polygon

Solana (SOL) price rally could fizzle out due to weak fundamentals

Solana’s usage data and ecosystem development do not support the recent bullish rally, raising the probability of a SOL price correction. Market Analysis Own this piece of history Collect this article as an NFT Solana’s (SOL) recent 250% rally to $25 has shocked many investors in the crypto market. At the same time, traders who had eyes on the negative funding rate for SOL in the futures market could have anticipated the bullish move ahead of others. It’s because excessive negative funding rates, like the one in Solana displayed below, implies that the majority of traders are on the short side, providing an opportunity for buyers to run their stops. SOL funding rate for perpetual swaps. Source: Coinglass Regardless of the reason behind the price increase, if enough buyers are interested in...

Price analysis 1/17: SPX, DXY, BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT

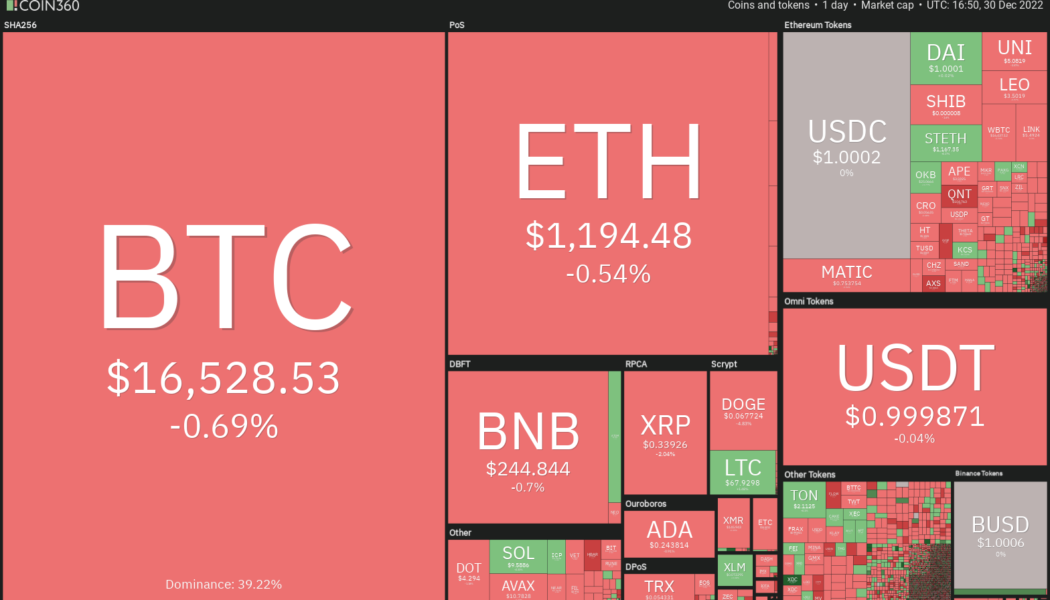

Risk assets have started the new year on a strong note. The S&P 500 (SPX) and the Nasdaq closed in the positive for the second successive week and also notched their best weekly performance since November. Bitcoin (BTC) led the recovery in the crypto markets with a sharp 21% rally last week. That sent the Bitcoin Fear and Greed Index into the neutral territory of 52 on Jan. 15, its highest since April 5, 2022. However, the index has given back its gains and is again back into the Fear zone on Jan. 17. Daily cryptocurrency market performance. Source: Coin360 The strong rally in Bitcoin has divided analysts’ opinions. While some expect the rally to be a bull trap, others believe that the up-move could be the start of a new bull market. The confirmation of the same will happen...

Polygon tests zero-knowledge rollups, mainnet integration inbound

Ethereum layer-2 scaling protocol Polygon (MATIC) is carrying out performance testing of zero-knowledge rollup (zk rollups) technology ahead of full integration with its mainnet. The development of the technology, called Polygon zkEVM (Ethereum Virtual Machine), has been ongoing for over three years by the Polygon Hermez team. The team has already confirmed that zero-knowledge proofs are possible on Ethereum, by generating over 12,000 zk-proofs in a primary version of the zkEVM testnet. David Schwartz, project lead of Polygon zkEVM and PolygonID, unpacked the development of the functionality in correspondence with Cointelegraph. Layer-2 platforms have continued to evolve and improve functionality which has played a key role in driving Ethereum’s scalability. As he explained, zero-kno...

Price analysis 1/6: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

The United States December nonfarm payrolls report showed a growth of 223,000 jobs, above the market’s expectation of an increase of 200,000 jobs. While this shows that the economy remains strong, market observers shifted their focus to the slower wage growth of 0.3% for the month, below economists’ expectation of 0.4%. In addition, the euro zone’s headline inflation dropped from 10.1% in November to 9.2% in December. Both economic data boosted hopes that the central bank’s aggressive rate tightening may slow down. This triggered a rally in the U.S. and European stock markets. Daily cryptocurrency market performance. Source: Coin360 However, the reaction in the cryptocurrency space remains muted, with Bitcoin (BTC) continuing to trade inside a narrow range. The crypto investors...

NFT project accepted $3M to move its collection to Polygon

The team behind y00ts and DeGods were paid $3m to move their collections off Solana and onto Polygon, according to a January 6 announcement from the company. The statement was made on Discord and copied to Twitter by Frank III, founder of the two projects. Here is a screenshot of our latest @y00tsNFT Discord announcement. pic.twitter.com/qWxjBsexv6 — Frank III (@frankdegods) January 6, 2023 The developers had previously announced on Dec. 27 that the projects would be moving to Polygon. This was widely seen as a possible death blow to the Solana network, as the network was already under pressure due to fallout from the collapsed FTX exchange. However, there was no evidence at the time that the y00ts team had received money in exchange for making the move Let’s check the temperature on #sola...

Mastercard partners with Polygon to launch Web3 musician accelerator program

Global payments giant Mastercard is ramping up its exposure blockchain tech yet again, after announcing a Polygon-based accelerator program to help musicians build their careers via Web3. The firm announced the “Mastercard Artist Accelerator” program via a Jan. 7 blog post, outlining that from this spring, it will connect five emerging musicians from across the globe with mentors that will help them set up their brand in the Web3 music space. “The artists will gain exclusive access to special events, music releases and more. A first-of-its-kind curriculum will teach the artists how to build (and own) their brand through Web3 experiences like minting NFTs, representing themselves in virtual worlds and establishing an engaged community,” the post reads. The prog...

Crypto adoption in 2022: What events moved the industry forward?

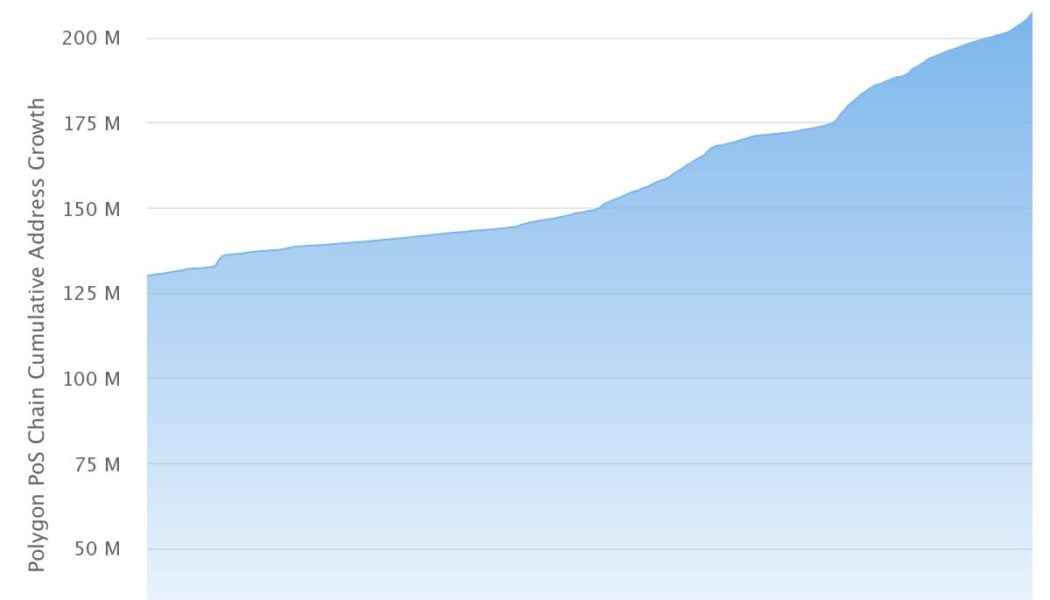

It’s no secret that the crypto market was gripped by bearish pressure for the entirety of 2022. However, amid all the volatility and chaos, many positive news stories appeared as well — especially regarding the global adoption of digital assets and crypto-related technologies in general. Looking back at 2022, here are some key adoption-related events that helped drive the industry last year. Polygon accrues 200 million addresses despite challenging 2022 Even though an air of financial uncertainty has shrouded the crypto market since the end of 2021, Polygon — a layer-2 scaling solution running alongside the Ethereum blockchain, allowing for speedy transactions and low fees — continued to witness a lot of growth in 2022. To this point, the network’s unique address count recently surpassed t...

Top crypto funding stories of 2022

2022 was a watershed year for crypto venture capital, as investors poured tens of billions of dollars into blockchain-focused startups despite the overwhelmingly bearish trend in asset prices. Is the VC-dominated crypto funding model good for the industry? Only time will tell. Cointelegraph Research is still in the process of tallying all the funding figures for the year, but 2022 easily outpaced all other years in terms of total capital raised and deals completed. VC inflows were above $14 billion in each of the first two quarters before receding to just under $5 billion in the third quarter — still an impressive tally given the industry-wide contagion sparked by the sudden collapses of Celsius, Three Arrows Capital, Genesis, BlockFi and FTX, among others. Against this backdrop, we’...

Price analysis 12/30: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

Investors have faced a tumultuous year in 2022 as stocks, bonds, and the cryptocurrency sector have all witnessed sharp declines. As of Nov. 30, the performance of a traditional portfolio comprising 60% stocks and 40% bonds has been the worst since 1932, according to a report by Financial Times. The next big question troubling crypto investors is whether the pain in Bitcoin (BTC) is over or will the downtrend continue in 2023. Analysts seem to be divided in their opinion for the first quarter of the new year. While some expect a drop to $10,000 others anticipate a rally to $22,000. Daily cryptocurrency market performance. Source: Coin360 While the near-term remains uncertain, research and trading firm Capriole Investments said in its latest edition of the Capriole Newsletter that Bitcoin c...

Price analysis 12/28: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

Gold has been an outperformer in 2022 compared to the United States equities markets and Bitcoin (BTC). The yellow metal is almost flat for the year while the S&P 500 is down more than 19% and Bitcoin has plunged roughly 64%. The sharp fall in Bitcoin’s price has hurt both short-term and long-term investors alike. According to Glassnode data, 1,889,585 Bitcoin held by short-term holders was at a loss as of Dec. 26 while the loss-making tally of long-term holders was 6,057,858 Bitcoin. Daily cryptocurrency market performance. Source: Coin360 In spite of gold’s good showing and Bitcoin’s dismal performance in 2022, billionaire investor Mark Cuban continues to favor Bitcoin over gold. While speaking on Bill Maher’s Club Random podcast, Cuban told Maher, “If you have gold, you’re dum...

ILLENIUM Launches Decentralized Fan Community

Thanks to blockchain technology, “Illenials” now have access to ILLENIUM like never before. The Grammy-nominated dance music superstar has launched “The Phoenix Family,” a new community offering his diehard fans “first access for all things ILLENIUM.” Powered by the Polygon blockchain, “The Phoenix Family” was developed in partnership with Medallion, a Web3 platform that helps artists enhance their connection with fans. The community’s name derives from ILLENIUM’s signature emblem depicting a phoenix, which he integrates into his logo, visuals, merchandise and more. ILLENIUM performs at Chicago’s North Coast Music Festival on September 3rd, 2022. Christian Wade/EDM.com Scroll to Continue Recommended Articles “...

Price analysis 12/23: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

Bitcoin (BTC) is on track to end the year with a loss of about 65%. This would mark the third negative year for Bitcoin with the other two being 2014 and 2018. In comparison, the S&P 500 has fared much better but that is also down close to 20% in 2022. Although cryptocurrency prices have seen deep cuts this year, traders have continued to plow money into the space. An online survey conducted by Blockchain.com shows that 41% of the respondents bought crypto this year and 40% plan to purchase crypto in the next year. Daily cryptocurrency market performance. Source: Coin360 However, a sustained recovery in risk-assets may happen only after inflation shows signs of cooling. That would raise expectations of a pivot by the United States Federal Reserve from its aggressive monetary ...