polygon

MSP Recovery joins forces with Tokenology to release tokenized healthcare initiative

MSP Recovery LLC, a healthcare recovery firm based in Miami, United States and valued in the region of $32.6 billion, has announced a collaborative partnership with Web3 solution Tokenology to launch a fraud-prevention blockchain platform, titled Lifechain. Lifechain will seek to utilize the verifiable and transparent nature of blockchain technology to enhance the accessibility of healthcare charges, claims and medical records for patients and industry professionals. MSP Recovery’s consumer application LifeWallet — which launched in January this year and has since registered over 1 million users, according to recent data — will house the technology alongside a tokenized solution LifeCoin. The press release provided greater context into the scale of the task within the healthcare industry; ...

Polygon and others extend helping hand to Terra blockchain projects

Numerous developers have been left in uncertainty in the aftermath of the Terra (LUNA) collapse. These Terra-based projects, which are already under a lot of pressure, may be able to save their communities and projects by migrating to other networks. In a move that is expected to benefit both the Polygon (MATIC) community and Terra projects, Polygon Studios’ CEO Ryan Wyatt tweeted on Monday that Polygon is working with a number of Terra projects to assist them migrating to the Polygon Network. The Polygon community, according to Wyatt, “is ready to welcome the developers and communities of these Terra projects.” He also stated that Polygon would provide the capital and resources needed to assist them in their migration. Polygon founder Sandeep Nailwal added his two cents ...

ApeCoin eyes 250% rally amid ‘bull pennant’ breakout, Robinhood APE listing rumors

ApeCoin’s (APE) market valuation could grow by nearly 250% in the second quarter of 2022 as it breaks out of a widely-tracked, classic technical pattern. APE price “bull pennant” breakout underway On April 13, APE’s price broke above the upper trendline of what appears to be a “bull pennant” chart pattern. Bull pennants appear when the price consolidates inside a triangle-like structure following a strong uptrend. Many traditional analysts consider them as continuation patterns, for they typically result in the price breaking out in the direction of its previous trend. As a rule, traders estimate a bull pennant’s upside target by measuring the size of the previous uptrend, called “flagpole,” and adding it to the breakout point. Applying...

Polygon commits to going carbon neutral in 2022

The Polygon network announced on Tuesday its commitment to going carbon neutral and climate positive this year by releasing their “Green Manifesto: A Smart Contract with Planet Earth.” They also made a $20 million pledge to offset their carbon footprints, and buy extra credits to eventually become carbon negative. #PolygonGoesGreen Unveiling the Green Manifesto – a smart contract with Planet Earth!https://t.co/p9DFtUG9XP [1/2] pic.twitter.com/Xgn8jubffa — Polygon (@0xPolygon) April 12, 2022 Part of the Ethereum scaling solution’s plan for a more sustainable future includes providing resources for ecosystem partners who also want to offset their carbon footprint. Additionally, they hope to facilitate NGOs to make donations that go towards fighting climate change. According to th...

Kyber Network (KNC) soars after integrating with Uniswap v3 and Avalanche Rush Phase 2

The outlook for projects in the decentralized finance (DeFi) sector has begun to improve in recent months as a combination of global events have highlighted the benefits of holding funds outside of the traditional financial systems. One project that has rallied over the past few months is Kyber Network (KNC), a multi-chain cryptocurrency trading and liquidity hub that aims to offer users the best trading rates. Data from Cointelegraph Markets Pro and TradingView shows that after bouncing off a low of $2.83 on April 6, the price of KNC jumped 55.4% to hit an all-time high of $4.04 on April 8 amid a 253% spike in its 24-hour trading volume. KNC/USDT 1-day chart. Source: TradingView Three reasons for the building momentum of KNC include the integration of support for ten separate blockchain n...

Opera integrates Bitcoin, Solana, Polygon and five other blockchains

Opera, one of the major crypto-friendly internet browsers, announced the integration of eight blockchains in a continued effort to introduce Web3 to more than 380 million mobile and desktop users worldwide. In Jan. 2022, Opera launched the Crypto Browser project, a Web3-focused initiative for facilitating navigation across decentralized applications (DApp), games and metaverse platforms. As part of this initiative, the browser company added support for eight major blockchain ecosystems, including Bitcoin (BTC), Solana (SOL), Polygon (MATIC), StarkEx, Ronin, Celo, Nervos DAO and IXO. Opera said in the announcement that its users now have access to the Polygon and Solana DApp ecosystems, as well as “the benefits of Layer 2 DeFi via StarkWare-powered DiversiFi.” The latest in...

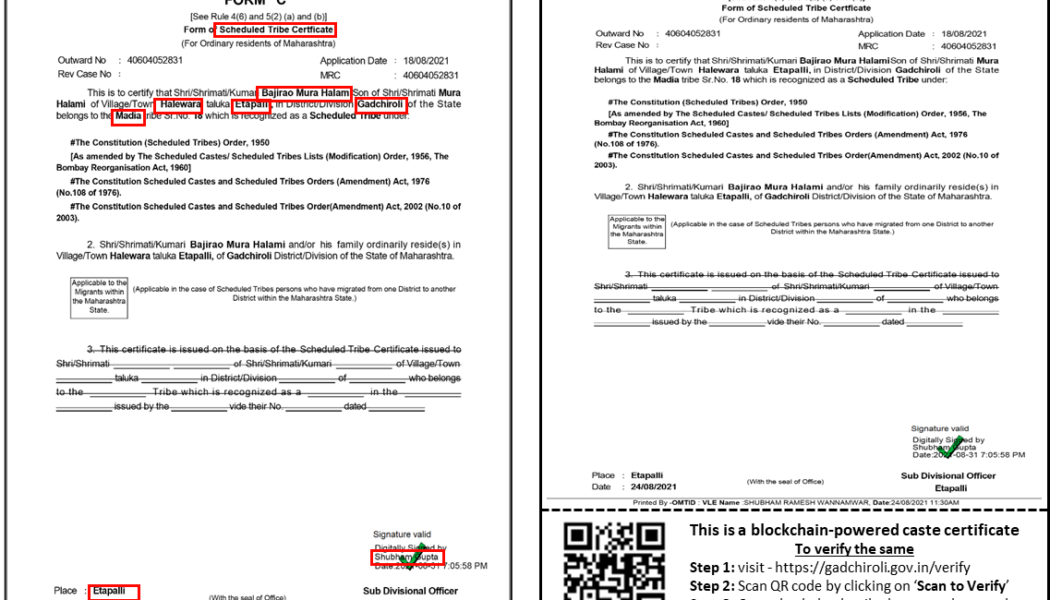

Indian state gov’t uses Polygon to issue verifiable caste certificates

The Government of Maharashtra, one of India’s state governments, has started issuing caste certificates over the Polygon blockchain to citizens residing in Etapalli village, Gadchiroli district, as a part of the Digital India campaign. In partnership with LegitDoc, a blockchain-based application, the Maharashtra state government is in the process of rolling out 65,000 caste certificates to aid the process of delivering governmental schemes and benefits. Speaking to Cointelegraph, Indian Administrative Service (IAS) officer Shubham Gupta revealed that the Indian government is always on the lookout to implement disruptive technologies that can help democratize citizen services, adding: “Web3 takes the concept of democratization to a whole new level, whereby, data/informatio...

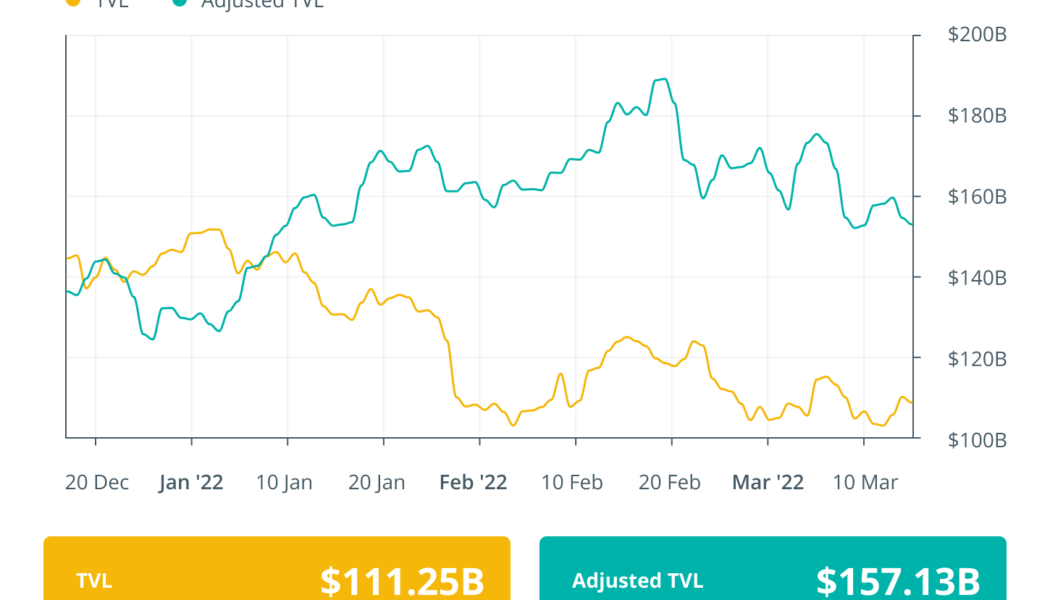

Finance Redefined: DeFi ‘Godfather’ Cronje quits, CAKE launches $100M venture arm and more

The decentralized finance (DeFi) ecosystem had quite an eventful week with several new developments and price action. The week started with DeFi “Godfather” Andre Cronje announcing his departure from most of his projects, leading to a massive drop in prices of projects that Cronje was associated with. CAKE DeFi launched a new $100 million venture fund to support Web3 initiatives, ThorChain spiked over 34% after activating synthetic assets and Polygon network suffered an extended outage post new upgrade that impacted its price momentum. DeFi “Godfather” Cronje quits as TVL and tokens tank for related projects DeFi architect, Fantom Foundation technical adviser and Yearn.finance founder Andre Cronje has left the decentralized finance space reeling after deactivating his Twitter account. Cron...

Polygon’s focus on building L2 infrastructure outweighs MATIC’s 50% drop from ATH

After a devastating 50% correction between Dec. 25 and Jan. 25, Polygon (MATIC) has been struggling to sustain the $1.40 support. While some argue this top-15 coin has merely adjusted after a 16,200% gain in 2021, others point to competing scaling solutions growth. MATIC token/USD at FTX. Source: TradingView Either way, MATIC remains 50.8% below its all-time high at an $11 billion market capitalization. Currently, the market cap of Terra (LUNA) stands at $37 billion, Solana (SOL) is above $26 billion and Avalanche (AVAX) is at a $19 billion market value. A positive note is that Polygon raised $450 million on Feb. 7, and the funding round was backed by some of blockchain’s most considerable venture funds, including Sequoia Capital. Polygon offers scaling and infrastructure support to Ethere...

Altcoin Roundup: 3 portfolio trackers NFT and DeFi investors can use to stay organized

The cryptocurrency ecosystem has seen a tremendous amount of growth over the past couple of years, as the introduction of decentralized finance (DeFi) and the popularity of nonfungible tokens (NFT) have led to an explosion of projects on more than a dozen blockchain networks. The rapidly growing ecosystem means investors have to keep track of multiple wallet addresses, making portfolio trackers a popular option for traders needing to manage a diverse multichain portfolio. Here are three portfolio-tracking decentralized applications, or DApps, crypto traders can use to help monitor their investments. Zapper Zapper supports the basic management of cryptocurrencies held on 11 different networks including Ethereum, Polygon, BNB Chain, Fantom, Avalanche and Optimism. The basic layout of t...

Polygon price risks 50% drop as MATIC paints inverted cup and handle pattern

Polygon (MATIC) has dropped by more than 40% from its record high of $2.92, established on Dec. 27, 2021. But if a classic technical indicator is to be believed, the token has more room to drop in the sessions ahead. MATIC price chart painting classic bearish pattern MATIC’s recent rollover from bullish to bearish, followed by a rebound to the upside, has led to the formation of what appears like an inverted cup and handle pattern — a large crescent shape followed by a less extreme upside retracement, as shown in the chart below. MATIC/USD three-day price chart featuring inverted cup and handle pattern. Source: TradingView In a “perfect” scenario, inverted cup and handle setups set the stage for a downturn ahead. As they do, the price tends to fall towards levels tha...