Nonfungible Token

GameStop to drop crypto efforts as Q3 losses near $95M

Gaming retailer GameStop says it will no longer focus any efforts on cryptocurrencies, after amounting $94.7 million in net losses in the third quarter and laying off staff from its digital assets department. On a Dec. 7 earnings call GameStop CEO, Matt Furlong, said it “proactively minimized exposure to cryptocurrency” over the year and “does not currently hold a material balance of any token,” adding: “Although we continue to believe there is long-term potential for digital assets in the gaming world, we have not and will not risk meaningful stockholder capital in this space.” Earlier this year the company said it was looking at crypto, along with nonfungible tokens (NFTs) and Web3 applications, as avenues for growth calling these spaces “increasingly relevant for gamers of the fut...

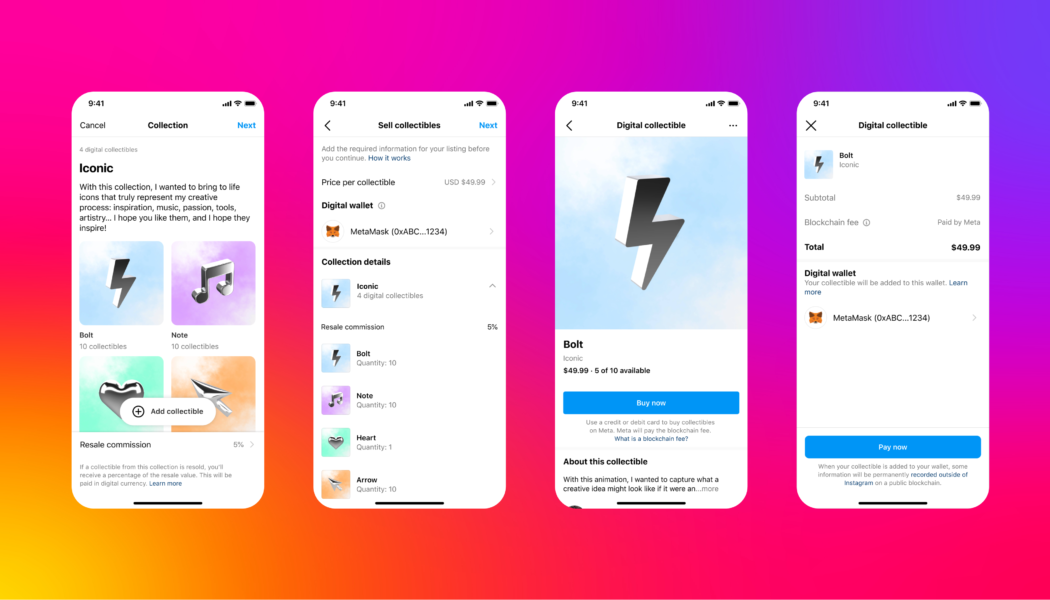

Magic Eden follows OpenSea with NFT royalty enforcement tool

Magic Eden, a Solana-based nonfungible token (NFT) marketplace, has become the latest platform to release a tool allowing creators to enforce royalties on their collections. It follows the announcement of a similar tool from rival NFT marketplace OpenSea in early November. According to a Dec. 1 statement, the open-source royalty enforcement tool is built on top of Solana’s SPL token standard and is called the Open Creator Protocol (OCP). This will allow royalty enforcement for new collections that opt-in to the standard starting Dec. 2. Lu previously floated the idea of NFTs designed to enforce royalties at Solana’s Breakpoint 2022 conference on Nov. 5, citing the need for NFT creators to have a “sustained revenue model.” Creators who use OCP will also be able to ban marketplaces tha...

Nifty News: LooksRare the latest NFT market to sack royalties, Twitter’s tweeting tiles and more

Nonfungible token (NFT) marketplace LooksRare is the latest in a string of NFT markets to do away with enforcing creator royalties by default, following the likes of Magic Eden and X2Y2. The platform tweeted on Oct. 27 that it would not be supporting creator royalties by default, instead choosing to share 25% of its protocol fees with NFT creators and collection owners. Buyers can still choose to pay royalties when purchasing an NFT but it will be on an opt-in basis. Explaining the changes, it said 0.5% of its 2% protocol fee would go to collections, as long as that collection has a receiving address for the funds. LooksRare said the willingness of buyers to pay royalties has “eroded” as a result of many NFT markets now moving to a zero-royalty model adding that these disadvantage cre...

Is MATIC price about to double? Polygon’s Reddit hype pushes exchange balance to 9-month lows

A sharp rebound in the Polygon (MATIC) market in the last four months has increased its price by 200% when measured from its June 2022 bottom of $0.31. And now, the token is showing signs of undergoing another major market rally. MATIC exchange balance hits nine-month low Notably, the MATIC supply held by all crypto exchanges fell to 802.15 million on Oct. 26, its lowest level since January 2022. The plunge came as a part of a broader downtrend that has witnessed over 600 million MATIC leaving exchanges in the last four months, data on Santiment shows. MATIC balance on exchanges versus price. Source: Santiment A declining crypto balance across exchanges is perceived as bullish by the market since traders typically withdraw their funds from trading platforms when they want to hold the token...

Almost everything could be tokenized in 5-10 years — Matrixport co-founder

In five to ten years, almost every “real world” asset class could be tokenized in the form of a nonfungible token (NFT) according to Cynthia Wu, co-founder of digital asset service platform Matrixport. Speaking to Cointelegraph, Wu said the best case for NFTs would see the widespread representation of real-world assets to be stored and traded on-chain: “Eventually, all the major financial asset classes are going to be represented on this new financial infrastructure [and] NFTs could be our instrument to represent off-chain assets like real estate deeds, equities or bonds.” The move on-chain would make these real-world assets “more liquid and more tradable,” which would improve price discovery and transaction activity, Wu added. But Wu said that while it’s great that we’ve created over two ...

Totality Corp CEO explains why India is still largely untapped for NFTs

Despite ranking as one of the highest adopters of cryptocurrency among emerging markets, the majority of the Indian market is yet to embrace nonfungible tokens (NFTs). In an interview with Cointelegraph, Totality Corp Founder and CEO Anshul Rustaggi explained that social and cultural barriers, as well as anti-crypto regulations, are holding back NFTs from mass adoption — particularly in some of the lower-tier cities in the country. India has a population of 1.38 billion people and is the second-most populous country in the world sitting just behind China. Last month, the United Nations forecast the country to overtake its competitor sometime in 2023. However, Rustaggi explained that crypto trading and NFT collection are seen as speculative investments — a concept that is frowned upon in In...

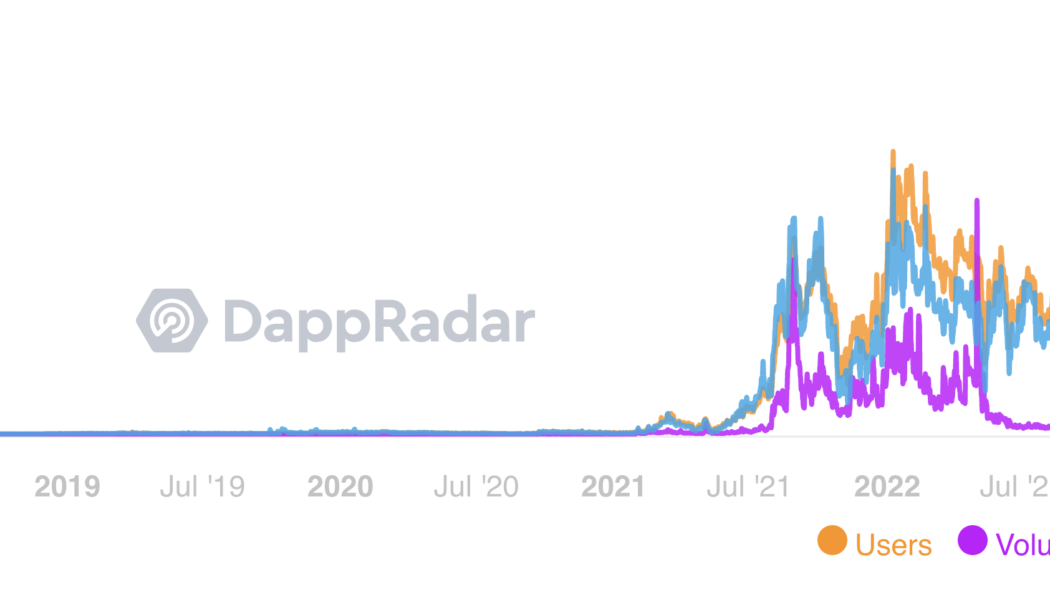

Looks bare: OpenSea turns into NFT ghost-town after volume plunges 99% in 90 days

OpenSea, the world’s largest nonfungible token (NFT) marketplace, has witnessed a substantial drop in daily volumes as fears about a potential market bubble grow. OpenSea volume plummets to yearly lows Notably, the marketplace processed nearly $5 million worth of NFT transactions on Aug. 28 — approximately 99% lower than its record high of $405.75 million on May 1, according to DappRadar. OpenSea users, volume, and transactions statistics. Source: DappRadar The massive declines in daily volumes coincided with equally drastic drops in OpenSea users and their transactions, suggesting that the value and interest in the blockchain-based collectibles have diminished in the recent months. That is further visible in the falling floor prices — the minimum amount one is ready to pay for an NF...

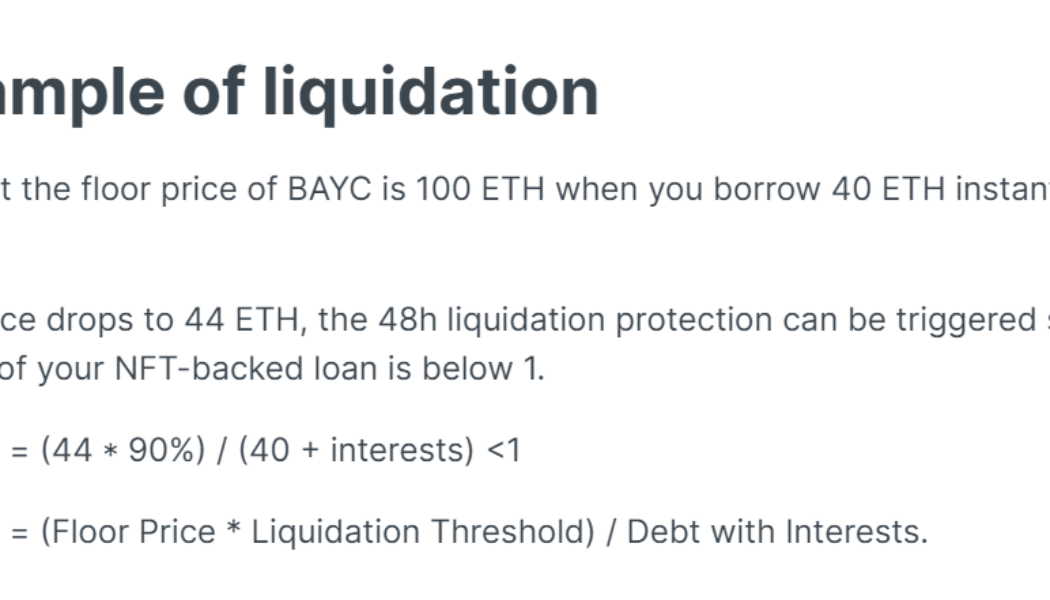

Nearly $55M worth of Bored Ape, CryptoPunks NFTs risk liquidation amid debt crisis

Many owners of precious Bored Ape Yacht Club (BAYC) and CryptoPunks NFTs, who used them as collateral to take out loans in Ether (ETH), have failed to repay their debts. The situation could lead up to the NFT sector’s first massive liquidation event. gm. As a result of the floor dropping to 72, the first BAYC liquidation auction on BendDAO has begun Starting price of 68.4e… Any takers or is this going to be the first bad-debt domino that falls for the platform? pic.twitter.com/7qxsIi661e — Cirrus (@CirrusNFT) August 18, 2022 BAYC “death spiral” incoming? DoubleQ, the founder of web3 launchpad Double Studio, says lending service BendDAO could liquidate up to $55 million worth of NFTs to recover its loans, fearing the so-called “health factor” of these deb...

- 1

- 2