Payments

Tether fortifies its reserves: Will it silence critics, mollify investors?

There is an old Arabic proverb: “The dogs bark, but the caravan moves on.” It could summarize the journey to date of Tether (USDT), the world’s largest stablecoin. Tether has been embroiled in legal and financial wrangling through much of its short history. There have been lawsuits over alleged market manipulation, charges by the New York State attorney general that Tether lied about its reserves — costing the firm $18.5 million in fines in 2021 — and this year, questions voiced by United States Treasury Secretary Janet Yellen as to whether USDT could maintain its peg to the U.S. dollar. More recently, investment short sellers “have been ramping up their bets against Tether,” the Wall Street Journal reported on June 27. But, Tether has weathered all those storms and seems to keep mov...

Tether fortifies its reserves: Will it silence critics, mollify investors?

There is an old Arabic proverb: “The dogs bark, but the caravan moves on.” It could summarize the journey to date of Tether (USDT), the world’s largest stablecoin. Tether has been embroiled in legal and financial wrangling through much of its short history. There have been lawsuits over alleged market manipulation, charges by the New York State attorney general that Tether lied about its reserves — costing the firm $18.5 million in fines in 2021 — and this year, questions voiced by United States Treasury Secretary Janet Yellen as to whether USDT could maintain its peg to the U.S. dollar. More recently, investment short sellers “have been ramping up their bets against Tether,” the Wall Street Journal reported on June 27. But, Tether has weathered all those storms and seems to keep mov...

It seems NFT-themed Bored & Hungry restaurant no longer accepts crypto

The Los Angeles Times reported Friday that recently opened NFT-themed burger joint Bored & Hungry no longer accepts cryptocurrency as a form of payment for its food. When questioned, one Bored & Hungry employee told the Los Angeles Times “Not today — I don’t know.” The individual didn’t give any indication of when the decision was made to cut crypto from the menu of payment options, nor did they know if crypto payments would be making a return. Bored & Hungry initially launched back in April of this year. At the time, one worker told the Los Angeles Times that the majority of its customers didn’t seem to care about crypto payment options, also noting that customers were generally indifferent to “the restaurant’s fidelity to the crypto cause.” Another Bored & Hungry restaura...

Taxes of top concern behind Bitcoin salaries, Exodus CEO says

Major cryptocurrency wallet provider Exodus continues paying its employees in Bitcoin (BTC) despite the ongoing bear market, with the total market cap dropping below $1 trillion on Monday. Since launching its software crypto wallet back in 2015, Exodus has been paying its staff 100% in BTC, Exodus co-founder and CEO JP Richardson told Cointelegraph. The company continued to pay all its 300 employees in BTC even during major market downturns, by providing monthly payroll based on their salary in U.S. dollars. “For example, if Bitcoin is $30,000 per token, and someone makes $15,000 a month, they’ll get half a Bitcoin on the first of that month,” Richardson noted. In addition to converting each salary to BTC each month, Exodus also adds a small percentage to every “paycheck” to account for th...

Taxes of top concern behind Bitcoin salaries, Exodus CEO says

Major cryptocurrency wallet provider Exodus continues paying its employees in Bitcoin (BTC) despite the ongoing bear market, with the total market cap dropping below $1 trillion on Monday. Since launching its software crypto wallet back in 2015, Exodus has been paying its staff 100% in BTC, Exodus co-founder and CEO JP Richardson told Cointelegraph. The company continued to pay all its 300 employees in BTC even during major market downturns, by providing monthly payroll based on their salary in U.S. dollars. “For example, if Bitcoin is $30,000 per token, and someone makes $15,000 a month, they’ll get half a Bitcoin on the first of that month,” Richardson noted. In addition to converting each salary to BTC each month, Exodus also adds a small percentage to every “paycheck” to account for th...

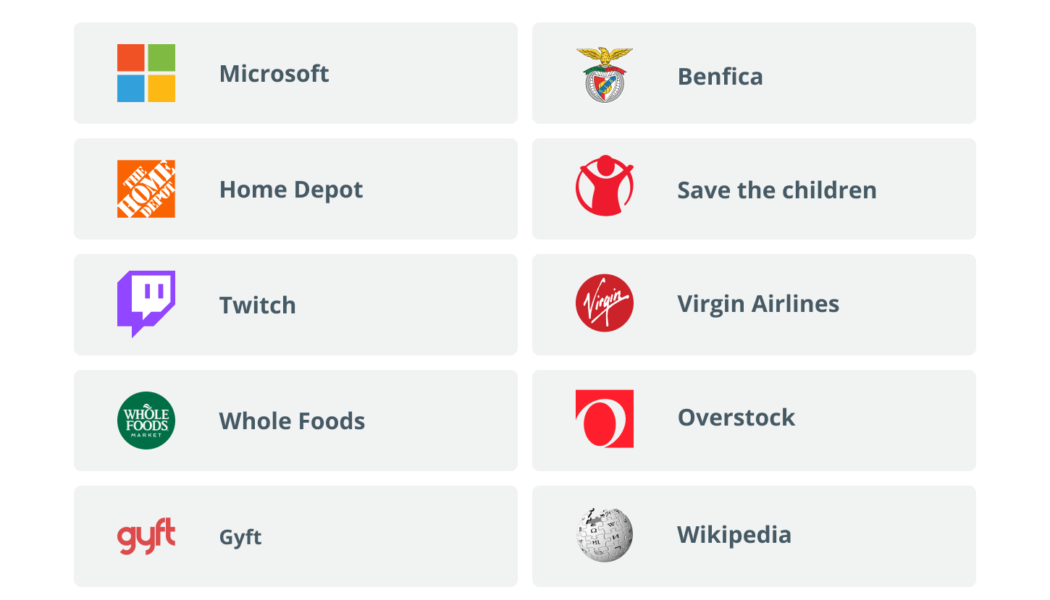

Who accepts Bitcoin as payment?

This is a list of some of the biggest places that accept Bitcoin, such as Microsoft and Whole Foods. First, we’re going to take a look at businesses that accept Bitcoin. There are some early adopters, but most of them recently started to accept payments using this digital currency. These major companies are the ones where you can pay via Bitcoin: Microsoft Microsoft is one of the early adopters of BTC, as they started accepting payments with Bitcoin in 2014. Users could buy games and applications with digital currencies, but digital coins were far from usual back then, so Microsoft stopped accepting BTC in 2016 and once again in 2018 due to high volatility. We’re eight years into the future, and now it’s way more usual and trustworthy to pay with dig...

SpaceX to follow Tesla in accepting DOGE payments for merch: Elon Musk

Just four months after EV manufacturer Tesla started accepting Dogecoin (DOGE) for merchandise purchases, Elon Musk announced his plan to extend the payment option for his space exploration company, SpaceX. Musk, the CEO of SpaceX and Tesla, has been a staunch supporter of the DOGE ecosystem since 2019 and has since publicly revealed interest in accepting meme coin payments across his multibillion-dollar enterprises. Tesla merch can be bought with Doge, soon SpaceX merch too — Elon Musk (@elonmusk) May 27, 2022 Historically, Musk’s pro-Dogecoin tweets have had an immediate and positive impact on DOGE’s market prices as investors try to cash in on the hype. However, the recent revelation about SpaceX’s plan to accept DOGE payments for merchandise had no significant effect on the price...

Falling Bitcoin price doesn’t affect El Salvador’s strategy: ‘Now it’s time to buy more,’ reveals Deputy Dania Gonzalez

Dania Gonzalez, Deputy of the Republic of El Salvador, was recently in Brazil to reveal her country’s experiences with the decision to adopt Bitcoin (BTC) as legal tender. Gonzalez’s invitation to Brazil came from digital influencer Rodrix Digital, who was recently in El Salvador to produce a documentary about cryptocurrencies. Among the lawmaker’s activities in Brazil was attending Bitconf 2022, as well as meeting with Dape Capital CEO Daniele Abdo Philippi and Ana Élle, CEO of Agency ROE. Between her agendas, Gonzalez spoke with Cointelegraph and revealed how Bitcoin has helped to change people’s lives in El Salvador and how the federal government, led by President Nayib Bukele, has been taking advantage of the resources invested in BTC to improve the economy. El Salvador jus...

Partying in Davos with Cointelegraph: Crypto card payments accepted

With the World Economic Forum (WEF) Annual Meeting drawing to a close, attendees had the opportunity to join Cointelegraph for a farewell party at Ex Bar in Davos — where they could actually pay for food and drinks using cryptocurrency. The annual meeting of the World Economic Forum is scheduled to take place between May 22–26, with a slew of world leaders expected to attend. What role will blockchain have at the event? https://t.co/wEtEvuVK5I — Cointelegraph (@Cointelegraph) May 20, 2022 Early partygoers had the opportunity to win one of 20 cards loaded with up to 100 Davos Coins, which are pegged one-for-one with the Swiss franc. The winners enjoyed a seamless checkout experience using a new hardware wallet with the look and feel of a regular credit card. Powered by German crypto c...

Rising global adoption positions crypto perfectly for use in retail

Even though the cryptocurrency market seems to be going through a bit of a lull at the moment, there’s no denying the fact that the industry has grown from strength to strength over the last few years, especially from an adoption perspective. To this point, a recent study revealed that the number of adults in the United States using digital assets for everyday purchases will increase by 70% by the end of the year when compared to 2021, with the metric rising from 1.08 million to 3.6 million users. The study’s chief author suggests that as the crypto market’s volatility continues to reduce — thanks to the growing use of stablecoins and central bank digital currencies (CBDCs) — more and more people will look at these offerings as a legitimate means of payment. In fact, by the end of 20...

Indian central bank’s ‘informal pressure’ disrupted payments: Coinbase CEO

Just three days after debuting in the Indian market, United States-based crypto exchange Coinbase abruptly stopped using United Payments Interface (UPI), the most popular payment service in the region. Coinbase CEO Brian Armstrong later revealed that the service disruption was due to an “informal pressure” from India’s central bank. During Coinbase’s 2022 Quarterly Earnings call, Armstrong spoke about the company’s global expansion plans while acknowledging Coinbase’s role in starting the conversation with regulators related to crypto adoption. When asked about the impact of the recent disruption related to offering payment services in India, Armstrong stated: “So a few days after launching, we ended up disabling UPI because of some informal pressure from the Reserve Bank of Indi...