Polkadot

Price analysis 4/8: BTC, ETH, BNB, SOL, XRP, ADA, LUNA, AVAX, DOT, DOGE

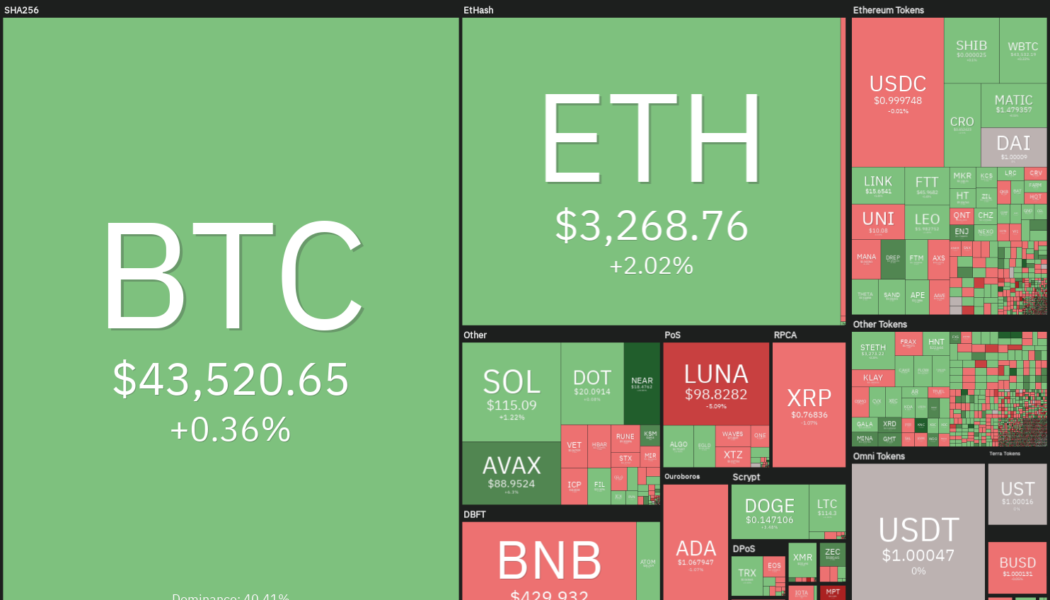

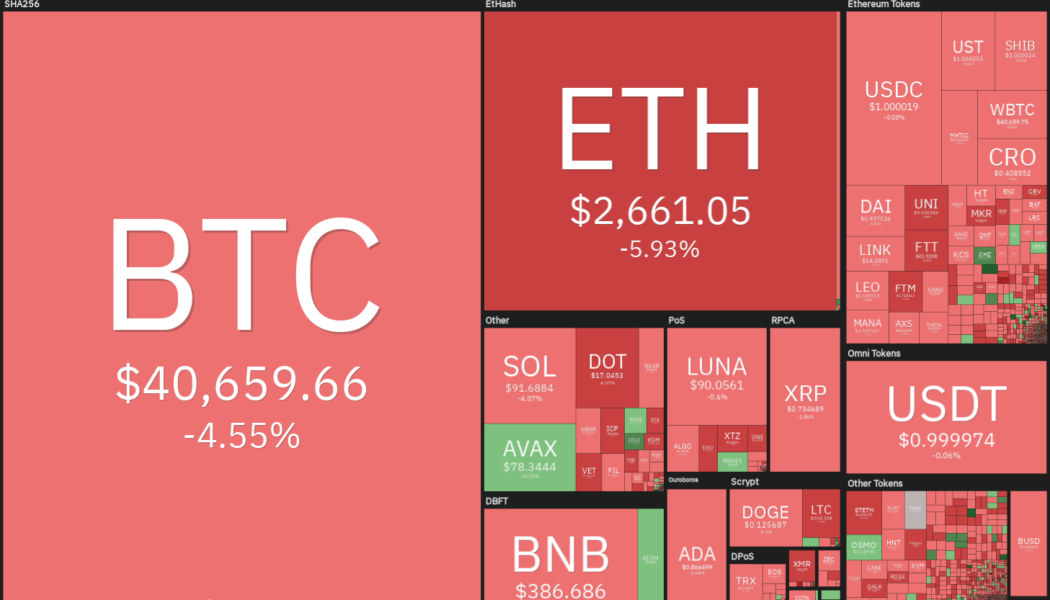

Bitcoin (BTC) and most major altcoins are attempting to defend the immediate support levels, indicating that bears sense an opportunity and are looking to take control of the price action. The short-term price action does not seem to worry the long-term Bitcoin bulls who expect a massive return in the next few years. While speaking at the Bitcoin 2022 conference in Miami, ARK Invest CEO Cathie Wood reiterated her Bitcoin price target of $1 million by 2030. Meanwhile, telecom billionaire Ricardo Salinas said during the conference that BTC and Bitcoin equities form 60% of his liquid investment portfolio. That is a massive increase from his Bitcoin exposure in 2020, which formed just 10% of his liquid assets. Daily cryptocurrency market performance. Source: Coin360 While the long-term may be ...

Altcoin Roundup: Interoperability push puts attention back on Polkadot

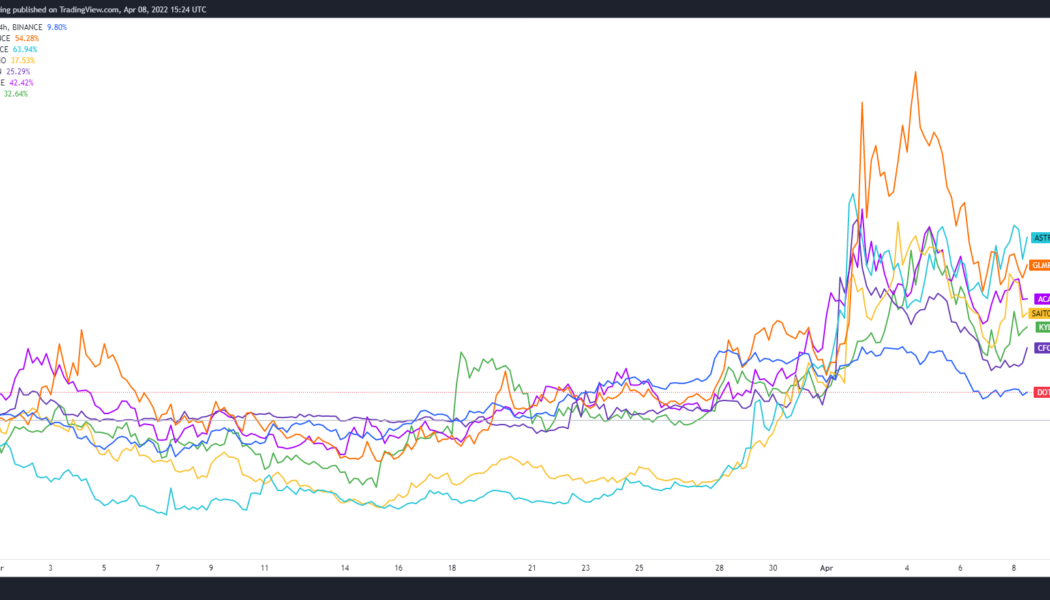

The Polkadot ecosystem sorely underperformed compared to other layer-1 networks in 2021, while the slow roll-out of parachain auctions and mainnet launches left the network playing catch-up in 2021. It appears that this trend came to an end in mid-March when numerous projects in the Polkadot ecosystem saw their prices climb higher after users began to engage with networks that expanded their offerings and made a push toward Ethereum Virtual Machine (EVM) compatibility. DOT, GLMR, ACA, ASTR, SAITO, CFG and KYL in USDT pairs. Source: TradingView Here’s a look at six top moving protocols in the Polkadot ecosystem that are helping to establish a presence in the cryptocurrency market. Interoperability is the key Interoperability has been one of the driving themes of the cryptocurrency market fo...

Price analysis 4/1: BTC, ETH, BNB, SOL, XRP, ADA, LUNA, AVAX, DOT, DOGE

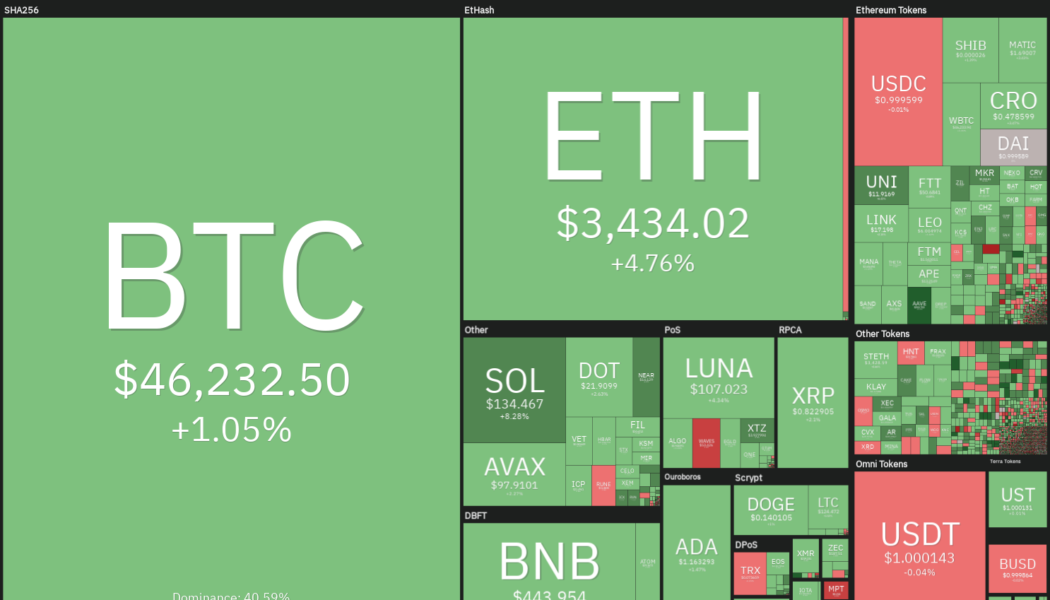

Bitcoin (BTC) has clawed back much of the losses that took place in January and now the focus of traders shifts to April, which has historically been a strong month for the cryptocurrency. According to Coinglass data, Bitcoin has closed April in the red on onlthree occasions and the worst monthly loss was a 3.46% drop in 2015. Although history favors the bulls, the Whale Shadows indicator has noticed that more than 11,000 Bitcoin has left a wallet in which it had been lying dormant for seven to ten years. The movement of similar-sized quantities from dormant accounts has generally resulted in a major top, according to independent market analyst Phillip Swift. Daily cryptocurrency market performance. Source: Coin360 Along with keeping an eye on the crypto markets, traders should ...

Astar (ASTR) price doubles as the network prepares to add 15 new projects in April

Following the successful completion of its initial parachain auctions, the Polkadot (DOT) ecosystem has begun to gain traction with the cryptocurrency community as the first chains begin to come online and integrate with Ethereum (ETH). Astar (ASTR) is one such Polkadot-based project that finished off the month of March on a hot streak after the multi-chain smart contract platform attracted the attention of retail and institutional crypto investors. Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $0.107 on March 22, the price of ASTR has climbed 104% to a daily high at $0.208 on April 1 as demand for the token increased 20-fold. ASTR/USDT 4-hour chart. Source: TradingView Three reasons for the rally include the completion of a $22 million funding...

ETF provider WisdomTree launches Solana, Cardano, Polkadot ETPs

The American exchange-traded fund (ETF) provider WisdomTree continues expanding its cryptocurrency products in Europe by launching three new crypto exchange-traded products (ETP) backed by Solana (SOL), Cardano (ADA) and Polkadot (DOT). WisdomTree announced Tuesday the launch of three new physically-backed crypto ETPs, including WisdomTree Solana (SOLW), WisdomTree Cardano (ADAW) and WisdomTree Polkadot (DOTW). The ETPs are already listed on major European digital exchanges like Deutsche Boerse’s Xetra, the Swiss SIX exchange and the Swiss Stock Exchange. The pan-European exchange Euronext is expected to list the crypto ETPs in Amsterdam and Paris on Thursday, the announcement notes. The ETPs are designed to offer investors in Europe another option to gain exposure to the price of Solana, ...

Price analysis 3/21: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

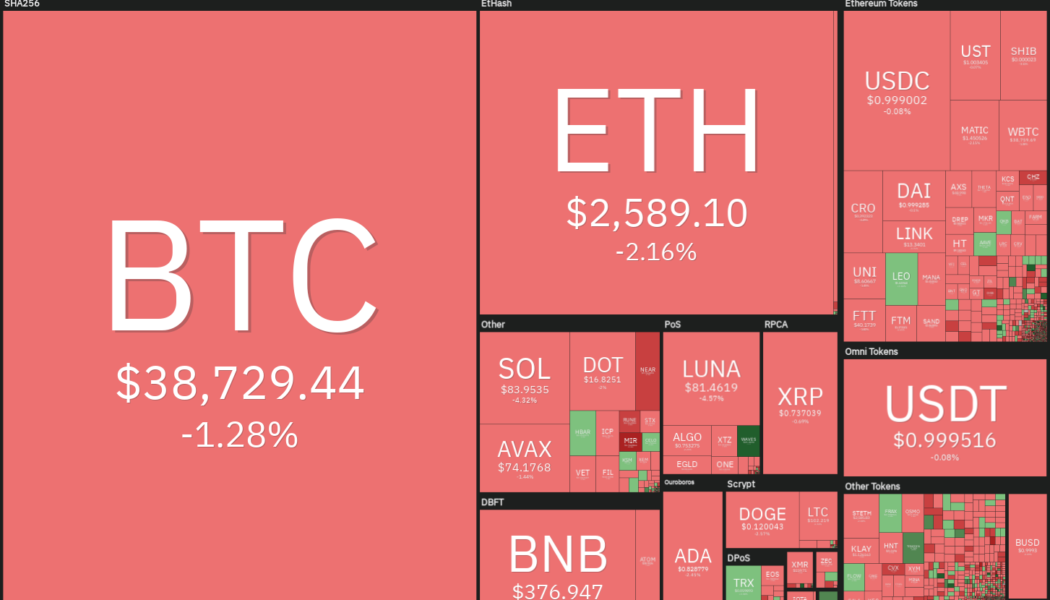

Bitcoin (BTC) and most major altcoins are attempting to start the new week on a positive note by bouncing off their respective support levels. Goldman Sachs became one of the first major banks in the United States to complete an over-the-counter “cash-settled cryptocurrency options trade” with the trading unit of Michael Novogratz’s Galaxy Digital. This could encourage other major banks to consider offering OTC transactions for cryptocurrencies. It is not only select nations that are showing growth in crypto adoption. A report by cryptocurrency exchange KuCoin shows that crypto transactions in Africa have soared by about 2,670% in 2022. Bitcoin Senegal founder Nourou believes that Africa could continue its thousand plus percent growth rates in the next few years. Daily cryptocurrency marke...

Price analysis 3/18: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

Bitcoin (BTC) is facing a challenging environment in 2022 due to the surging inflation and geopolitical turmoil. Although gold has outperformed Bitcoin year-to-date, Bloomberg Intelligence senior commodity strategist Mike McGlone believes that Bitcoin could make a strong comeback. McGlone expects the current circumstances to “mark another milestone in Bitcoin’s maturation.” Another bullish sign for the long term is that the Bitcoin miners have been increasing their Bitcoin holdings since 2021. Compass Mining founder and CEO Whit Gibbs said to Cointelegraph that Bitcoin mining companies are “taking more of a bullish approach to Bitcoin.” Daily cryptocurrency market performance. Source: Coin360 Terraform Labs founder Do Kwon said that its stablecoin TerraUSD (UST) will be backed by mor...

Price analysis 3/16: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

Bitcoin (BTC) is witnessing a see-saw battle near $40,000 with both the bulls and the bears trying to gain the upper hand. The volatility could remain high as the markets await the United States Federal Reserve’s policy decision due on March 16. Analyst Willy Woo suggests that Bitcoin could witness a capitulation event based on a cost basis, a metric that indicates the transfer of Bitcoin from inexperienced to experienced traders. Such sharp declines usually suggest the formation of market bottoms. Daily cryptocurrency market performance. Source: Coin360 However, Glassnode believes that a capitulation has been avoided because the sell-offs have been absorbed by a relatively strong market. Although 82% of the short-term holders’ coins are in loss, Glassnode considers this to be a late...

Price analysis 3/11: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

Bitcoin (BTC) has been volatile in the past few days but the long-term investors seem to be using the current weakness to buy. According to Whale Alert and CryptoQuant, about 30,000 BTC left Coinbase and was deposited in an unknown wallet. It is speculated to be a genuine purchase and not an in-house transaction. Although investors may be bullish for the long term, the short-term picture remains questionable. Stack Funds said in their recent weekly research report that they “expect sideways trading and possibly a potential dip” in the short term due to the increase in inflation and the lack of clarity regarding the conflict in Ukraine. Daily cryptocurrency market performance. Source: Coin360 While Bitcoin has been volatile, gold-backed crypto assets have made a strong showing in 2022...

Price analysis 3/7: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

The geopolitical tension between Russia and Ukraine has resulted in investors seeking safe-haven assets. Contrary to expectations by crypto investors, Bitcoin (BTC) has failed to rise along with gold and it remains closely correlated with the U.S. stock markets. Lloyd Blankfein, the former CEO of Goldman Sachs, said that the actions of governments freezing accounts, blocking payments and inflating the U.S. dollar should all be positive for crypto but the price action suggests a lack of large inflows. Daily cryptocurrency market performance. Source: Coin360 On-chain data suggests that investors may be accumulating Bitcoin for the long term. Data from Santiment shows that 21 out of the past 26 weeks have seen Bitcoin move off the exchanges. Could Bitcoin climb back above $40,000 and pull alt...

Price analysis 3/4: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

The equity markets in Europe and the United States are seeing a sea of red as traders continue to sell risky assets due to the geopolitical situation. Bitcoin (BTC) and several major cryptocurrencies are also witnessing profit-booking after the recent rise. Another reason that could be keeping investors on the edge is the upcoming Federal Open Market Committee (FOMC) meeting on March 16. A statement from Fed hair Jerome Powell on March 2 highlighted that the central bank is likely to hike rates this month. Fitch Ratings chief economist Brian Coulton expects core inflation to remain high in 2022 and the Fed to boost the “Fed fund rate to 3% by the end of 2022.” Daily cryptocurrency market performance. Source: Coin360 ExoAlpha managing partner and chief investment officer David Lifchit...

Ukraine accepts DOT, founder Gavin Wood donates $5.8 million

Calls from the crypto community for Ukraine to accept other cryptocurrencies have been answered. The official Ukraine Twitter account shared that it will now accept donations from Polkadot (DOT), while other cryptocurrencies will soon be added. The people of Ukraine are grateful for the support and donations from the global crypto community as we protect our freedom. We are now accepting Polkadot donations too: $DOT: 1x8aa2N2Ar9SQweJv9vsuZn3WYDHu7gMQu1RePjZuBe33Hv.More cryptocurrencies to be accepted soon. — Ukraine / Україна (@Ukraine) March 1, 2022 Gavin Wood, the co-founder of Polkadot had previously shared that if the Ukraine wallets were to add DOT, he would personally contribute $5 million. He made true on his promise, donating 298,367.2269896686 DOT, which is roughly...