Options

Bitcoin derivatives data shows room for BTC price to move higher this week

BTC options data suggest that the Bitcoin price rally still has legs, even with wider economic concerns growing and the potential of a brief pause in the crypto market rally. Market Analysis Own this piece of history Collect this article as an NFT This week Bitcoin (BTC) rallied to a 2023 high at $23,100 and the move followed a notable recovery in traditional markets, especially the tech-heavy Nasdaq Composite Index, which gained 2.9% on Jan. 20. Economic data continues to boost investors’ hope that the United States Federal Reserve will reduce the pace and length of interest rate hikes. For instance, sales of previously owned homes fell 1.5% in December, the 11th consecutive decline after high mortgage rates in the United States severely impacted demand. On Jan. 20, Google announced...

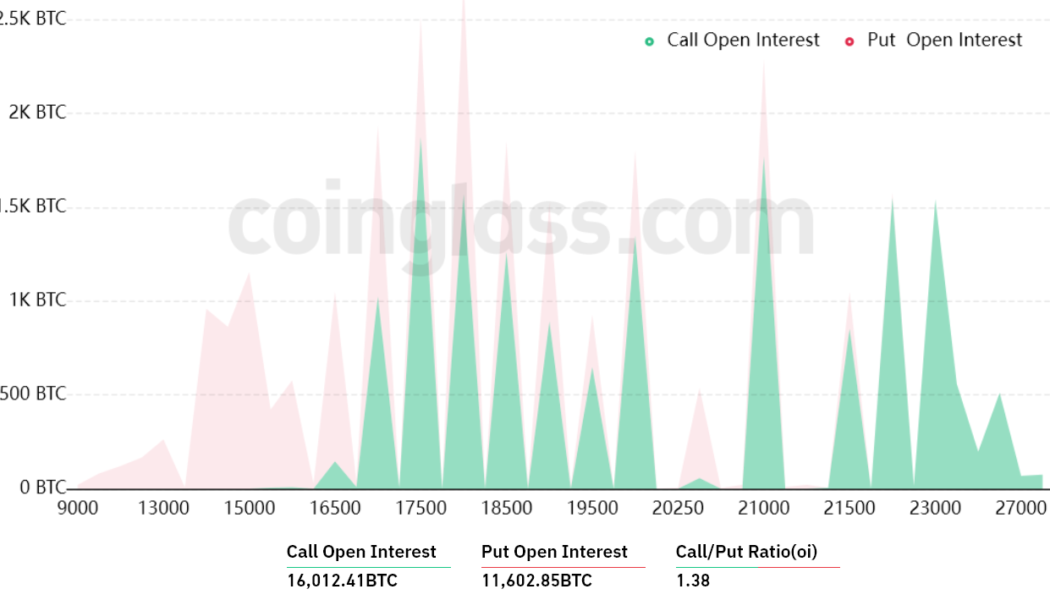

Bitcoin price corrected, but bulls are positioned to profit in Friday’s $580M BTC options expiry

Bitcoin (BTC) price has held above $20,700 for 4 days, fueling bulls’ hope for another leg up to $23,000 or even $25,000. Behind the optimistic move was a decline in inflationary pressure, confirmed by the December 2022 wholesale prices for goods on Jan. 18. The United States producer price index, which measures final demand prices across hundreds of categories also declined 0.5% versus the previous month. Eurozone inflation also came in at 9.2% year-on-year in December 2022, marking the second consecutive decline from October’s 10.7% record high. A milder-than-expected winter reduced the risk of a gas shortages and softened energy prices, boosting analysts’ hope of a “soft landing.” According to analysts, a soft landing would avoid a deep recession and ...

Bitcoin derivatives data suggests a BTC price pump above $18K won’t be easy

Traders might rejoice now that Bitcoin price ventured above $17,400, but 27 long days have passed since Bitcoin (BTC) last breached the $17,250 resistance. On December 13, after a two-week-long lateral movement, Bitcoin posted a 6.5% rally toward $18,000 and even though the current movement still lacks strength, traders believe that a retest of the $18,250 resistance remains possible. Bitcoin 12-hour price index, USD. Source: TradingView To start the week, the S&P 500 index rose to its highest level in 26 days on Jan. 9. Weak economic data had previously fueled investors’ expectation of slower interest rate hikes by the U.S. Federal Reserve and the Jan. 12 Consumer Price Index (CPI) report could lend some credence to this expectation. On Jan. 6, German retail sales data sho...

Why is Ethereum (ETH) price up today?

Ethereum’s native token, Ether (ETH), rose to three-week highs, rallying in lockstep with the broader cryptocurrency market, as well as stocks. ETH price rises to three-week highs On Jan. 9, ETH’s price rose 2.85% to cross above $1,325 for the first time in three weeks, a key level that could pave the token’s path toward $1,350 next if its previous price performance is any indication. The crypto market’s capitalization gained 2.66%, or $21.18 billion, in the same period. ETH/USD daily price chart. Source: TradingView Cooling inflation boosts Ethereum price Investors are rushing into riskier markets on signs of cooling inflation. Notably, on Jan. 6, the U.S. Labor Department’s nonfarm payrolls report showed a slowdown in wage increases, w...

3 ways crypto derivatives could evolve and impact the market in 2023

Futures and options let traders put down only a tiny portion of a trade’s value and bet that prices will go up or down to a certain point within a certain period. It can make traders’ profits bigger because they can borrow more money to add to their positions, but it can also boost their losses much if the market moves against them. Even though the market for crypto derivatives is growing, the instruments and infrastructure that support it are not as developed as those in traditional financial markets. Next year will be the year that crypto derivatives reach a new level of growth and market maturity because the infrastructure has been built and improved this ye, and an increasing number of institutions are getting involved. Crypto derivatives’ growth in 2023 In 2023, the volume...

3 reasons why Bitcoin is likely heading below $16,000

December will likely be remembered by Bitcoin’s (BTC) fake breakout above $18,000, but apart from that brief overshoot, its trajectory was entirely bearish. In fact, the downward trend that currently offers an $18,850 resistance could bring the BTC price below $16,000 by mid-January. Bitcoin/USD price index, 12-hour chart. Source: TradingView A handful of reasons can explain the negative movement, including the reported withdrawal of the Mazars Group auditing firm from the cryptocurrency sector on Dec. 16. The company previously handled proof-of-reserve audit services for Binance, KuCoin and Crypto.com. Additionally, one can point to the bankruptcy of Core Scientific, one of the largest cryptocurrency miners in the United States, Core Scientific. The publicly listed company filed for ...

Total crypto market cap takes another hit, but traders remain neutral

The total cryptocurrency market capitalization dropped 8.1% in the past two days after failing to break the $880 billion resistance on Dec. 14. The rejection did not invalidate the 4-week-long ascending channel, but a weekly close below $825 billion will confirm a shift to the lower band and reduce the support level to $790 billion. Total crypto market cap in USD, 12-hour. Source: TradingView The overall investor sentiment toward the market remains bearish, and year-to-date losses amount to 66%. Despite this, Bitcoin (BTC) price dropped a mere 2% on the week, down to the $16,800 level at 17:00 UTC on Dec. 16. A far different scenario emerged for altcoins which are being pressured by pending regulation and fears that major exchanges and miners could be insolvent. This explains why the total...

Bitcoin retraces intraday gains as bears aim to pin BTC price under $18K

On Dec. 14, Bitcoin (BTC) broke above $18,000 for the first time in 34 days, marking a 16.5% gain from the $15,500 low on Nov. 21. The move followed a 3% gain in the S&P 500 futures in three days, which reclaimed the critical 4,000 points support. Bitcoin/USD index (orange, left) vs. S&P 500 futures (right). Source: TradingView While BTC price started the day in favor of bulls, investors anxiously awaited the U.S. Federal Reserve decision on interest rates, along with Fed chair Jerome Powell’s remarks. The subsequent 50 basis point hike and Powell’s explanation of why the Fed would stay the course gave investors good reason to doubt that BTC price will hold its current gains leading into the $370 million options expiry on Dec. 16. Analysts and traders expect some form o...

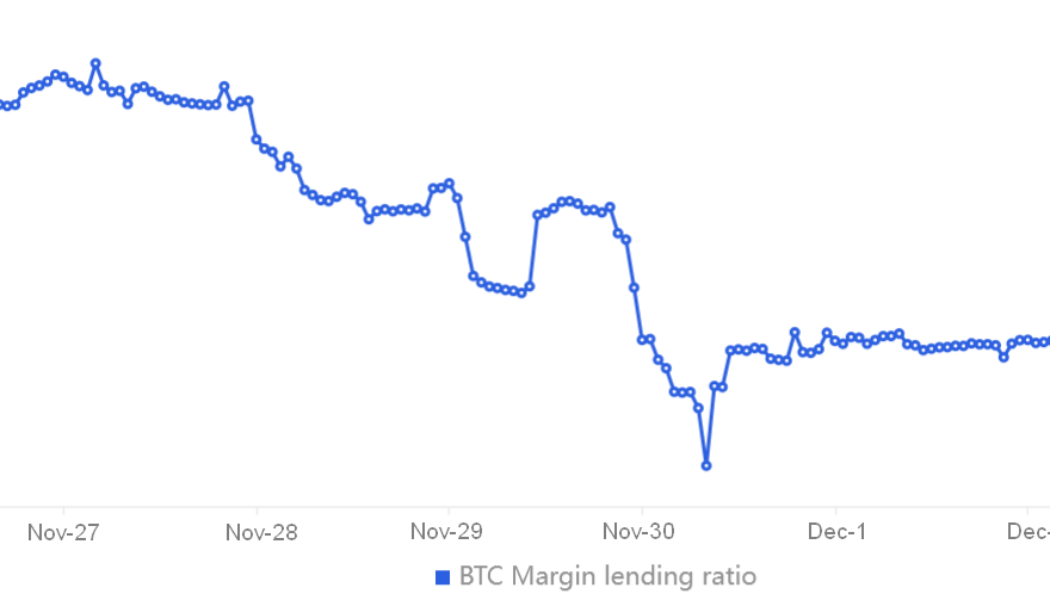

Bitcoin price liquidation risk increases as BTC struggles to reclaim $18K

Bitcoin (BTC) price had a mixed reaction on Dec. 9 after the November report on United States producer prices showed a 7.4% increase versus 2021. The data suggested that wholesale costs continued to rise and inflation may last longer than investors had previously believed. Oil prices are also still a focus for investors, with crude WTI hitting a new yearly low at $71.10 on Dec. 8. The United States Dollar Index (DXY), a measure of the dollar’s strength against a basket of top foreign currencies, sustained the 104.50 level, but the index traded at 104.10, a 5-month low on Dec. 4. This signals low confidence in the U.S. Federal Reserve’s ability to curb inflation without causing a significant recession. Trader gutsareon noted that the choppy activity caused leverage longs and shorts to...

Total crypto market cap falls to $840 billion, but derivatives data shows traders are neutral

The total cryptocurrency market capitalization dropped 1.5% in the past seven days to rest at $840 billion. The slightly negative movement did not break the ascending channel initiated on Nov. 12, although the overall sentiment remains bearish and year-to-date losses amount to 64%. Total crypto market cap in USD, 12-hour. Source: TradingView Bitcoin (BTC) price dropped 0.8% on the week, stabilizing near the $16,800 level at 10:00 UTC on Dec. 8 — even though it eventually broke above $17,200 later on the day. Discussions related to regulating crypto markets pressured markets and the FTX exchange collapse limited traders’ appetites, causing lawmakers to turn their attention to the potential impact on financial institutions and the retail investors’ lack of protection. On Dec. 6, ...

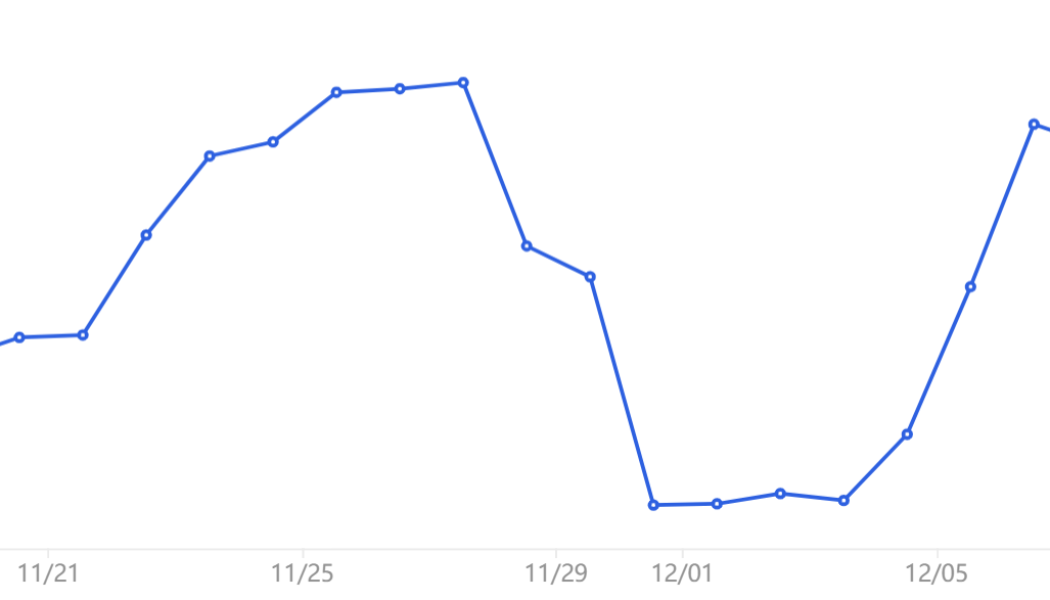

DXY bounces at major support, reducing Bitcoin’s chance at breaking the $17.2K resistance

On Dec. 2, the United States dollar index (DXY), an index that measures the dollar’s strength against a basket of top foreign currencies, reached 104.40 which was the lowest level seen in 5 months. To recap, the U.S. dollar’s weight against the basket of top foreign currencies grew by 19.6% in 2022 until late September as investors looked for protection against the impact of a hawkish Federal Reserve and, more recently, the rising energy costs and effect of high inflation. The U.S. dollar’s retreat may have been an interim correction to neutralize its “overbought” condition, as the 114.60 peak was the highest level in 20 years. Still, its inverse correlation with Bitcoin (BTC) remains strong, as pointed out by analyst Thecryer on Twitter: $DXY $BTC pic.t...

This simple Bitcoin options strategy allows traders to go long with limited downside risk

Bitcoin (BTC) bulls were hopeful that the Nov. 21 dip to $15,500 would mark the cycle bottom, but BTC has not been able to produce a daily close above $17,600 for the past eighteen days. Traders are clearly uncomfortable with the current price action and the confirmation of BlockFi’s demise on Nov. 28 was not helpful for any potential Bitcoin price recovery. The cryptocurrency lending platform filed for Chapter 11 bankruptcy in the United States a couple of weeks after the firm halted withdrawals. In a statement sent to Cointelegraph, Ripple’s APAC policy lead Rahul Advani said he expects the FTX exchange bankruptcy to lead to greater scrutiny on crypto regulations.” Following the event, several global regulators pledged to focus on developing greater crypto regulat...