Ponzi Scheme

Charges laid over alleged ‘crypto mining’ Ponzis that netted $8.4M

United States prosecutors have laid charges in two separate cases against nine people who founded or promoted a pair of cryptocurrency companies alleged to be Ponzi schemes that netted $8.4 million from investors. On Dec. 14 the U.S. Attorney’s Office for the Southern District of New York unsealed the indictment, alleging the purported crypto mining and trading companies IcomTech and Forcount promised investors “guaranteed daily returns” that could double their investment in six months. In reality, prosecutors say both firms were using the money from later investors to pay earlier investors, while other funds were spent on promoting the companies and buying luxury items and real estate. “Lavish expos” were held in the U.S. and abroad, along with presentations in small communities, that lur...

Trouble in the Bahamas following FTX collapse: Report

Following the collapse of crypto exchange FTX, which was headquartered in the island country of Bahamas, Bahamians are reportedly still trying to find a way to make sense of everything, while remaining optimistic about the future. According to a report by the Wall Street Journal, the island country — which had encouraged cryptocurrency companies to feel at home with their “copacetic regulatory touch” — has been rocked by the implosion of FTX. The Bahamas was hard hit by Hurricane Dorian in 2019 and the pandemic shortly afterward in 2020 and was already struggling to find ways to strengthen its economy, which relies heavily on tourism and offshore banking for a bulk of its gross domestic product. It appeared that the prime minister of the Bahamas, Philip Davis, and his gover...

How to tell if a cryptocurrency project is a Ponzi scheme

The crypto world has experienced an increase in Ponzi schemes since 2016 when the market gained mainstream prominence. Many shady investment programs are designed to take advantage of the hype behind cryptocurrency booms to beguile impressionable investors. Ponzi schemes have become rampant in the sector primarily due to the decentralized nature of blockchain technology which enables scammers to sidestep centralized monetary authorities who would otherwise flag or freeze suspicious transactions. The immutable nature of blockchain systems that makes fund transfers irreversible also works in the scammers’ favor by making it harder for Ponzi victims to get their money back. Speaking to Cointelegraph earlier this week, KuCoin exchange CEO Johnny Lyu said that the sector was fertile ground for ...

How to identify and avoid a crypto pump-and-dump scheme?

Educating oneself about the crypto ecosystem is crucial for investors to pursue during a bear market while awaiting a bull cycle. That being said, having a good understanding of crypto investment entails keeping an eye out for fraudulent projects that threaten to drain assets overnight, a.k.a. pump-and-dump schemes. Pump-and-dump in crypto is an orchestrated fraud that involves misleading investors into purchasing artificially inflated tokens — typically marketed and hyped by paying celebrities and social influencers. SafeMoon token is one of the most prominent examples of an alleged pump-and-dump scheme involving A-list celebrities, including Nick Carter, Soulja Boy, Lil Yachty and YouTubers Jake Paul and Ben Phillips. Once the investors have purchased tokens at inflated prices, the peopl...

Analysts identify 3 critical flaws that brought DeFi down

The cryptocurrency market has had a rough go this year and the collapse of multiple projects and funds sparked a contagion effect that has affected just about everyone in the space. The dust has yet to settle, but a steady flow of details is allowing investors to piece together a picture that highlights the systemic risks of decentralized finance and poor risk management. Here’s a look at what several experts are saying about the reasons behind the DeFi crash and their perspectives on what needs to be done for the sector to make a comeback. Failure to generate sustainable revenue One of the most frequently cited reasons for DeFi protocols struggling is their inability to generate sustainable income that adds meaningful value to the platform’s ecosystem. Fundamental Design Princ...

Binance’s CZ says he is ‘skeptical’ about the Terra relaunch

Binance CEO Changpeng Zhao, also known as CZ, expressed skepticism around the revival plan for the Terra ecosystem and the launch of the new LUNA token. “I try not to predict what the community will do. […] Many are skeptical. I’m one of those guys,” said CZ in an exclusive interview with Cointelegraph. Following the collapse of TerraUSD (USD), the Terra ecosystem’s stablecoin, CZ criticized its team for not handling the crisis properly and pointed at the project’s flaws that led to the crash. Still, Binance is now actively participating in Terra’s revival plan by hosting the airdrop of its new LUNA token. As CZ pointed out, despite the widespread skepticism around the Terra relaunch, Binance has a responsibility to help users affected by the crash of LUNA. “We still need to ensure c...

Terrible crypto trader gets 42 months for fraud, claiming he was a total gun

A crypto trader who defrauded over 170 people was sentenced to 42 months in prison on May 11 for operating a series of cryptocurrency funds claiming to make big returns but in reality were losing money and instead operated as a Ponzi scheme. The DOJ said that 25 year old Jeremy Spence had solicited millions through false representations, “including that Spence’s crypto trading had been extremely profitable when, in fact, Spence’s trading had been consistently unprofitable.” Spence, who operated the social media channels for a crypto investment scheme called “Coin Signals” was handed the decision by United Stated District Judge Lewis Kaplan for the U.S. District Court for the Southern District of New York. Spence was also sentenced to three years of supervised release and ordered to p...

DOJ indicts BitConnect’s Indian founder for $2.4B crypto Ponzi scheme

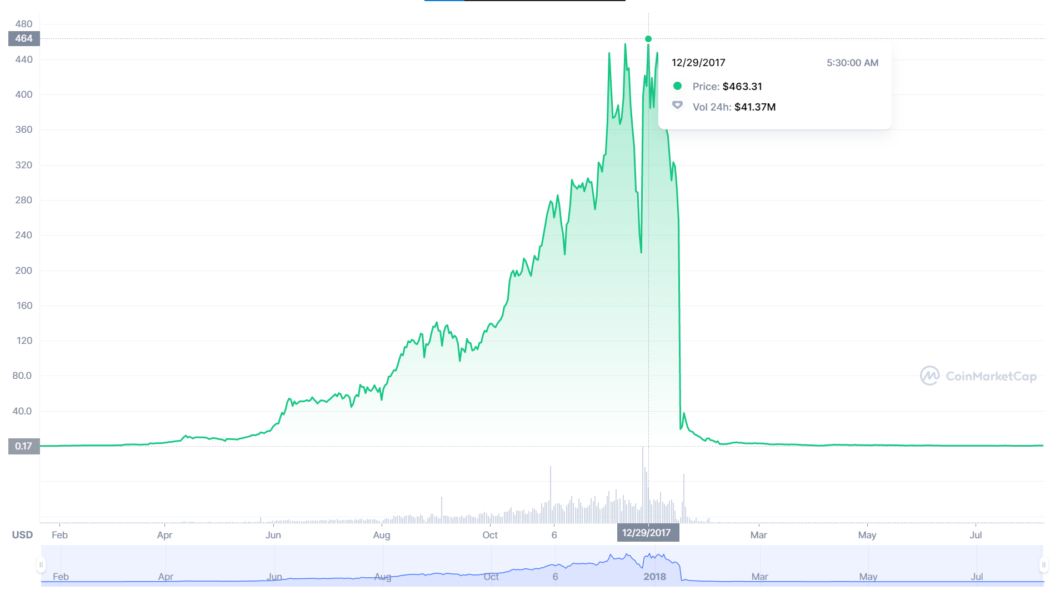

The founder of the infamous crypto exchange BitConnect, Satish Kumbhani, has been charged for allegedly misleading investors globally and defrauding them of $2.4 billion in the process. According to the Department of Justice (DOJ), a San Diego-based federal grand jury specifically charged Kumbhani for orchestrating the alleged Ponzi scheme via BitConnect’s “Lending Program”: “BitConnect operated as a Ponzi scheme by paying earlier BitConnect investors with money from later investors. In total, Kumbhani and his co-conspirators obtained approximately $2.4 billion from investors.” BitConnect (BCC) price history. Source: CoinMarketCap Back in 2017 amid the hype, BitConnect (BCC) recorded an all-time high of $463.31 in trading price, which according to the DOJ reached a peak market capitalizati...

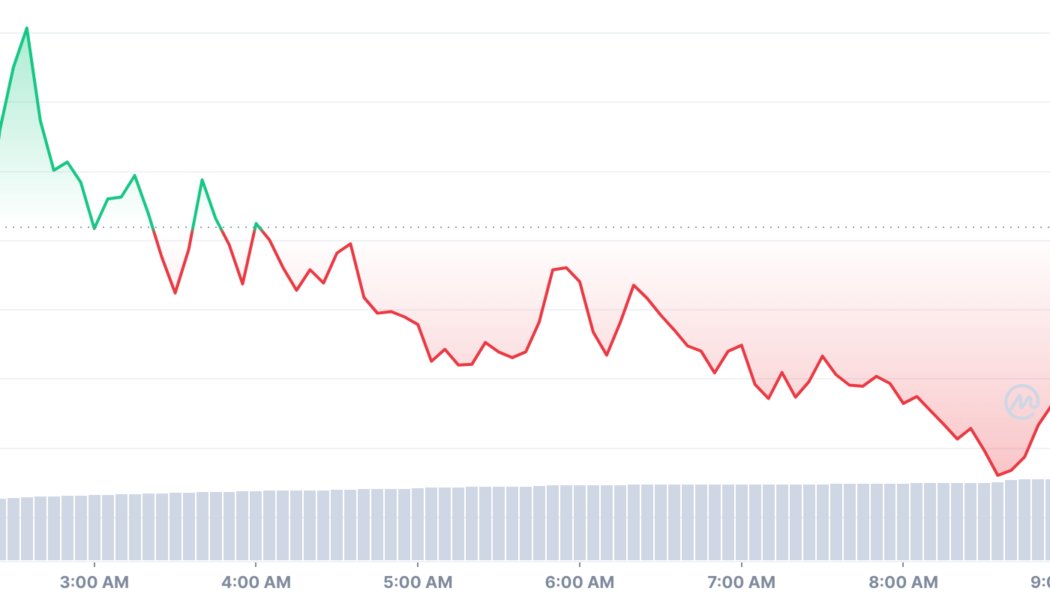

Battle of the bots: WTF token launch drains 58 ETH

Fees.wtf is a simple service that shows Ether (ETH) users their lifetime spending amount on Ethereum blockchain transactions by measuring gas. You plug in your wallet address on its website, and it tells you how much gas you spent. The project released its WTF token in an airdrop Friday. Essentially, users were able to claim WTF tokens as well as a “Rekt” nonfungible token (NFT) for 0.01 ETH. The Rekt NFT grants lifetime access to the pro version of Fees.wtf. According to its Discord announcement, the initial launch planned to offer 100 million WTF, and the “circulating supply will be the main attraction in the tokenomics.” However, it didn’t quite go as planned. Following frantic trading behavior between bots in the opening hours of the airdrop, one bot ran off with a repo...

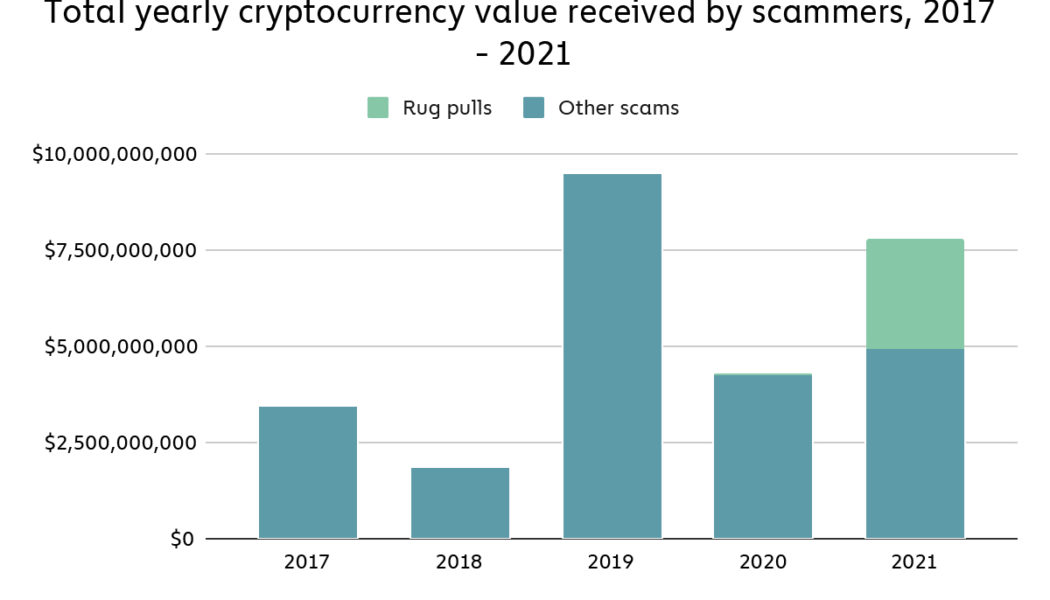

Beware of sophisticated scams and rug pulls, as thugs target crypto users

This year has been monumental for the cryptocurrency sector in terms of mainstream adoption. A recent report published by Grayscale Investments found that more than one-quarter of United States investors (26%) surveyed own Bitcoin (BTC), up from 23% in 2020. With the holidays around the corner, financial services provider MagnifyMoney also found that nearly two-thirds of surveyed Americans hope to receive cryptocurrency as a gift this year. While crypto’s growth is notable, there has also been an increase in the number of scams associated with digital assets. A Chainalysis blog post highlighting the company’s “2022 Crypto Crime Report” revealed that scams were the dominant form of cryptocurrency-based crimes by transaction volume this year. The post notes that over $7.7 billion ...