Price analysis

Top 5 cryptocurrencies to watch this week: BTC, LEO, MANA, KLAY, XTZ

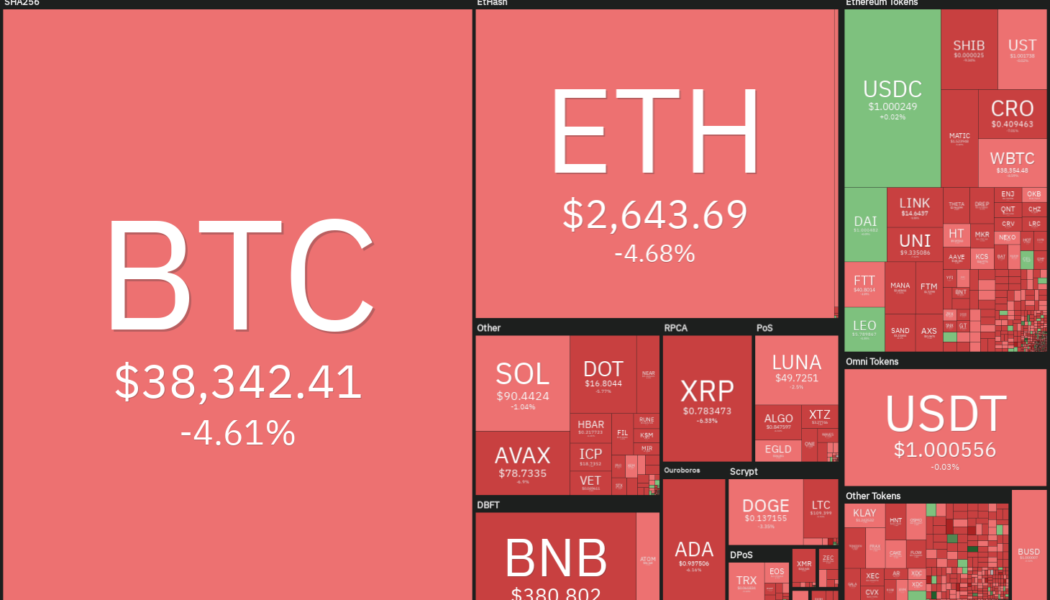

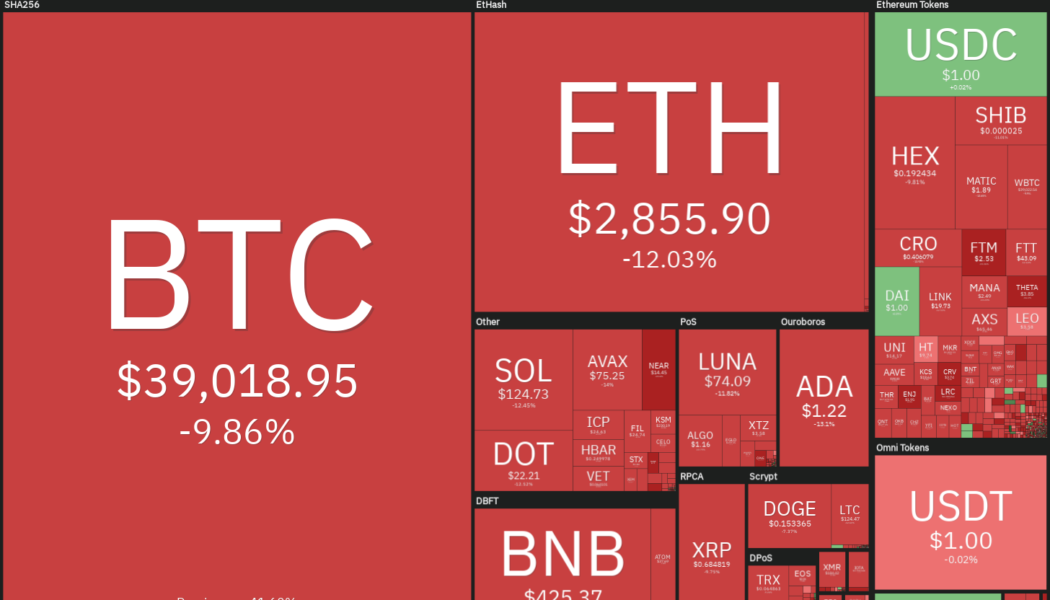

Russia’s massive build-up of soldiers, warplanes, equipment and extended military drills near Ukraine’s borders increased fears of a possible invasion within the next few days. That could have renewed selling in Bitcoin (BTC), which plummeted below the strong support at $39,600. Among the gloom and doom, there is a ray of hope for crypto investors because data from Glassnode shows that more than 60% of Bitcoin supply has not been used in any transaction for more than a year. This suggests that long-term hodlers are not dumping their positions in the downtrend. Crypto market data daily view. Source: Coin360 Mike McGlone, chief commodity strategist at Bloomberg Intelligence, warned that Bitcoin could be in for a “rough week ahead” and cautioned that “inflation is unlikely to drop...

Top 5 cryptocurrencies to watch this week: BTC, XRP, CRO, FTT, THETA

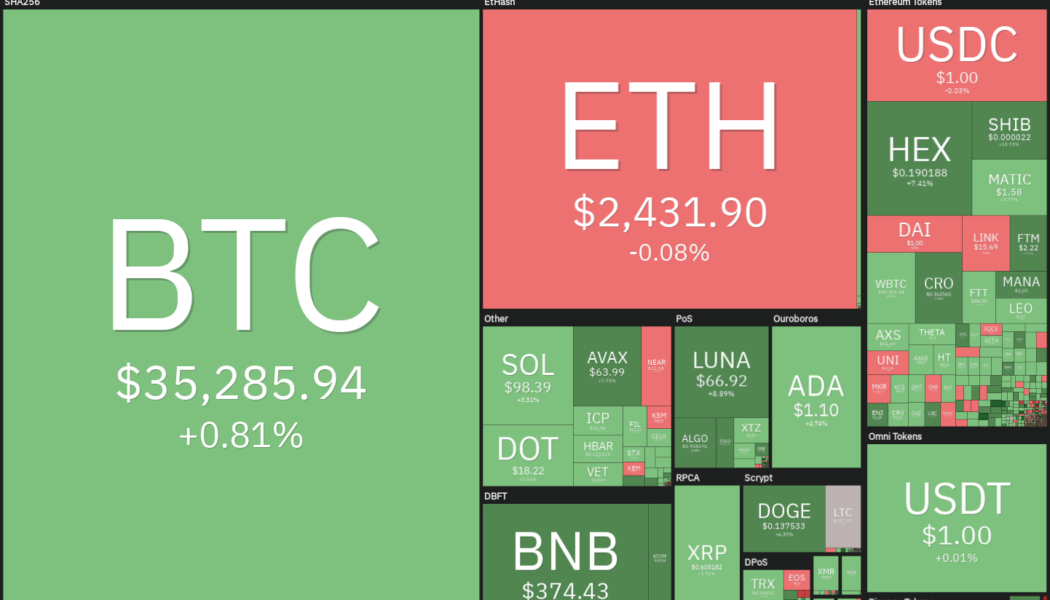

Bitcoin (BTC) has given back some of its recent gains, but on-chain data resource Ecoinometrics said that whales are accumulating because they believe the price is attractive from a long-term perspective. On the downside, analyst Willy Woo believes that $33,000 is a strong bottom for Bitcoin. Popular Twitter trader Credible Crypto citing data from PlanC said that the odds of Bitcoin declining below $30,000 are poor. Crypto market data daily view. Source: Coin360 Fidelity Digital Assets Head of Research Chris Kuiper believes that Bitcoin’s downside risk could be minimal when compared to other digital assets, but it could rally substantially if it manages to replace gold as a store of value. Could Bitcoin and altcoins stage a recovery after the recent pullback? Let’s study th...

Investors underestimate Bitcoin’s “huge upside potential”, Fidelity researcher says

Chris Kuiper, Head of Research at Fidelity Digital Assets, is convinced that Bitcoin (BTC) should be treated separately from other digital assets and believes it plays an exclusive role in investors’ portfolios. Fidelity Digital Assets’ latest report, titled Bitcoin First, targets two main concerns that Fidelity’s clients have raised towards BTC — eventually being replaced by some other cryptocurrencies and lower upside potential left compared to other coins. According to Kuiper, BTC offers a unique value proposition as the most decentralized and censorship-resistant monetary network. That, according to him, is a non-incremental sort of innovation similar to the invention of the wheel. “You can’t reinvent something that’s already been invented in terms of the m...

Polygon price risks 50% drop as MATIC paints inverted cup and handle pattern

Polygon (MATIC) has dropped by more than 40% from its record high of $2.92, established on Dec. 27, 2021. But if a classic technical indicator is to be believed, the token has more room to drop in the sessions ahead. MATIC price chart painting classic bearish pattern MATIC’s recent rollover from bullish to bearish, followed by a rebound to the upside, has led to the formation of what appears like an inverted cup and handle pattern — a large crescent shape followed by a less extreme upside retracement, as shown in the chart below. MATIC/USD three-day price chart featuring inverted cup and handle pattern. Source: TradingView In a “perfect” scenario, inverted cup and handle setups set the stage for a downturn ahead. As they do, the price tends to fall towards levels tha...

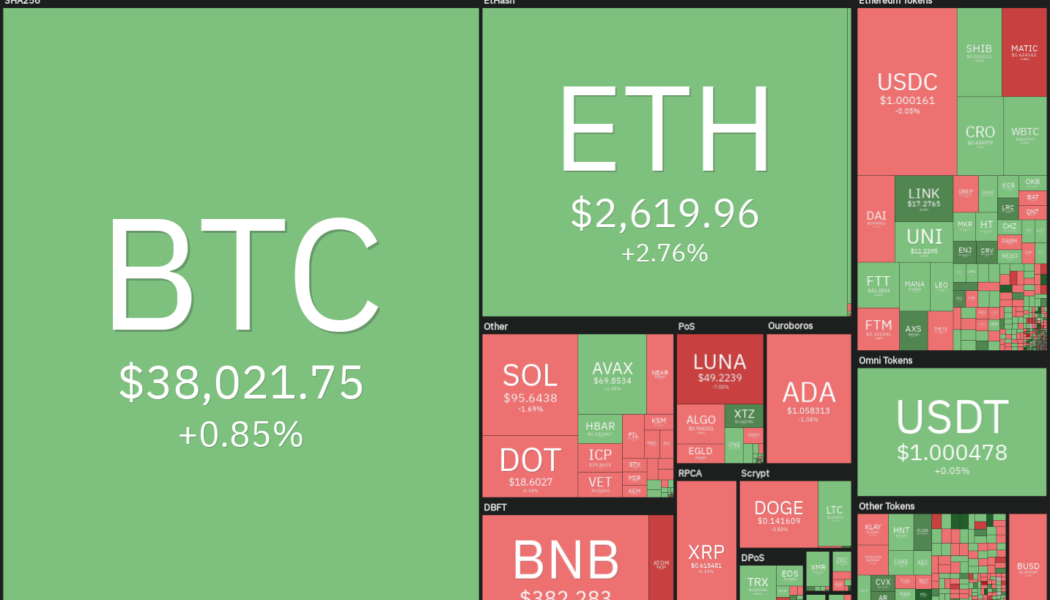

Top 5 cryptocurrencies to watch this week: BTC, ETH, NEAR, MANA, LEO

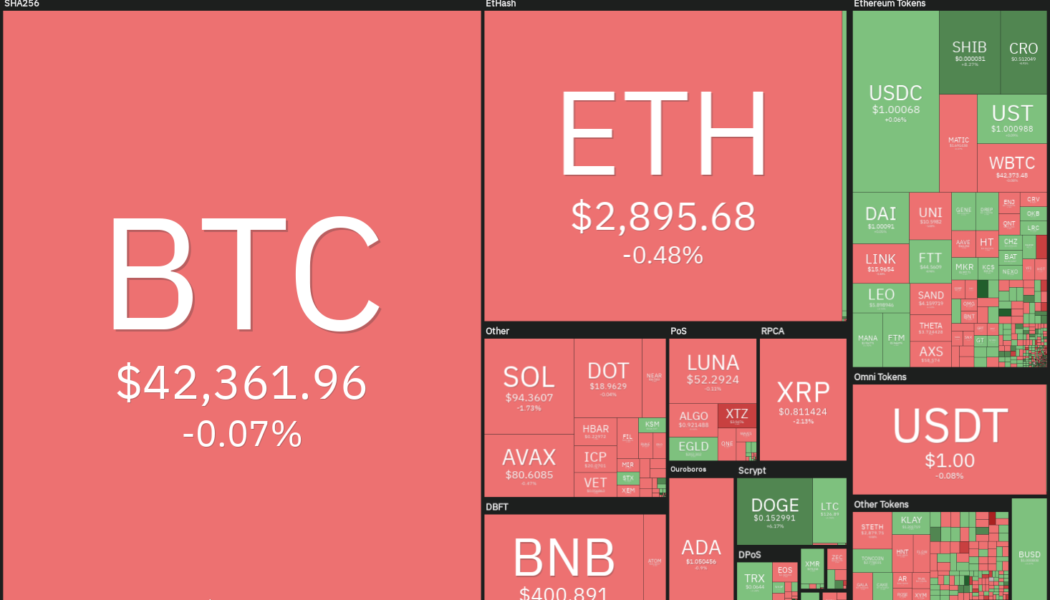

Bitcoin (BTC) surged above the $40,000 psychological resistance on Feb. 4 and successfully held the level over the weekend. This boosted the total crypto market capitalization from $1.78 trillion on Feb. 3 to about $2 trillion on Feb. 6, according to data from CoinGecko. A new financial disclosure by Senator Ted Cruz shows that he bought the recent dip in Bitcoin on Jan. 25 through River brokerage. On that day, Bitcoin traded roughly between $35,700 and $37,600. If the Texas Senator has held his purchase, he is already in the profit. Crypto market data daily view. Source: Coin360 Although the sharp recovery in Bitcoin’s price may have provided relief to the bulls, data analyst Material Scientist warned that large traders with a ticket size of over $100,000 are selling the rally. Could...

Price analysis 2/2: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOGE, DOT, AVAX

Bitcoin (BTC) rose above $39,000 on Feb. 1 but the sharp fall in the shares of PayPal may have resulted in aggressive selling by the short-term traders. However, in the long-term, large investors seem to be viewing the decline as a buying opportunity. On-chain monitoring resource Whalemap said that whales holding between 100 to 10,000 BTC have accumulated during the recent decline. Fidelity recently released a paper dubbed “Bitcoin First,” which highlights that Bitcoin is the most “secure, decentralized form of asset” and is unlikely to be overtaken by any of the altcoins “as a monetary good.” The report said that Bitcoin combines “the scarcity and durability of gold with the ease of use, storage and transportability of fiat.” Daily cryptocurrency market performance. Source: Coin360 I...

Top 5 cryptocurrencies to watch this week: BTC, LINK, HNT, FLOW, ONE

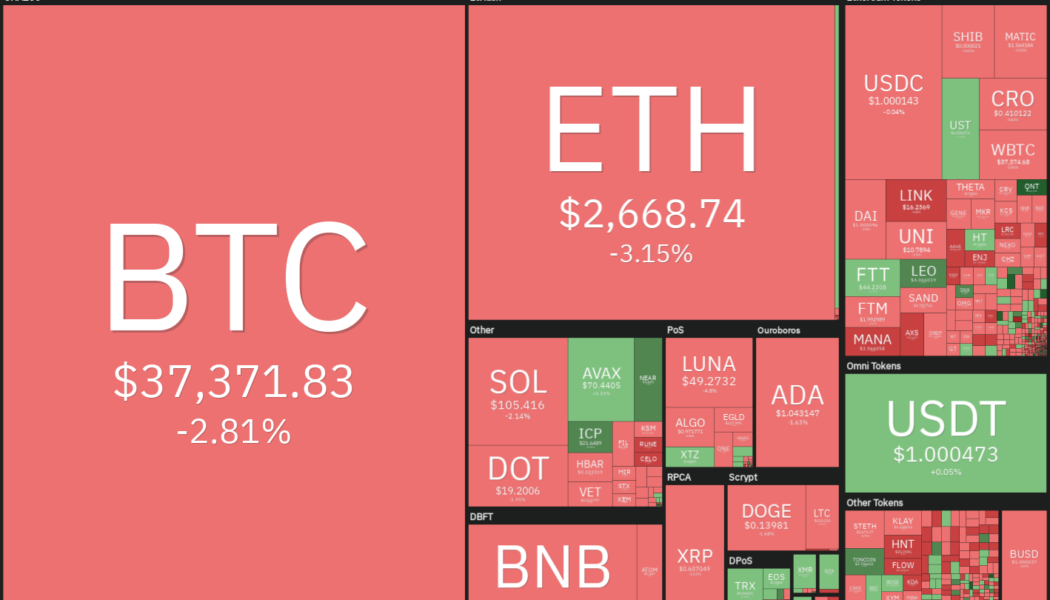

Bitcoin’s (BTC) relief rally rose above $38,500 on Jan. 29, but the bulls are struggling to sustain the higher levels. For the past few days, Bitcoin’s sentiment has closely followed the U.S. equity markets. Hence, analysts warned traders to be careful and not to read much into any possible weekend rallies when traditional markets are closed because it could be a trap. However, analysts at trading suite Decentrader said in a recent report that a “near-term relief bounce” is possible. The report also highlighted that “meaningful buyers” were stepping in and that could result in “a potential change in the higher time frame trend from bearish to bullish.” Crypto market data daily view. Source: Coin360 The recent downturn in Bitcoin seems to have turned the JPMorgan analysts bearish as they be...

Price analysis 1/26: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOGE, DOT, AVAX

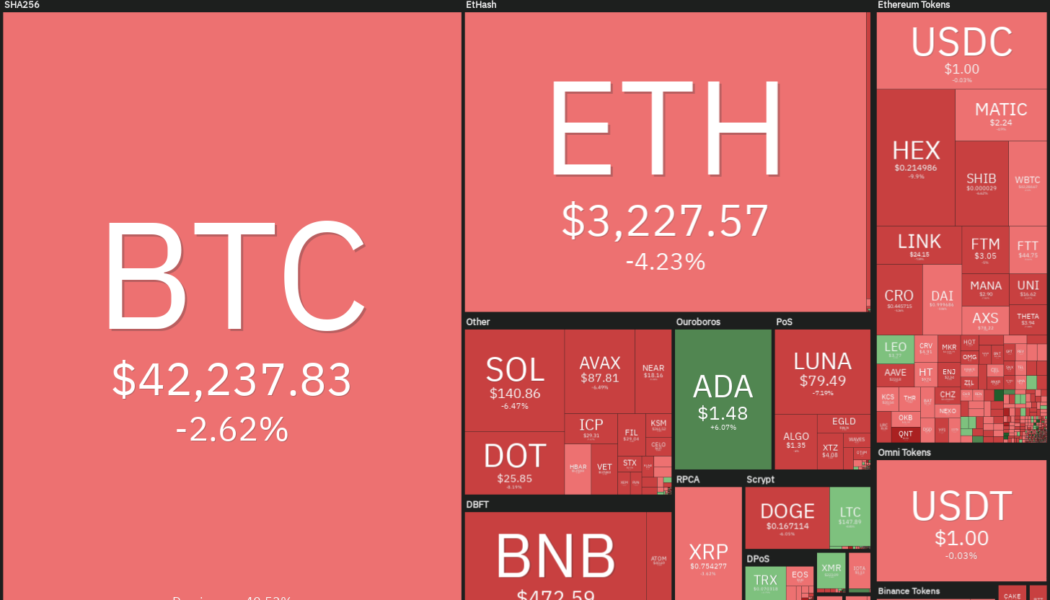

Bitcoin (BTC) and most major altcoins have bounced off their strong support levels but could the rally sustain to the extent that traders feel confident that a bottom in place? Bloomberg Intelligence senior commodity strategist Mike McGlone said that Bitcoin’s price is “about 30% below its 20-week moving average,” roughly at the same position, which had led to bottom formations in March 2020 and July 2021. Although Bitcoin has corrected sharply in January, the exchanges’ balances dropped from 2.428 million Bitcoin on December 28 to 2.366 million Bitcoin on Jan. 24, according to data from CryptoQuant. This indicates that investors may be stashing away their recent purchases safely. Daily cryptocurrency market performance. Source: Coin360 However, it may not be a V-shaped recovery for ...

Top 5 cryptocurrencies to watch this week: BTC, LUNA, ATOM, ACH*, FTM

Bitcoin (BTC) fell close to $34,000 on Jan. 21, which reflects a 50% decline from the $69,000 all-time high made on Nov. 10, 2021. Altcoins also could not buck the trend and faced intense selling pressure, which pulled the total crypto market capitalization to $1.6 trillion, a 46% decline from its November 2021 all-time high near $3 trillion. It is not only the crypto markets that are facing selling by investors. The S&P 500 has also plummeted 8% year-to-date. However, gold has outperformed and risen about 1.76% during the period, cementing its billing as a safe haven asset. Crypto market data daily view. Source: Coin360 Several retail traders who purchased Bitcoin near its all-time high are voicing their concerns on social media. However, El Salvador’s President Nayib Bukele does not ...

Price analysis 1/21: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOT, AVAX, DOGE

Bitcoin (BTC) and most major altcoins continue to witness a bloodbath on Jan. 21 and the result of the most recent downturn has been a $200 billion reduction in market capitalization. A new report by Huobi Research, in collaboration with Blockchain Association Singapore, forecast Bitcoin to enter a bear market in 2022. The liquidity tightening measures undertaken by the U.S. Federal Reserve and other central banks across the world and the regulatory action by authorities could play spoilsport and keep crypto prices under check. Daily cryptocurrency market performance. Source: Coin360 The calls for a bear market have not shaken up the resolve of MicroStrategy CEO Michael Saylor who is determined to hold on to the company’s Bitcoin holdings. Saylor said in a recent interview...

Price analysis 1/17: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOT, AVAX, DOGE

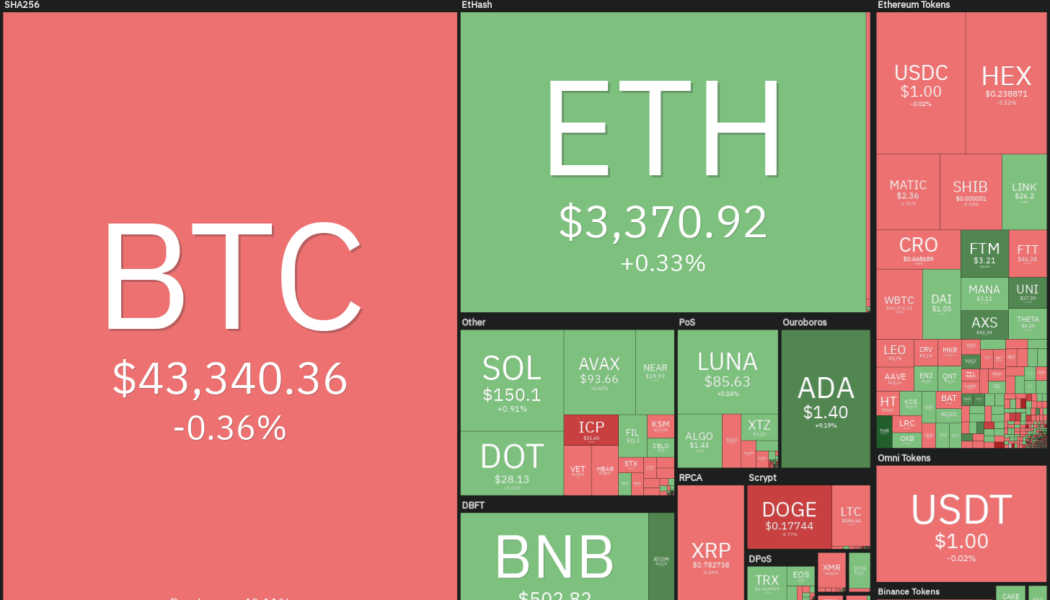

Bitcoin’s (BTC) volatility has been shrinking in the past few days. The standard deviation of daily Bitcoin returns for the last 30 and 60 days as calculated by the Bitcoin Volatility Index is at 2.63%, the least volatile it has been since November 2020. Generally, tight ranges are followed by strong price expansions. In 2020, the low volatility period in November was followed by a sharp rally in mid-December, which resulted in a supercycle that carried the price all the way to $64,854 on April 14, 2021. Daily cryptocurrency market performance. Source: Coin360 However, there is no certainty that the volatility expansion will happen only to the upside. The price could break out in either direction. Commentator Vince Prince warned that the high leverage ratio of Bitcoin could trigger a big c...

Top 5 cryptocurrencies to watch this week: BTC, NEAR, ATOM, FTM, FTT

Bitcoin (BTC) has stopped its decline and is attempting a recovery along with select altcoins. Some traders have been fearing a massive sell-off in Bitcoin but Capriole CEO Charles Edwards said that Bitcoin’s worst crashes have happened “due to miner capitulation (December 2018 and March 2020), when BTC fell below production costs.” However, the current production cost of Bitcoin was $34,000, which is well below the current price. In a sign that institutional investors remain bullish on the crypto sector even after the recent fall, Cathie Wood’s Ark Invest bought 6.93 million shares of the special purchase acquisition company that will merge with Circle, the principal operator of USD Coin (USDC) and the second-largest stablecoin in terms of market capitalization. Crypto market data d...