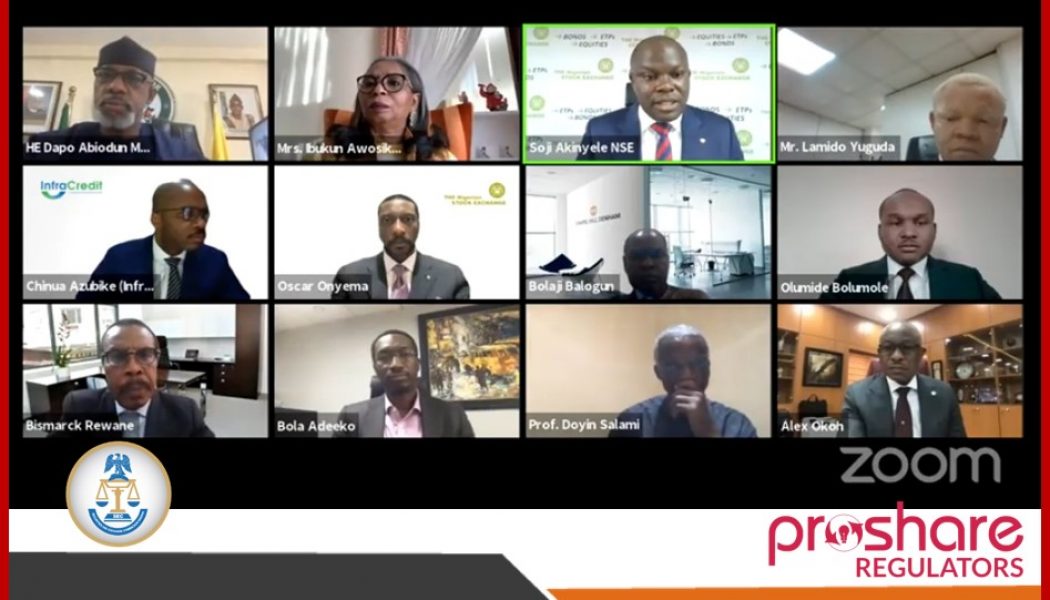

Onyema

CSCS reiterates commitment to deepening capital market

The Central Securities Clearing System (CSCS) has restatement its commitment in repositioning business to efficiently play a more active and leading role in deepening the Nigerian capital market growth. Also, CSCS grew its profit after tax by 41.4 per cent for the year ended December 31, 2020. The company results showed that amidst unprecedented economic and financial market conditions occasioned by the COVID-19 pandemic, the Group grew total income by 31.3 per cent year-on-year (YoY) to N12.09 billion. Profit after tax grew by 41.4 per cent to N6.93 billion, translating to N1.39 earnings per share. The group delivered 20.3 per cent return on average equity for the 2020 financial year, compared to 15.3 per cent in 2019 full year. The company’s total assets stood at N41.42 billion, as again...

DMO: Nigerian roads financed with Sukuk not repaying debt as planned

File Photo The Debt Management Office (DMO) has decried the country’s debt service to revenue ratio, describing it as a major issue of concern. Patience Oniha, the Director-General of DMO, said this in Abuja on Thursday at the fifth Budget Seminar (webinar) organised by the Securities and Exchange Commission (SEC). The theme of the budget seminar was, “Financing Nigeria’s Budget and Infrastructure Deficit through the Capital Market.” Oniha stressed the need for infrastructure built with borrowed funds to generate revenue to service the debts. According to her, “We have done the Sukuk, for instance, but the government is the one servicing the debt of those Sukuk. “They (the debts) are not being serviced with revenue from those sources (infrastructure). “I think that when we are talking abou...