Options

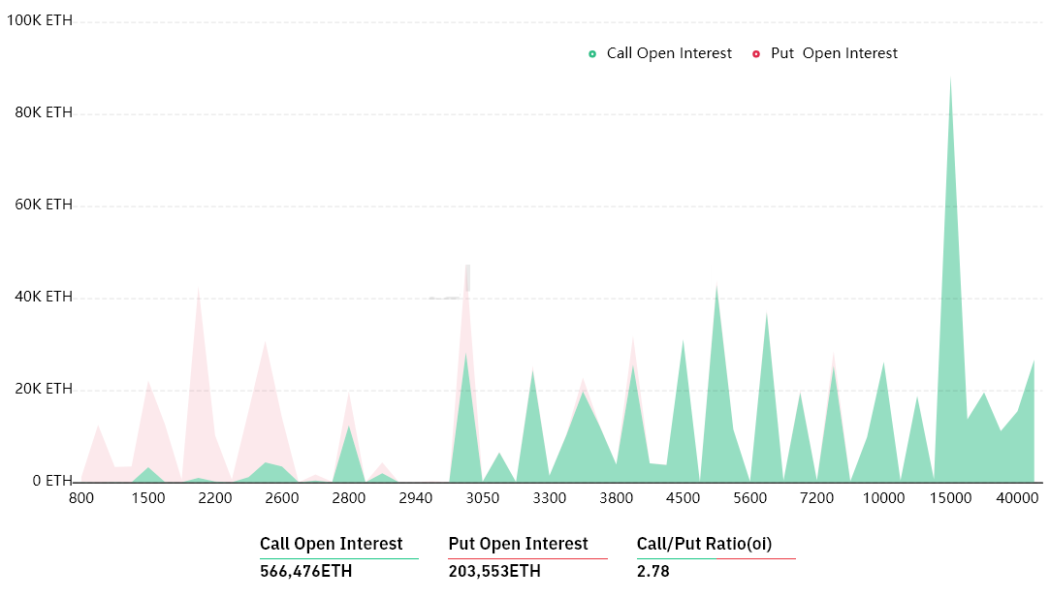

Pro traders turn into bears after Ethereum price dropped to $3,200

After a 42% rally over a three-week period, Ether (ETH) peaked at $3,580 on April 3 and since then, a 12% correction to $3,140 has taken place. Tech giants launching their own smart contract platforms and regulatory uncertainty might have impacted investors’ sentiment and derivatives metrics also show worsening conditions that confirm professional traders’ shift toward a bearish sentiment. Ether/USD price at FTX. Source: TradingView On April 6, the Financial Times reported that Meta is reportedly planning to introduce virtual currency and lending services. This move is aimed at exploring alternative sources of revenue for Facebook, WhatsApp, Instagram and Messenger. United States Senator Pat Toomey, the ranking member of the Senate Banking Committee, also drafted a bill proposing a r...

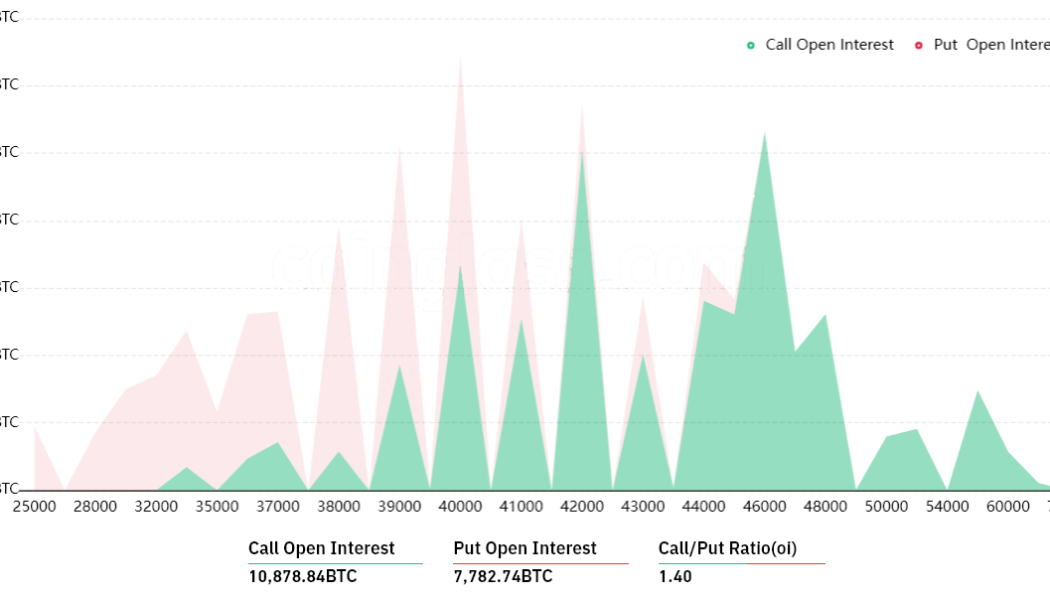

Bitcoin price drops to $43.5K, but data and BTC’s market structure project strength

Bitcoin (BTC) has been struggling to break the $47,000 resistance and even with April 6’s drop below $44,000, there is still mounting evidence that the market structure is healthy. On Dec. 3, 2021, Bitcoin initiated a 25.6% correction that lasted 18 hours and culminated with a $42,360 low. Four months later, the price remained 18% below the $56,650, closing on Dec. 2, 2021. Much has changed over that period, and hard evidence comes from other sections of the sector. Between February 15 and April 2, 2022, enterprise software development firm MicroStrategy announced the acquisition of 4,197 Bitcoin. Inflows to Canadian Bitcoin exchange-traded funds (ETFs) also hit an all-time high, according to data from Glassnode. These investment vehicles in Canada have increased their holdings by 6,...

Pro traders curb their enthusiasm until Ethereum confirms $3,400 as support

Ether (ETH) price jumped 11% between March 26 and March 29 to reach $3,480, which is the highest level in 82 days. Currently, the price is down 9% year-to-date but does data support the belief that the altcoin has resumed its uptrend toward a new all-time high? Institutional investors seem excited that the CoinShares Digital Asset Fund Flows Weekly Report revealed on Tuesday that the exchange-listed crypto products inflows reached the highest level in three months. Data showed that investment products for digital assets saw net deposits of $193 million last week. At the same time, the Office of Science and Technology Policy, an executive office of the President of the United States, launched a study to offset energy use related to digital assets. Furthermore, on March 9, U.S. Preside...

Terra’s Bitcoin purchase and BlackRock comments back ETH’s surge to $3.1K

Ether (ETH) bulls have a few good reasons to celebrate the 20% gain between March 14 and March 24. The price increase surprised many and led to the first daily close above $3,000 in 34 days. Even with this move, Marc’s $2.4 billion Ether options expiry is somewhat uncertain because bears can easily profit by pushing the price below $3,000. In a letter to shareholders, Larry Fink, the CEO of BlackRock, the world’s largest asset manager, noted that the global socio-political crisis and growing inflation could make way for a global digital payment network. Moreover, cryptocurrency investors turned bullish after Terra co-founder Do Kwon reconfirmed plans for the giant $10-billion BTC allocation. On March 24, the third tranche of Tether (USDT) left a wallet thought to hold fun...

Here’s why Bitcoin bulls will defend $42K ahead of Friday’s $3.3B BTC options expiry

Over the past two months, Bitcoin (BTC) has respected an ascending triangle formation, bouncing multiple times from its support and resistance lines. While this might sound like a positive, the price is still down 11% year-to-date. As a comparison, the Bloomberg Commodity Index (BCOM) gained 29% in the same period. Bitcoin/USD 1-day chart at FTX. Source: TradingView The broader commodity index benefited from price increases in crude oil, natural gas, corn, wheat and lean hogs. Meanwhile, the total cryptocurrency market capitalization was unable to break the $2 trillion resistance level and currently stands at $1.98 trillion. In addition to 40-year record high inflation in the United States, a $1.5 trillion spending bill was approved on March 15, enough to fund the government through Septem...

Bitcoin bulls to defend $40K leading into Friday’s $760M options expiry

Over the past two months, Bitcoin (BTC) has respected a slightly ascending trend, bouncing multiple times from its support. Even though that might sound positive, Bitcoin’s performance year-to-date remains a lackluster negative 14%. On the other hand, the Bloomberg Commodity Index (BCOM) gained 2% in the same period. Bitcoin/USD 1-day candle chart. Source: TradingView The broader commodity index benefited from price increases in crude oil, natural gas, gold, corn, and lean hogs. Worsening macroeconomic conditions pressured the supply curve, which, in turn, shifted the equilibrium price toward a higher level. Moreover, the United States approved a $1.5 trillion spending bill on March 15 that funds the government through September. President Joe Biden’s signing of the legislation...

How professional Ethereum traders place bullish ETH price bets while limiting losses

Being bullish on Ether (ETH) over the past four months did not pay off as its price dropped 44% from $4,600. The decentralized finance (DeFi) applications growth that fueled the rally faded away, partially due to network congestion and average transaction fees of $30 and higher. The cool-off period can also be attributed to excessive expectations as the fee burn mechanism implemented in August 2021 with the London hard fork. After drastically reducing the daily net issuance, investors jumped to the conclusion that Ether would become “ultrasound money.” The Ethereum network burned more ETH over the last 24 hours than was issued by both the PoW (eth1) and PoS (eth2) networks. This is the first time this has happened since EIP-1559 went live less than 3 months ago. ETH is ultra so...

Softer-than-expected crypto regulation and stocks’ rebound position Bitcoin for a $42K close

Bitcoin (BTC) bulls jumped in to defend the $40,000 level after a devastating retest of the $38,000 support on March 7. The confidence and momentum that was building up earlier in the month was suddenly shattered after BTC failed to break $44,500 for the third time this month on March 2. The Bitcoin price rally on March 9 has partially been attributed to this week’s expected United States inflation data report. Analysts expect another 40-year record high as the consumer price index (CPI) reaches 7.9% yearly gains. Furthermore, a statement from the U.S. Treasury Secretary Janet Yellen on President Biden’s executive order on digital assets was somewhat milder than expected. Although deleted from the website, the order will apparently call for “a coordinated and comprehensive approach to digi...

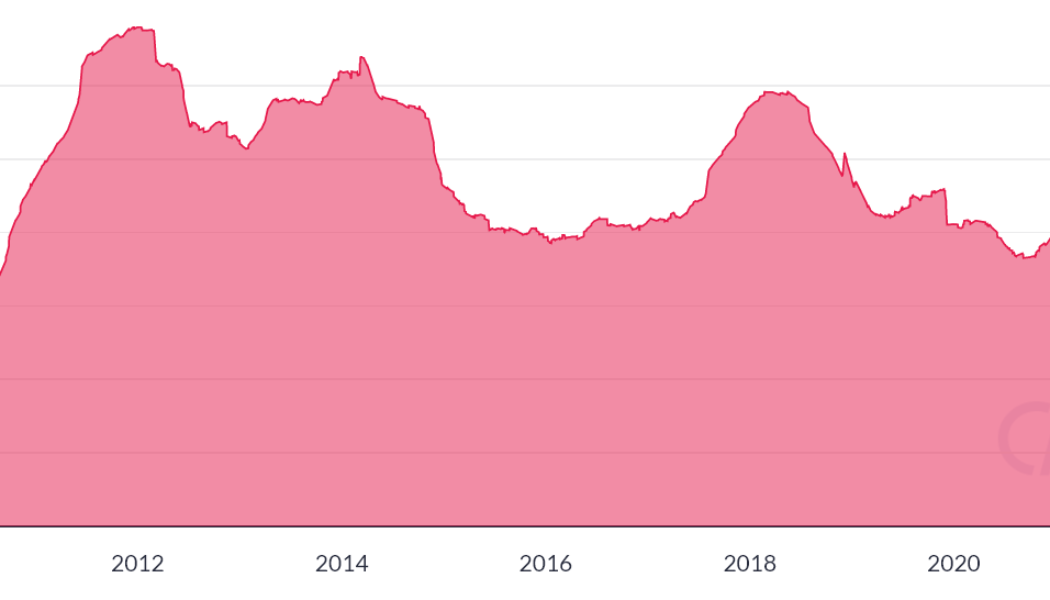

Bitcoin’s sub-$40K range trading and mixed data reflect traders’ uncertainty

The phrase “hindsight is 20/20” is a perfect expression for financial markets because every price chart pattern and analysis is obvious after the movement has occurred. For example, traders playing the Feb. 28 pump that took Bitcoin (BTC) above $43,000 should have known that the price would face some resistance. Considering that the market had previously rejected at $44,500 on multiple instances, calling for a retest below $40,000 made perfect sense, right? Bitcoin/USD at Coinbase. Source: TradingView This is a common fallacy, known as “post hoc” in which one event is said to be the cause of a later event merely because it had occurred earlier. The truth is, one will always find analysts and pundits calling for continuation and rejection after a significant price move. Usually ...

Here’s a clever options strategy for cautiously optimistic Bitcoin traders

Bitcoin (BTC) entered an upward channel in early January and despite the sideways trading near $40,000, order book analysts cited “significant buying pressure” and noted that the overall negative sentiment might be heading towards exhaustion. Bitcoin/USD price at FTX. Source: TradingView Independent analyst Johal Miles noted that BTC’s price formed a bullish hammer candlestick on its daily chart on Jan. 24 and Feb. 24, hinting that the longer-term downtrend is close to an end. However, the rally above $41,000 on Feb. 28 was unable to create strong demand from Asia-based traders, as depicted by the lack of a China-based peer-to-peer Tether (USDT) premium versus the the official U.S. dollar currency. Currently, there is positive news coming from the...

Ethereum price moves toward $3K, but pro traders choose not to add leverage

Even though Ether (ETH) price bounced over 20% from the $2,300 low on Feb. 22, derivatives data shows that investors are still cautious. To date, Ether’s price is down 24% for the year, and key overhead resistances lay ahead. Ethereum’s most pressing issue has been high network transaction fees and investors are increasingly worried that this will remain an issue even after the network integrates its long-awaited upgrades. For example, the 7-day network average transaction fee is still above $18, while the network value locked in smart contracts (TVL) decreased 25% to $111 billion between Jan. 1 and Feb. 27. This negative indicator could partially explain why Ether has been down-trending since early February. Ether/USD price at FTX. Source: TradingView The above channel current...

LAX ft Ayra Starr – Options

Don’t miss this brand new single from L.A.X he calls “Options”. Nigerian singer L.A.X returns to the music space with a special song titled “Options” teams up with Mavin Records songstress Ayra Starr to deliver a memorable piece. The new single “Options” is Lax’s first music for the year and it is an awesome tune dedicated to his fans as a new year special. “Options” definitely deserves a spot on your playlist, production credit goes to ATG Musick. Listen and L.A.X ft Ayra Starr – “Options” below. [embedded content]