Polkadot

Price analysis 8/12: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

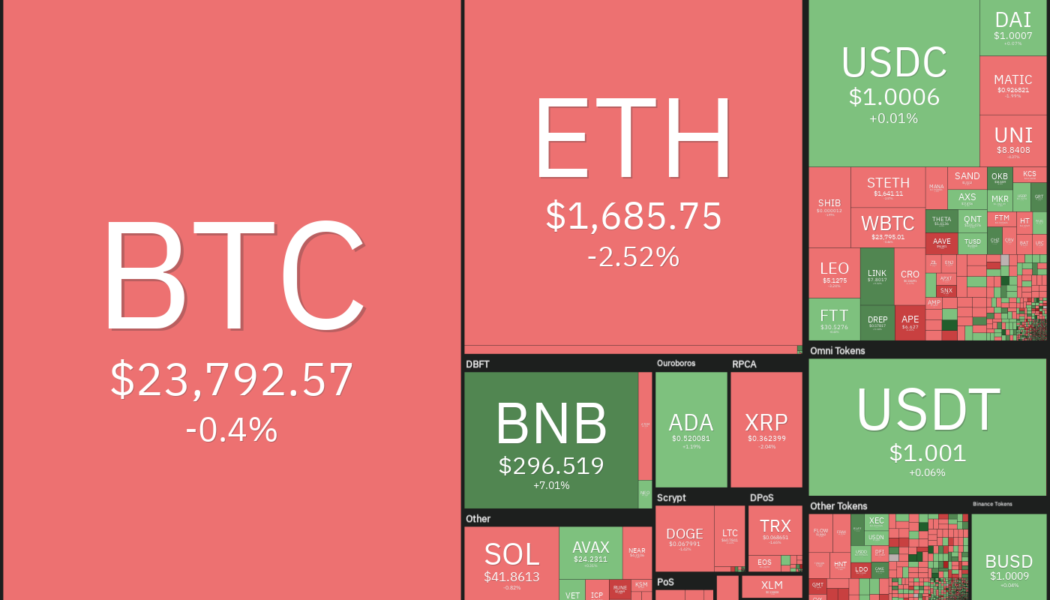

Bitcoin (BTC) could not overcome the barrier at $25,000 on Aug. 11 even though it had two catalysts in the form of a “favorable” Consumer Price Index print and news that BlackRock — the world’s largest asset manager, overseeing over $10 trillion in total assets — had launched a spot Bitcoin investment product. In comparison, Ether (ETH) has managed to hold on to its recent gains on news that the Goerli testnet had successfully activated proof-of-stake, clearing the path for Ethereum’s mainnet transition planned for Sept. 15 or 16. Data from Santiment shows that Ether whale transactions have increased along with possible whale accumulation. Daily cryptocurrency market performance. Source: Coin360 However, analysts remain divided about the prospects of the current rec...

Price analysis 8/5: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

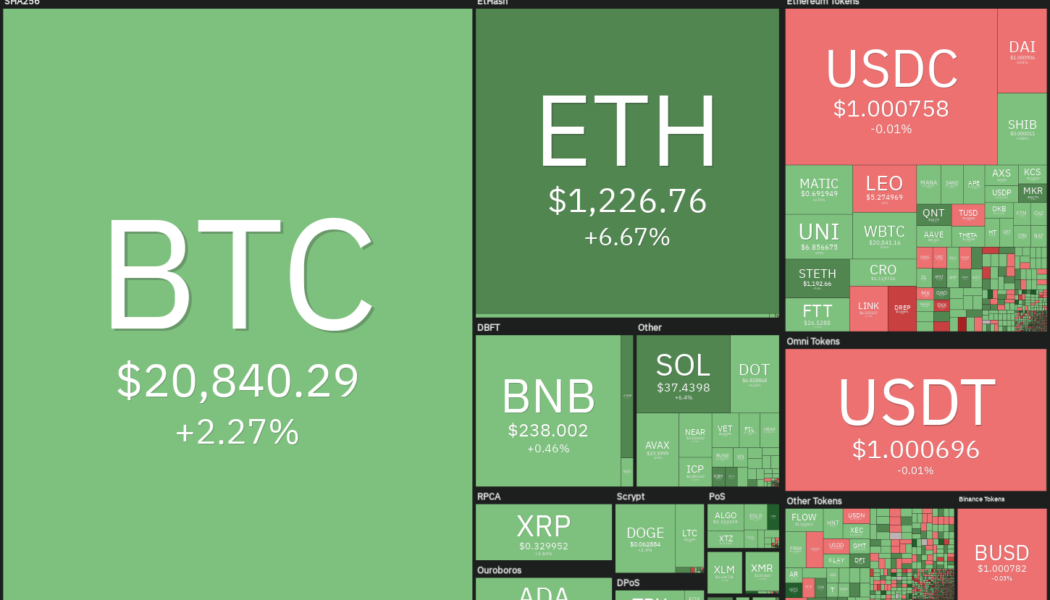

The United States Labor market added 528,000 jobs in July, much better than the 258,000 estimate. Wages saw growth of 5.2% year-over-year and 0.5% over the month. This suggests that inflation remains high and the U.S. Federal Reserve may continue with its rate hikes in the near future. After staying in close correlation with the U.S. equities markets for the past several months, the crypto space could be ready to chalk out a new course. Bloomberg Intelligence senior commodity strategist Mike McGlone and senior market structure analyst Jamie Coutts said in a recent report that Bitcoin (BTC) has started base building similar to the one seen near $5,000 in 2018–2019. They expect the recovery to decouple from stocks and behave more like U.S. “Treasury bonds or gold.” Daily cryptocu...

Price analysis 7/29: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

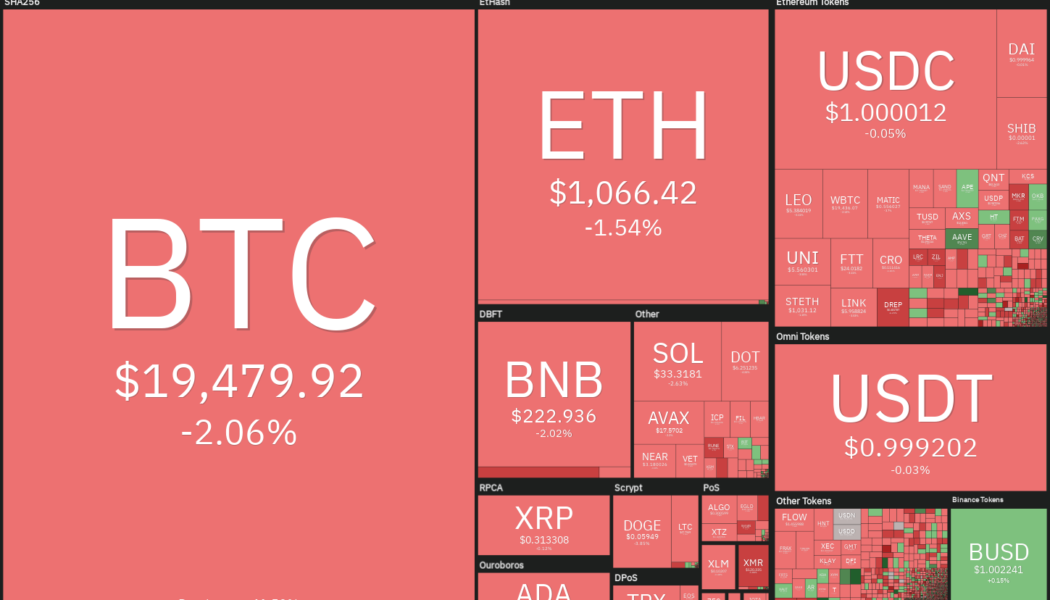

Bitcoin (BTC) hit a six-week high above $24,000 on July 29, extending its rally that picked up momentum after the United States Federal Reserve hiked rates by 75 basis points on July 27. If the rally sustains for the next two days, Bitcoin could be on target to close the month of July with gains of more than 20%, according to data from Coinglass. It is not only the crypto markets that have seen a post-Federal Open Market Committee (FOMC) rally. The U.S. equities markets are on track for big monthly gains in July. The S&P 500 and the Nasdaq Composite are up about 8.8% and 12% in July, on track to their best monthly gains since November 2020. Daily cryptocurrency market performance. Source: Coin360 The crypto and equities markets have risen in the expectation that the pace of rate hikes ...

Price analysis 7/25: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

Bitcoin (BTC) and most major altcoins are witnessing profit-booking on July 25 as the bulls scale back their positions before the Federal Open Market Committee meeting on July 26 through July 27. This indicates that the sentiment remains fragile and that bulls are not confident about carrying long positions into the event. Several analysts have retained their bearish view after Bitcoin failed to sustain above the 200-week moving average at $22,780. CryptoQuant contributor Venturefounder expects the selling to resume and Bitcoin to fall as low as $14,000 before a macro bottom is confirmed. Daily cryptocurrency market performance. Source: Coin360 The institutional investors seem to be absent from the markets and the recovery is being driven by the retail investors. Data from on-chain analyti...

Price analysis 7/22: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

In a downtrend, when markets do not respond negatively to bearish news, it is a sign that the selling may have reached exhaustion. Reports of electric vehicle maker Tesla dumping 75% of its Bitcoin (BTC) holdings in the second quarter only caused a minor blip as lower levels attracted strong buying from the bulls. Tesla was not the only institution that sold its Bitcoin. Arcane Research analyst Vetle Lunde highlighted in a Twitter thread that large institutions have sold 236,237 BTC since May 10. It is encouraging to note that even after huge selling by institutions and the unfavorable macro environment, Bitcoin has held up quite well. Daily cryptocurrency market performance. Source: Coin360 The current bear market allows an opportunity for new traders to enter at lower levels. A repo...

All ‘Ethereum killers’ will fail: Blockdaemon’s Freddy Zwanzger

Blockdaemon’s ETH ecosystem lead Freddy Zwanzger believes Ethereum will retain its leadership position in the crypto ecosystem over the coming years due to its utility as a smart contract platform and upgrades to the network following the Merge. Speaking to Cointelegraph during the Ethereum Community Conference (EthCC) this week, Zwanzger said: “It’ll continue to be a leader. I mean, obviously, the first and most important smart contract platform, and that’s not going to change.” Blockdaemon is an institutional-grade blockchain infrastructure platform that offers node operations and infrastructure tooling for blockchain projects. The Blockdaemon employee also took aim at so-called “Ethereum killers” — competing Layer 1 blockchains — which have tried to topple Ethereum fro...

Price analysis 7/20: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

Bitcoin (BTC) briefly extended its recovery above $24,000 and the altcoins continued to make smart gains on July 20, but the bullish momentum of the week experienced a brief setback after Tesla’s earnings report showed the company had sold 75% of its BTC position. Although the sharp breakout of this week is a positive sign, analysts were quick to point out that a sustained recovery depends on a strong performance from Wall Street. Analyst Venturefounder pointed out that the rally was largely macro-driven and Bitcoin’s correlation with NASDAQ remained at a historical high of 91%. Bitcoin’s sharp rally in the past few days has awakened hibernating bulls who are dishing out lofty targets. Analyst TechDev projected a target of $120,000 in 2023, while Galaxy Digital CEO Mike Novogratz tol...

Price analysis 7/18: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

Bitcoin (BTC) rose above $22,000 and Ether (ETH) traded above $1,500 on July 18, indicating that bulls are gradually returning to the cryptocurrency markets. This pushed the total crypto market capitalization above $1 trillion for the first time since June 13, raising hopes that the worst of the bear market may be behind us. In another positive sign, more than 80% of the total Bitcoin supply denominated in the United States dollar has been dormant for at least three months, according to crypto intelligence firm Glassnode. During previous bear markets, such an occurrence preceded the end of the bear phase. Daily cryptocurrency market performance. Source: Coin360 However, a report by Grayscale Investments voices a different opinion. It suggests that the current bear market in Bitcoin started...

Price analysis 7/15: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

The recovery in the cryptocurrency markets is being led by Bitcoin (BTC), which has risen above the $21,000 level. However, BlockTrends analyst Caue Oliveira said that on-chain data shows a decline in “whale activity” since the month of May, barring the flurry of activity during the Terra (LUNA) — since renamed Terra Classic (LUNC) — collapse. A survey conducted in China shows that most participants believe that Bitcoin could fall much further. About 40% of the participants said they would buy Bitcoin if the price dropped to $10,000. Only 8% of the voters showed interest in buying Bitcoin if it drops to $18,000. Daily cryptocurrency market performance. Source: Coin360 Millionaire investor Kevin O’Leary told Cointelegraph that crypto markets are likely to witness “massive volatility” and en...

Price analysis 7/13: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, LEO

The United States Consumer Price Index soared to 9.1% in June, exceeding expectations of an 8.8% rise year-on-year. Currently, the Fed funds futures point to an 81 basis points rate hike for July, suggesting that some participants anticipate a 100 basis points hike. Several on-chain indicators have been pointing to a likely bottom in Bitcoin (BTC) but the analysts from market intelligence firm Glassnode are not convinced that the low has been made. In “The Week On-Chain” report on July 11, the analysts said that the market may have to fall further “to fully test investor resolve, and enable the market to establish a resilient bottom.” Daily cryptocurrency market performance. Source: Coin360 While the short term remains bearish, strategists are confident about its long-term prospects. ...

Price analysis 7/4: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, LEO, SHIB

The crypto markets have remained relatively stable over the weekend and on July 4, which is a holiday for the United States financial markets due to Independence Day. Although Arthur Hayes, former CEO of derivatives platform BitMEX, was expecting a “mega crypto dump” around July 4, it has not materialized. The drop in Bitcoin’s (BTC) volatility in the past few days has resulted in the squeezing of the Bollinger Band’s width. This indicates a possible increase in volatility in the next few days, according to popular analyst Matthew Hyland. Daily cryptocurrency market performance. Source: Coin360 Meanwhile, crypto investors seem to be waiting for clues from the U.S. equities markets and the U.S. dollar. Bitcoin’s correlation coefficient with the dollar in the week ending July 3 slumped to 0....

Price analysis 7/1: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, LEO, SHIB

Bitcoin dropped 56.2% in the second quarter of 2022, according to crypto analytics platform Coinglass. That makes it Bitcoin’s worst quarter since the third quarter of 2011 when BTC price fell by 67%. A large part of the damage was done in the month of June when Bitcoin plunged 37%, the worst monthly drawdown since September 2011. It is not all gloom and doom for crypto investors. On June 29, JPMorgan strategist Nikolaos Panigirtzoglou said that the “Net Leverage metric” suggests that crypto’s deleveraging may be on its last legs. The eagerness of crypto companies with stronger balance sheets to bail out crypto firms in distress is also a positive sign. Daily cryptocurrency market performance. Source: Coin360 Another positive view on Bitcoin came from Deutsche Bank analysts. In a recent re...