Payments

What are the top social tokens waiting to take off? | Find out now on The Market Report

“The Market Report” with Cointelegraph is live right now. On this week’s show, Cointelegraph’s resident experts discuss the social tokens you should be keeping a close eye on. But first, market expert Marcel Pechman carefully examines the Bitcoin (BTC) and Ether (ETH) markets. Are the current market conditions bullish or bearish? What is the outlook for the next few months? Pechman is here to break it down. Next up: the main event. Join Cointelegraph analysts Benton Yaun, Jordan Finneseth and Sam Bourgi as each makes his case for the top social token. First up, we have Bourgi with his pick of STEEM, the native token of the Steem social blockchain network, which rewards users for content creation. Its aim is to give back value to content creators who contribute on the platform. Although is ...

ECB, Eurosystem begins experimental prototyping of digital euro customer interface

Progress will continue on the development of the digital euro as the European Central Bank (ECB) and Eurosystem have begun looking for companies to participate in an exercise to prototype customer-facing payments services. Payment service providers, banks and other relevant companies were invited to express interest in the project in an announcement released Thursday. Eurosystem, which comprises the ECB and the national central banks of countries that use the euro, stated that it will select up to five front-end providers on the basis of their capabilities and the use cases they present. While participants are not required to have previous experience with the service they will prototype, experience will be considered in the selection process. The prototype providers will be expected to dev...

Takeaways and reviews, what went down during Miami Tech Week

Miami Tech Week took place last week in the South Florida city as part of April’s Tech Month programming, which also included NFT Miami and the Bitcoin 2022 conference earlier in the month. Tech Week kicked off with the eMerge Americas conference and the myriad of panel discussions scheduled throughout the city that followed. Cointelegraph gathered some key insights from thought leaders who participated, and the two main themes are Miami as a hot spot for crypto folks, and crypto as a disruptor of the investment landscape. eMerge Americas is a venture-backed organization with a mission to position Miami as the tech hub of North and South America. Its signature event since 2014 has been the annual tech conference, which features a startup pitch competition. After a two-year hiatu...

Crypto is going mainstream: Here’s how the future founders will build on it

Crypto has long been criticized for its lack of inherent value. However, the shift toward contactless transactions amid the pandemic has emphasized the value of digital currencies and blockchain technology in the modern world. For this reason, merchants have been slow to adopt cryptocurrencies as a form of payment. As it gains widespread usage, however, we can expect to see more businesses accepting crypto in the future. The global pandemic has changed the way a lot of us do business. The shift away from cash and face-to-face transactions toward digital cashless ones has introduced many people to the convenience of paying digitally. So, it’s no surprise that crypto is starting to gain traction as a viable payment option — one that will only continue to evolve. While sti...

Top Latin America delivery app to accept crypto

Rappi, the most popular delivery service in Latin America, is working with Bitso and Bitpay to accept Bitcoin (BTC) and other cryptocurrency payments. As reported by Cointelegraph Brazil, Rappi is integrating with Bitso and Bitpay through a trial project in Mexico. However, it’s unclear whether the pilot plan will also enable access to the service in Brazil and other Latin American countries. In Mexico, Rappi, a Colombian delivery app with operations in nine Latin American countries, has launched a crypto payments pilot program. Customers will be able to convert crypto into credits that can subsequently be used to complete purchases on Rappi’s platform. — Crypto Goddy (@CryptoGoddy) April 12, 2022 Sebastián Mejia, the co-founder and president of Rappi, noted that cryptocurrenci...

Dozens of VIP backers invest $87M into crypto payment startup MoonPay

In November 2021, MoonPay announced a $555 million Series A financing round that brought the crypto payment platform’s valuation to $3.4 billion. On Wednesday, the fintech company revealed that $87 million of the total $555 million came collectively from more than 60 public figures and celebrities in the music, sports, media and entertainment industries. While the Series A round was led by firms like Tiger Global Management and Coatue with participation from Blossom Capital, Thrive Capital, Paradigm and NEA, the following household names are also considered strategic investors: Gwyneth Paltrow, Maria Sharapova, Eva Longoria, Gal Gadot, Matthew McConaughey and Bruce Willis. Other “industry VIPs” like Ashton Kutcher, Justin Bieber, Snoop Dogg, Paris Hilton and Steve A...

New crypto card by Nexo allows users to pay without selling Bitcoin

Major cryptocurrency loan company Nexo has officially launched a crypto-backed Mastercard card enabling users to pay for services with cryptocurrencies like Bitcoin (BTC) without selling their crypto. Nexo has partnered with Mastercard and the peer-to-peer payment startup DiPocket to launch the Nexo Card, a crypto card allowing cardholders to use their crypto as collateral rather than selling it, the firm announced to Cointelegraph on Wednesday. The card is linked to a Nexo-provided, crypto-backed credit line allowing to use of multiple assets as collateral, including but not limited to Bitcoin, Ether (ETH) and the Tether (USDT) stablecoin. “The Nexo Card functions through Nexo’s crypto-backed credit lines, which means that funds for your purchases come from your available credit lin...

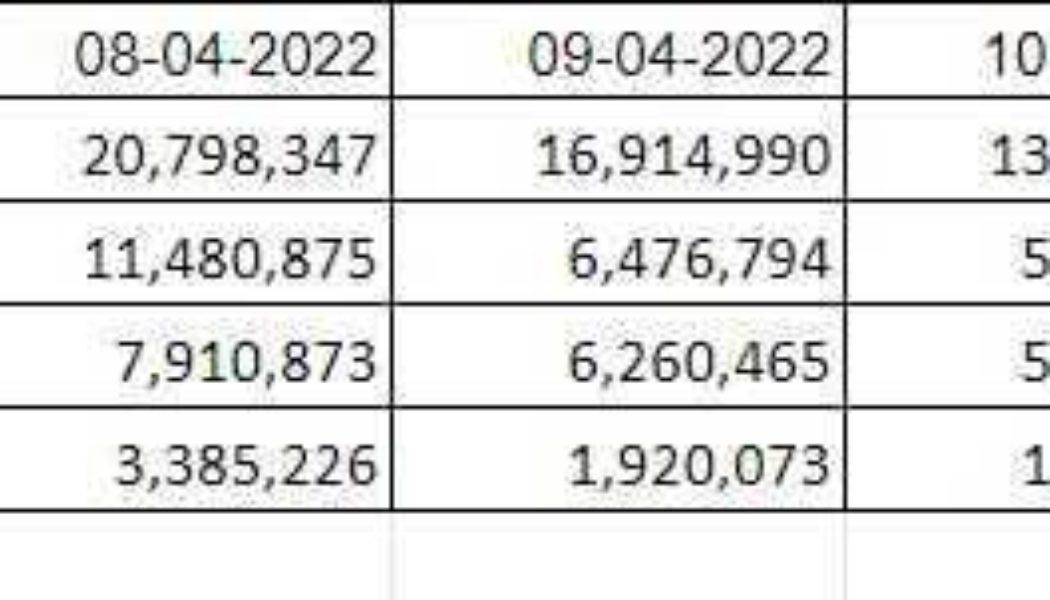

Indian crypto exchanges’ volume plunges down as 30% tax goes into effect

Fresh data on Indian crypto exchanges’ trading volume reveals a significant decline in trading practices among Indians just ten days after the tax rule implementation. India’s new 30% crypto tax rule came into effect on April 1, despite many stakeholders and exchange operators warning against its ill effects. A research data report shared by Indian blockchain analytic firm Crebaco with Cointelegraph shows that trading volume on top Indian crypto exchanges has declined as high as 70% in the past 10 days. Crypto Trading Volume on Major Indian Exchanges Source: Creabaco The trading volume on WazirX, the leading crypto exchange in India, declined from $47.8 million on April 1 to $13.2 million on April 10. CoinDCX’s trading volume dropped from $12.16 million to $5.76 million, ...

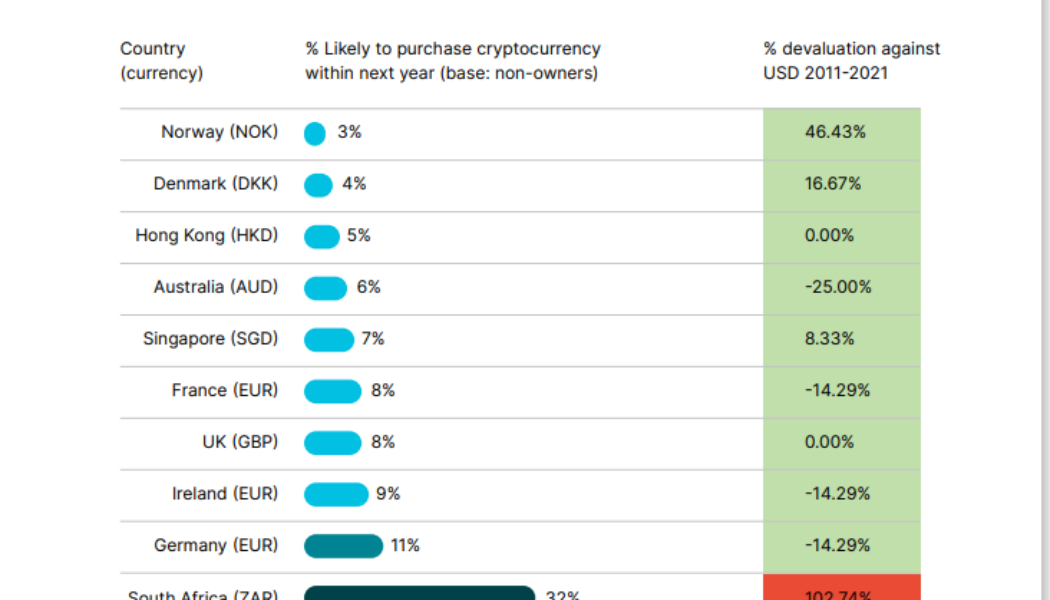

Crypto seen as the ‘future of money’ in inflation-mired countries

Last year, cryptocurrencies reached a “tipping point,” according to Gemini’s 2022 Global State of Crypto report, “evolving from what many considered a niche investment into an established asset class.” According to the report, 41% of crypto owners surveyed globally purchased crypto for the first time in 2021, including more than half of crypto owners in Brazil at 51%, Hong Kong at 51% and India at 54%. The study, based on a survey of 30,000 adults in 20 countries over six continents, also made a strong case that inflation and currency devaluation are powerful drivers of crypto adoption, especially in emerging market (EM) countries: “Respondents in countries that have experienced 50% or more devaluation of their currency against the USD over the last 10 years were more than 5 times as...

Mastercard files 15 metaverse and NFT related trademarks

Payments giant Mastercard has filed 15 nonfungible token (NFT) and metaverse trademark applications with the United States Patent and Trademark Office, or USPTO. Highlights of the filings include plans for a virtual community for interacting with digital assets, the processing of payment cards in the Metaverse, an online marketplace for buyers and sellers of downloadable digital goods, virtual reality events and more. One trademark filing for the company’s “Priceless” slogan consists of multimedia files such as artwork, text, audio and video that are authenticated by NFTs. Another application illustrates plans for its red and yellow “Circles” logo to process card transactions used for payment of goods and services in the Metaverse and other virtual worlds. An additional patent &...

‘I’ve never paid with crypto before’: How digital assets make a difference amid a war

The ongoing conflict in Ukraine has become a stress test for crypto in many tangible ways. Digital assets have emerged as an effective means of directly supporting humanitarian efforts, and the crypto industry, despite enormous pressure, has largely proved itself a mature community — one ready to comply with international policies without compromising the core principles of decentralization. But there is another vital role that crypto has filled during these tragic events: It is becoming more and more familiar to those who have found themselves cut off from the payment systems that had once seemed unfailing. Traditional financial infrastructures don’t usually work well during military confrontations and humanitarian crises. From hyperinflation and cash shortages to the destruction of ATMs,...

Sweden’s central bank completes second phase of e-krona testing

The Swedish central bank’s digital currency project, a proposed CBDC, known as the e-krona has successfully finished its second phase of trials. According to Riksbank, the nation’s central bank, the asset is now technically ready to be integrated into banking networks and facilitate transactions. During the second phase of the e-krona pilot project — which began in February 2021 — the CBDC was investigated on the matter of its technical ability to function within the country’s existing digital banking infrastructure. Participating banks included Handelsbanken and Tietoevry. The report indicated that the e-krona could indeed be successfully exchanged for fiat money and used in transactions, both online and offline. This phase of testing also brought legal clarity to the project ...