on-chain

Grayscale cites security concerns for withholding on-chain proof of reserves

Cryptocurrency investment product provider Grayscale Investments has refused to provide on-chain proof of reserves or wallet addresses to show the underlying assets of its digital currency products citing “security concerns.” In a Nov. 18 Twitter thread addressing investor concerns, Grayscale laid out information regarding the security and storage of its crypto holdings and said all crypto underlying its investment products are stored with Coinbase’s custody service, stopping short of revealing the wallet addresses. 6) Coinbase frequently performs on-chain validation. Due to security concerns, we do not make such on-chain wallet information and confirmation information publicly available through a cryptographic Proof-of-Reserve, or other advanced cryptographic accounting procedure. — Grays...

Ethereum price falls below $1.1K and data suggests the bottom is still a ways away

Ether (ETH) price nosedived below $1,100 in the early hours of June 14 to prices not seen since January 2021. The downside move marks a 78% correction since the $4,870 all-time high on Nov. 10, 2021. More importantly, Ether has underperformed Bitcoin (BTC) by 33% between May 10 and June 14, 2022, and the last time a similar event happened was mid-2021. ETH/BTC price at Binance, 2021. Source: TradingView Even though Bitcoin oscillated in a narrow range two weeks before the 0.082 ETH/BTC peak, this period marked the “DeFi summer” peak when Ethereum’s total value locked (TVL) catapulted to $93 billion from $42 billion two months earlier. What’s behind Ether’s 2021 underperformance? Before jumping to conclusions, a broader set of data is needed to understand what led to the 3...

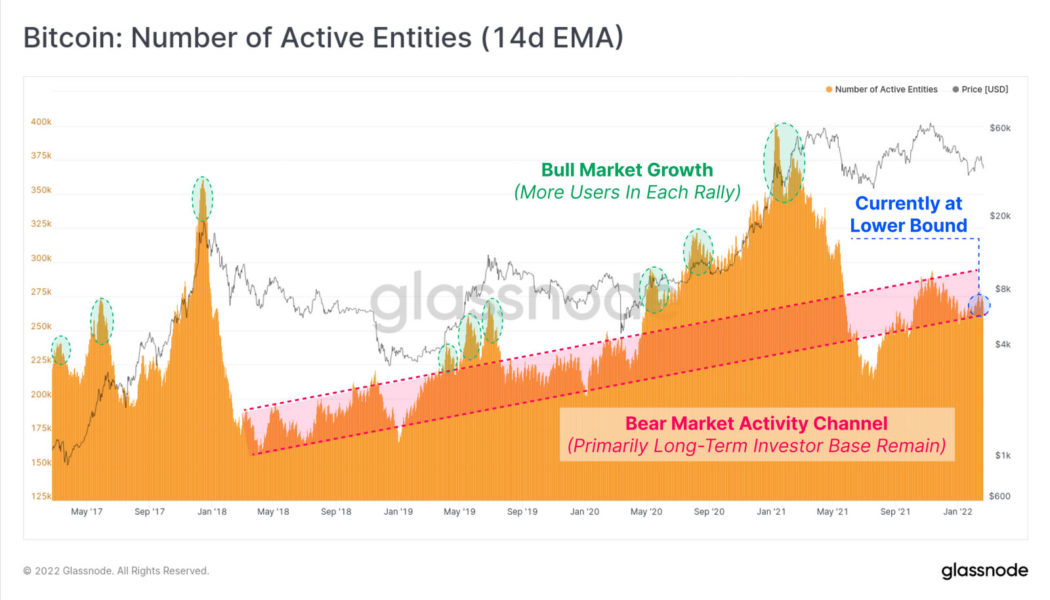

On-chain metrics hint at a bearish outlook for Bitcoin

Blockchain analytics provider Glassnode has depicted a bearish scenario for Bitcoin as on-chain metrics suggest increased selling pressure is imminent. In its weekly analytics report on Feb. 21, on-chain metrics firm Glassnode said that Bitcoin bulls “face a number of headwinds,” referring to increasingly bearish network data. The researchers pointed at the general weakness in mainstream markets alongside wider geopolitical issues as the reason for the current risk-off sentiment for crypto assets. “Weakness in both Bitcoin, and traditional markets, reflects the persistent risk and uncertainty associated with Fed rate hikes expected in March, fears of conflict in Ukraine, as well as growing civil unrest in Canada and elsewhere.” It added that as the downtrend deepens, “the probability of a ...