Peer-to-peer lending

Cred Protocol unveils its first decentralized credit scores

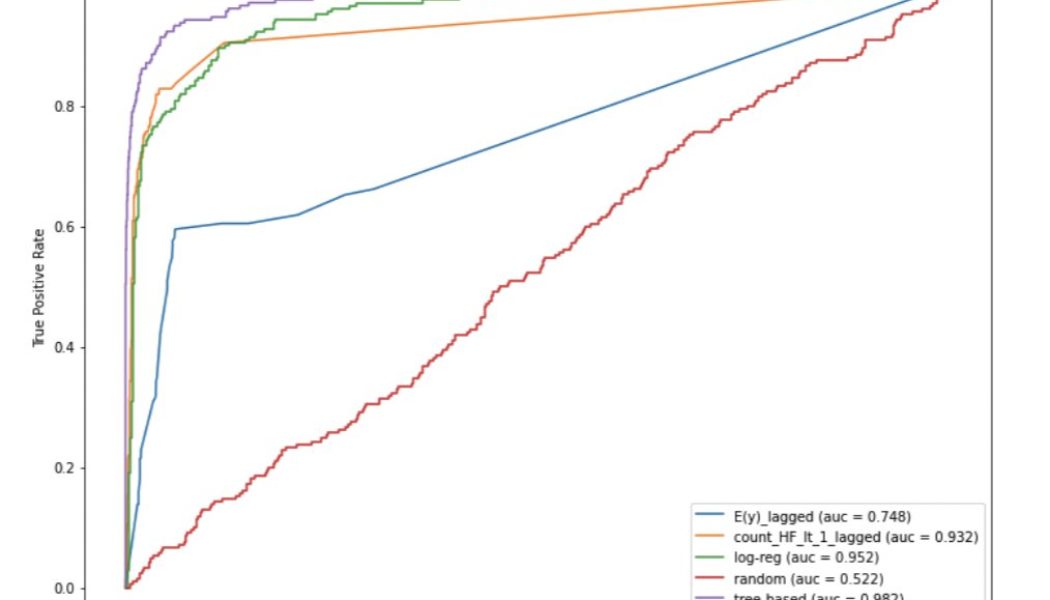

Cred Protocol, a decentralized credit scoring startup has unveiled the results of its first automated credit scoring system for users of decentralized finance (DeFi). Cred Protocol CEO Julian Gay outlined the results in a Twitter thread, which showed how Cred successfully utilized past transaction behavior on the Aave protocol to assess the creditworthiness of future borrowers based on on-chain behavior in the DeFi space. 1/ Over the last few months, we’ve been working to build one of the first credit scores for DeFi. Today, we’re excited to share the results of our first credit score with the world! Read more below — Julian Gay (@juliangay) July 14, 2022 By using machine learning to assess time-based account attributes and analyze the user’s past transaction behavior, Cred Pro...

UNI, MATIC and AAVE surge after Bitcoin price bounces back above $20K

Crypto investors found cause for celebration on July 14 as the market experienced a positive trading session just one day after the Consumer Price Index (CPI) posted a June print of 9.1%, its highest level since 1981. Daily cryptocurrency market performance. Source: Coin360 The move higher in the market wasn’t entirely unexpected for seasoned traders who have become familiar with a one to two-day bounce in asset prices following the most recent CPI prints. These traders also know there’s nothing to get too excited about as the bounces have typically been followed by more downside once people realize that the high inflation print is a negative development. Nevertheless, the green in the market is a welcome sight after the rough start to 2022. Top 5 coins with the highest 24-hour price...

Here are 3 ways hodlers can profit during bull and bear markets

For years, cryptocurrency advocates have touted the world-changing capability of digital currency and blockchain technology. Yet with the passing of each market cycle, new projects come and go, and the promised utility of these “real-world use case” projects fails to satisfy. While a majority of tokens promise to solve real-world problems, only a few achieve this, and the others are mere speculative investments. Here’s a look at the three things cryptocurrency investors can actually “do” with their coins. Lending Perhaps the simplest use case offered to cryptocurrency holders is also one of the oldest monetary applications in finance: lending. Ever since the decentralized finance (DeFi) sector took off in 2020, the opportunities available for crypto holders to lend out their tokens in exch...

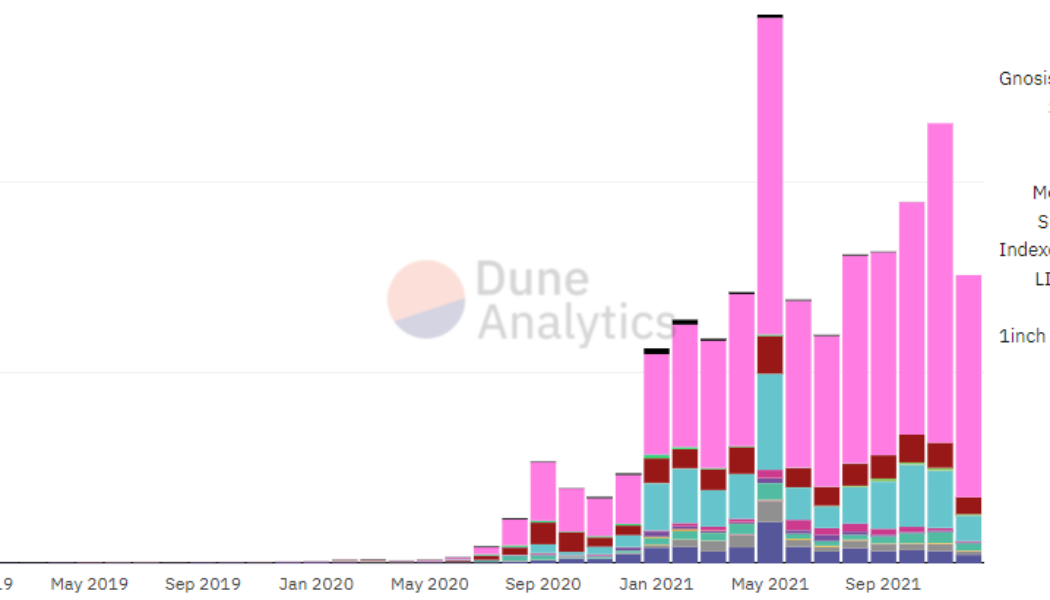

5 cryptocurrency projects that made waves in 2021

2021 was a breakout year for the cryptocurrency market in many respects and most investors are absolutely thrilled that Bitcoin (BTC) price established a new all-time high of $68,789. In the same timeframe, Ether (ETH) went on a parabolic rally which saw its price gain 565% from Jan. 1 to hit a record high at $4,859 on Nov. 10. While it was a banner year for large cap cryptocurrencies, some of the biggest gains and most impactful developments came from the altcoin market where decentralized finance (DeFi) and nonfungible tokens (NFTs) rallied by thousands of percent and helped to usher in a new level of awareness and adoption for blockchain technology and cryptocurrencies. Here’s a look at five altcoin projects that made significant contributions to the cryptocurrency ecosystem in 2021. Un...