Polkadot

Price analysis 6/27: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

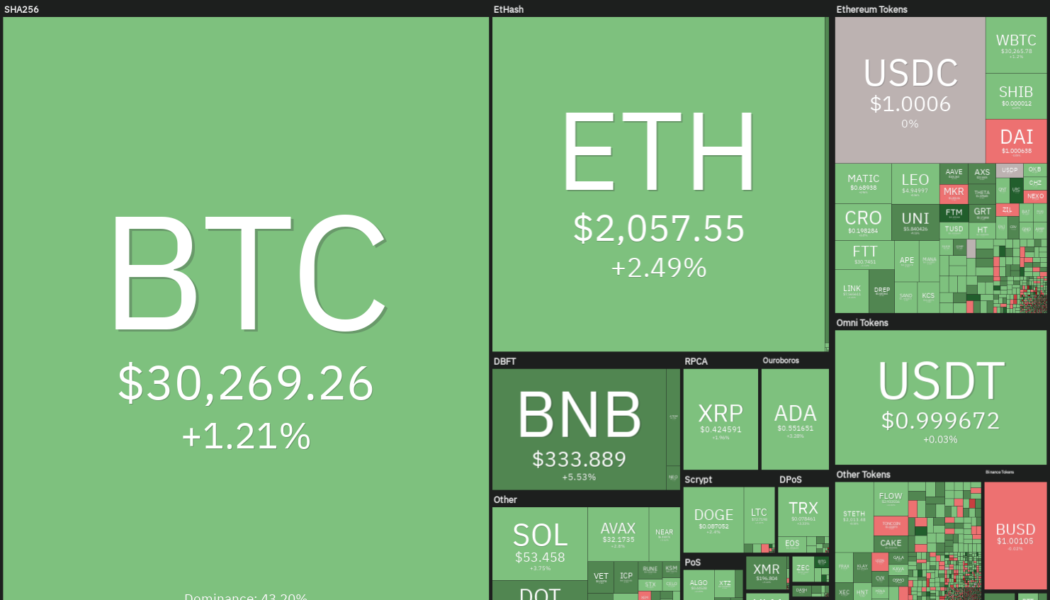

Bitcoin’s (BTC) current bear market is one of the worst, according to a report by on-chain analytics firm Glassnode. This was the first time in history that the Mayer Multiple slipped below the previous cycle’s low. Bitcoin’s fall below $20,000 on June 18 also marked the biggest loss ever booked by investors in a single day at $4.23 billion. Considering the above factors and a few other events, Glassnode believes that the capitulation in Bitcoin may have started. Bitcoin whales seem to have started their purchasing, suggesting that the bottom may be close and on June 25, analytics resource “Game of Trades” highlighted that demand from whales holding 1,000 to 10,000 Bitcoin witnessed a sharp spike in demand. Daily cryptocurrency market performance. Source: Coin360 Another sign t...

Price analysis 6/24: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, LEO

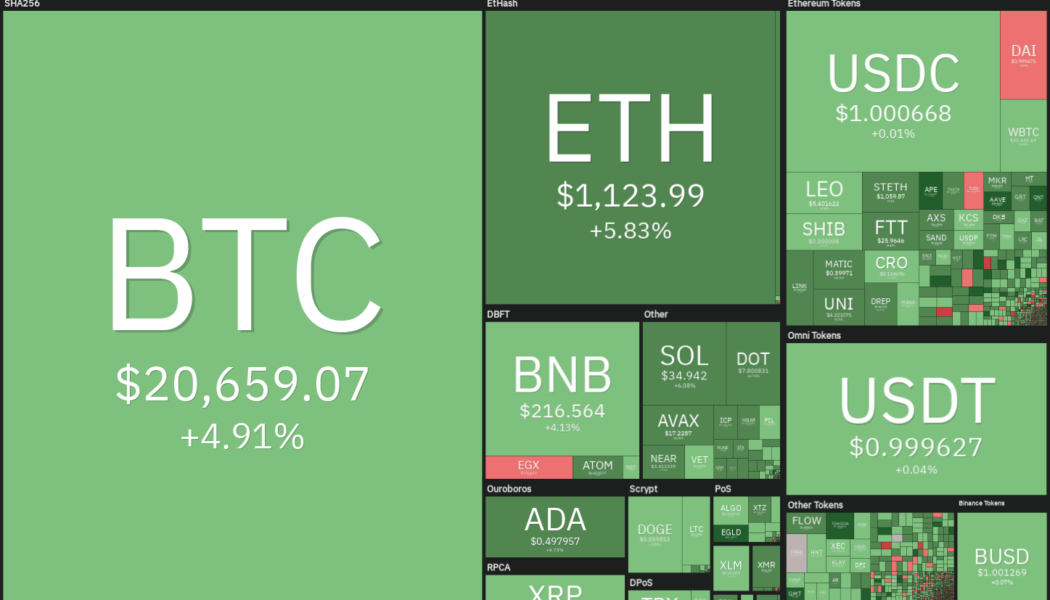

A handful of on-chain metrics suggest that Bitcoin could be close to bottoming, and if true, the eventual relief rally could induce sharp gains from altcoins. The United States equity markets and the cryptocurrency space are witnessing a relief rally this week. Supporting the rise in risky assets is the U.S. dollar index (DXY), which retreated from its multi-year high. Generally, cryptocurrencies move inverse to the price of the U.S. dollar, but this week’s bounce does not necessarily mean that bulls’ grip over the market has come to an end. Citing on-chain data, CryptoQuant senior analyst Julio Moreno, said that Bitcoin (BTC) miners may have already capitulated. Historical data suggests that miner capitulation usually precedes market bottoms. Daily cryptocurrency market perfor...

Price analysis 6/22: BTC, ETH, BNB, ADA, XRP, SOL, DOGE, DOT, LEO, SHIB

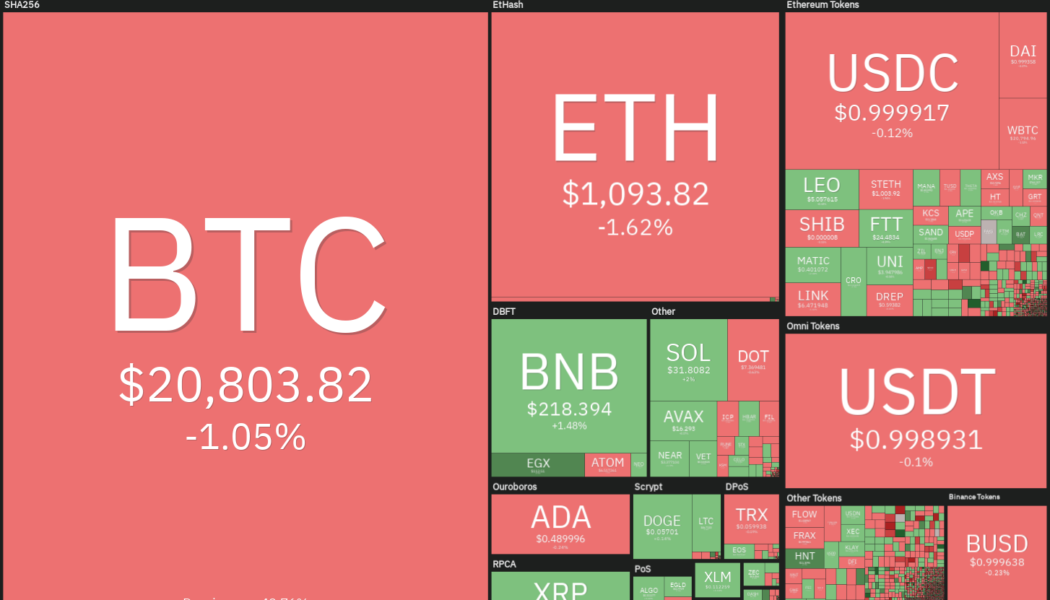

Bitcoin (BTC) continues to face a tough battle near the psychological level of $20,000 as the bulls and the bears attempt to assert their supremacy. Trading firm QCP Capital said in their latest market circular that funding rates on derivatives markets were stable and bearish conditions were fading. Another ray of hope for the Bitcoin bulls is that Bitcoin miners may be capitulating as the recent decline in the price has made some mining machines unprofitable. Data from Arcane Research shows that public Bitcoin mining companies that had only sold 30% of their mined production from January to April of this year had dumped 100% of their Bitcoin production in May. Some analysts believe that miners giving up was a bullish signal. Daily cryptocurrency market performance. Source: Coin360 However...

Price analysis 6/20: BTC, ETH, BNB, ADA, XRP, SOL, DOGE, DOT, LEO, AVAX

The crypto markets have been in a strong bear phase for the past several months but JPMorgan Chase analysts expect that to change and they have projected a significant upside from the current levels. The analysts cited the rising share of all stablecoins in the total crypto market for their bullish outlook. Unperturbed by the current fall, retail traders have been adding Bitcoin (BTC) to their portfolios. The number of wallet addresses holding one Bitcoin surged by 13,091 to a record high of 865,254. Similarly, the number of addresses holding about 0.1 Bitcoin has also witnessed a sharp rise in the past 10 days, according to data from Glassnode. Daily cryptocurrency market performance. Source: Coin360 Bitcoin’s sharp recovery from the June 18 fall shows strong buying at lower levels&n...

Price analysis 6/17: BTC, ETH, BNB, ADA, XRP, SOL, DOGE, DOT, LEO, AVAX

The sharp fall in cryptocurrencies has pulled the total crypto market capitalization below $900 billion. According to CoinGoLive, 72 out of the top 100 tokens have declined in excess of 90% from their all-time highs. In comparison, the top-10 coins have outperformed during the fall, dropping an average of 79% from their all-time high. Bitcoin (BTC) is down more than 70% from its all-time high but the bulls are struggling to arrest the decline. Jurrien Timmer, director of global macro of Fidelity, highlighted that Bitcoin could be “cheaper than it looks” considering the metric of price-to-network ratio, which is similar to the price-to-earnings ratio used in the equities market to value a stock. Daily cryptocurrency market performance. Source: Coin360 Billionaire investor Mark Cuban s...

Price analysis 6/13: BTC, ETH, BNB, ADA, XRP, SOL, DOGE, DOT, LEO, AVAX

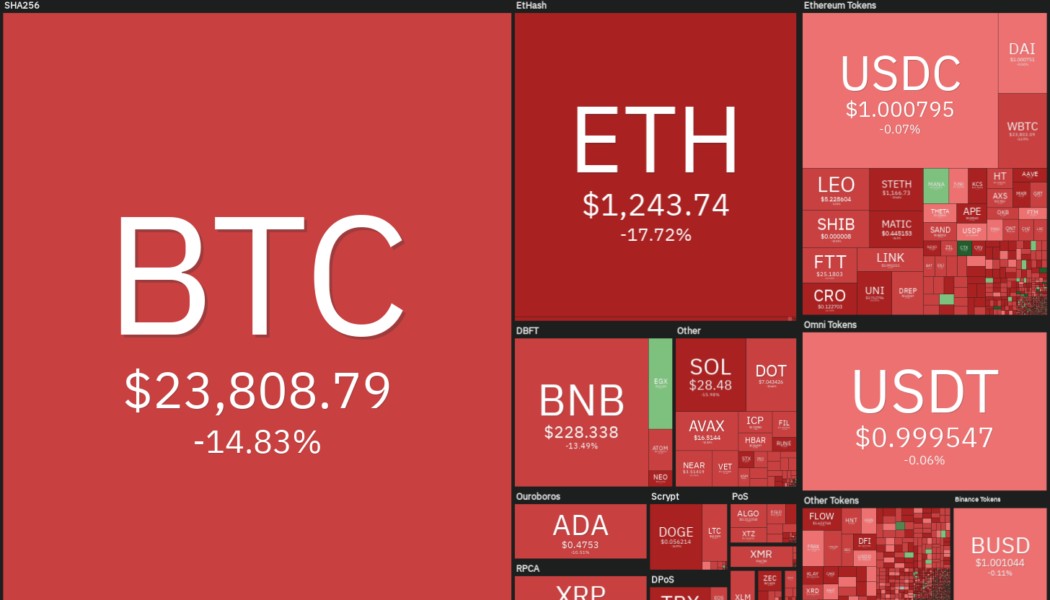

The United States equities markets extended their decline to start the week on June 13. The S&P 500 hit a new year-to-date low and dipped into bear market territory, falling more than 20% from its all-time high made on Jan. 4. The cryptocurrency markets are tracking the equities markets lower and the selling pressure further intensified due to the rumored liquidity crisis of major lending platform Celsius and traders possibly selling positions to meet margin calls. This pulled the total crypto market capitalization below $1 trillion. Daily cryptocurrency market performance. Source: Coin360 The sharp declines have led some analysts to project extremely bearish targets. While anything is possible in the markets and it is difficult to call a bottom, capitulations usually tend to sta...

Price analysis 6/10: BTC, ETH, BNB, ADA, XRP, SOL, DOGE, DOT, AVAX, SHIB

The United States equities markets tumbled on June 10 after the Consumer Price Index (CPI) report showed inflation soaring 8.6% from a year ago, the highest increase since 1981. The latest figures show that talks of inflation having peaked were premature and according to Bloomberg, investors are pricing in the key interest rate of 3% by the end of the year. Continuing its tight correlation with the S&P 500, Bitcoin (BTC) dipped below $30,000 on June 10. Analysts are still divided about the near-term price action but Fundstrat co-founder Tom Lee said in an interview with CNBC that Bitcoin may have already bottomed. However, Lee seems to have toned down his expectations as he said that Bitcoin could “remain flat for the year, possibly up.” Daily cryptocurrency market performance. So...

Ethereum 2.0 vs. the top Ethereum killers|The Market Report

“The Market Report” with Cointelegraph is live right now. On this week’s show, Cointelegraph’s resident experts give you the details about Ethereum 2.0, its main competitors, and how they differ from each other. To kick things off, we break down the latest news in the markets this week. Here’s what to expect in this week’s markets news breakdown: Bitcoin ‘Bart Simpson’ returns as BTC price dives 7% in hours: Bitcoin (BTC) price action failed to crack $32,000 and headed back to square one, sparking $60 million of long liquidations in the process. How much longer will we stay in the current price range? What is it going to take for Bitcoin to break out from here? Bad day for Binance with SEC investigation and Reuters exposé: The United States Securities and Exchange Commission...

Price analysis 5/30: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

After creating the dubious record of nine successive red weekly closes, Bitcoin (BTC) is attempting to make amends by starting a price recovery to end the losing streak. Analysts have repeatedly said that investors should not fear a bear market because it is one of the best times to invest in fundamentally strong projects in preparation for the next bull phase. CryptoQuant CEO Ki Young Ju highlighted that unspent transaction outputs (UTXOs) that are older than six months reflect 62% of the realized cap, which is similar to the level seen during the March 2020 crash. Hence, Ki said that Bitcoin may be close to forming a cyclic bottom. Daily cryptocurrency market performance. Source: Coin360 In the current bearish environment, it is difficult to fathom a Bitcoin rally to $250,000 ...

Polkadot parachains spike after the launch of a $250M aUSD stablecoin fund

Crypto prices have been exploring new lows for weeks and currently it’s unclear what it will take to reverse the trend. Despite the downtrend, cryptocurrencies within the Polkadot (DOT) ecosystem began to rally on May 24 and have managed to maintain gains ranging from 10% to 25%, a possible sign that certain sub-sectors of the market are on the verge of a breakout. Here’s a look at three Polkadot ecosystem protocols that have seen their token prices trend higher in recent days. Acala launches a $250 million aUSD ecosystem fund Acala (ACA) is the leading decentralized finance (DeF) platform on the Polkadot network, primarily due to the launch of aUSD, the first native stablecoin in the Polkadot ecosystem. Following the collapse of Terra’s LUNA and TerraUSD (UST), traders we...

Crypto funds under management drop to a low not seen since July 2021

Digital asset investment products saw $141 million in outflows during the week ending on May 20, a move that reduced the total assets under management (AUM) by institutional funds down to $38 billion, the lowest level since July 2021. According to the latest edition of CoinShare’s weekly Digital Asset Fund Flows report, Bitcoin (BTC) was the primary focus of outflows after experiencing a decline of $154 million for the week. The removal of funds coincided with a choppy week of trading that saw the price of BTC oscillate between $28,600 and $31,430. BTC/USDT 1-day chart. Source: TradingView Despite the sizable outflow, the month-to-date BTC flow for May remain positive at $187.1 million, while the year-to-date figure stands at $307 million. On a more positive note, the multi-asset cat...

Price analysis 5/23: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

The United States equity markets are attempting a recovery after weeks of relentless selling. Along similar lines, on-chain monitoring resource Material Indicators expects the crypto market to recover, but they anticipate Bitcoin (BTC) to spend some time in a range before “a real breakout.” The seven-day moving average of the on-chain transaction volume tracked by Glassnode hit a nine-month low on May 23. This suggests that Bitcoin’s lackluster price action in 2022 has led to reduced participation from traders. Daily cryptocurrency market performance. Source: Coin360 While signs of a short-term recovery are visible, a sustained recovery could be difficult because the macro conditions remain challenging. International Monetary Fund managing director Kristalina Georgieva wrote in a blog post...