin (BTC) has bottomed out when the price breaks below the realized price. However, barring the 2019 to 2020 bear market, during previous bear cycles, Bitcoin’s price stayed below the realized price for anywhere between 114 to 299 days. This suggests that if macro situations are not favorable, a quick recovery is unlikely. Daily cryptocurrency market performance. Source: Coin360 While the curre...

Price analysis 5/13: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

Bitcoin (BTC) rebounded sharply after dropping near its realized price of $24,000 on May 12, suggesting some bulls went against the herd and bought the dip. According to on-chain analytics platform CryptoQuant, the exchange balances declined by more than 24,335 Bitcoin on May 11 and 12, indicating that bulls may have started bottom fishing. However, macro investor Raoul Pal is not confident that a bottom has been made. In an exclusive interview with Cointelegraph, Pal said that if equity markets witness a capitulation phase, crypto markets are also likely to plunge before forming a bottom. He anticipates the current bear phase to end after the United States Federal Reserve stops hiking rates. Daily cryptocurrency market performance. Source: Coin360 Bear markets are known for sharp relief r...

What are the top social tokens waiting to take off? | Find out now on The Market Report

“The Market Report” with Cointelegraph is live right now. On this week’s show, Cointelegraph’s resident experts discuss the social tokens you should be keeping a close eye on. But first, market expert Marcel Pechman carefully examines the Bitcoin (BTC) and Ether (ETH) markets. Are the current market conditions bullish or bearish? What is the outlook for the next few months? Pechman is here to break it down. Next up: the main event. Join Cointelegraph analysts Benton Yaun, Jordan Finneseth and Sam Bourgi as each makes his case for the top social token. First up, we have Bourgi with his pick of STEEM, the native token of the Steem social blockchain network, which rewards users for content creation. Its aim is to give back value to content creators who contribute on the platform. Although is ...

Top 5 cryptocurrencies to watch this week: BTC, ALGO, XMR, XTZ, THETA

The S&P 500 and the Nasdaq have declined for five consecutive weeks, indicating that traders continue to reduce exposure to risky assets. Bitcoin’s (BTC) close correlation with United States equity markets has resulted in its price remaining under pressure. Bitcoin has extended its decline during the weekend and is now on track for its sixth successive weekly loss, the first such occurrence since 2014. The weakness in Bitcoin has pulled down the entire crypto markets, whose market capitalization has dipped below $1.6 trillion. Crypto market data daily view. Source: Coin360 When the sentiment is bearish, traders sell on every negative news. The de-peg of Terra’s U. S. dollar stablecoin TerraUSD (UST) also appears to be increasing sell pressure across the crypto market. After Bitcoin’s s...

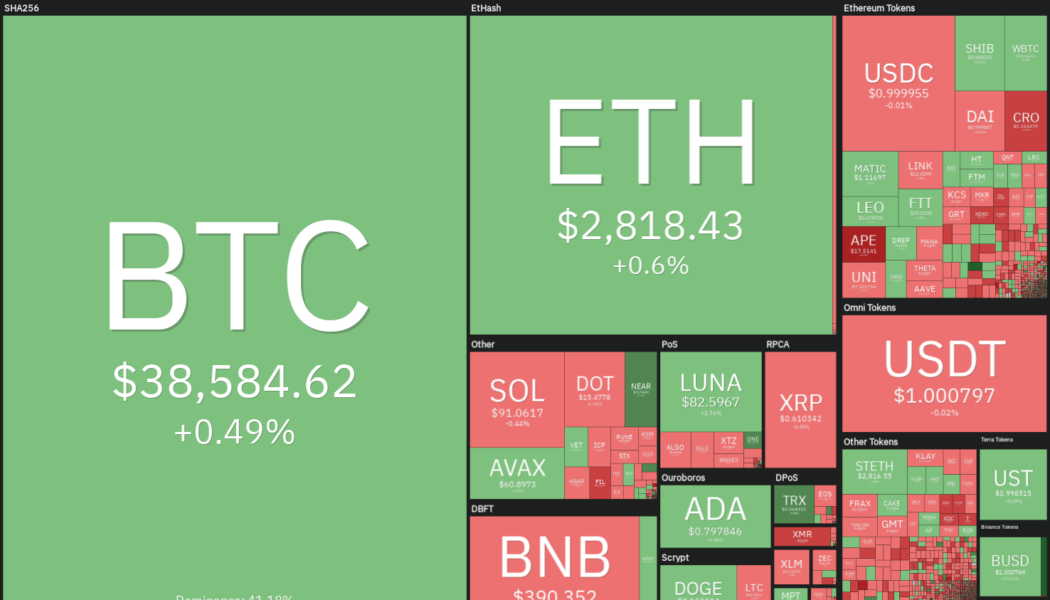

Top 5 cryptocurrencies to watch this week: BTC, LUNA, NEAR, VET, GMT

The month of April has been a forgettable one for equities and cryptocurrency investors. Bitcoin (BTC) plummeted 17% in April to record its worst ever performance in the month of April. Similarly, the Nasdaq Composite plunged 13.3% in April, its worst monthly performance since October 2008. However, a major positive for crypto investors is that Bitcoin is still above its year-to-date low near $33,000. In comparison, the Nasdaq 100 has hit a new low for 2022 while the S&P 500 is just a whisker away from making a new year-to-date low. This suggests that Bitcoin has managed to avoid a major sell-off, indicating demand at lower levels. Crypto market data daily view. Source: Coin360 Along with Bitcoin, Ether (ETH) has also managed to sustain well above its year-to-date low. Accor...

Price analysis 4/29: BTC, ETH, BNB, SOL, LUNA, XRP, ADA, DOGE, AVAX, DOT

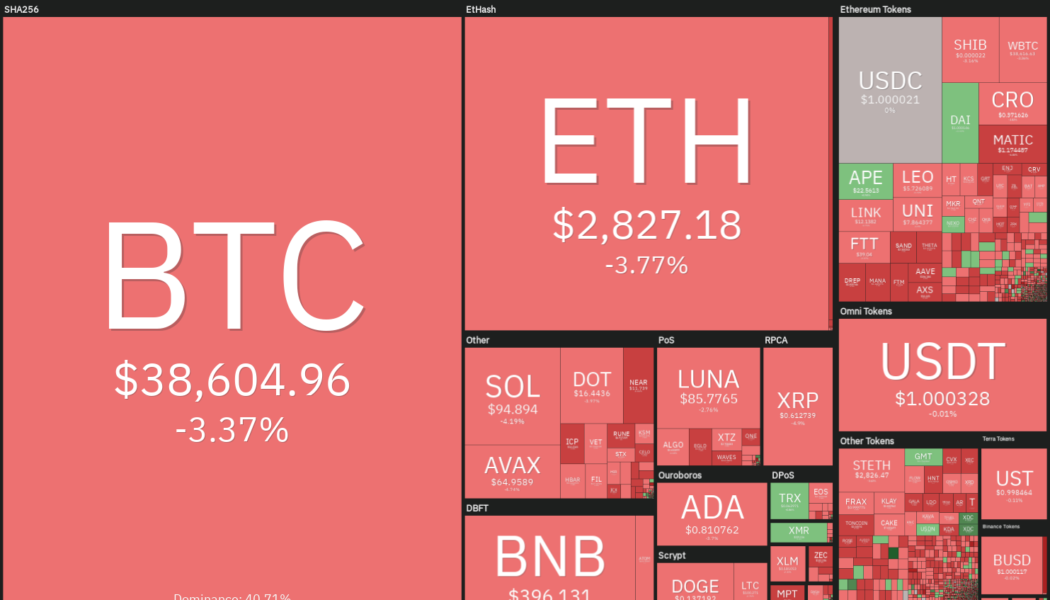

The U.S. dollar index (DXY) turned down from its 20-year high on April 29 but that has not changed the bearish price action seen in Bitcoin (BTC) and the U.S. equity markets. Equities remain under pressure and this week, Amazon stock saw its biggest intraday drop since 2014 after uncertainty over the U.S. Federal Reserve’s tightening measures placed investor sentiment back into choppy waters. If Bitcoin extends its correction, on-chain analysis platform Whalemap believes that the $25,000 to $27,000 zone may be the best place “to go all-in” on Bitcoin. Long-term investors do not appear to be panicking over the current weakness in Bitcoin and on-chain data from CryptoQuant shows that the combined BTC reserves of 21 crypto exchanges has plummeted to levels not seen since September 2...

Price analysis 4/22: BTC, ETH, BNB, XRP, SOL, ADA, LUNA, AVAX, DOGE, DOT

Bitcoin (BTC) turned down sharply on April 21, maintaining its tight correlation with the U.S. equity markets, which reversed direction after U.S. Federal Reserve Chair Jerome Powell hinted that a 50 basis point rate hike was “on the table” in May. The selling has continued on April 22 as investors trim risky assets in expectation of an aggressive stance from central banks to curb surging inflation. Veteran trader Peter Brandt said in a tweet recently that the Nasdaq 100 (NDX) was showing a formation similar to the one it had made before plunging in the year 2000. If history repeats itself then the NDX could witness a sharp correction. That may be negative for the crypto markets in the short term because of the close correlation between Bitcoin and the NDX. Daily cryptocurrency market...