Pantera Capital

Crypto Biz: The Voyager Digital auction is over — What now?

Voyager Digital filed for Chapter 11 bankruptcy in July after its exposure to the toxic Three Arrows Capital led to its ultimate downfall. This week, rumblings of a Voyager Digital auction surfaced, with Cointelegraph breaking the story on the afternoon of Sept. 26 after a reputable source confirmed the parties involved. A few hours later, a winner was announced: crypto exchange FTX US. But, not everyone is convinced that Voyager’s depositors will be taken care of. This week’s Crypto Biz chronicles the bidders involved in the Voyager Digital auction. It also documents the resignation of a disgruntled crypto boss and major funding plans from a blockchain-focused hedge fund. FTX US wins auction for Voyager Digital’s assets Cointelegraph reported this week that crypto exchanges FTX, Binance a...

Pantera plans to raise $1.25B for second blockchain fund: Report

Dan Morehead, founder and CEO of Pantera Capital, reportedly said the hedge fund was planning to raise $1.25 billion for a second blockchain fund. According to a Sept. 28 Bloomberg report, Morehead said Pantera aimed to close the blockchain fund by May. The fund will reportedly invest in digital tokens and equity in an effort to appeal to institutional investors. “We want to provide liquidity for people that are kind of giving up because we’re still very bullish for the next 10 or 20 years,” said the Pantera CEO, according to the report. Pantera Capital is seeking $1.25 billion for its second blockchain fund, founder Dan Morehead says https://t.co/H5AXy55hqa — Bloomberg Crypto (@crypto) September 28, 2022 Launched in 2013, Pantera was one of the first crypto funds in the United States at a...

Crypto Biz: An eye-opening chat with Mr. Wonderful, April 7–13, 2022

The past seven days have reminded me of how lucky I am to have forged a career in the Bitcoin (BTC) and cryptocurrency industry. Cointelegraph sent a contingency of reporters to the Bitcoin conference in Miami, where we got to chop it up with billionaires, business leaders and hedge fund managers. I had the privilege of sitting down with Canadian businessman and Shark Tank star Kevin O’Leary, who actually revealed most of his crypto portfolio. I also got to interview Bloomberg’s senior commodity strategist Mike McGlone, who shed light on crypto market volatility, as well as Mark Yusko of Morgan Creek Capital. Yusko and I laughed at traditional 60/40 portfolio strategies, and I got to ask him a curious question: Who in their right mind is buying bonds today? This week’s Crypto Biz giv...

Crypto funds register largest weekly inflows since December

Inflows into cryptocurrency investment funds rose sharply last week, offering cautious optimism that investors are broadening their exposure to digital assets despite geopolitical uncertainty and monetary tightening from central banks. Digital asset investment products registered $127 million worth of cumulative inflows for the week ending March 6, according to CoinShares data. A CoinShares representative told Cointelegraph that this was the highest weekly inflows since Dec. 12, 2021. The increase was also significantly higher than the $36 million of inflows registered the previous week. Like in previous weeks, Bitcoin (BTC) products recorded the largest weekly inflows at $95 million. Bitcoin fund flows have increased for seven consecutive weeks. Ether (ETH) funds saw inflows totaling $25 ...

NFT infrastructure startup Rarify raises $10M from Pantera Capital

NFT infrastructure startup Rarify has raised $10 million in Series A funding from Pantera Capital at a valuation of $100 million. The backing from Pantera Capital appears significant as the company is one of the top venture capital firms in crypto. One of Rarify’s primary offerings is an NFT-commerce-focused application programming interface (APIs) that enables firms to launch and integrate user-friendly marketplaces in their platforms. The API also allows minting and porting NFTs between different blockchains. Speaking with Forbes on March 3, Rarify co-founder Revas Tsivtsivadze stated that the company aims to simplify NFT buying and selling similarly to “how Square made it super easy to accept payments.” Tsivtsivadze highlighted the check-out process of marketplaces such as OpenSea, whic...

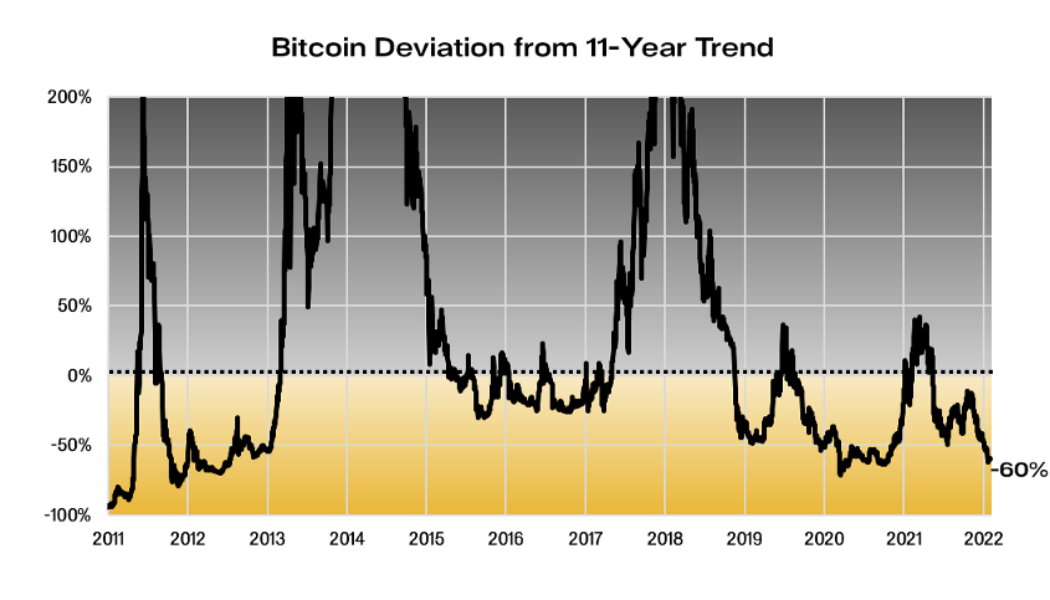

Crypto ‘best place’ to store wealth during Fed rate hike: Pantera CEO

The CEO and founder of leading blockchain venture fund Pantera Capital, Dan Morehead, stated that digital assets will be the “best place” to store capital following the potential fallout of interest rate hikes from the U.S. Federal Reserve. Investors across stock and crypto markets are currently fixated on the direction the Fed might take to combat rising inflation which topped 7.5% as of this month. Bitcoin and crypto markets have often moved in correlation to trends in the stock market, however, Morehead argued in his Feb. 16 newsletter that bonds, stocks, and real estate will cop the brunt of the Fed‘s “massive policy U-turn,” in relation to hiking interest rates. Despite the crypto market suffering a downturn since late 2021, the CEO suggested that digital assets will be the “best plac...