NFTs

‘Natural extension’: Sega’s Super Game project looking to add NFTs

Japanese gaming giant Sega is looking at integrating cloud technology and NFTs as part of its new “Super Game” project to connect different games to each other. The news has caused a predictable backlash from the crypto-skeptic section of the gaming community, with many people voicing their frustrations at the firm online this week. The Super Game initiative is set to roll out over the next five years and will reportedly see the development of a wide range of new cross-platform triple A grade games. The firm is said to be weighing up an investment of around $800 million into the project. The suggestion of potential NFT and cloud support was made during an interview on Sega Japan’s recruitment website. Gaming news outlet Video Games Chronicle provided a translation for English speakers earl...

Nifty News: AC Milan launches NFT collection, Magic Eden accepts Solana projects’ tokens and more

Italian professional soccer club AC Milan will be releasing its first-ever nonfungible token (NFT) project in collaboration with the BitMEX crypto exchange. Proceeds will go to Fondazione Milan, the clubs’ charity arm. The limited-edition collection will feature 75,817 NFTs, a number representative of the capacity of the club’s home ground, San Siro stadium. It will depict a 3D image of a jersey found in South Sudan by Danish war photographer Jan Grarup who was in the country documenting widespread flooding last December. BitMEX partnered with AC Milan to contribute to the project by providing trading discounts and “other benefits” to the first 10,000 pre-orders. BitMEX will also donate to Fondazione Milan by purchasing a “large number” of the NFTs. As per the announcement, the club says t...

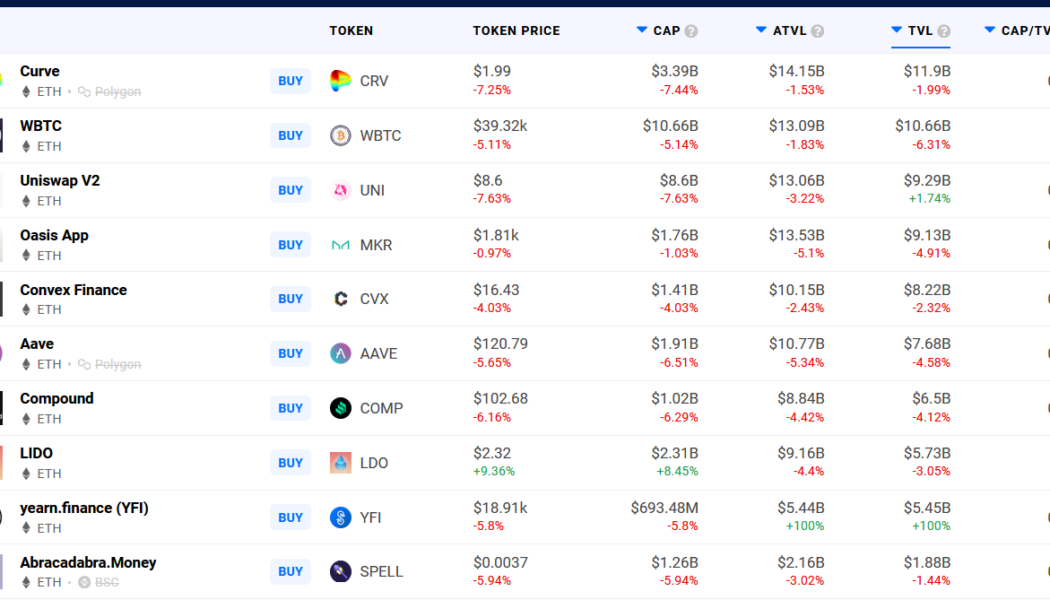

NFT Investments PLC mulls £96M acquisition of Pluto Digital

On Friday, NFT Investments PLC, a U.K.-based blockchain firm that invests in companies operating in the nonfungible tokens, or NFTs, space, announced that it would no longer pursue a 96 million pound acquisition of Pluto Digital. Although it did not directly state its reasons for canceling the deal, NFT Investments wrote: “The company is well-positioned to take advantage of the recent market correction in the blockchain and digital assets sectors by investing at attractive valuations.” Back in January, NFT Investments signed a non-binding letter of intent to acquire Pluto Digital, which builds infrastructure in the decentralized finance, or DeFi, realm, via the new issuance of NFT shares. From last November to March of this year, the blockchain industry witnessed a month-long&n...

Deep Dive: A Musician’s Guide to Web3

The music industry hasn’t always welcomed new technology, but the booming NFT marketplace — overall sales generated $25 billion last year — shows the promise of Web3, and everyone wants a piece of the action. Deep Dive explains how artists and executives can get in on it wisely and examines blockchain’s potential to reshape the industry. Plus: lessons in NFT drops from dance music’s pioneers, legal pitfalls to avoid when you’re minting the goods, all the crypto lingo you need to know and a guide to the top startups supporting musicians in the metaverse. Read the full Deep Dive here. Learn To Speak Web3: Translating Crypto’s Buzzwords For The Music Business A primer for artists and executives considering doing business in the metaverse. Read more. Shira Inbar Doing Music Deals In The M...

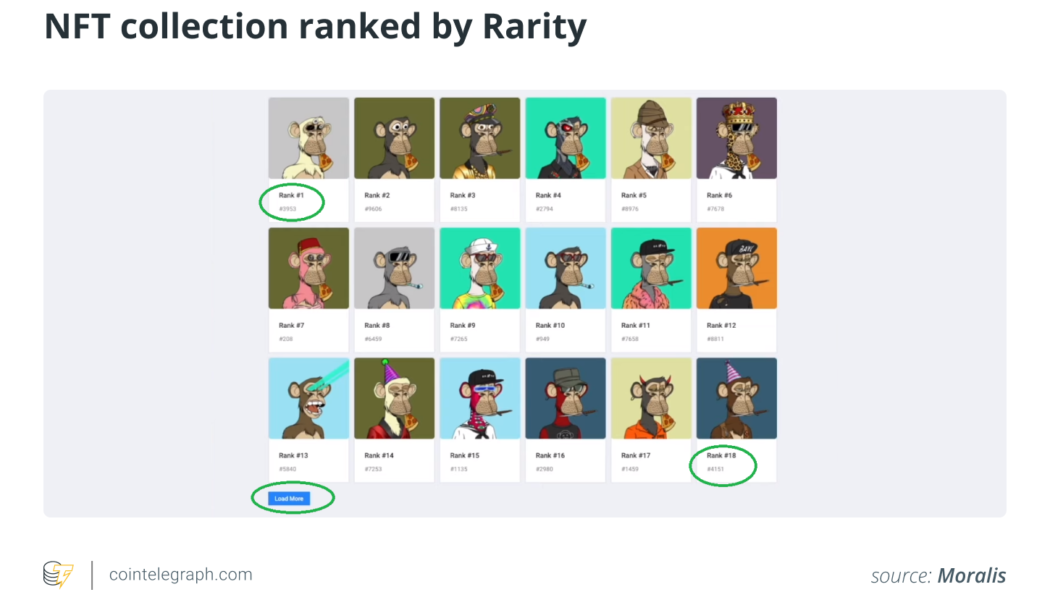

How do you assess the value of an NFT?

Understanding the valuation matrix There is no rule book on how to assess an NFT valuation. The metrics you use for evaluating private companies or conventional investment vehicles such as shares are simply not applicable to NFTs. Usually, the payment rolled out by the last buyer gives some indication of the value. For NFTs, however, it is hard to guess what the next buyer might pay, depending on their estimates. Most buyers lack the skills to ascertain the value of NFTs logically and base their quotes on guesswork. For sellers too, it is hard to determine what they might end up receiving for the tokens they hold. Over time, the value of NFTs is driven by a perception over which both buyers and sellers may lack any control. An example can bring home the point even better. An artwork NFT mi...

Ethereum gas fees drop to lowest levels since August 2021

Gas fees for transactions on the Ethereum (ETH) blockchain have dropped to the lowest levels since August. But they’re still not cheap. According to data sourced from Coinmetrics and shared by CryptoRank Platform, the seven-day moving average cost of an Ethereum transaction as of March 9 totaled $11.14, placing it back amongst the levels recorded mid-last year before it surged dramatically to as high as $55 at the tail end of 2021. The cost of transactions on the @Ethereum network has not been this low since Aug 2021. Notably, gas prices surged after staying in this range for about 3 months with experts attributing the spike to a rise in interest in the #NFT and #DeFi ecosystems. https://t.co/oLDJyfSea2 pic.twitter.com/ieigvLT4Gz — CryptoRank Platform (@CryptoRank_io) March 9, 2022 At the ...