Polkadot

Price analysis 5/18: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

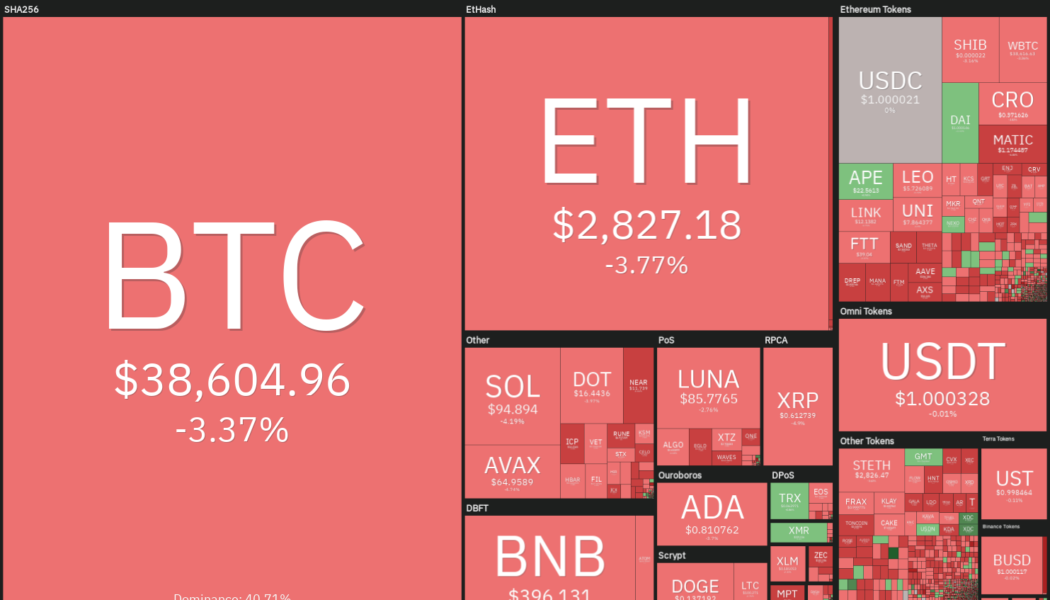

On May 17, United States Federal Reserve Chairman Jerome Powell told the Wall Street Journal that the 50-basis-point rate hikes would continue until inflation is under control. Powell’s emphasis on a hawkish policy suggests that monetary conditions are likely to remain tight in 2022, which could limit the upside in risky assets. On-chain market intelligence firm Glassnode said that historically, Bitcoin (BTC) has bottomed out when the price breaks below the realized price. However, barring the 2019 to 2020 bear market, during previous bear cycles, Bitcoin’s price stayed below the realized price for anywhere between 114 to 299 days. This suggests that if macro situations are not favorable, a quick recovery is unlikely. Daily cryptocurrency market performance. Source: Coin360 While the curre...

Price analysis 5/13: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

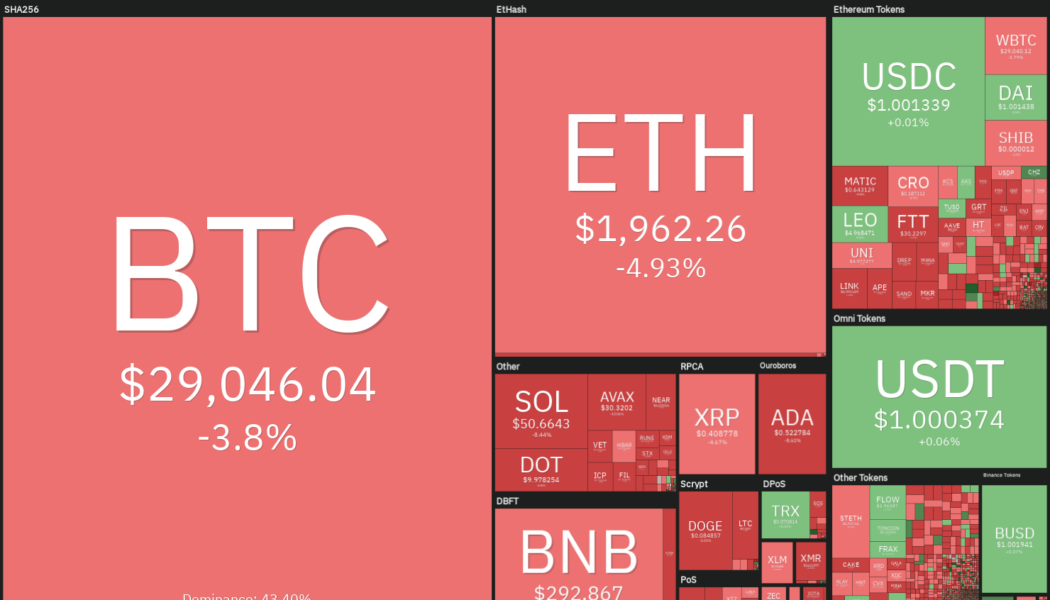

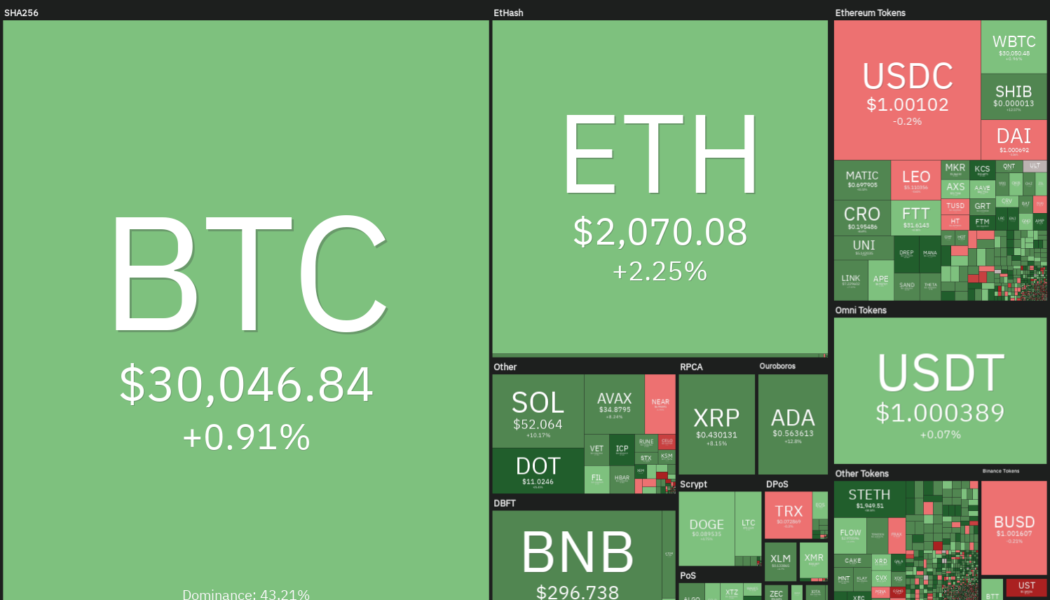

Bitcoin (BTC) rebounded sharply after dropping near its realized price of $24,000 on May 12, suggesting some bulls went against the herd and bought the dip. According to on-chain analytics platform CryptoQuant, the exchange balances declined by more than 24,335 Bitcoin on May 11 and 12, indicating that bulls may have started bottom fishing. However, macro investor Raoul Pal is not confident that a bottom has been made. In an exclusive interview with Cointelegraph, Pal said that if equity markets witness a capitulation phase, crypto markets are also likely to plunge before forming a bottom. He anticipates the current bear phase to end after the United States Federal Reserve stops hiking rates. Daily cryptocurrency market performance. Source: Coin360 Bear markets are known for sharp relief r...

Anchor Protocol rebounds sharply after falling 70% in just two months — what’s next for ANC?

Anchor Protocol (ANC) returned to its bullish form this May after plunging by over 70% in the previous two months. Pullback risks ahead ANC’s price rebounded by a little over 42.50% between May 1 and May 6, reaching $2.26, its highest level in three weeks. Nonetheless, the token experienced a selloff on May 6 and May 7 after ramming into what appears to be a resistance confluence. That consists of a 50-day exponential moving average (50-day EMA; the red wave) and 0.786 Fib line of the Fibonacci retracement graph, drawn from the $1.32-swing low to the $5.82-swing high, as shown in the chart below. ANC/USD daily price chart. Source: TradingView A continued pullback move could see ANC’s price plunging towards its rising trendline support, coinciding with the floor near&...

Will Polkadot (DOT) price reverse course now that cross-chain messaging is live?

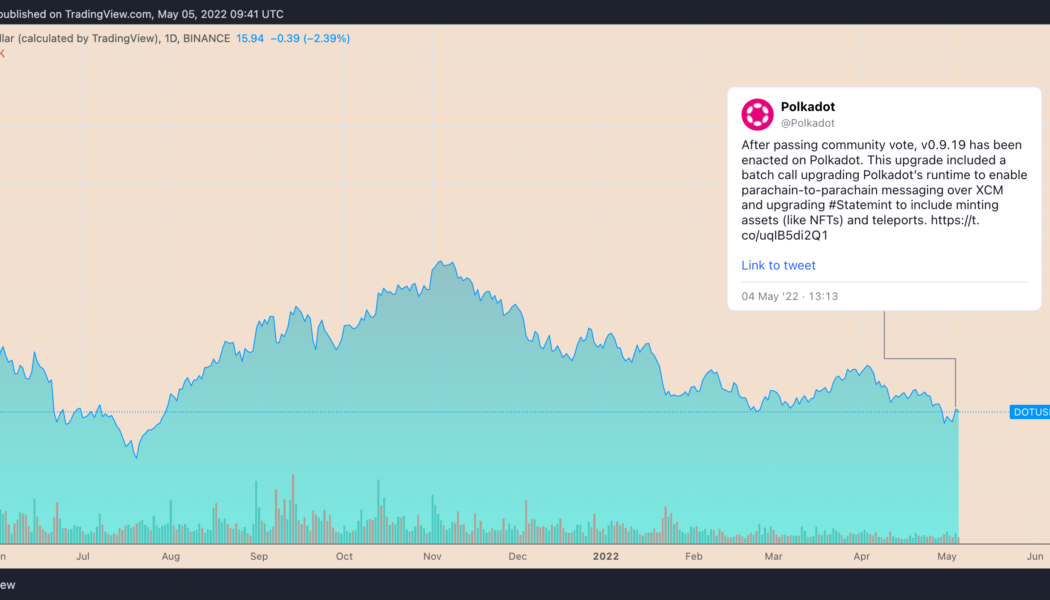

Development within the Polkadot (DOT) ecosystem has been slowly unfolding over the past year and a half, and the work put in by developers is finally starting to bear fruit as parachain auctions finish and the first chains launch on the mainnet. The next phase of interoperability within the ecosystem is set to kick off now that cross-chain functionality is about to go live. This next step will allow Polkadot-based parachains to communicate with each other and transfer assets between chains. After passing community vote, v0.9.19 has been enacted on Polkadot. This upgrade included a batch call upgrading Polkadot’s runtime to enable parachain-to-parachain messaging over XCM and upgrading #Statemint to include minting assets (like NFTs) and teleports. pic.twitter.com/uqIB5di2Q1 — Polkado...

DOT rallies 12% in a day as Polkadot gears up to solve a major blockchain hacking problem

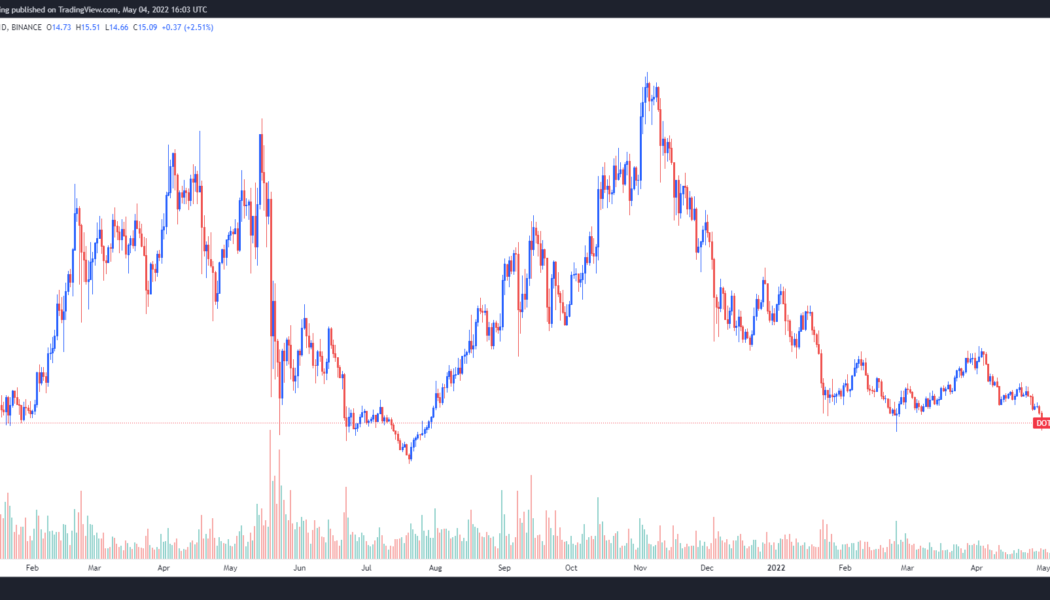

Polkadot (DOT) price ticked higher in the past 24 hours on anticipations that its new cross-chain communications protocol would solve a long-standing problem in the blockchain sector. DOT price gains 12% on XCM launch Bulls pushed DOT’s price to $16.44 on May 5 from $14.72 a day before, gaining a little over 12% as they assessed the launch of XCM, a messaging system that allows parachains — individual blockchains that operate in parallel inside the Polkadot ecosystem — to communicate with each other. DOT/USD daily price chart. Source: TradingView As Cointelegraph reported, future updates in the XCM protocol would see parachains exchanging messages without relying on Polkadot’s central blockchain, the Relay Chain. That expects to eliminate bridge hacks that have cost the in...

Polkadot launches cross-chain messaging system to solve blockchain’s bridge problem

Blockchain platform Polkadot has launched a new cross-chain communications protocol, saying it will do away with cumbersome bridging mechanisms that have cost the crypto industry billions in cyber attacks. The newly launched XCM messaging system is intended to promote Polkadot’s multichain ecosystem, which is being built on the premise of full interoperability. XCM channels are said to be secured at the same level as Polkadot’s central hub, dubbed Relay Chain, and are also available for use by parachains. In other words, XCM will enable communication between parachains themselves as well as smart contracts. Future iterations of XCM will allow messages to be sent between parachains without having to be stored on the Relay Chain, thereby improving scalability and eliminating governance...

Price analysis 4/29: BTC, ETH, BNB, SOL, LUNA, XRP, ADA, DOGE, AVAX, DOT

The U.S. dollar index (DXY) turned down from its 20-year high on April 29 but that has not changed the bearish price action seen in Bitcoin (BTC) and the U.S. equity markets. Equities remain under pressure and this week, Amazon stock saw its biggest intraday drop since 2014 after uncertainty over the U.S. Federal Reserve’s tightening measures placed investor sentiment back into choppy waters. If Bitcoin extends its correction, on-chain analysis platform Whalemap believes that the $25,000 to $27,000 zone may be the best place “to go all-in” on Bitcoin. Long-term investors do not appear to be panicking over the current weakness in Bitcoin and on-chain data from CryptoQuant shows that the combined BTC reserves of 21 crypto exchanges has plummeted to levels not seen since September 2...

Here are 3 ways hodlers can profit during bull and bear markets

For years, cryptocurrency advocates have touted the world-changing capability of digital currency and blockchain technology. Yet with the passing of each market cycle, new projects come and go, and the promised utility of these “real-world use case” projects fails to satisfy. While a majority of tokens promise to solve real-world problems, only a few achieve this, and the others are mere speculative investments. Here’s a look at the three things cryptocurrency investors can actually “do” with their coins. Lending Perhaps the simplest use case offered to cryptocurrency holders is also one of the oldest monetary applications in finance: lending. Ever since the decentralized finance (DeFi) sector took off in 2020, the opportunities available for crypto holders to lend out their tokens in exch...

Price analysis 4/22: BTC, ETH, BNB, XRP, SOL, ADA, LUNA, AVAX, DOGE, DOT

Bitcoin (BTC) turned down sharply on April 21, maintaining its tight correlation with the U.S. equity markets, which reversed direction after U.S. Federal Reserve Chair Jerome Powell hinted that a 50 basis point rate hike was “on the table” in May. The selling has continued on April 22 as investors trim risky assets in expectation of an aggressive stance from central banks to curb surging inflation. Veteran trader Peter Brandt said in a tweet recently that the Nasdaq 100 (NDX) was showing a formation similar to the one it had made before plunging in the year 2000. If history repeats itself then the NDX could witness a sharp correction. That may be negative for the crypto markets in the short term because of the close correlation between Bitcoin and the NDX. Daily cryptocurrency market...

Cointelegraph’s experts reveal their crypto portfolios | Watch now on The Market Report

On this week’s show, Cointelegraph’s resident experts reveal exactly what percentages of their portfolios are allocated to what coins and why. But first, market expert Marcel Pechman carefully examines the Bitcoin (BTC) and Ether (ETH) markets. Are the current market conditions bullish or bearish? What is the outlook for the next few months? Pechman is here to break it down. Next up: the main event. Join Cointelegraph analysts Benton Yaun, Jordan Finneseth and Sam Bourgi as they reveal their crypto portfolios. We kick things off with Bourgi, whose top holdings are BTC with 67%, ETH with 20%. No surprise there but what about the rest? It’s an interesting mix, to say the least so make sure you stick around to find out. Next, we have Yuan, whose top three holdings are 35% BTC, 28% Terra...

Price analysis 4/18: BTC, ETH, BNB, XRP, SOL, ADA, LUNA, AVAX, DOGE, DOT

Bitcoin (BTC) and most major altcoins have started the new week on a soft note and the Crypto Fear and Greed Index has dropped into the “extreme fear” zone, suggesting that investors are still nervous. Bitcoin has declined about 17% year-to-date while the Nasdaq 100 has dropped about 16% during the same period, indicating a tight correlation between the two. In comparison, gold has risen more than 10% in 2022 and its 50-day correlation coefficient with Bitcoin “is around minus 0.4, the lowest since 2018,” according to journalist Colin Wu. Daily cryptocurrency market performance. Source: Coin360 Although the crypto price action has remained bearish, the declining balance of Bitcoin on the crypto exchanges indicates that long-term investors are unperturbed and continue to accumulate at...

Price analysis 4/15: BTC, ETH, BNB, XRP, SOL, ADA, LUNA, AVAX, DOGE, DOT

Bitcoin (BTC) remains closely correlated with the S&P 500 but the institutional investors do not seem to be waiting for a turnaround in the United States’ equities market or decoupling to happen before buying more Bitcoin. Notably, 30,000 Bitcoin moved out of Coinbase Pro in a single day, suggesting strong institutional demand. MicroStrategy, the publicly listed company, which is the largest single-wallet holder of Bitcoin, does not seem to be content with its stash of 129,219 Bitcoin. In a letter to shareholders, the firm’s CEO Michael Saylor said that the company aims to “vigorously pursue” and “increase awareness” about its Bitcoin strategy. Daily cryptocurrency market performance. Source: Coin360 Another entity that has been at the forefront of Bitcoin purchases in the p...