Options

$15.5K retest is more likely, according to Bitcoin futures and options

Bitcoin (BTC) has been trading near $16,500 since Nov. 23, recovering from a dip to $15,500 as investors feared the imminent insolvency of Genesis Global, a cryptocurrency lending and trending company. Genesis stated on Nov. 16 that it would “temporarily suspend redemptions and new loan originations in the lending business.” After causing initial mayhem in the markets, the firm refuted speculation of “imminent” bankruptcy on Nov. 22, although it confirmed difficulties in raising money. More importantly, Genesis’ parent company Digital Currency Group (DCG) owns Grayscale — the asset manager behind Grayscale Bitcoin Trust, which holds some 633,360 BTC. Contagion risks from the FTX-Alameda Research implosion continue to exert negative pressure on the markets, but the industry is w...

3 major mistakes to avoid when trading crypto futures and options

Novice traders are usually drawn to futures and options markets due to the promise of high returns. These traders watch influencers post incredible gains, and at the same time, the multiple advertisements from derivatives exchanges that offer 100x leverage are at times irresistible for most. Although traders can effectively increase gains with recurring derivatives contracts, a few mistakes can quickly turn the dream of outsized gains into nightmares and an empty account. Even experienced investors in traditional markets fall victim to issues particular t cryptocurrency markets. Cryptocurrency derivatives function similarly to traditional markets because buyers and sellers enter into contracts dependent on an underlying asset. The contract cannot be transferred across different excha...

3 striking similarities with past Bitcoin price bottoms — But there’s a catch

Bitcoin (BTC) has been consolidating inside the $18,000–$20,000 price range since mid-June, pausing a strong bear market that began after the price peaked at $69,000 in November 2021. Many analysts have looked at Bitcoin’s sideways trend as a sign of a potential market bottom, drawing comparisons from the cryptocurrency’s previous bear markets that show similar price behaviors preceding sharp bullish reversals. Here are three strikingly similar trends that preceded past market bottoms. 2018’s sideways trend for BTC price The 2018’s Bitcoin bear market serves as a major cue for a potential market bottom in 2022 if one looks at its eerily similar price trends and indicators. One of the key indicators is Bitcoin’s 200-week exponential moving average (200-week EMA; the blue wave in the ch...

Here’s how Bitcoin pro traders plan to profit from BTC’s eventual pop above $20K

Bitcoin (BTC) entered an ascending channel in mid-September and has continued to trade sideways activity near $19,500. Due to the bullish nature of the technical formation and a drop in the sell pressure from troubled miners, analysts expect a price increase over the next couple of months. Bitcoin/USD price at FTX. Source: TradingView Independent analyst @el_crypto_prof noted that BTC’s price formed a “1-2-3 Reversal-Pattern” on a daily time frame, hinting that $20,000 could flip to support soon. $BTC #Bitcoin Yes, the price action of $BTC is really boring, isn’t it? But if you look closely, a textbook “1-2-3 Reversal-Pattern” has formed in the last few days, which should finally send Bitcoin above 20k soon. pic.twitter.com/29Wa64XKQa — ⓗ (@el_crypto_pro...

Here’s why Bitcoin price could tap $21K before Friday’s $510M BTC options expiry

Bitcoin (BTC) has been trying to break above the $20,500 resistance for the past 35 days, with the latest failed attempt on Oct. 6. Meanwhile, bears have displayed strength on four different occasions after BTC tested levels below $18,500 during that period. Bitcoin/USD price index, 12-hour chart. Source: TradingView Investors are still unsure whether $18,200 was really the bottom because the support level weakens each time it is tested. That is why it’s important for bulls to keep the momentum during this week’s $510 million options expiry. The Oct. 21 options expiry is especially relevant because Bitcoin bears can profit $80 million by suppressing BTC below $19,000. Bears placed their bets at $19,000 and lower The open interest for the Oct. 21 options expiry is $510 million, but the actu...

2 key Ethereum price indicators point to traders opening long positions

Ether (ETH) price has been unable to close above $1,400 for the past 29 days and it has been trading in a relatively tight $150 range. At the moment, the $1,250 support and the $1,400 resistance seem difficult to break, but two months ago, Ether was trading at $2,000. The current price range for Ether simply reflects how volatile cryptocurrencies can be. From one side, investors are calm as Ether trades 50% above the $880 intraday low on June 18. However, the price is still down 65% year-to-date despite the most exciting upgrade in the network’s sev-year history. More importantly, Ethereum’s biggest rival, BNB Chain, suffered a cross-chain security exploit on Oct. 6. The $568 million exploit caused BNB Chain to temporarily suspend all transactions on the network, which holds $5...

Bitcoin traders were ready for a hot CPI report, but BTC bears are still in control

Cryptocurrency traders were caught by surprise after the Oct. 13 Consumer Price Index Report showed inflation in the United States rising by 0.6% in September versus the previous month. The slightly higher-than-expected number caused Bitcoin (BTC) to face a 4.4% price correction from $19,000 to $18,175 in less than three hours. The abrupt movement caused $55 million in Bitcoin futures liquidations at derivatives exchanges, the largest amount in three weeks. The $18,200 level was the lowest since Sept. 21 and marks an 8.3% weekly correction. Bitcoin/USD 1-hour price. Source: TradingView It is worth highlighting that the dip under $18,600 on Sept. 21 lasted less than 5 hours. Bears were likely disappointed as a 6.3% rally took place on Sept. 22, causing Bitcoin to test the $19,500 resi...

Bitcoin derivatives data reflects traders’ belief that $20K will become support

Bitcoin (BTC) showed strength on Oct. 4 and 5, posting a 5% gain on Oct. 5 and breaking through the $20,000 resistance. The move liquidated $75 million worth of leverage short (bear) positions and it led some traders to predict a potential rally to $28,000. $BTC #Bitcoin Shared this descending channel 2 days ago.$BTC has managed to break through the middle line.Next target = Upper channel trendline = ~21.5k. In case of a breakout, 28k-30k are possible. pic.twitter.com/dyqMLdcXZ4 — ⓗ (@el_crypto_prof) October 4, 2022 As described by Moustache, the descending channel continues to exert its pressure, but there could be enough strength to test the upper channel trendline at $21,500. The price action coincided with improving conditions for global equity markets on Oct. 4, as the S&P 50...

A crumbling stock market could create profitable opportunities for Bitcoin traders

Some of the biggest companies in the world are expected to report their 2Q earnings in October, including electric automaker Tesla on Oct. 18, tech giants Meta and Microsoft on Oct. 24, Apple and Amazon on Oct. 26 and Google on Oct. 30. Currently, the possibility of an even more severe global economic slowdown is in the cards and lackluster profits could further add to the uncertainty. Given the unprecedented nature of the United State Federal Reserve tightening and mounting macroeconomic uncertainties, investors are afraid that corporate profitability will start to deteriorate. In addition, persistent inflation continues to force businesses to cut back on hiring and adopt cost-cutting measures. Strengthening the dollar is particularly punitive for U.S. listed companies because their produ...

Long the Bitcoin bottom, or watch and wait? Bitcoin traders plan their next move

Bitcoin (BTC) faced a 9% correction in the early hours of Sept. 19 as the price traded down to $18,270. Even though the price quickly bounced back above $19,000, this level was the lowest price seen in three months. However, pro traders held their ground and were not inclined to take the loss, as measured by derivatives contracts. Bitcoin/USD price index, 2-hour. Source: TradingView Pinpointing the rationale behind the crash is extremely difficult, but some say United States President Joe Biden’s interview on CBS “60 Minutes” raised concerns about global warfare. When responding to whether U.S. forces would defend Taiwan in the event of a China-led invasion, Biden replied: “Yes, if in fact, there was an unprecedented attack.” Others cite China’s central ...

Volatility expected as $490M in ETH options expire shortly after the Ethereum Merge

Given the current state of the wider crypto market, some traders might be surprised to learn that Ether (ETH) has been trading in an ascending trend for the past 17 days. While the entire cryptocurrency market experienced a 10% decline on Sept. 13, Ether’s price held firm near the $1,570 support level. Ether/USD price index. Source: TradingView In less than 12 hours, the Ethereum network is scheduled to undergo its largest ever upgrade and the possibility of extreme volatility should not be ignored. The transition to a proof-of-stake network will be a game changer for multiple reasons, including a 98.5% cut in energy use and reduced coin inflation. During an upgrade, there is always the risk of multiple malfunctions, especially in more complex systems like the Ethereum Virtual Machin...

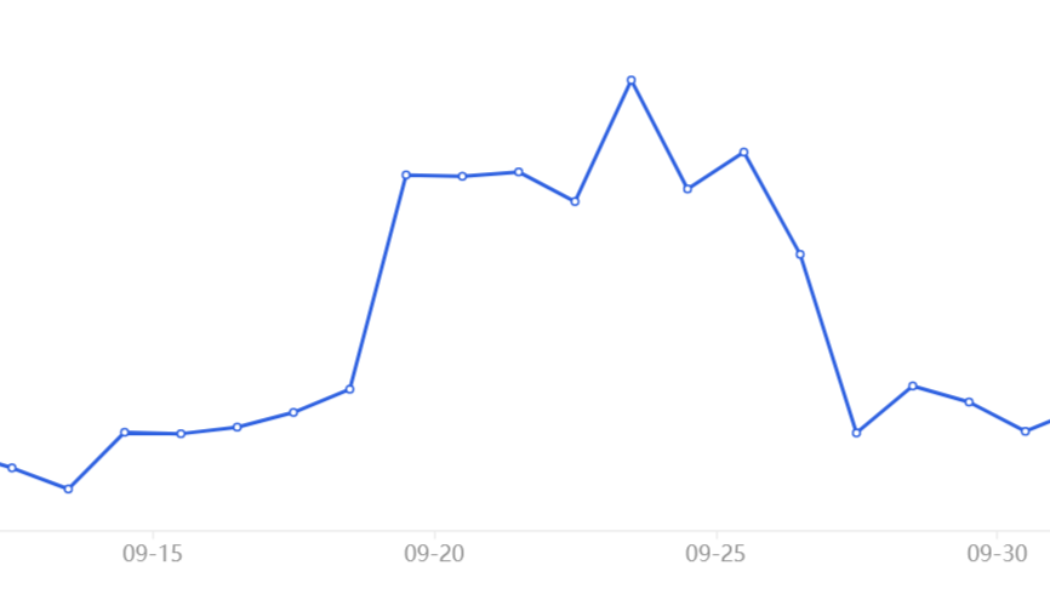

3 Bitcoin price metrics suggest Sept. 9’s 10% pump marked the final cycle bottom

The correlation between Bitcoin (BTC) and stock markets has been unusually high since mid-March, meaning the two asset classes have presented near-identical directional movement. This data might explain why the 10% rally above $21,000 is being dismissed by most traders, especially considering S&P 500 futures gained 4% in two days. However, Bitcoin trading activity and the derivatives market strongly support the recent gains. Curiously, the current Bitcoin rally happened a day after the White House Office of Science and Technology Policy released a report investigating the energy usage associated with digital assets. The study recommended enforcing energy reliability and efficiency standards. It also suggested federal agencies provide technical assistance and initiate a collaborative pr...