Payments

Crypto Biz: $43T bank enters crypto — Probably nothing, right?

As crypto traders debate whether Bitcoin (BTC) is going to $25,000 or $15,000 first, the world’s largest financial institutions are laying the groundwork for mass adoption. The proverbial floodgates are unlikely to open before the United States provides a clear regulatory framework for crypto, but regulators and industry insiders are confident that guidance could come in 2023 at the earliest. In the meantime, megabanks like BNY Mellon, whose roots date back to 1784, are entering the space. This week’s Crypto Biz chronicles BNY Mellon’s foray into digital assets, JPMorgan’s ongoing experimentation with blockchain technology and Crypto.com’s new European headquarters. BNY Mellon, America’s oldest bank, launches crypto services Arguably the biggest story of the week was news of another ...

EU regulators ban cross-border payments from Russian crypto accounts

In a statement released on Oct. 6, the European Union introduced another set of sanctions against Russia due to the prolonged and recently escalated conflict in Ukraine. The new sanctions include a complete ban on cross-border crypto payments between Russians and the EU. This statement includes the prohibition of, “all crypto-asset wallets, accounts, or custody services, irrespective of the amount of the wallet.” New sanctions were installed as a response to Russia’s annexation of Ukrainian territory as the result of what the EU calls a “sham” referendum, along with troop mobilization and threats of nuclear escalation. The previous sanctions capped crypto payments from Russian to EU wallets at 10,000 euros (approximately $9,900). However, this new total ban on cross-border crypto...

Russia unlikely to choose Bitcoin for cross-border crypto payments: Analysis

Despite Russia pushing the idea of using cryptocurrencies for cross-border payments, the specific digital asset the government plans to adopt for such transactions still remains unclear. Russian authorities are quite unlikely to approve the use of cryptocurrencies like Bitcoin (BTC) for cross-border transactions, according to local lawyers and fintech executives. Bank of Russia needs to control cross-border transactions That Russia would allow Bitcoin or any other similar cryptocurrency to be usefor cross-border payments is “highly questionable” because such assets are “hard to control,” according to Elena Klyuchareva, the senior associate at the local law firm KKMP. Klyuchareva emphasized that the draft amendments to the legislation on cross-border crypto payments are not...

Crypto Biz: DID you see what Africa is doing with Web3?

If you’ve spent any time reading about blockchain and Web3, you know that this industry is filled with big buzzwords and half-baked concepts. But, concepts such as decentralized identity services, or DIDs, bring real meaning and utility to Web3. If you haven’t yet wrapped your mind around DID, it refers to a self-owned, independent identity that enables trusted data exchange. In other words, it puts digital identity management and administration directly in your hands instead of some third party’s. In this week’s Crypto Biz, we take a look at a Web3 partnership designed to bring DID-powered payment solutions to Africa. We also chronicle Maple Finance, the European Central Bank and Nasdaq. Payments platform Fuse integrates ChromePay to bring DID services to Africa Is Web3 even possibl...

Hearing: Alternative payments’ threat to national security goes far beyond crypto

Non-crypto alternative payment systems pose a serious threat to United States security, according to testimony presented at a U.S. House Financial Services Committee Subcommittee on National Security, International Development, and Monetary Policy hearing Tuesday. The alternative payments ecosystem should be seen as a whole, and crypto can enhance national security, speakers said. Wilson Center fellow Scott Dueweke told the U.S. House Financial Services subcommittee in written testimony, “By focusing only on cryptocurrencies we risk missing the forest for the trees.” Money services businesses are heavily regulated in the United States, but those based outside the country may be unwilling to conform to U.S. requirements, including Know Your Customer/Anti-Money Laundering, and they may...

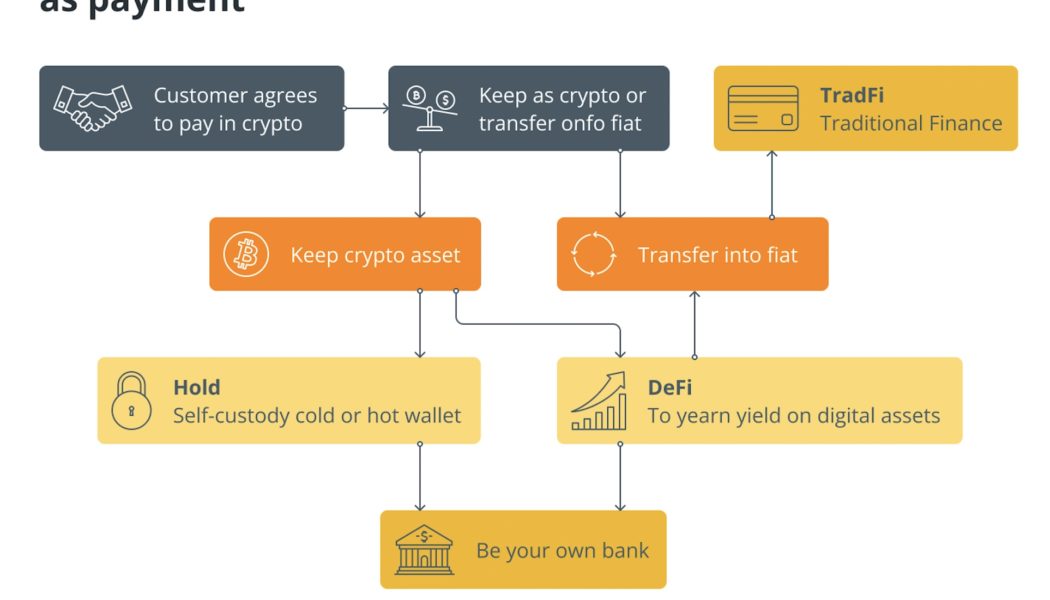

Business owners should get off PayPal and move to the blockchain

Do you believe that in five years every second transaction in e-commerce will be settled on blockchain? No? Well, that’s what people thought of plastic credit cards versus cash a few decades ago when it came to traditional stores. There is no doubt that Web3 will drastically transform the way e-commerce operates. Using cryptocurrency payments in e-commerce stores will become just as common as accepting PayPal, Klarna, Visa or Mastercard. Stores that don’t adapt their e-commerce platforms to accept cryptocurrencies will soon find themselves out of business. How Web3 has changed the e-commerce landscape Thanks to the converging forces of Web3 — blockchain, decentralized finance (DeFi), AI and machine learning — new, smart algorithms can analyze and adapt to provide user-centric experie...

US Treasury report encourages instant payment, recommends more CBDC research

United States President Joe Biden ordered more than a dozen reports to be written when he released his Executive Order (EO) 14067 “Ensuring Responsible Development of Digital Assets.” Five had due dates within 90 days, and the last three were published simultaneously by the Treasury Department on Sept. 16. The reports were prepared in response to instructions in Sections 4, 5 and 7 of the EO. The report ordered in EO Section 4 is titled “The Future of Money and Payments.” The report looks at the several payment systems currently in use that are operated by the Federal Reserve or the Clearing House, which is owned by a group of major banks. These will be supplemented by the non-blockchain FedNow Service instant payment system that is expected to begin operating in 2023. Stablecoins are intr...

Binance partners with Ukrainian supermarket chain to accept crypto through Pay Wallet.

Binance announced Friday that it has partnered with the Ukrainian supermarket chain VARUS, saying it will enable cryptocurrency payments for grocery purchases through its Binance Pay Wallet. The grocery store is one of the largest companies in Ukraine with over 111 stores across 28 cities in the country. The company said that this partnership will allow its customers to access instant cryptocurrency payments and fast delivery in 9 cities in Ukraine, namely; Kyiv, Dnipro, Kamianske, Kryvyi Rih, Zaporizhzhia, Brovary, Nikopol, Vyshhorod, and Pavlograd. The companies have also announced a “reward fund promotion”, where customers who order anything from the VARUS Delivery program worth over UAH 500 and pay with Binance Pay, will be rewarded with UAH 100. A month ago, a Ukrainian POS...

Bank of Russia agrees to legalize crypto for cross-border payments: Report

The Bank of Russia, the country’s central bank, has reportedly admitted that cross-border payments in crypto are inevitable in the current geopolitical conditions. The Russian central bank has been rethinking the approach to regulating crypto and agreed with the finance ministry to legalize crypto for cross-border payments, the local news agency TASS reported on Monday. Deputy finance minister Alexei Moiseev reportedly said that the Bank of Russia and the finance ministry expect to legitimize cross-border payments in crypto soon. Moiseev outlined the importance of enabling local crypto services in Russia, noting that many Russians rely on foreign platforms to open a crypto wallet. “It is necessary to do this in Russia, involving entities supervised by the central bank, which are obliged to...

Who accepts Ethereum as payment?

Taking payment in Ethereum brings in a gamut of advantages for both users and entrepreneurs. Transitioning to a blockchain-based ecosystem brings in a string of advantages for users as well as entrepreneurs. Here is a drop-down detailing why accepting payment in Ethereum works well for the customers of an enterprise: Additional payment option In a world that is fast adopting cryptocurrencies, providing customers with an additional payment option gives businesses an advantage over their competitors. Cryptocurrency gateways enable merchants to accept digital payments and receive the amount in fiat. Transparency A decentralized ecosystem is inherently transparent, giving customers more confidence while making the purchase. Crypto transactions get executed on a blockchain where they are writte...

Brazilian payment app PicPay launches crypto exchange with Paxos

Major Brazilian payment application PicPay is moving into cryptocurrencies by integrating a crypto exchange service allowing users to buy Bitcoin (BTC) and Ether (ETH). The firm officially announced on Wednesday that PicPay clients can now buy, sell and store two major cryptocurrencies, BTC or ETH, directly on its app. PicPay pointed out that its choice was due to the real use cases provided by these digital assets, including security and many other benefits. The firm stated: “Blockchain technology, which is behind coins like Bitcoin and Ethereum, is already used in the real estate sector, the insurance industry and even the art market, through non-fungible tokens.” The new crypto feature is enabled through a partnership with the major crypto company Paxos and allows customers to use Paxos...

Technicals suggest Bitcoin is still far from ideal for daily payments

It is no secret that a vast majority of investors, both from the realm of traditional as well as crypto finance, view Bitcoin (BTC) as a long-term store of value akin to “digital gold.” And, while that may be the dominant narrative surrounding the asset, it is worth noting that in recent years the flagship crypto’s use as a medium of exchange has been on the rise. To this point, recently, the central bank of El Salvador revealed that its citizens living abroad have sent over $50 million in remittances to their friends and family. To elaborate, Douglas Rodríguez, president of El Salvador’s Central Reserve Bank, announced that $52 million worth of BTC remittances had been processed via the country’s national digital wallet service Chivo through the first five months of the year alone, markin...