price analylsis

Bitcoin seller exhaustion hits 4-year low in ‘typical’ bear market move

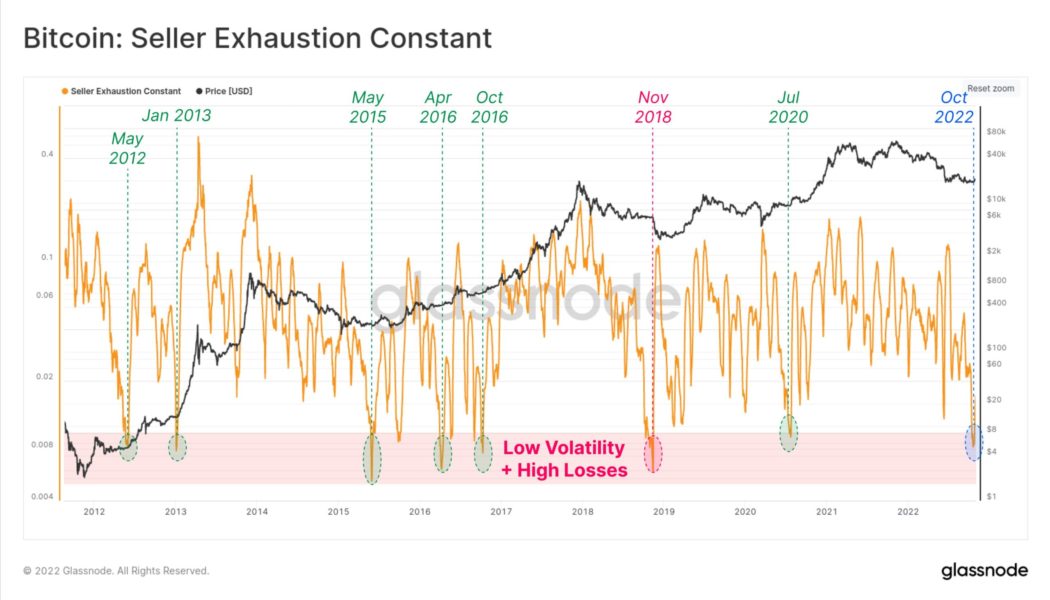

Bitcoin (BTC) sellers may not have capitulated enough, but current trends are “typical” of the end of bear markets. According to data from on-chain analytics firm Glassnode, seller behavior suggests that a macro price bottom is forming. Analyst: Seller exhaustion “near” bear market lows In the latest hint that Bitcoin’s latest bear market is nearing its end, Glassnode has revealed that the network is currently weathering a “perfect storm” of low volatility and high on-chain losses. The Seller Exhaustion Constant, calculated from one-month rolling volatility and on-chain transaction profitability, is thus at long-term lows of its own. As a Twitter post explains, such lows are rare, having only appeared seven times before. Six of those times, upside volatility resulted, implying ...