Polkadot

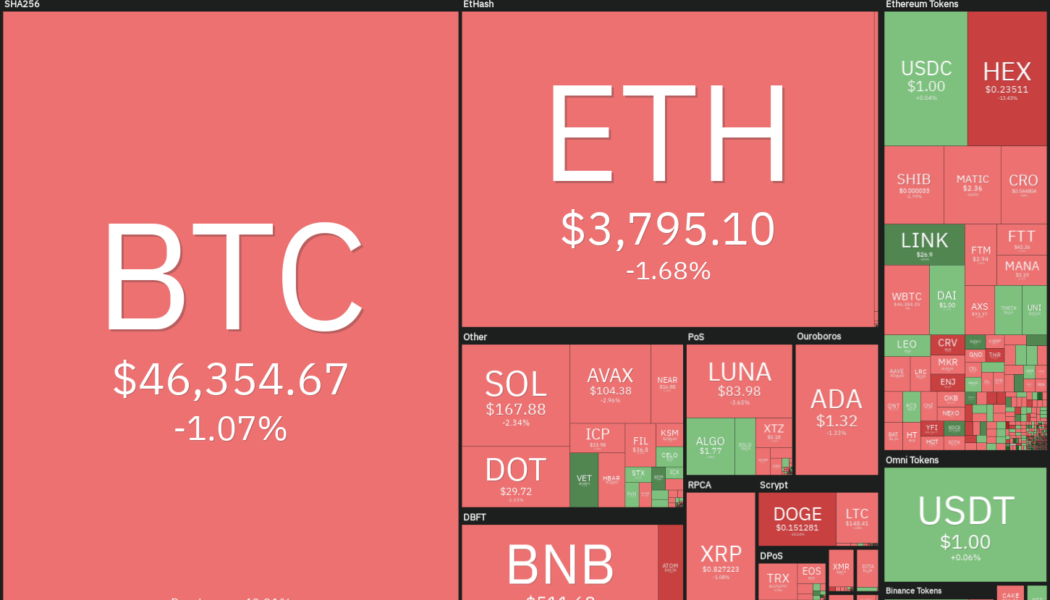

Price analysis 1/12: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, DOT, AVAX, DOGE

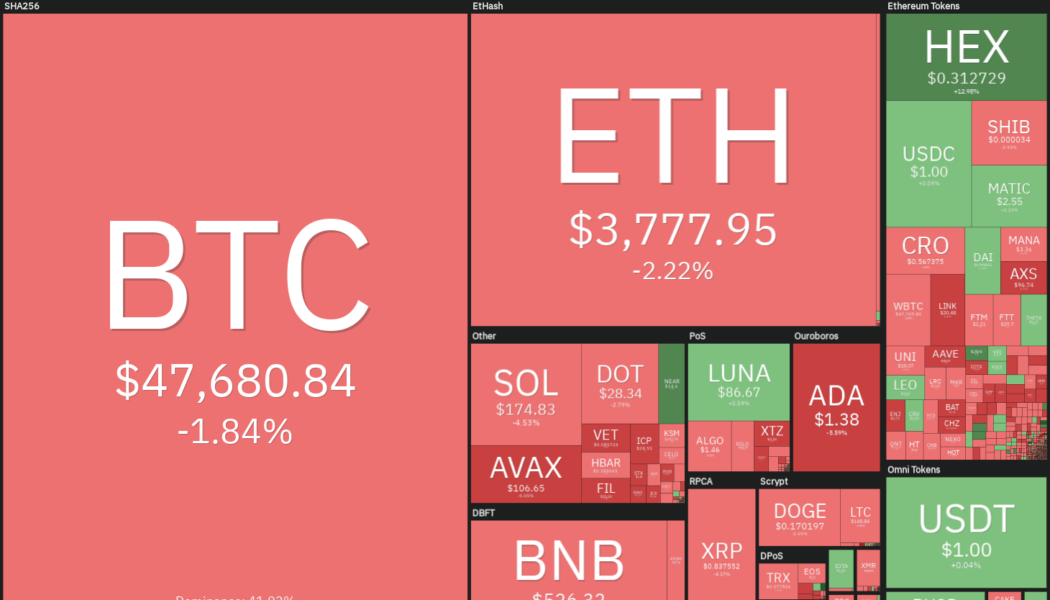

Bitcoin (BTC) and most major altcoins appear to have started a relief rally. Glassnode data suggests that Bitcoin addresses with a non-zero balance have risen to about 40 million, indicating increasing adoption by retail traders. Edelman Financial Engines founder Ric Edelman said that the number of Americans owning Bitcoin could rise from 24% currently to one-third by 2022. He expects this to happen as “Bitcoin is becoming more and more mainstream. People are hearing about it everywhere — it isn’t going away.” Daily cryptocurrency market performance. Source: Coin360 The investors buying Bitcoin seem to be in it for the long haul if the outflows from major exchanges are any indication. CryptoQuant data shows outflows of 29,371 BTC on Jan. 11, the highest withdrawals since Sep. 10. Could the...

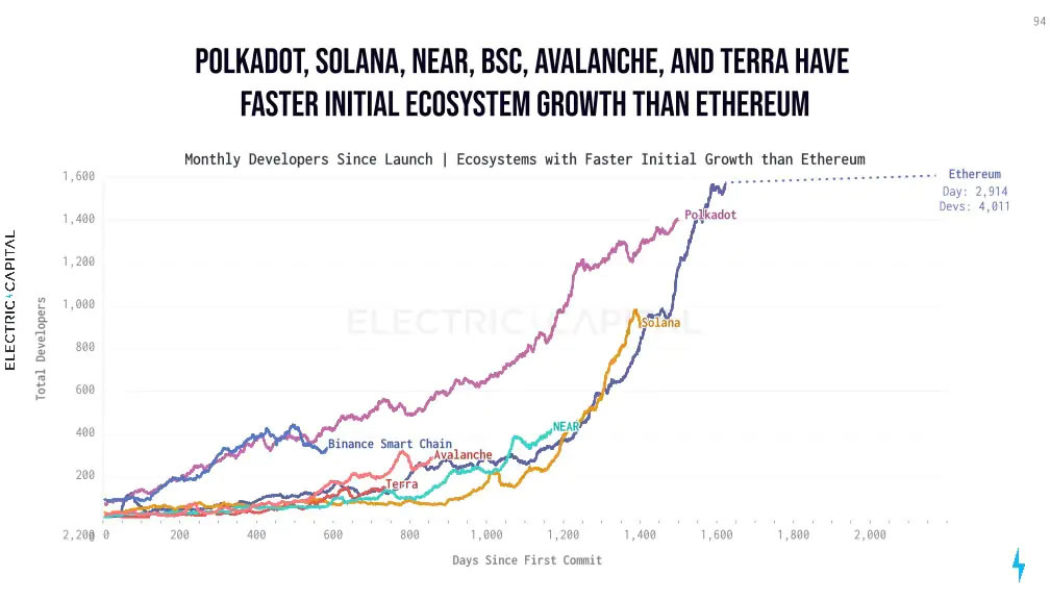

Ethereum dominates among developers but competitors growing faster

The Ethereum ecosystem still has far more developers than rival networks, but they are catching up with a faster rate of growth. Ethereum competitors such as Polkadot, Solana, and Binance Smart Chain are growing faster in terms of development activity according to crypto research firm Electric Capital which released its findings on the blockchain development ecosystem in a new report on Jan. 6. It revealed that more than 4,000 monthly active open-source developers work on Ethereum — considerably more than the 680 who work on the Bitcoin network. Across all chains, the total monthly active developers measured was more than 18,400 and the record was broken for the number of code commits by new developers in 2021 with more than 34,000. The measurements were gleaned by analyzing around 500,000...

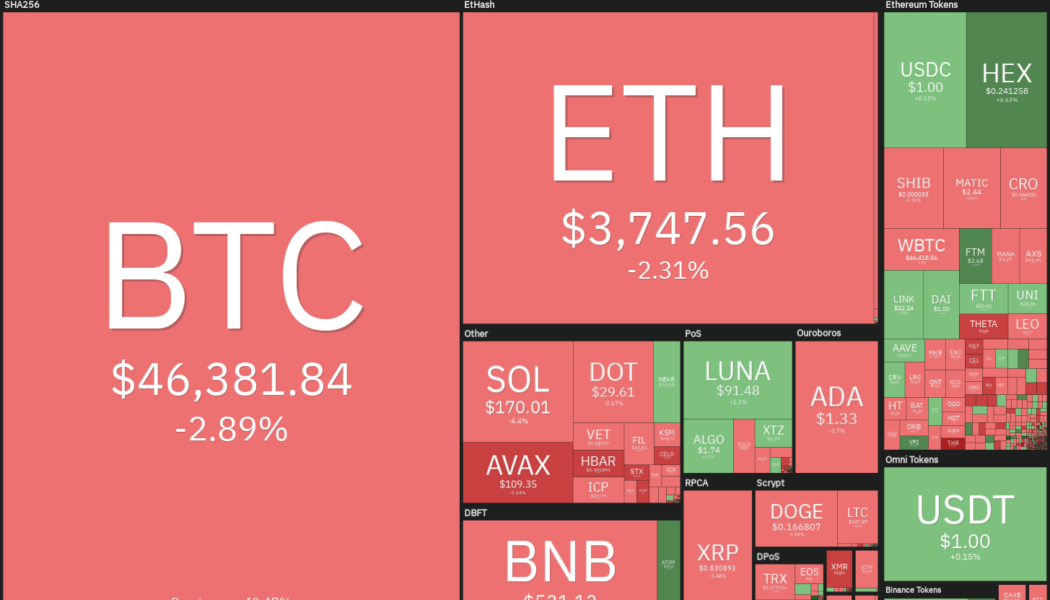

Price analysis 1/5: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, DOT, AVAX, DOGE

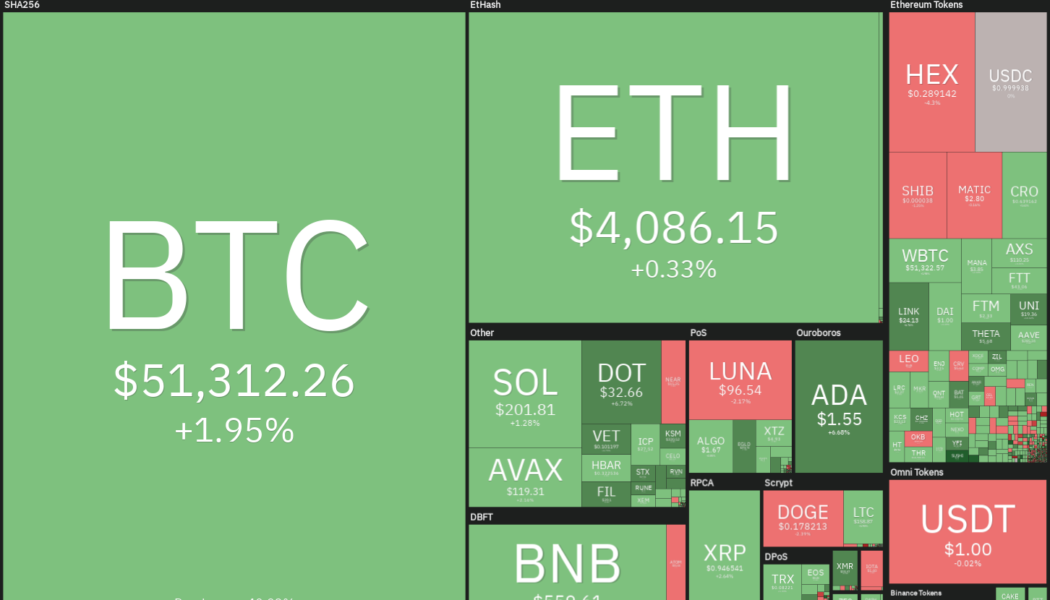

Bitcoin (BTC) and most major altcoins are stuck in a tight range with bulls buying near the support and bears selling at resistance levels. Usually, such tight ranges are followed by an expansion in volatility. Although a few analysts have not ruled out a quick drop to low $40,000s, most traders expect Bitcoin to rebound sharply and move up to $60,000. Goldman Sachs said in a note to investors that if Bitcoin continues to increase its market share over gold as a store of value and crosses the 50% mark, then it could rally to $100,000 over the next five years. Daily cryptocurrency market performance. Source: Coin360 On-chain analytics provider Glassnode said in its report on Monday that Bitcoin’s illiquid supply has increased to more than 76% of the total circulating supply. According to Gl...

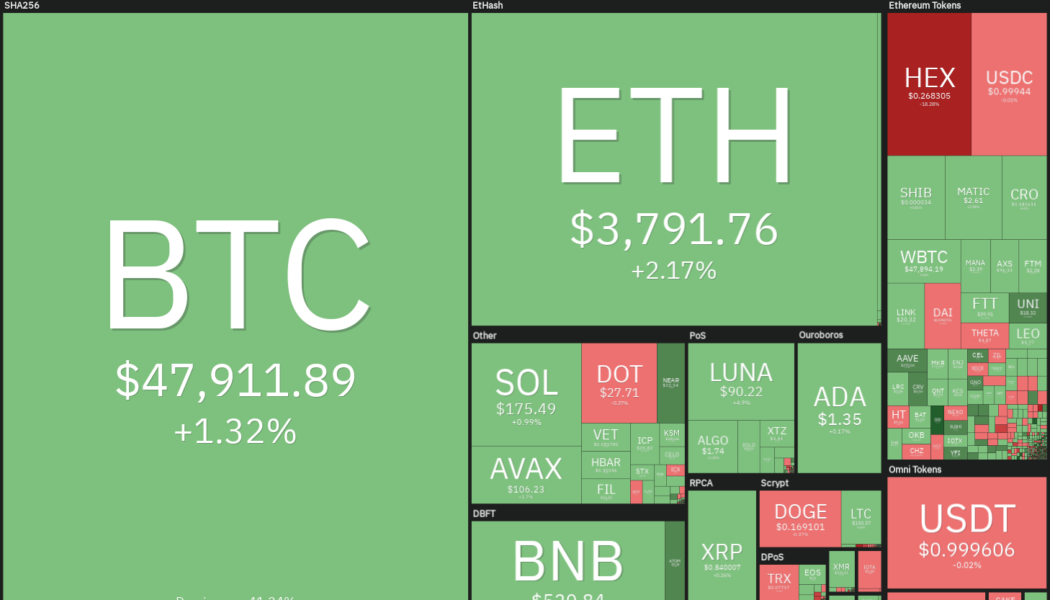

Price analysis 1/3: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

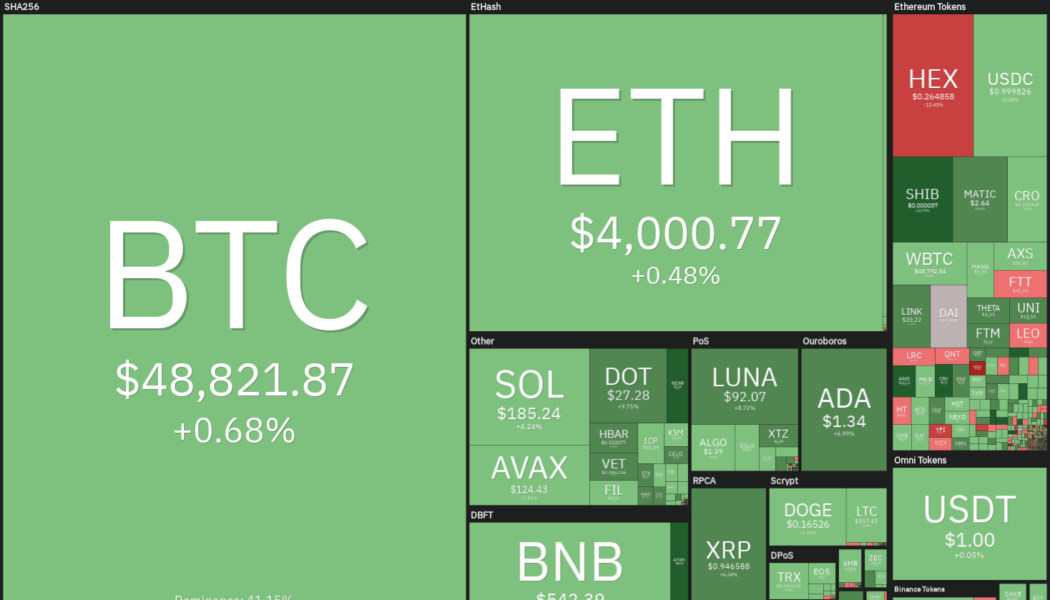

Bitcoin’s (BTC) price action has been uneventful in the first few days of the new year and it continues to languish below the psychological level at $50,000. The Crypto Fear and Greed Index is in the fear zone registering a value of 29/100. On-chain analytics resource Ecoinometrics said stages of extreme fear rarely remain for long, which means “there is a limited downside at 30 days.” Bitcoin continues to garner support from various quarters. Wharton School finance professor Jeremy Siegel said in an interview with CNBC that Bitcoin has replaced gold as an inflation hedge in the minds of Millennials. Daily cryptocurrency market performance. Source: Coin360 Savvy investors have been turning to Bitcoin to protect their portfolios against the possible debasement of fiat currencies. Hung...

Price analysis 12/31: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

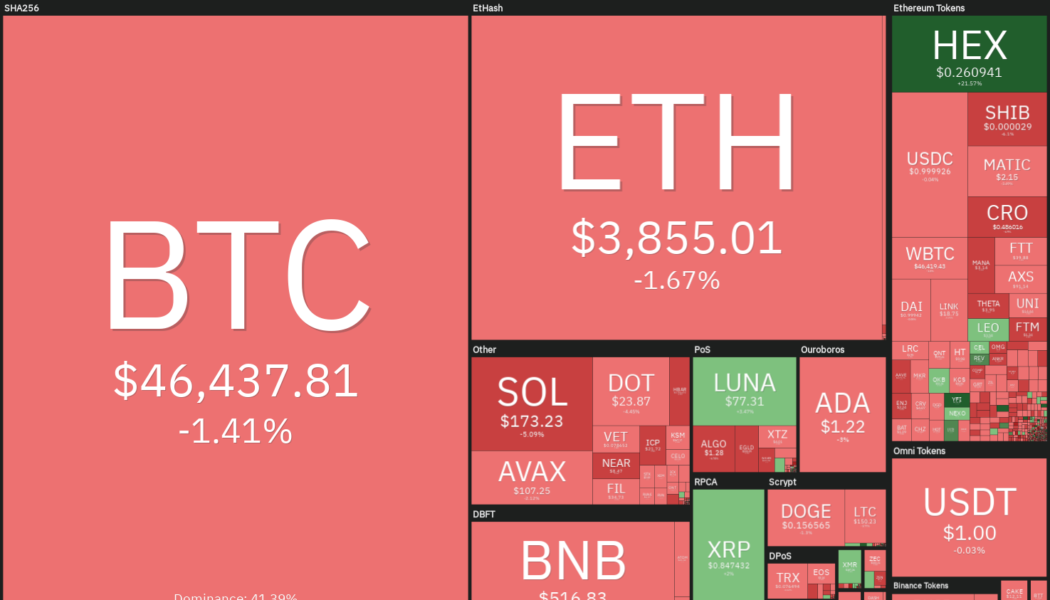

Bitcoin (BTC) and most major altcoins are attempting a rebound off their respective support levels, indicating that buyers continue to accumulate on dips. Data from Coinglass shows that 9,925 Bitcoin left Coinbase Pro, the professional trading arm of Coinbase, on Dec. 30, a possible sign of institutional buying. This is in sharp contrast to the strong inflows seen in Binance and OKEx. Several analysts believe that institutional buying could pick up in January. Economist and trader Alex Krüger expects a Bitcoin rally in early January based on fund flows. He also highlighted that January has produced positive results for Bitcoin between 2018 and 2021, with gains ranging from 7% to 36%. Daily cryptocurrency market performance. Source: Coin360 While investors debate about the next possible dir...

Price analysis 12/29: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

The S&P 500 is trading near its all-time high but Bitcoin (BTC) has plunged about 30% from its all-time high at $69,000. Even after the sharp drop, Bitcoin is up 63%, year-to-date, outperforming the S&P 500, which is up about 30% in 2021. Gold, which is popular as a hedge against inflation, is down roughly 7% this year. Arcane research said in its report that Bitcoin’s outperformance in the high inflationary environment shows that “Bitcoin has proven itself to be an excellent inflation hedge.” Daily cryptocurrency market performance. Source: Coin360 Real Vision CEO Raoul Pal said in an interview with Vlad from The Stakeborg Talks that the recent selling in Bitcoin may have been due to institutional investors booking profits but he believes the selling may be coming to an end. Howev...

Price analysis 12/27: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

Bitcoin (BTC) and most major altcoins have bounced off their immediate support levels, indicating that the sentiment is improving and traders are buying on minor dips. Billionaire and Mexico’s third-richest person Ricardo Salinas Pliego said in his Christmas and New Year message to stay away from fiat money, terming it as “fake money made of paper lies.” Instead, he advised people to “invest in Bitcoin.” Veteran trader Peter Brandt warned that “chart pattern breakouts should be viewed with great suspicion” during the thinly traded holiday period in the last half of December. Daily cryptocurrency market performance. Source: Coin360 Analysts remain bullish for 2022. Crypto analyst and pseudonymous Twitter user DecodeJar believes that Bitcoin could surpass $100,000 and reach the conservative ...

Price analysis 12/24: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

Bitcoin (BTC) bounced back above the psychological level at $50,000 and the S&P 500 hit a new all-time closing high on Dec. 23, suggesting that the panic selling caused due to the omicron variant is subsiding and the much-awaited “Santa rally” may have started. Data from on-chain analytics firm Glassnode shows that about 100,000 Bitcoin are going from “liquid” to “illiquid” state every month, which means that the coins are being sent to addresses “with little history of spending.” This suggests accumulation by investors. Daily cryptocurrency market performance. Source: Coin360 In another sign that investors are not dumping their coins on small corrections, data from CryptoRank shows that the total Bitcoin on crypto exchanges has dropped from 9.5% of the total Bitcoin supply in October ...

Price analysis 12/22: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

Bitcoin (BTC) is attempting to break above the psychologically critical level at $50,000 and close the year on a strong note. The up-move in Bitcoin has led to a sharp recovery in the value of the Crypto Fear & Greed Index from 27 to 45 within a day, signaling improving sentiment. BlockFi co-founder Flori Marquez said in a recent interview that new talent, regulatory clarity and higher crypto prices could lead to a feeling of FOMO, boosting crypto adoption in 2022. Marquez added that the “majority of Blockfi’s clients—when they receive a BTC reward, they’re not selling that for cash.” Daily cryptocurrency market performance. Source: Coin360 In another positive news that could boost crypto adoption further, popular internet browser Opera announced an integration with Polygon (MATIC), ex...

Interlay raises $6.5M to accelerate Bitcoin DeFi interoperability

DFG Capital has led a $6.5 million investment in the interoperability start-up Interlay, which is building infrastructure for decentralized finance applications across major blockchains such as Ethereum, Cosmos and Polkadot. As per the announcement, the new funds will be used by Interlay to scale its operations and bring more developers on board with its open-source platform. In a statement, James Wo, DFG Founder and CEO, said Interlay’s solution will “expand the cross-chain possibilities for Bitcoin.” Interlay aims to integrate cryptocurrencies like Bitcoin (BTC) with DeFi platforms such as Polkadot and Ethereum. InterBTC, the company’s main product, is a fully crypto-based Bitcoin-backed asset. It’s backed by multiple collaterals and functions li...

Price analysis 12/20: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

Bitcoin (BTC) continues to lose ground in December, a signal that traders may be locking in their gains before the end of the year. The lack of a Santa rally in the U.S. equity markets indicates that the risk-off sentiment prevails due to the uncertainty regarding the spread of the COVID-19 omicron variant in several parts of the world. Even after the sharp drop in Bitcoin’s price, the demand from institutional investors remains tepid, and data shows that the largest institutional Bitcoin product, the Grayscale Bitcoin Trust (GBTC), is trading at a discount of more than 20%. Daily cryptocurrency market performance. Source: Coin360 Veteran trader Peter Brandt said that “high volume panic capitulations” usually signal a bottom in Bitcoin and that has not yet happened during the current decli...

Polkadot envisions Web3 disruption with multiple parachain launches

Open-source blockchain platform Polkadot announced the launch of its first parachains (or parallelized chain) aimed at improving the interoperability between multiple blockchains. According to the announcement, the Polkadot team invested five years into the development of the parachains, which were allocated to teams via auctions, namely, Acala, Moonbeam, Parallel Finance, Astar, and Clover. With individual blockchains running in parallel within the Polkadot ecosystem, the auction winners will be able to lease slots on Polkadot’s Relay Chain for up to 96 weeks at a time. Developed by Polkadot Founder and Ethereum co-founder Gavin Wood, the Relay Chain helps in coordinating the consensus and communication between parachains: “And as the ecosystem grows, especially with nascent e...