Nexo

Troubled crypto lender Vauld gets extended creditor protection

Embattled crypto lending platform Vauld one more time gets the period of creditor protection from a Singapore court. The company should come up with a revival plan before Feb. 28. As reported by Bloomberg on Jan. 17, Vauld has been granted more than a month to close its negotiations with one of two digital-asset fund managers to take over the executive control of the tokens stuck on its platform. Apparently, the Singapore high court was satisfied by the company’s claim that the negotiations have entered to the “advanced stage.” In July 2022 the platform halted the withdrawals for its 800,000 customers, citing unfavorable market conditions and an unprecedented $200 million worth of withdrawals in under two weeks. In August, it has already been granted a three-month moratorium to come ...

Nexo investigation is not political, Bulgarian prosecutors say

Siika Mileva, a spokesperson for Bulgaria’s chief prosecutors, has denied political motivations behind the probe against the crypto lending firm Nexo, according to local reports. The comments were made in response to claims that the investigation had a connection to the company’s political donations. Almost all cases where a prosecution launches an investigation that affects someone’s financial interests results in attacks and accusations, Mileva said. “It has become a national sport to attack the institutions,” he added. On Jan. 12, a group of prosecutors, investigators and foreign agents searched the company’s offices in the Bulgarian capital city of Sofia. The operation targeted a large-scale money laundering scheme as well as violations of Russia’s international sanctions. In less than...

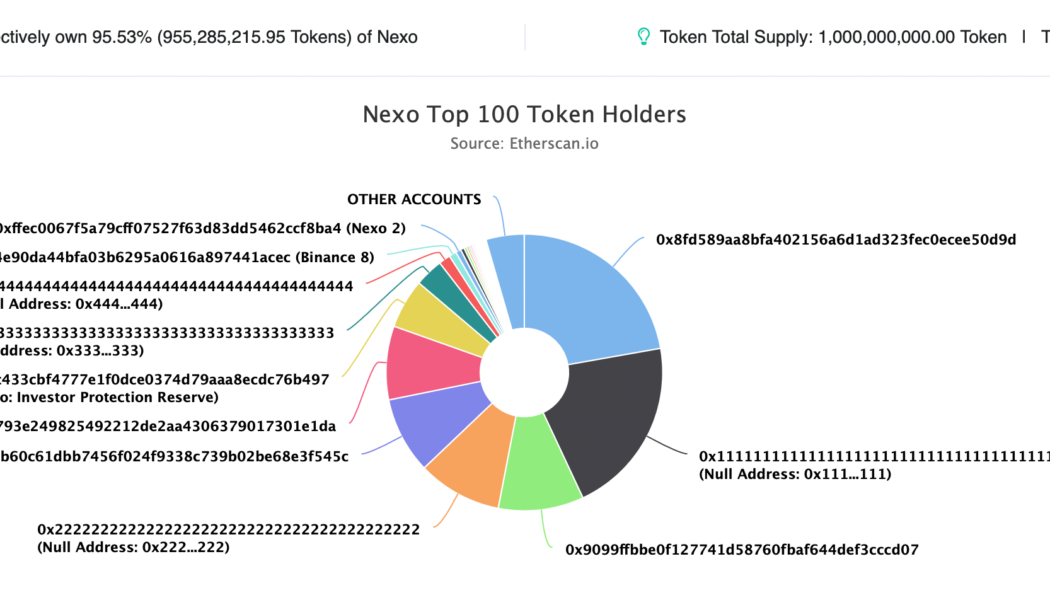

NEXO risks 50% drop due to regulatory pressure and investor concerns

Crypto lending firm Nexo is at risk of losing half of the valuation of its native token by the end of 2022 as doubts about its potential insolvency grow in the market. Is Nexo too centralized? For the unversed: Eight U.S. states filed a cease-and-desist order against Nexo on Sep. 26, alleging that the firm offers unregistered securities to investors without alerting them about the risks of the financial products. In particular, regulators in Kentucky accused Nexo of being insolvent, noting that without its namesake native token, NEXO, the firm’s “liabilities would exceed its assets.” As of July 31, Nexo had 959,089,286 NEXO in its reserves — 95.9% of all tokens in existence. “This is a big, big, big problem because a very basic market analysis demonstrates that Nexo would be...

Nexo ‘surprised’ by state regulators’ actions, says co-founder

Kalin Metodiev, the co-founder and managing partner of crypto lender Nexo stated his firm was “surprised” by the way in which eight state regulators publicly took action against it for securities violations. Earlier this week the California Department of Financial Protection & Innovation (DFPI) filed a desist and refrain order against Nexo’s Earn Interest Product, claiming the company was offering a security product that had not been cleared by the government for sale in the form of an investment contract. The DFPI also stated that it was joining regulators from seven other states in taking action against the company, including Kentucky, New York, Maryland, Oklahoma, South Carolina, Washington and Vermont. Speaking with Cointelegraph at Token2049, Metodiev explained that Nexo was caugh...

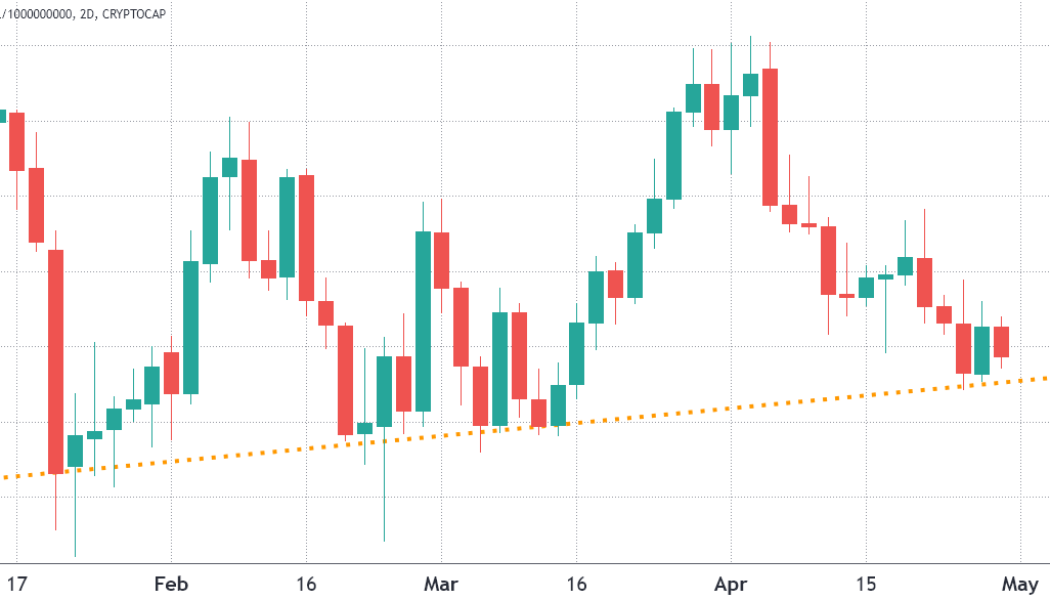

2 key metrics point toward further downside for the entire crypto market

The total crypto market capitalization has been holding a slightly ascending trend for the past 3 months and the $1.75 trillion support was most recently tested on April 27 as Bitcoin (BTC) bounced at $38,000 and Ether (ETH) at $2,800 on April 27. Total crypto market cap, USD billion. Source: TradingView The crypto market’s aggregate capitalization showed a 3.5% decrease in the last 7 days and notable losers were a 18.8% loss from XRP, a 10.2% loss from Cardano (ADA), and 9.7% drop in Polkadot (DOT) price. Analyzing a broader range of altcoins provides a more balanced picture, that includes 25% gains from some gaming and Metaverse projects in the same time period. Weekly winners and losers among the top 80 coins. Source: Nomics Apecoin (APE) rallied 44% due to the upcoming Otherside metave...