Price analysis

Here is why a 0.75% Fed rate hike could be bullish for Bitcoin and altcoins

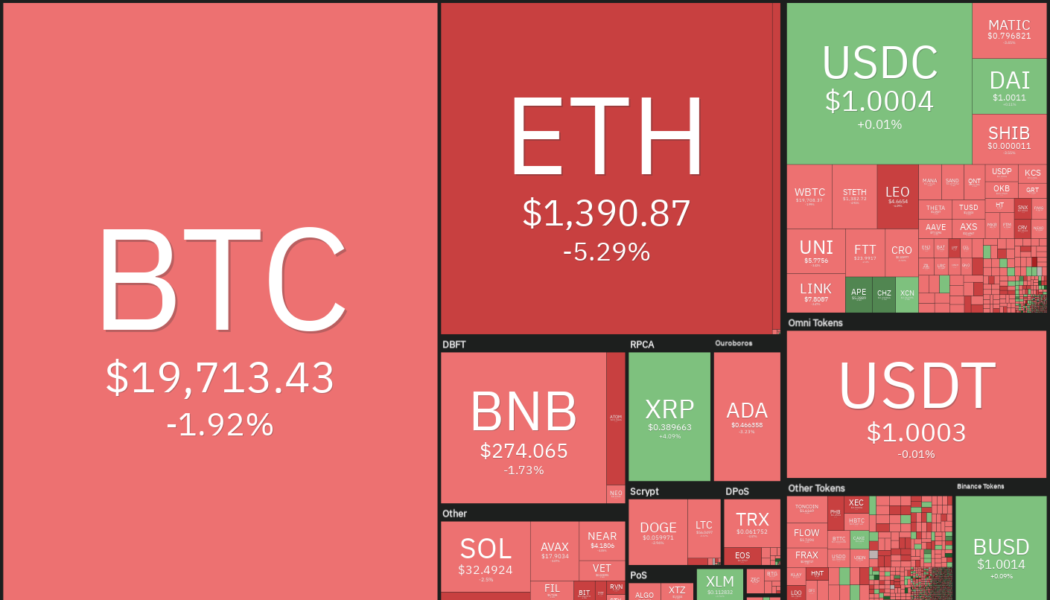

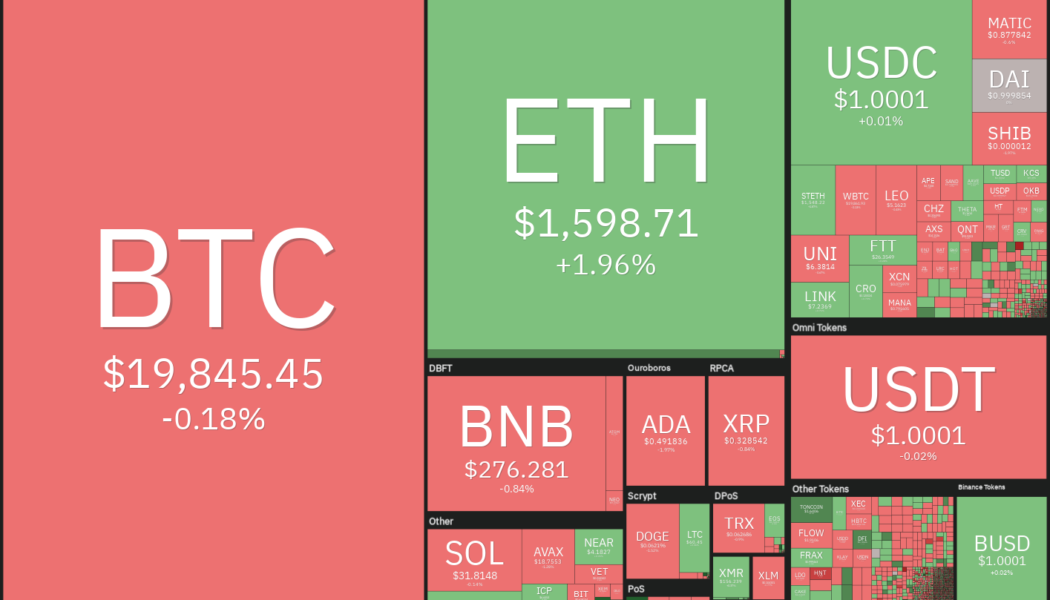

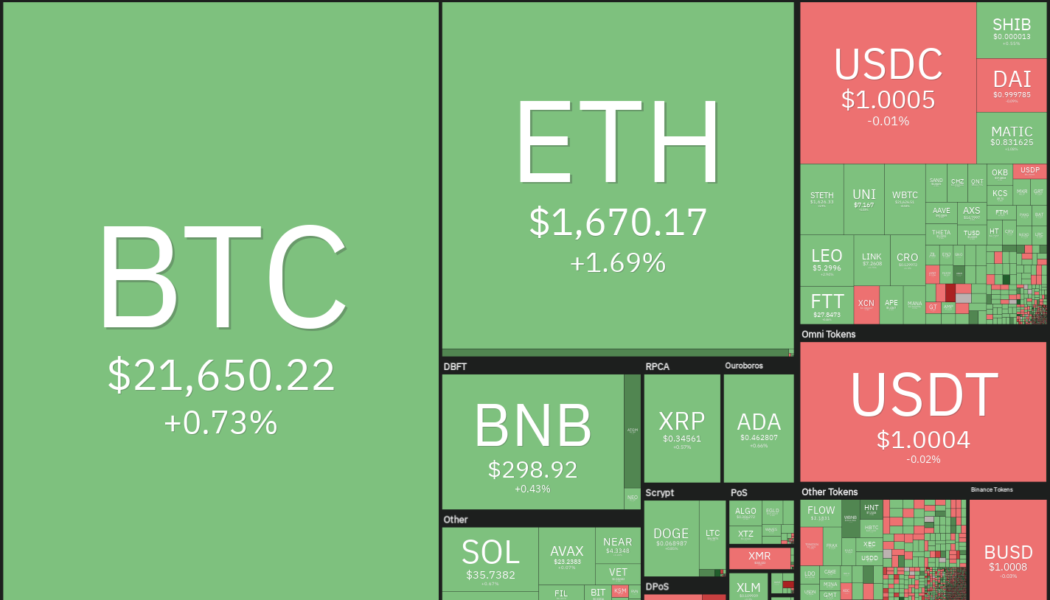

The S&P 500 and the Nasdaq Composite index suffered their worst weekly performance since June as investors remain concerned that the Federal Reserve will have to continue with its aggressive monetary policy to curb inflation and that could lead to a recession in the United States. Bitcoin (BTC) remains closely correlated to the S&P 500 and is on track to fall more than 9% this week. If this correlation continues, it could bring more pain to the cryptocurrency markets because Goldman Sachs strategist Sharon Bell cautioned that aggressive rate hikes could trigger a 26% fall in the S&P 500. Crypto market data daily view. Source: Coin360 The majority expect the Fed to hike rates by 75 basis points in the next meeting on Sept. 20 to Sept. 21 but the FedWatch Tool shows an 18% probab...

Price analysis 9/16: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

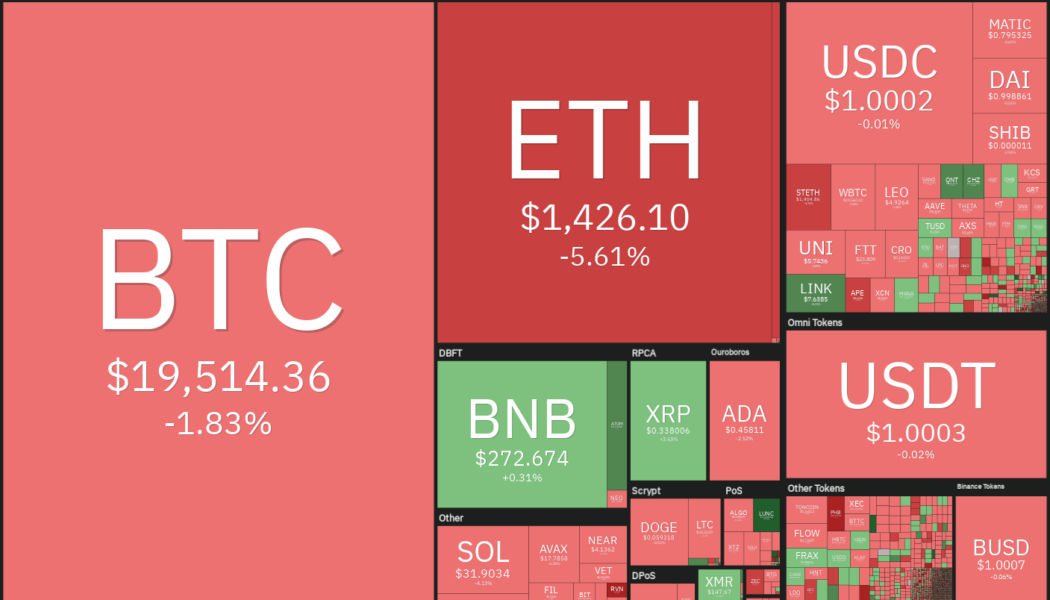

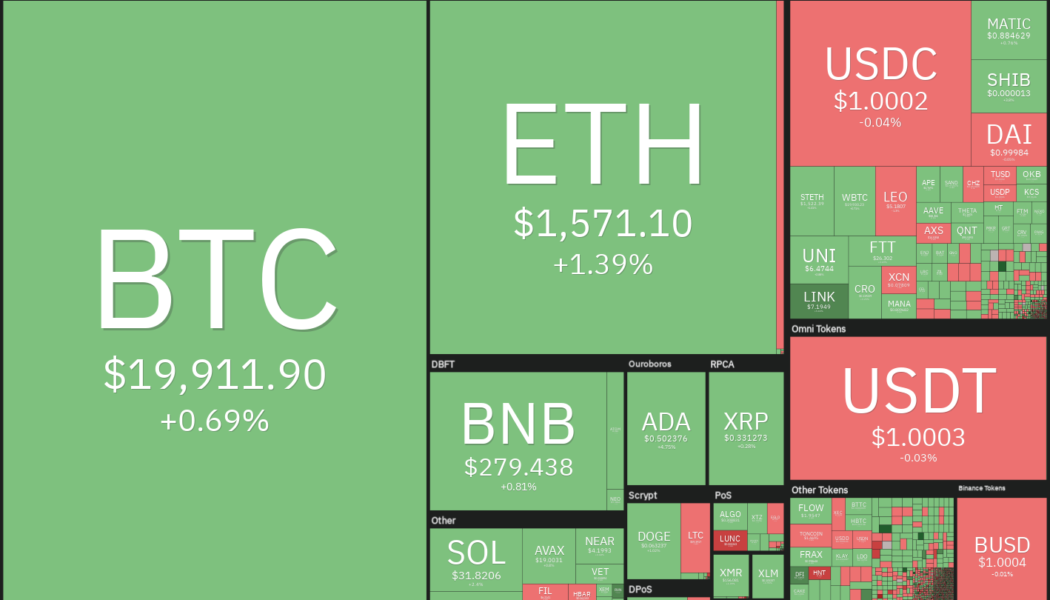

The World Bank has warned of a possible global recession in 2023. In a press release on Sept. 15, the bank said that the current pace of rate hikes and policy decisions is unlikely to be enough to bring inflation down to pre-pandemic levels. Ray Dalio, the billionaire founder of Bridgewater Associates said in a blog post on Sept. 13 that if rates were to rise to about 4.5% in the United States, it would “produce about a 20 percent negative impact on equity prices.” The negative outlook for the equity markets does not bode well for the cryptocurrency markets as both have been closely correlated in 2022. Daily cryptocurrency market performance. Source: Coin360 The macroeconomic developments seem to be worrying cryptocurrency investors who sent 236,000 Bitcoin (BTC) to major cryptocurren...

Price analysis 9/14: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

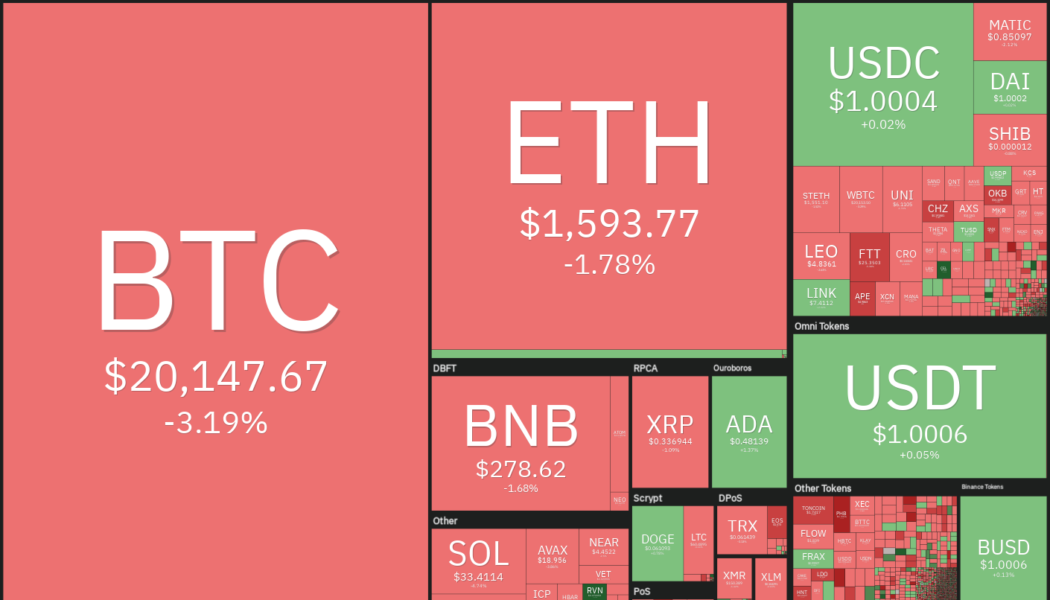

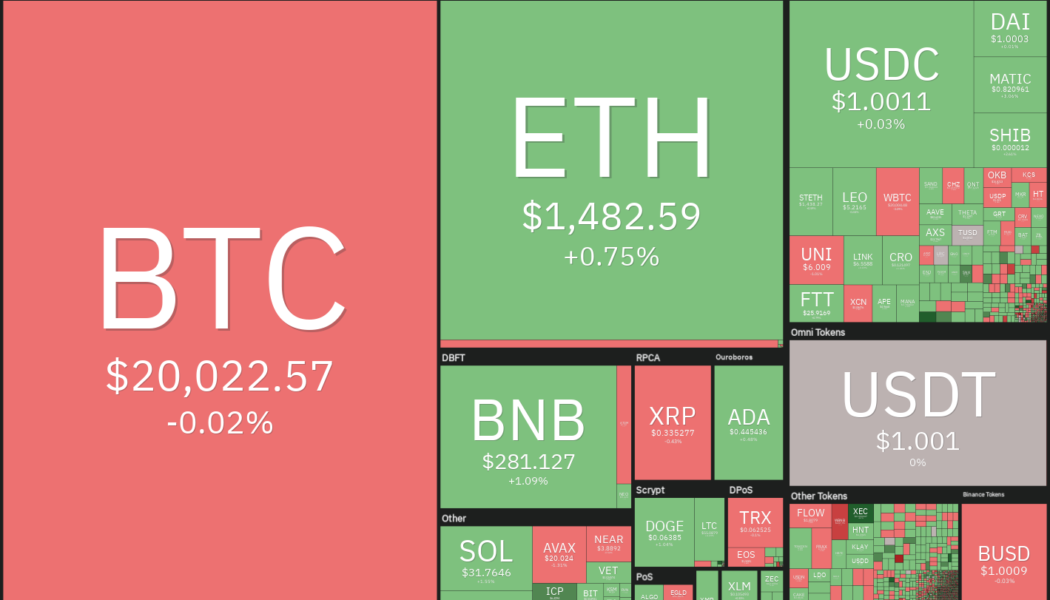

The United States equities markets and the cryptocurrency markets had been rising leading up to the Sept. 13 release of the August consumer price index data, but the rally fell apart once the data showed inflation rising, rather than falling. The negative data dashed any hope of a Federal Reserve pivot in the near term and it triggered a sharp decline in risky assets. The market capitalization of U.S. stocks plunged by about $1.6 trillion on Sept. 13 and the market cap of the cryptocurrency markets slipped below $1 trillion. Daily cryptocurrency market performance. Source: Coin360 Statistician and independent market analyst Willy Woo, believes that Bitcoin (BTC) may have to fall further before it reaches the maximum pain experienced during previous bottoms. Woo expects Bitcoin price to dec...

Crypto traders eye ATOM, APE, CHZ and QNT as Bitcoin flashes bottom signs

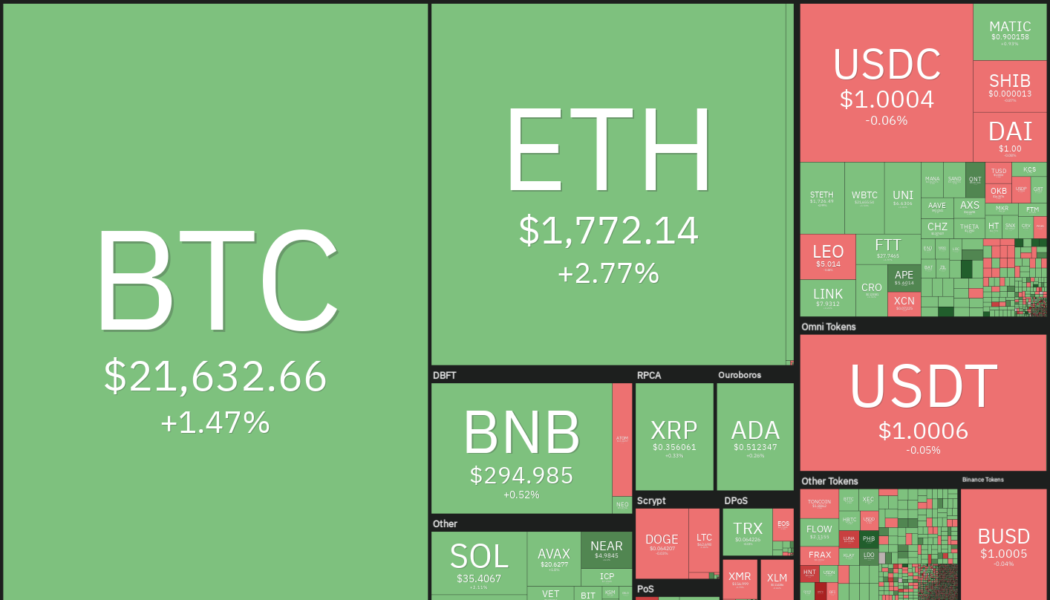

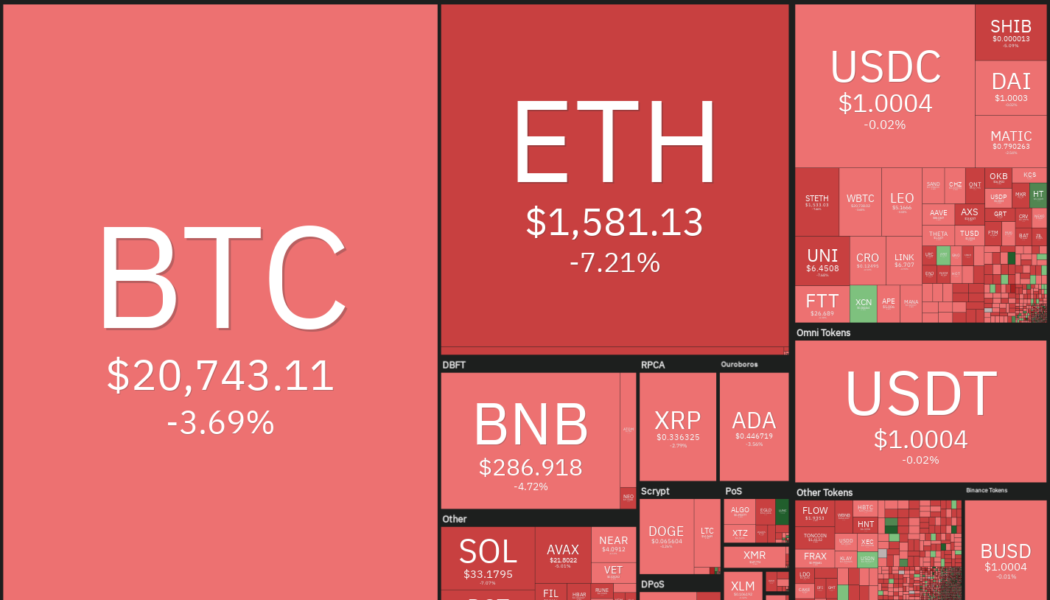

The United States equities markets rallied sharply last week, ending a three-week losing streak. The S&P 500 rose 3.65% last week while the Nasdaq Composite soared 4.14%. Continuing its close correlation with the U.S. equities markets, Bitcoin (BTC) also made a strong comeback and is trying to end the week with gains of more than 7%. The sharp rally in the stock markets and cryptocurrency markets are showing signs of a bottoming formation but it may be too early to predict the start of a new bull move. The equities markets may remain on the edge before the release of the U.S. inflation data on Sept. 13 and the Federal Reserve meeting on Sept. 20-21. Crypto market data daily view. Source: Coin360 Along with taking cues from the equities markets, the cryptocurrency space has its own impo...

Will the Ethereum Merge crash or revive the crypto market? | Find out now on The Market Report

On this week’s “The Market Report” show, Cointelegraph’s resident experts discuss the Ethereum Merge and how it might impact the crypto market To kick things off, we broke down the latest news in the markets this week. Surge or purge? Why the Merge may not save Ether (ETH) price from “Septembear.” Options data, macroeconomic catalysts and technical signals suggest a decline in Ether price is on the table despite the Merge. Ethereum’s native token, Ether, is not immune to downside risk in September after rallying approximately 90% from its bottom of around $880 in June. Can Ethereum prove analysts wrong and break out in price following the Merge or has the price already been factored in and we’ve already seen the price spike for the end of this year? ETH Merge: CoinGecko c...

Price analysis 9/5: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

The cryptocurrency markets have been quiet over the weekend. The sideways price action continues on Sept. 5 and there are unlikely to be any fresh triggers from the United States equities markets, which are closed for Labor Day. However, the bullish picture for cryptocurrencies looks clouded as the energy crisis in Europe sent the euro to a two-decade low versus the U.S. dollar. Meanwhile, the U.S. dollar index (DXY) which has an inverse correlation with the equities markets and cryptocurrencies soared above 110 for the first time since June 2002. Daily cryptocurrency market performance. Source: Coin360 A positive sign among all the mayhem is that Bitcoin (BTC) has not given up much ground over the past few days and continues to trade near the psychological level of $20,000. This suggests ...

A range-break from Bitcoin could trigger buying in ADA, ATOM, FIL and EOS this week

The decline in the United States equities markets last week extended the market-wide losing streak to three consecutive weeks. The Nasdaq Composite fell for six days in a row for the first time since 2019. The markets negative reaction to a seemingly positive August jobs report suggests that traders are nervous about the Federal Reserve’s future steps and its effects on the economy. Weakness in the U.S. equities markets pulled Bitcoin (BTC) back below $20,000 on Sept. 2 and bears sustained the price below the level during the weekend. This pulled Bitcoin’s market dominance to just under 39% on Sept. 4, its lowest level since June 2018, according to data from CoinMarketCap. Crypto market data daily view. Source: Coin360 Although the sentiment remains negative and it is difficult to call a b...

Price analysis 9/2: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

Nonfarm payrolls rose by 315,000 jobs in August, down from the July increase of 526,000 jobs. The report was just below the Dow Jones estimate of 318,000 jobs and the slowest monthly gain since April 2021. The S&P 500 rose in response to the report, but later erased its gains, indicating that bears continue to sell on rallies. That may be because the U.S. dollar index (DXY), which had retreated from its Sept.1 20-year high, recovered part of its losses. The bears will have to pull the DXY lower to boost the prices of stocks and thcryptocurrency markets as both are usually inversely correlated with the dollar index. Daily cryptocurrency market performance. Source: Coin360 Although Bitcoin (BTC) has dropped more than 70% from its all-time high of $69,000, several traders have held on to ...

Rocky road lies ahead, but here’s 5 altcoins that still look bullish

The United States equities markets plunged on Aug. 26 following Federal Reserve Chair Jerome Powell’s speech where he reiterated the central bank’s hawkish stance. Continuing its correlation with the equities market, Bitcoin (BTC) and the cryptocurrency markets also witnessed a sharp selloff on Aug. 26. Bitcoin has declined about 14% this month, making it the worst performance for August since 2015 when the price had dropped 18.67%. That may be bad news for investors because September has a dubious record of a 6% average loss since 2013, according to data from CoinGlass. Crypto market data daily view. Source: Coin360 Although buying in a downtrending market is not a good strategy, traders can keep a close watch on cryptocurrencies that are outperforming the markets because, in case of any ...

Price analysis 8/26: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, MATIC

Federal Reserve Chairman Jerome Powell warned that the central bank will continue to use the “tools forcefully” to bring down inflation, which is close to its highest level in 40 years. He cautioned that the restrictive policy may remain for some time and warned that it could “bring some pain to households and businesses.” The United States equities markets reacted negatively to Powell’s comments with the Dow Jones Industrial Average dropping more than 600 points. The cryptocurrency markets also witnessed sharp selling with Bitcoin (BTC) and most altcoins threatening to break below their immediate support levels. Daily cryptocurrency market performance. Source: Coin360 Along with a not-so-supportive macro environment, Bitcoin’s historical data for September also presents a negative picture...

Why $20.8K is a critical level for Bitcoin | Find out now on Market Talks with Charlie Burton

In this week’s episode of Market Talks, we welcome professional trader Charlie Burton. Charlie is a professional trader with 24 years of experience and has been trading full-time since 2001. He is the founder of EzeeTrader and Charlie Burton Trading. He is also undefeated in the annual London Forex show live trade-off for the five years it was running. He has also been featured in the hugely popular BBC documentary “Trader, Millions by the Minute.” Charlie is one of the very few trading educators who is also a professional money manager trading FCA-regulated capital. The main topic of discussion with Charlie will be the current support level for Bitcoin (BTC) and why it is so critical. If Bitcoin goes below its current support, what are other major price levels you should...

Price analysis 8/24: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, MATIC

Bitcoin (BTC) and several major cryptocurrencies have been trading sideways as traders avoid taking large bets before the United States Federal Reserve’s Jackson Hole Economic Symposium, which begins on Aug. 25. The volatility is likely to soar as investors get some clarity on the Fed’s stance in the next few days. On Aug. 23, a team led by Goldman Sachs chief economist Jan Hatzius said that Fed chair Jerome Powell could sound dovish when he speaks on Aug. 26, reiterating that the central bank may move at a slower pace in future meetings. The analysts expect the Fed to raise rates by 50 basis points in the September meeting, which would be less than the 75 bps hike done in June and July. Daily cryptocurrency market performance. Source: Coin360 Although the short-term price...