Polkadot

Price analysis 2/28: BTC, ETH, BNB, XRP, ADA, SOL, AVAX, LUNA, DOGE, DOT

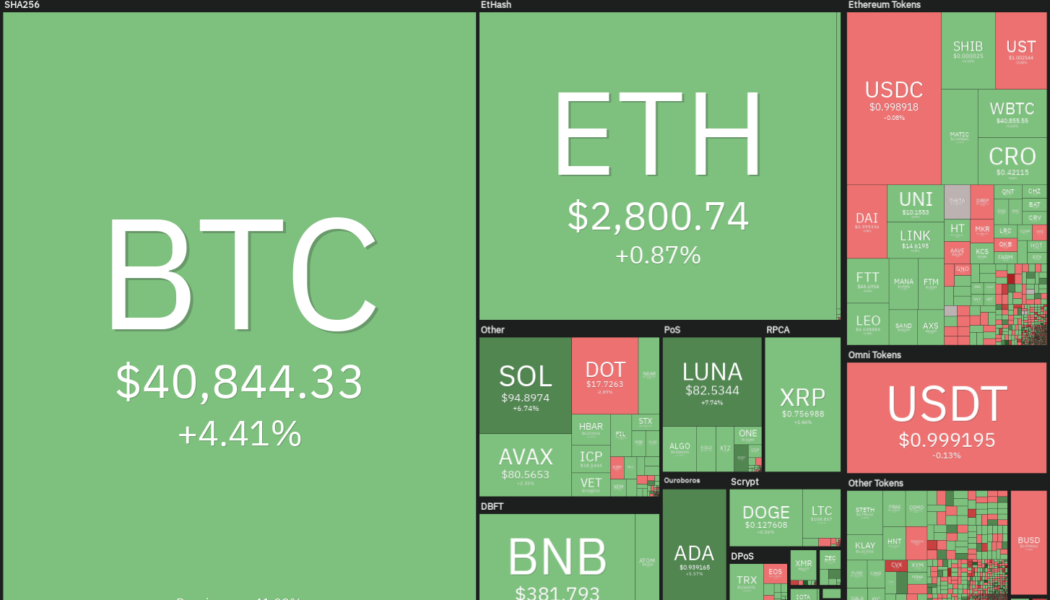

Bitcoin (BTC) soared above $40,000 on Feb. 28 even though the S&P 500 remained soft. This suggests that the correlation between Bitcoin and the U.S. equity markets may be showing the first signs of decoupling. If bulls sustain the price above $38,500 till the end of the day, Bitcoin would avoid four successive months of decline. The volatility of the past few days does not seem to have shaken the resolve of the long-term investors planning to stick with their positions. Data from on-chain analytics firm Glassnode showed that the amount of Bitcoin supply that last moved between three to five years ago soared to more than 2.8 million Bitcoin, which is a four year high. Daily cryptocurrency market performance. Source: Coin360 Interestingly, an experiment by Portuguese software developer T...

Price analysis 2/25: BTC, ETH, BNB, XRP, ADA, SOL, AVAX, LUNA, DOGE, DOT

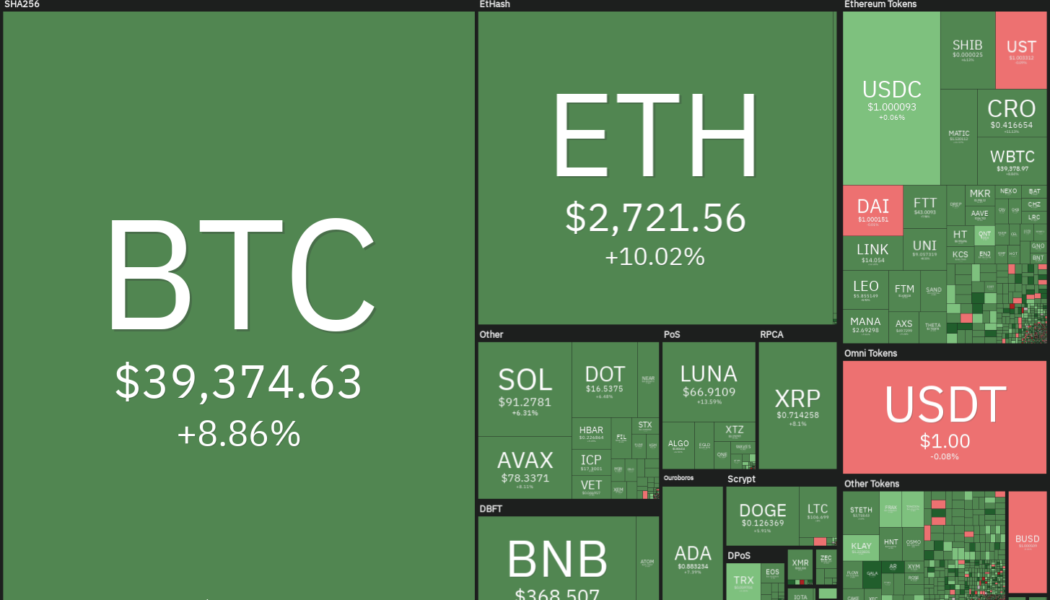

The U.S. equity markets and Bitcoin (BTC) have rebounded sharply from their Feb. 24 lows while gold has made a retreat from its recent highs. This indicates that investors may be buying risky assets and reducing exposure to assets perceived as a safe haven. Recent reports also suggest that Russian President Vladimir Putin may send a delegation to negotiate with Ukraine and this raises hope that the conflict could end sooner than analysts expect. Some analysts believe that the U.S. Federal Reserve may not raise rates aggressively in March due to the geopolitical situation. Allianz chief economic advisor Mohamed El-Erian believes that the March 50 basis point rate hike is “completely off the table.” Daily cryptocurrency market performance. Source: Coin360 Dr. Raullen Chai, the co-f...

Price analysis 2/23: BTC, ETH, BNB, XRP, ADA, SOL, AVAX, LUNA, DOGE, DOT

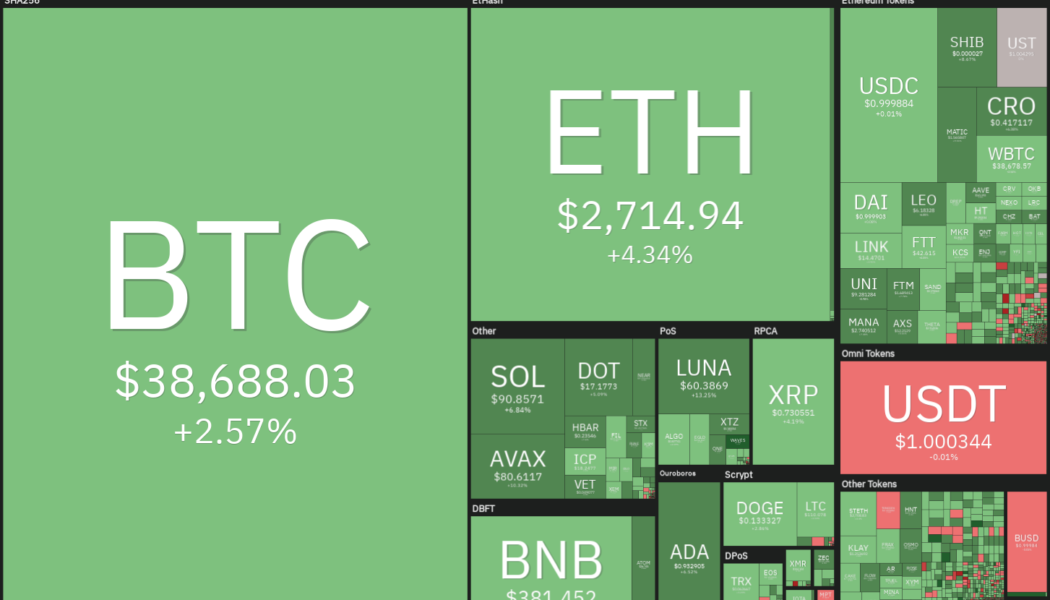

Bitcoin (BTC) and several altcoins have bounced off their immediate support levels after buyers attempted to arrest the current decline. Bloomberg Senior Commodity Strategist Mike McGlone highlighted in a recent Tweet that Bitcoin was trading roughly 20% below its 50-week moving average and such discounted levels have “often resulted in good price support.” The bearish price action of the past few days does not seem to have deterred the institutional traders from accumulating at lower levels. According to CoinShares’ Feb. 22 “Digital Asset Fund Flows Weekly” report, institutional investors pumped about $89 million into Bitcoin funds between Feb. 14 and Feb. 18, taking the total inflows in the current month to $178.3 million. Daily cryptocurrency market performance. Source: Coin360 Crypto t...

FC Barcelona turns down sponsorship offers from crypto brands

Several entities in the crypto sector presented offers, but the football club turned them down The Catalan club is said to be in the final stages of sealing a deal with Spotify Cryptocurrencies have gained mainstream adoption over the last couple of months, leading to an intersection between the industry and other niches. Notably, cryptocurrency firms and brands have injected huge sums into various sports, especially in the US and Europe. For the former, crypto platforms have targeted the major professional sports leagues, including the NBA and MLB. In Europe, crypto entities have eyed top professional football clubs as they guarantee a lot of exposure crucial for brand awareness. Earlier this month, Tezos announced an agreement with Premier League club Manchester United that will see the ...

Exec at Composable Finance allegedly doxed as convicted fraudster Omar Zaki

Late Friday afternoon, decentralized finance, or DeFi, investigator @zachxbt published a series of tweets accusing fraudster Omar Zaki of hiding behind the facade of 0xbrainjar, the anonymous head of product at Composable Finance. From last November to this February, Composable Finance raised over $167 million through seed funding, as well as crowdloan auctions on the Polkadot (DOT) and Kusama (KSM) parachains. Over 9,000 participants contributed to the DOT crowdloan alone. As told by zachxbt, who cited documents from the U.S. Securities and Exchange Commission, or SEC, Omar Zaki, then a 21-year-old New York resident and graduate of Yale University with a bachelor degree in physics and economics, was charged with fraud after misleading investors while operating an unregistered hedge ...

Price analysis 2/2: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOGE, DOT, AVAX

Bitcoin (BTC) rose above $39,000 on Feb. 1 but the sharp fall in the shares of PayPal may have resulted in aggressive selling by the short-term traders. However, in the long-term, large investors seem to be viewing the decline as a buying opportunity. On-chain monitoring resource Whalemap said that whales holding between 100 to 10,000 BTC have accumulated during the recent decline. Fidelity recently released a paper dubbed “Bitcoin First,” which highlights that Bitcoin is the most “secure, decentralized form of asset” and is unlikely to be overtaken by any of the altcoins “as a monetary good.” The report said that Bitcoin combines “the scarcity and durability of gold with the ease of use, storage and transportability of fiat.” Daily cryptocurrency market performance. Source: Coin360 I...

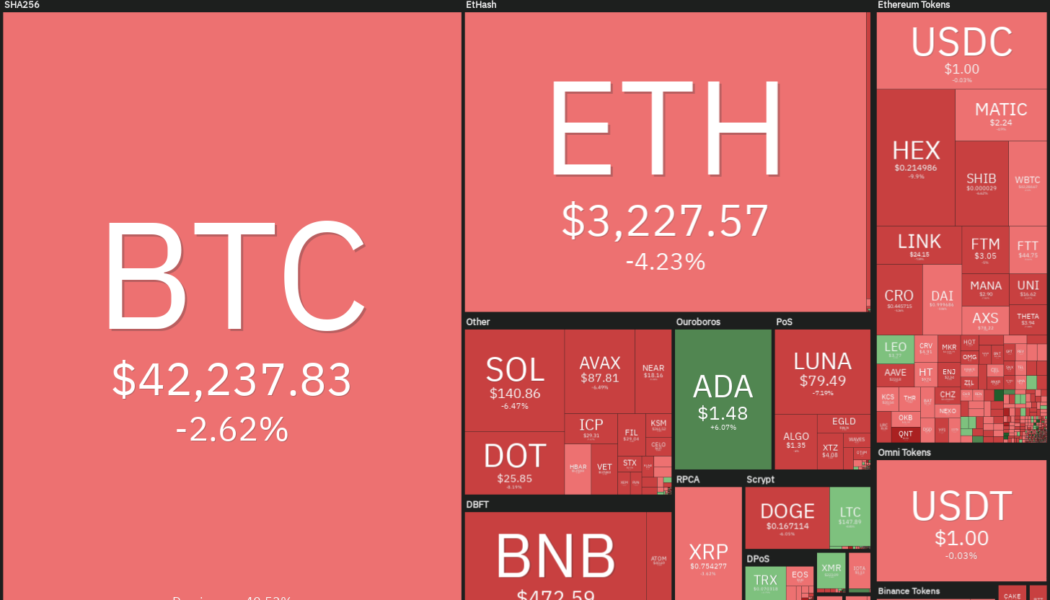

Price analysis 1/26: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOGE, DOT, AVAX

Bitcoin (BTC) and most major altcoins have bounced off their strong support levels but could the rally sustain to the extent that traders feel confident that a bottom in place? Bloomberg Intelligence senior commodity strategist Mike McGlone said that Bitcoin’s price is “about 30% below its 20-week moving average,” roughly at the same position, which had led to bottom formations in March 2020 and July 2021. Although Bitcoin has corrected sharply in January, the exchanges’ balances dropped from 2.428 million Bitcoin on December 28 to 2.366 million Bitcoin on Jan. 24, according to data from CryptoQuant. This indicates that investors may be stashing away their recent purchases safely. Daily cryptocurrency market performance. Source: Coin360 However, it may not be a V-shaped recovery for ...

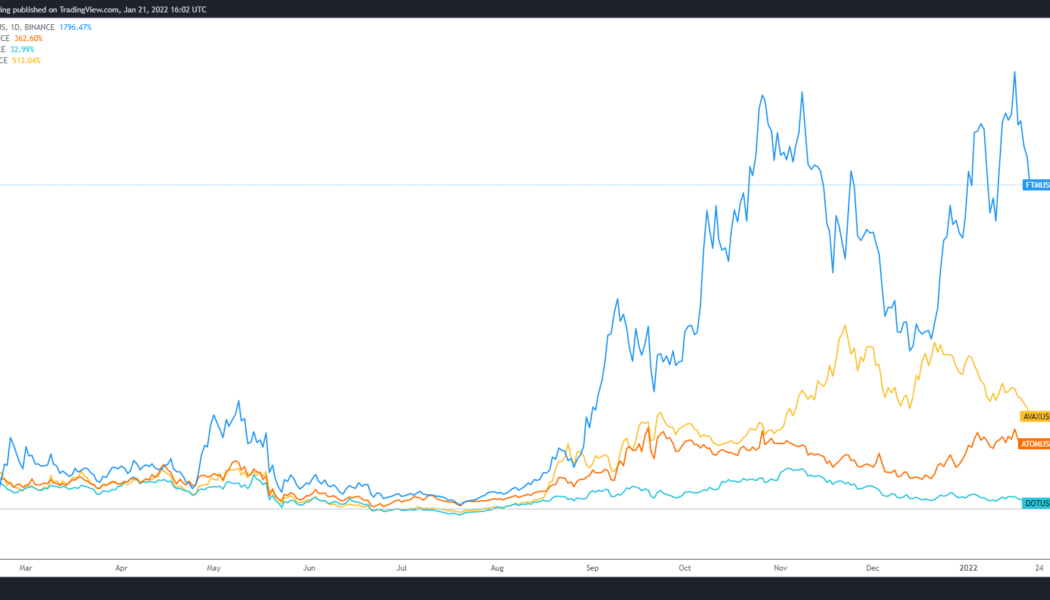

3 possible reasons why Polkadot is playing second fiddle in the L1 race

2021 was a sort of “coming-of-age” for many layer-one (L1) blockchain protocols because the growth of decentralized finance (DeFi) and nonfungible tokens (NFTs) forced users to look for solutions outside of the Ethereum (ETH) network where high fees and network congestion continued to be barriers for many. Protocols like Fantom (FTM), Avalanche (AVAX) and Cosmos (ATOM) saw their token values rise and ecosystems flourished as 2021 came to a close. Meanwhile, popular projects like Polkadot (DOT) underperformed, comparatively speaking, despite the high expectations many had for the sharded multi-chain protocol. FTM/USDT vs. AVAX/USDT vs. ATOM/USDT vs. DOT/USDT daily chart. Source: TradingView Setting aside the specific capability that each protocol offers in terms of transactions ...

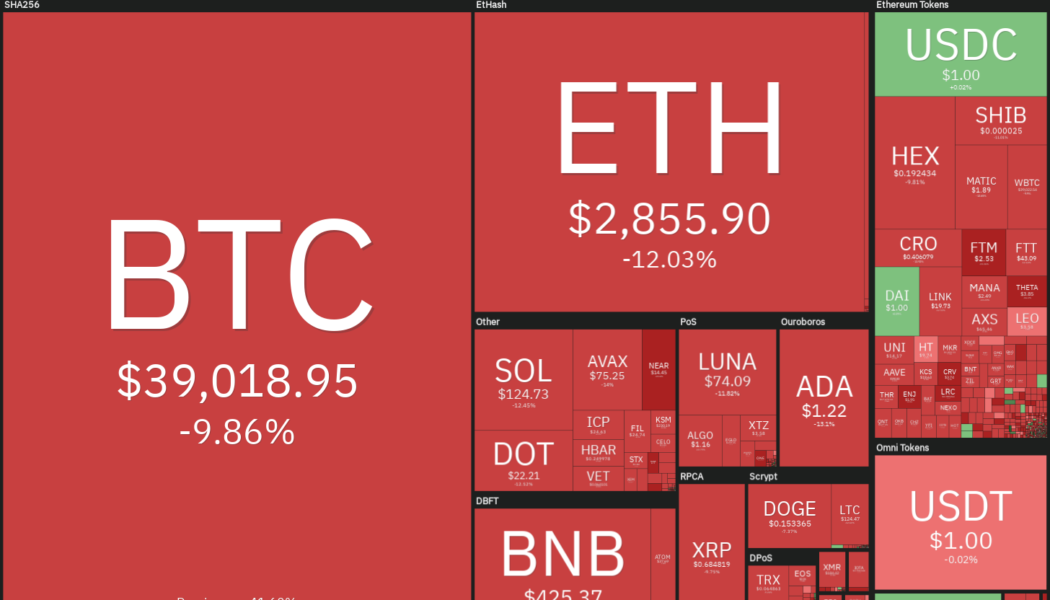

Price analysis 1/21: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOT, AVAX, DOGE

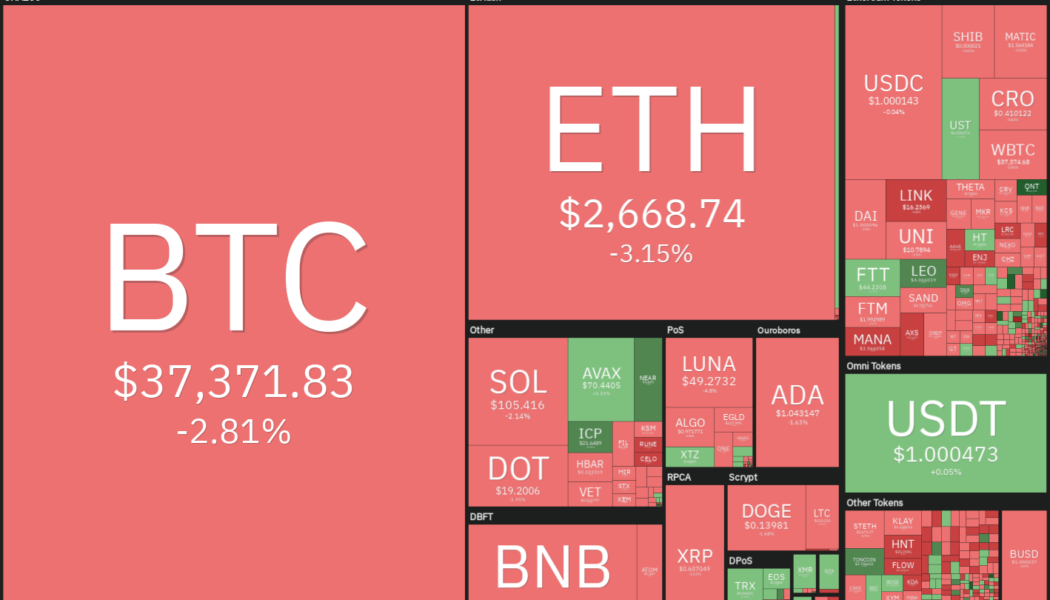

Bitcoin (BTC) and most major altcoins continue to witness a bloodbath on Jan. 21 and the result of the most recent downturn has been a $200 billion reduction in market capitalization. A new report by Huobi Research, in collaboration with Blockchain Association Singapore, forecast Bitcoin to enter a bear market in 2022. The liquidity tightening measures undertaken by the U.S. Federal Reserve and other central banks across the world and the regulatory action by authorities could play spoilsport and keep crypto prices under check. Daily cryptocurrency market performance. Source: Coin360 The calls for a bear market have not shaken up the resolve of MicroStrategy CEO Michael Saylor who is determined to hold on to the company’s Bitcoin holdings. Saylor said in a recent interview...

Moonbeam (GLMR) launch brings EVM interoperability closer to the Polkadot network

Cross-chain compatibility with the Ethereum (ETH) network has become a necessary component for any layer-one protocol looking to remain relevant because a majority of projects and funds locked in smart contracts are found on the top-ranked smart contract platform. After years of development and promises of interoperability, the Polkadot network moved toward its first Ethereum virtual machine (EVM) compatible smart contract protocol with the launch of Moonbeam (GLMR). The platform is designed to make it easy to use Ethereum developer tools to build or re-deploy Solidity projects in a Substrate-based environment. Data from Cointelegraph Markets Pro and TradingView shows that after a volatile start, which saw its price swing from a low of $8.40 on Jan. 11 to a high of $15.97 on Jan. 14,...

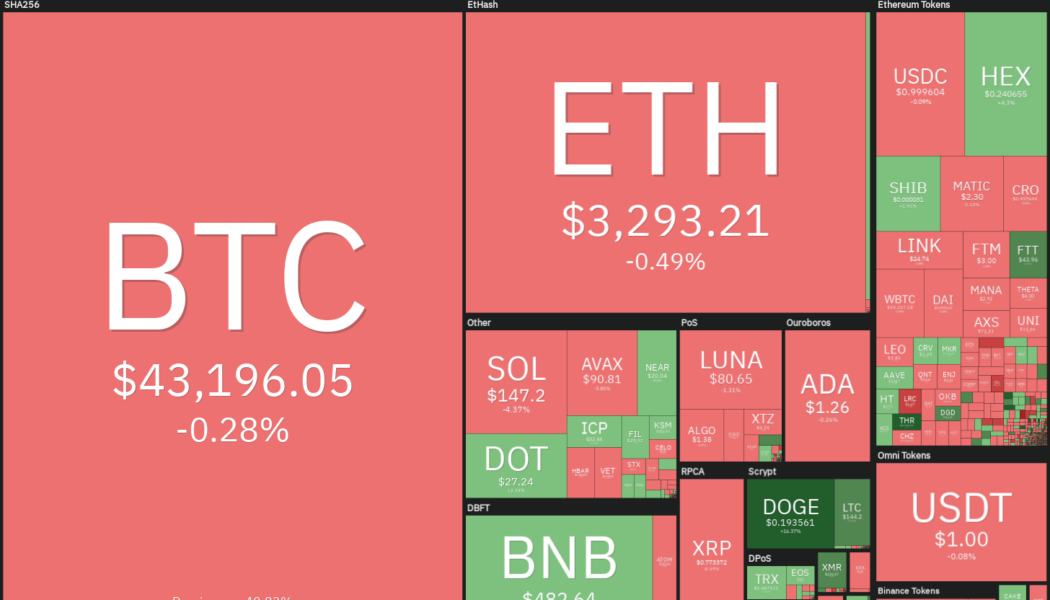

Price analysis 1/17: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOT, AVAX, DOGE

Bitcoin’s (BTC) volatility has been shrinking in the past few days. The standard deviation of daily Bitcoin returns for the last 30 and 60 days as calculated by the Bitcoin Volatility Index is at 2.63%, the least volatile it has been since November 2020. Generally, tight ranges are followed by strong price expansions. In 2020, the low volatility period in November was followed by a sharp rally in mid-December, which resulted in a supercycle that carried the price all the way to $64,854 on April 14, 2021. Daily cryptocurrency market performance. Source: Coin360 However, there is no certainty that the volatility expansion will happen only to the upside. The price could break out in either direction. Commentator Vince Prince warned that the high leverage ratio of Bitcoin could trigger a big c...

Price analysis 1/14: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, DOT, AVAX, DOGE

Bitcoin (BTC) and most major altcoins are facing selling at higher levels and buying on dips, indicating the possibility of a range formation. On-chain analysis firm Whalemap said that a “reclaim of $46,500 will look like a trend reversal,” for Bitcoin as the previous accumulation phase of 90,000 BTC was at this level. Fidelity Digital Assets said in its annual report that the “massive “ Bitcoin accumulation by Bitcoin miners suggests that the “Bitcoin cycle is far from over.” The report went on to add that more sovereign nations may “acquire Bitcoin in 2022 and perhaps even see a central bank make an acquisition.” Daily cryptocurrency market performance. Source: Coin360 Switzerland-based financial institution SEBA Bank CEO Guido Buehler said in a recent interview that if the right co...