NEAR Protocol

Skyward finance exploit allegedly results in $3 million loss

Skyward finance, an IDO platform enabling fair token distribution for projects on the NEAR Protocol, has reportedly been exploited for 1.1M NEAR tokens, worth an estimated $3 million USD at time of publication. The news was shared on Twitter by Aurora Lab’s community moderator Sanket Naikwadi, who stated that the exploit was first noticed by a member of the NEAR protocol community, who goes by the handle @Nearscout. The @skywardfinance was just exploited for ~1.1M $NEAR Tokens (Worth ~3M) . Thnx to @NearScout for noticing the treasury drain, he pinged me asking if something is wrong with skyward… then we looked into contract txns and found out about the exploit and sus txns. smol — SankΞt Ⓝ⚡️| sanketn81.near ,sanketn81.lens (@sanket_naikwadi) November 2, 202...

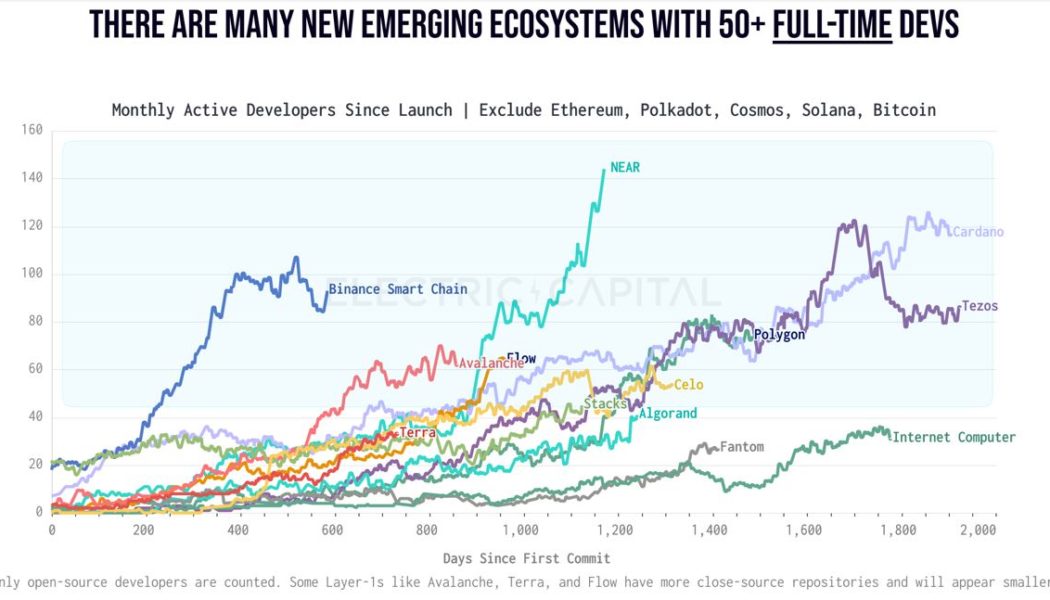

Near Protocol partners with Google Cloud to support Web3 devs

Near Foundation has announced a new partnership between Google Cloud and Near Protocol, providing infrastructure for Near’s Web3 startup platform, Pagoda. According to an Oct. 4 announcement, this partnership will allow Google Cloud to provide “technical support” to Near grant recipients by providing infrastructure for Near’s Remote Procedure Call node provider to Pagoda. Near Protocol is a decentralized application (DApp) platform that focuses on usability among developers and users. It utilizes sharding technology to achieve scalability and, as a competitor to Ethereum, is also smart-contract capable and a proof-of-stake blockchain. Launched in February 2022, Pagoda is a startup platform that provides Web3 developers building on Near with a full-stack toolset to construct, launch a...

Top 5 cryptocurrencies to watch this week: BTC, LUNA, NEAR, VET, GMT

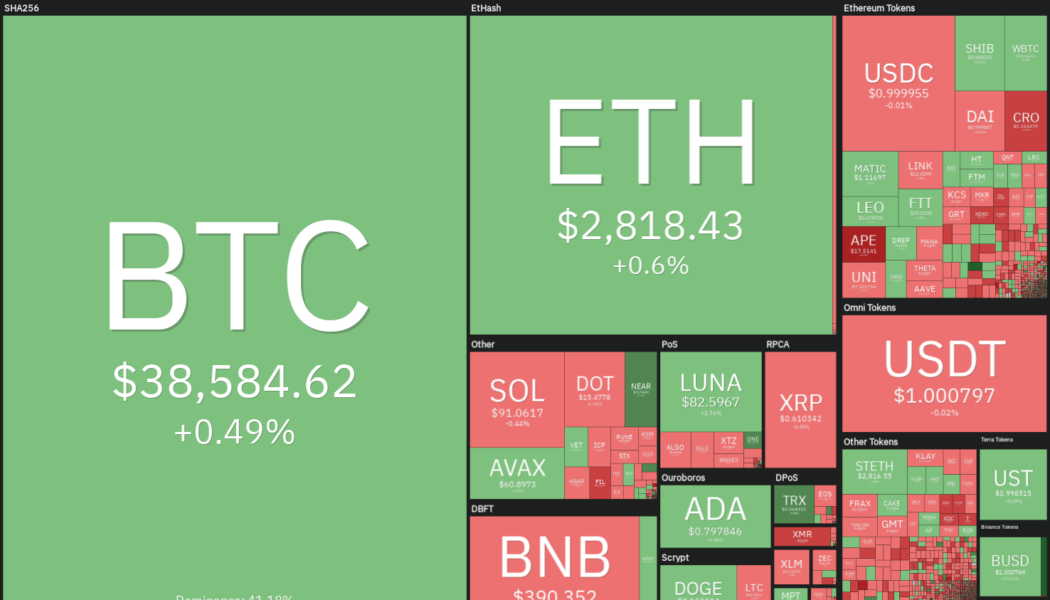

The month of April has been a forgettable one for equities and cryptocurrency investors. Bitcoin (BTC) plummeted 17% in April to record its worst ever performance in the month of April. Similarly, the Nasdaq Composite plunged 13.3% in April, its worst monthly performance since October 2008. However, a major positive for crypto investors is that Bitcoin is still above its year-to-date low near $33,000. In comparison, the Nasdaq 100 has hit a new low for 2022 while the S&P 500 is just a whisker away from making a new year-to-date low. This suggests that Bitcoin has managed to avoid a major sell-off, indicating demand at lower levels. Crypto market data daily view. Source: Coin360 Along with Bitcoin, Ether (ETH) has also managed to sustain well above its year-to-date low. Accor...

Top 5 cryptocurrencies to watch this week: BTC, NEAR, FTT, ETC, XMR

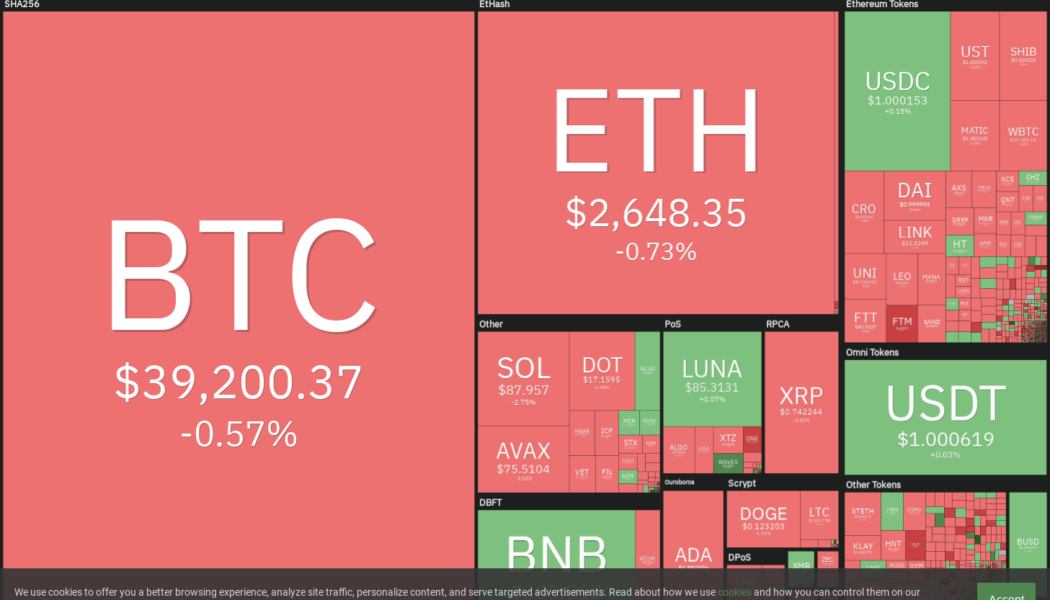

Bitcoin (BTC) dropped from a high of $47,200 on April 5 to a low of $42,107 on April 8, indicating possible selling by short-term traders who may have preferred to lock in their profits. However, the price action is still stuck in a tight range during the weekend, indicating that supply and demand are in balance. Although the Crypto Fear & Greed Index is in the fear zone, Bitcoin whales on crypto exchange Bitfinex remained unfazed and continued to purchase BTC. Interestingly, one large investor continued to buy $1 million of Bitcoin every day, without attempting to time the market, using the strategy of dollar-cost averaging. Crypto market data daily view. Source: Coin360 Another whale that utilized the dip to add more Bitcoin to its existing stockpile was Terra. This week, the wallet ...

Bitcoin plumbs April lows as US dollar strength hits highest since May 2020

Bitcoin (BTC) neared new price lows for April on April 8’s Wall Street open amid a fresh surge in the U.S. dollar. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView $43,000 hangs in the balance Data from Cointelegraph Markets Pro and TradingView captured another day of gloom for BTC bulls as the largest cryptocurrency slipped back under $43,000. In a classic move, BTC/USD reacted unfavorably to a resurgent dollar, with the U.S. dollar currency index (DXY) returning above 100 for the first time since May 2020. Coming on the back of tightening measures from the Federal Reserve, the greenback also spelled a headache for stocks, which opened down on the day. U.S. dollar currency index (DXY) 1-week candle chart. Source: TradingView While some considered the DXY event a temp...

Terra buys $200M in AVAX for reserves as rival stablecoins emerge

Terraform Labs (TFL) and the Luna Foundation Guard (LFG) have announced they have purchased a combined $200 million worth of AVAX tokens from the Avalanche Foundation. TFL, the company responsible for the development of the Terra blockchain, swapped $100 million worth of Terra’s native token, LUNA for AVAX tokens, in order to “strategically align ecosystem incentives”, according to Terra’s twitter. LFG, a non-profit organization mandated to build reserves for Terra’s algorithmic stablecoin UST, used its own holdings of UST to purchase an additional $100 million worth of AVAX from the Avalanche Foundation. These purchases are meant to reinforce the stability of Terra’s native UST stablecoin, which currently has a market cap of $16.7 billion. Do Kwon, the founder of Terraform Labs, tol...

Top 5 cryptocurrencies to watch this week: BTC, XRP, NEAR, XMR, WAVES

Bitcoin (BTC) plunged below $40,000 on March 4 and has been trading below the level throughout the weekend. Although the crypto price action has been volatile in the past few days, Glassnode data shows that institutional investors have been gradually accumulating Bitcoin through the Grayscale Bitcoin Trust (GBTC) shares since December 2021. Another positive sign has been that fund managers have not panicked and dumped their holdings in GBTC. This suggests that managers possibly are bullish in the long term, hence they are riding out the short term pain. Crypto market data daily view. Source: Coin360 Bloomberg Intelligence said in their crypto market outlook report on March 4 that Bitcoin may remain under pressure if the U.S. stock markets keep falling, but eventually, they expect crypto to...

Top 5 cryptocurrencies to watch this week: BTC, ETH, NEAR, MANA, LEO

Bitcoin (BTC) surged above the $40,000 psychological resistance on Feb. 4 and successfully held the level over the weekend. This boosted the total crypto market capitalization from $1.78 trillion on Feb. 3 to about $2 trillion on Feb. 6, according to data from CoinGecko. A new financial disclosure by Senator Ted Cruz shows that he bought the recent dip in Bitcoin on Jan. 25 through River brokerage. On that day, Bitcoin traded roughly between $35,700 and $37,600. If the Texas Senator has held his purchase, he is already in the profit. Crypto market data daily view. Source: Coin360 Although the sharp recovery in Bitcoin’s price may have provided relief to the bulls, data analyst Material Scientist warned that large traders with a ticket size of over $100,000 are selling the rally. Could...

Top 5 cryptocurrencies to watch this week: BTC, NEAR, ATOM, FTM, FTT

Bitcoin (BTC) has stopped its decline and is attempting a recovery along with select altcoins. Some traders have been fearing a massive sell-off in Bitcoin but Capriole CEO Charles Edwards said that Bitcoin’s worst crashes have happened “due to miner capitulation (December 2018 and March 2020), when BTC fell below production costs.” However, the current production cost of Bitcoin was $34,000, which is well below the current price. In a sign that institutional investors remain bullish on the crypto sector even after the recent fall, Cathie Wood’s Ark Invest bought 6.93 million shares of the special purchase acquisition company that will merge with Circle, the principal operator of USD Coin (USDC) and the second-largest stablecoin in terms of market capitalization. Crypto market data d...