Premium

Bitcoin rebound to $18.4K? BTC price derivatives show strength at key support zone

Bitcoin (BTC) price lost 11.3% between Dec. 14 and Dec. 18 after briefly testing the $18,300 resistance. The move followed a seven-day correction of 8% in the S&P 500 futures after United States Federal Reserve Chair Jerome Powell issued hawkish statements after raising the interest rate on Dec. 14. Bitcoin price retreats to channel support Macroeconomic trends have been the main driver of recent movements. For instance, the latest bounce from the five-week-long ascending channel support at $16,400 has been attributed to the Central Bank of Japan’s efforts to contain inflation. Bitcoin 12-hour price index, USD. Source: TradingView The Bank of Japan increased the limit on government bond yields on Dec. 20, which are now trading at levels unseen since 2015. However, not everything has be...

Market selling might ease, but traders are on the sidelines until BTC confirms $20K as support

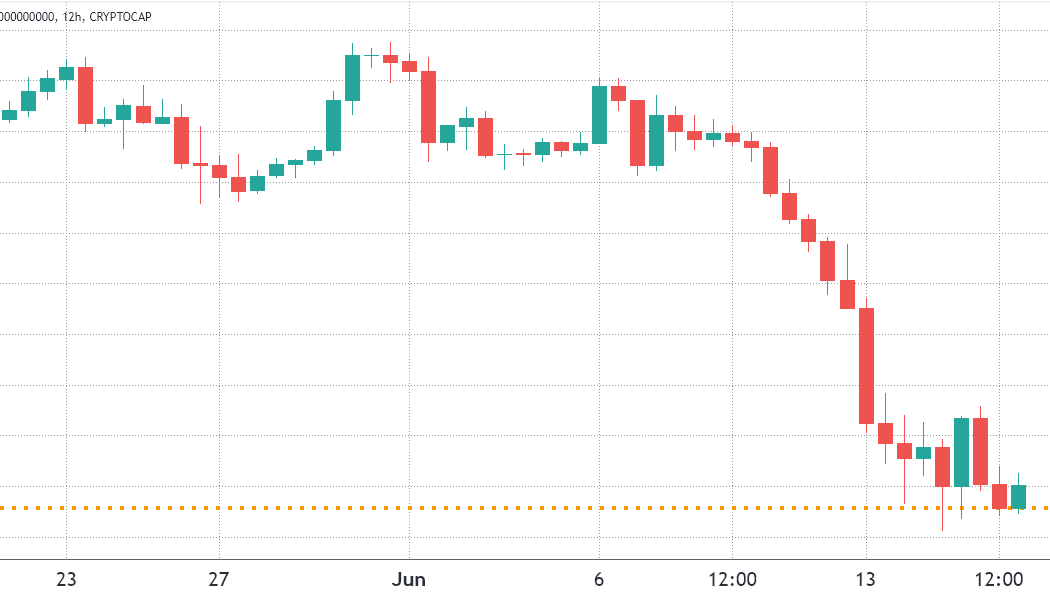

The total crypto market capitalization fell off a cliff between June 10 and 13 as it broke below $1 trillion for the first time since January 2021. Bitcoin (BTC) fell by 28% within a week and Ether (ETH) faced an agonizing 34.5% correction. Total crypto market cap, USD billion. Source: TradingView Presently, the total crypto capitalization is at $890 million, a 24.5% negative performance since June 10. That certainly raises the question of how the two leading crypto assets managed to underperform the remaining coins. The answer lies in the $154 billion worth of stablecoins distorting the broader market performance. Even though the chart shows support at the $878 billion level, it will take some time until traders take in every recent event that has impacted the market. For example, the U.S...

Weak stocks and declining DeFi use continue to weigh on Ethereum price

Ether’s (ETH) 12-hour closing price has been respecting a tight $1,910 to $2,150 range for twelve days, but oddly enough, these 13% oscillations have been enough to liquidate an aggregate of $495 million in futures contracts since May 13, according to data from Coinglass. Ether/USD 12-hour price at Kraken. Source: TradingView The worsening market conditions were also reflected in digital asset investment products. According to the latest edition of CoinShare’s weekly Digital Asset Fund Flows report, crypto funds and investment products saw a $141 million outflow during the week ending on May 20. In this instance, Bitcoin (BTC) was the investors’ focus after experiencing a $154 weekly net redemption. Russian regulation and crumbling U.S. tech stocks escalate the situation Regula...

Bitcoin and Ethereum had a rough week, but derivatives data reveals a silver lining

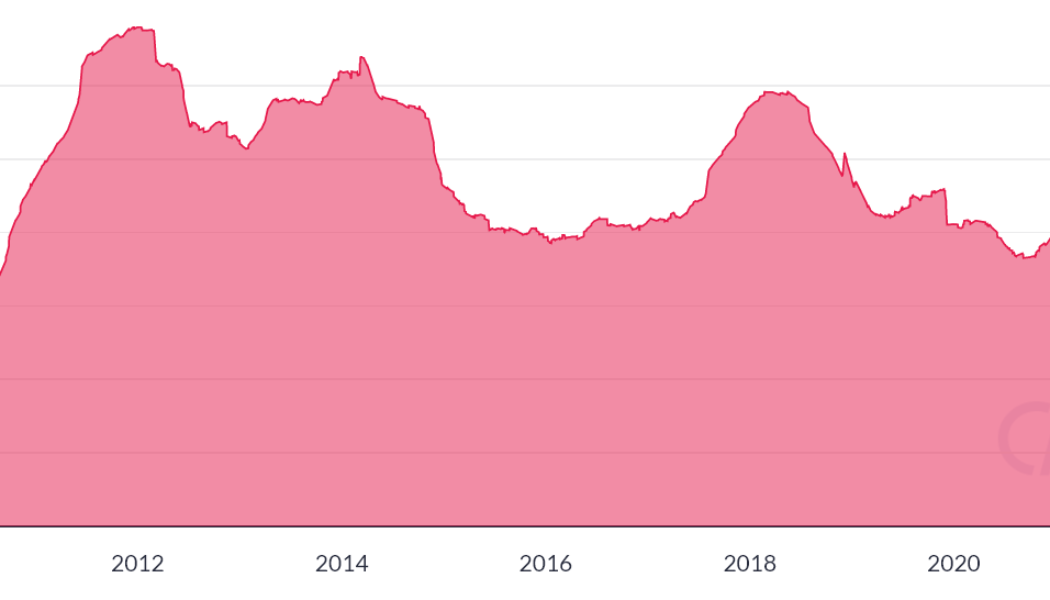

This week the crypto market endured a sharp drop in valuation after Coinbase, the leading U.S. exchange, reported a $430 million quarterly net loss and South Korea announced plans to introduce a 20% tax on crypto gains. During its worst moment, the total market crypto market cap faced a 39% drop from $1.81 trillion to $1.10 trillion in seven days, which is an impressive correction even for a volatile asset class. A similar size decrease in valuation was last seen in February 2021, creating bargains for the risk-takers. Total crypto market capitalization, USD billion. Source: TradingView Even with this week’s volatility, there were a few relief bounces as Bitcoin (BTC) bounced 18% from a $25,400 low to the current $30,000 level and Ether (ETH) price also made a brief rally to $2,100 af...

Any dip buyers left? Bulls are largely absent as the total crypto market cap drops to $1.65T

The total crypto market capitalization has been trading within a descending channel for 24 days and the $1.65 trillion support was retested on May 6. The drop to $1.65 trillion was followed by Bitcoin (BTC) reaching $35,550, its lowest price in 70 days. Total crypto market cap, USD billion. Source: TradingView In terms of performance, the aggregate market capitalization of all cryptocurrencies dropped 6% over the past seven days, but this modest correction in the overall market does not represent some mid-capitalization altcoins, which managed to lose 19% or more in the same time frame. As expected, altcoins suffered the most In the last seven days, Bitcoin price dropped 6% and Ether (ETH) declined by 3.5%. Meanwhile, altcoins experienced what can only be described as a bloodbath. Below ar...

2 key metrics point toward further downside for the entire crypto market

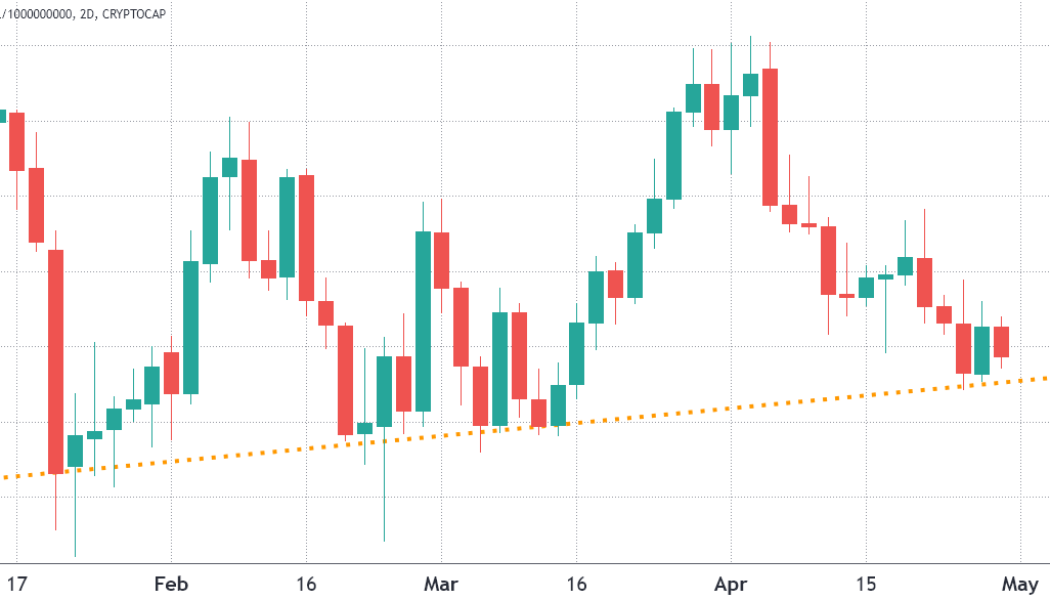

The total crypto market capitalization has been holding a slightly ascending trend for the past 3 months and the $1.75 trillion support was most recently tested on April 27 as Bitcoin (BTC) bounced at $38,000 and Ether (ETH) at $2,800 on April 27. Total crypto market cap, USD billion. Source: TradingView The crypto market’s aggregate capitalization showed a 3.5% decrease in the last 7 days and notable losers were a 18.8% loss from XRP, a 10.2% loss from Cardano (ADA), and 9.7% drop in Polkadot (DOT) price. Analyzing a broader range of altcoins provides a more balanced picture, that includes 25% gains from some gaming and Metaverse projects in the same time period. Weekly winners and losers among the top 80 coins. Source: Nomics Apecoin (APE) rallied 44% due to the upcoming Otherside metave...

Ethereum on-chain data hints at further downside for ETH price

Analyzing Ether’s (ETH) current price chart paints a bearish picture, which is largely justified by the 11% drop over the past month, but other traditional finance assets faced more extreme price corrections in the same period. The Invesco China Technology ETF (CQQ) is down 31% and the Russell 2000 declined by 8%. Ether price at FTX, in USD. Source: TradingView Currently, traders fear that losing the descending channel support at $2,850 could lead to a stronger price downturn, but this largely depends on how derivatives traders are positioned along with the Ethereum network’s on-chain metrics. According to Defi Llama, the Ethereum network’s total value locked (TVL) flattened in the last 30 days at 27 million Ether. TVL measures the number of coins deposited on smart contr...

Traders predict $3,800 Ethereum, but multiple data points suggest otherwise

Investors tend not to complain about a price rally, except when the chart presents steep downside risks. For example, analyzing Ether’s (ETH) current price chart could lead one to conclude that the ascending channel since March 15 is too aggressive. Ether price at FTX, in USD. Source: TradingView Thus, it is only natural for traders to fear that losing the $3,340 support could lead to a retest of the $3,100 level or a 12% correction down to $3,000. Of course, this largely depends on how traders are positioned along with the Ethereum network’s on-chain metrics. For starters, the Ethereum network’s total value locked (TVL) peaked at ETH 32.8 million on Jan. 23 and has since gone down by 20%. TVL measures the number of coins deposited on smart contracts, including decentralized fi...

Bitcoin’s got 3 strikes, but investors remain calm despite price drop

After Bitcoin (BTC) faced its third consecutive rejection, investors became more confident in adding altcoin positions. For the leading cryptocurrency, the path to $50,000 appears more challenging than previously expected. According to Euronews Next, on March 14, the European Union rejected a proposed rule that could have banned the energy-intensive proof-of-work (PoW) mining algorithm used by Bitcoin and other cryptocurrencies. Several EU parliamentarians have been pushing to ban PoW mining over energy concerns. BTC/USD price at FTX. Source: TradingView In terms of performance, the aggregate market capitalization of all cryptos was relatively flat over the past seven days, registering a modest 0.4% gain to $1.77 trillion. However, the apparent lack of performance in the overall market doe...